How Saudi Arabia’s Start-up Funding Skyrocketed in 2022

03 March 2023•

Saudi’s Start-up Ecosystem Today

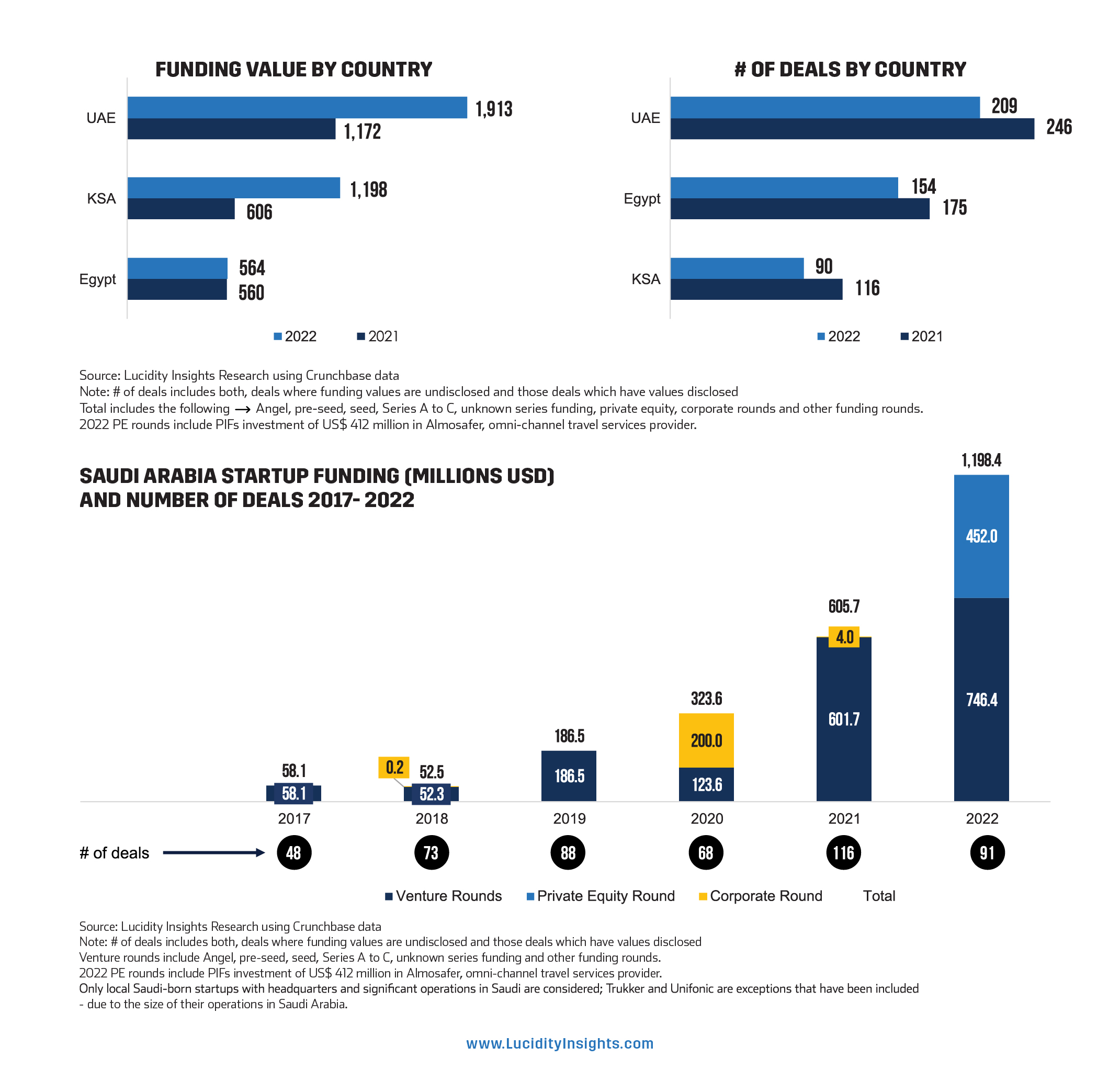

Saudi Arabia’s start-up ecosystem has grown at an unprecedented pace, from just a few SMEs prior to the launch of Vision 2030, to ground-breaking life-enhancing tech start-ups six years and a pandemic later. In 2022, the Kingdom came in second in the Arab world in total funding value with US$ 1.2 billion of Venture, Corporate and Equity funding going to Saudi startups. Saudi Arabia also came in third in the region for the number of deals (91) signed, behind the UAE and Egypt.

A Quick Climb in Startup Funding

See Graphs: Funding Value by Top 3 MENA Country (excluding Israel), Number of Deals by Top 3 MENA Country (excluding Israel), Saudi Arabia Startup Funding (Millions USD) And Number of Deals 2017- 2022.

Saudi Arabia may be relatively new on its entrepreneurial and digital economy journey, but the Kingdom’s laser focus on developing a strong entrepreneurial ecosystem has helped start-up activity grow, and quickly. Historically, Saudi Arabia has always trailed the UAE and Egypt’s startup ecosystems, but this changed in 2021, when Saudi Arabia became #2 in the Arab world in venture funding raised. Saudi strengthened its 2nd place positioning in 2022, pulling further away from Egypt and closing in on the UAE.

Saudi Arabia’s start-up funding has skyrocketed in 2022, growing more than 20x in 5 years to reach US$ 1.2 billion across 57 disclosed deals (out of 90 deals total); 2018 funding hovered at $50 million across 54 disclosed deals (out of 71 total deals). This also means that the average deal size in Saudi has grown substantially from <$1 million per deal in 2017, to an average of over US$ 20 million per deal in 2022.

It is a remarkable feat for Saudi start-ups to have raised more than US$ 1 billion in 2022, given that it took the United Arab Emirates, the reigning start-up capital of the Arab world, nearly a decade of fostering start-up activity in Dubai to break the $1 billion ceiling in 2021. This speaks to the speed of change and growth in Saudi’s start-up ecosystem, driven by the calibre of start-ups emerging in Saudi Arabia and their ability to scale across the Kingdom and beyond.

The Increase of Ticket Sizes in Saudi’s Funding Rounds

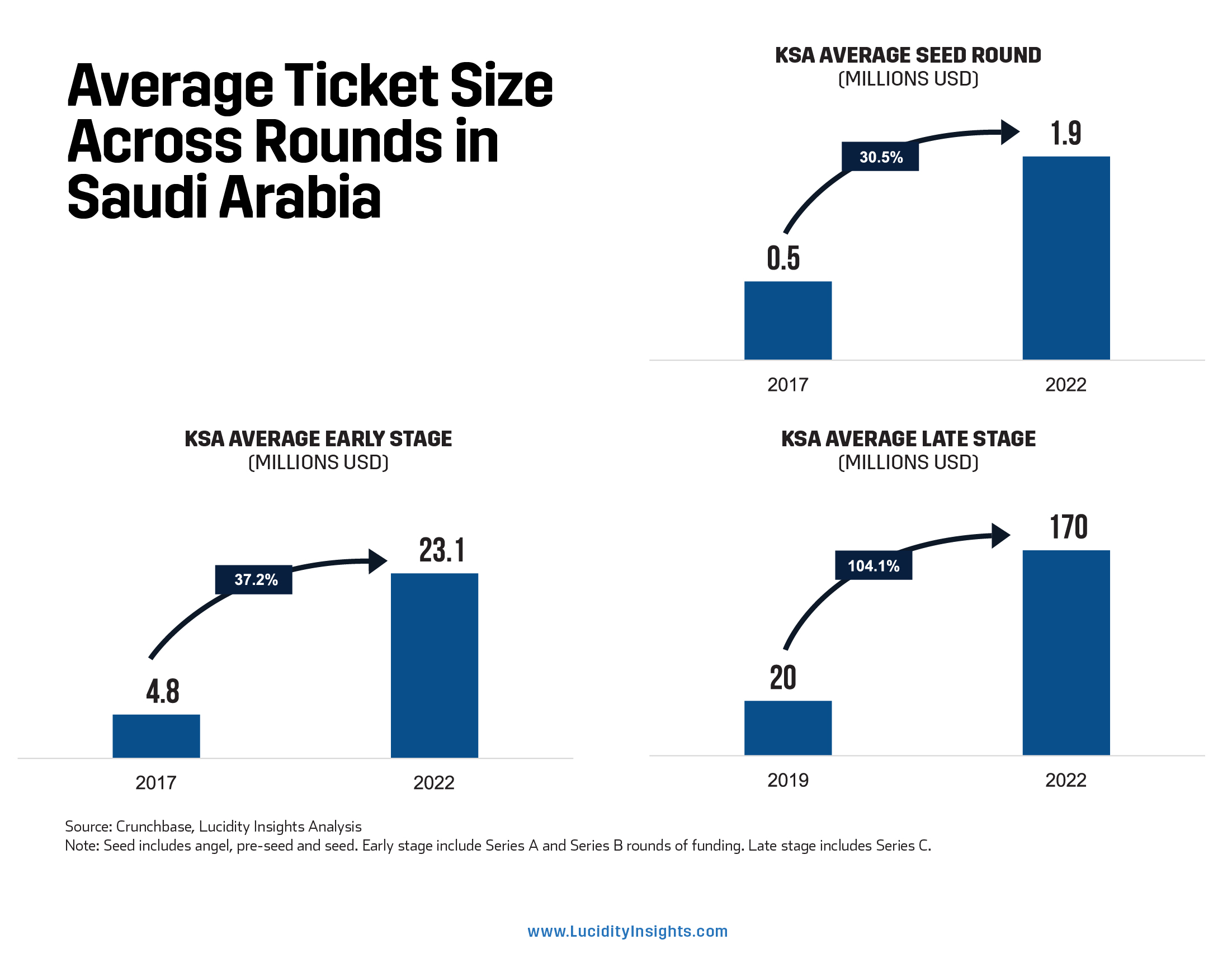

See Graph: Average Ticket Size Across Rounds in Saudi Arabia

It isn’t just the volume of funding being raised in the Kingdom that is growing. Ticket sizes across rounds have grown substantially over the past 4 years. The average Seed Round has increased at 30.5% CAGR from an average of $500,000 in 2017 to $1.9 million in 2022. Average early-stage funding (Series A and Series B) rounds have increased at 37.2% CAGR since 2017 from an average of $5 million to averaging $23 million in 2022. Late-stage investments, which was a category that was largely inexistent in 2017 have grown the most, showing over a 100% CAGR since 2019. While there has been only one disclosed Series C round in each of 2019, 2021 and 2022, what is encouraging is the value of funding has increased more than 8x from US$ 20 million in 2019 to US$ 170 million in 2022.

Read Next: What Are The Most Funded Startups in Saudi Arabia?

Learn more about the perspectives of some of the most prominent VCs in Saudi, in the most comprehensive report on the topic to date, The Evolution of Saudi Arabia's Start-Up Ecosystem 2010-2022.

%2Fuploads%2Fsaudi-venture%2Fcover11.jpg&w=3840&q=75)