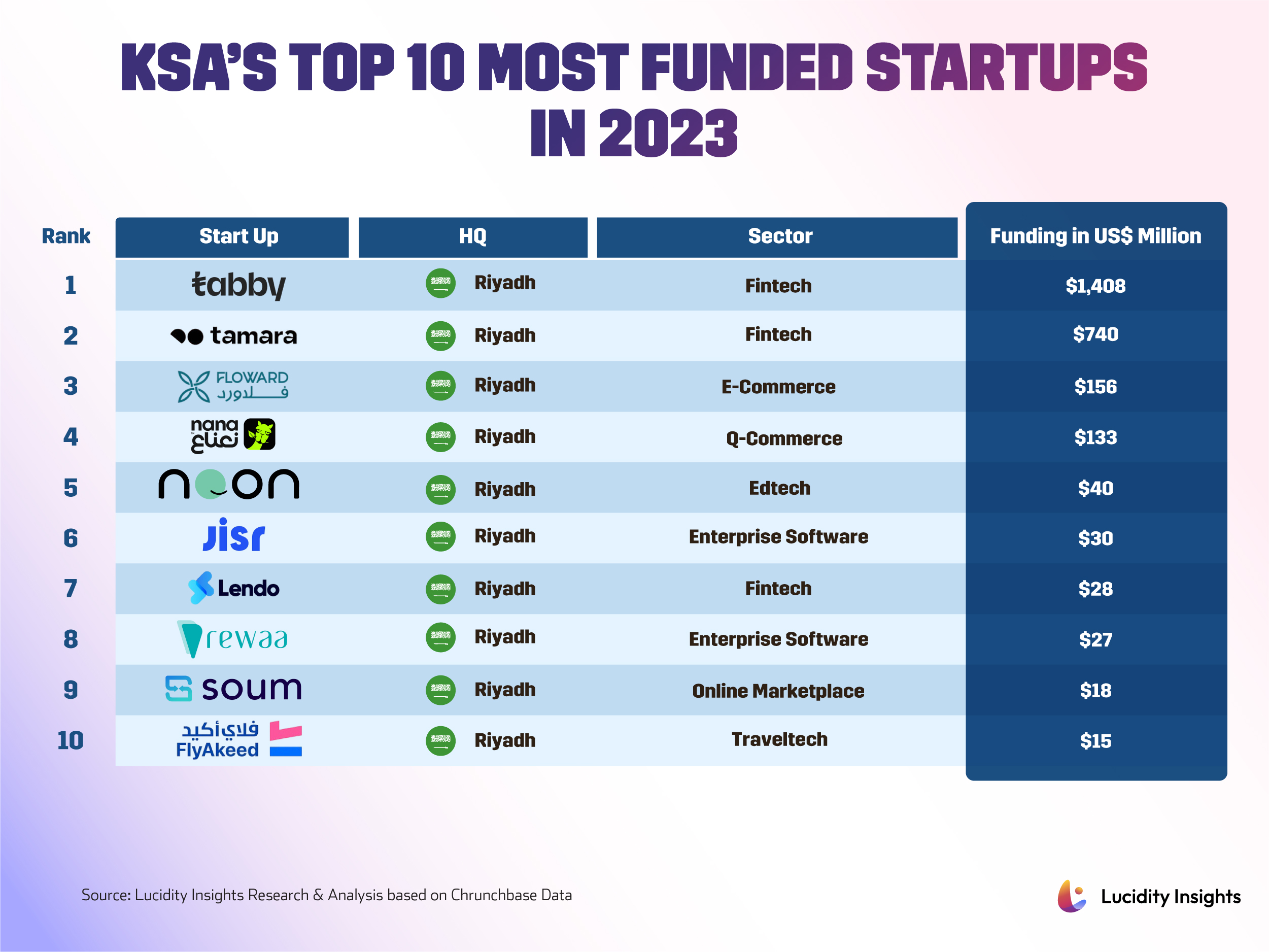

The Top 10 Most Funded Startups in the KSA in 2023

06 August 2024•

In 2023, Saudi Arabia emerged as a dynamic hub for startup growth, with half of the ten most funded startups in the MENA region originating from the Kingdom. This surge highlights Saudi Arabia's diverse and vibrant entrepreneurial landscape. Notably, the FinTech sector leads this growth, accompanied by significant advancements in e-commerce and digital platforms. All of these top-funded startups are headquartered in Riyadh, underscoring the city's role as the epicenter of innovation and business development in Saudi Arabia.

Infobyte: The Top 10 Most Funded Startups in the KSA in 2023

1. Tabby

Established: 2019 in Dubai, UAE

Sector: FinTech

Funding: US $1,408 million

HQ: Riyadh, KSA

Tabby operates a financial platform that offers consumers a "buy now, pay later" (BNPL) option to pay for online and offline purchases either in a deferred single payment or in multiple installments. Essentially, the platform provides flexible credit options for safe payments. It currently caters to four million active shoppers across the UAE, KSA, Kuwait, and Bahrain, selling 10,000+ global brands like H&M, Adidas, IKEA, SHEIN, and Bloomingdale’s. In 2023, Tabby raised US $700 million and US $350 million in Debt Financing from JP Morgan and Partners for Growth respectively, as well as US $58 million series C round from Partners for Growth and a US $50 million series D round from Wellington Management, achieving unicorn status with its funds raised totaling up to US $1.7 billion. The new funds target the expansion of Tabby's financial services amidst increasing demand for its BNPL solutions from its 10 million consumers and 30,000 retail partners.

2. Tamara

Established: 2020 in Riyadh, KSA

Sector: FinTech

Funding: US $740 million

HQ: Riyadh, KSA

Tamara operates a "buy now, pay later" (‘BNPL’) platform for both merchants and customers, aiming to empower people in their daily lives by revolutionizing how they shop, pay, and bank. The BNPL options are available during online checkout (for e-commerce) and via in-store QR codes (for brick-and-mortar stores), allowing shoppers to divide the cost of online purchases into interest-free installments or pay the entire amount after a specified period. Today, they serve over 10 million users and have partnered with 30,000+ merchants across the KSA, UAE, and Kuwait, and reported six times annual run rate revenue growth in less than two years. Tamara became Saudi Arabia's first fintech unicorn of 2023 after raising US $400 million in Debt Financing from Goldman Sachs and Shorooq Partners, as well as a US $340 million series C round led by Sanabil and Saudi National Bank in December. The new financing will fund new products and services, expanding beyond BNPL to capitalize on opportunities in shopping, payments, and banking services in Saudi Arabia and throughout the GCC.

3. Floward

Established: 2017 in Kuwait City, Kuwait

Sector: E-Commerce

Funding: US $156 million

HQ: Riyadh, KSA

Founded by Abdulaziz Al Loughani, Khalid Albader, Mohammed Al Arifi, and Taiba Al-Humaidhi, Floward is a leading online flowers and gifting company in the Middle East and the UK that offers a variety of gift products including fresh flowers, plants, chocolates, perfumes, and cakes. The company operates in around 40 cities in nine countries, and its app has been downloaded more than a million times, with over a million customers browsing per month. Floward has raised a total of US $186.3 million to date after securing US $156 million from Aljazira Capital and STV in 2023 to expand its gifting verticals while enhancing customer experience through the application of AI and ML.

4. Nana

Established: 2016 in Riyadh, KSA

Sector: Q-Commerce

Funding: US $133 million

HQ: Riyadh, KSA

Founded by Sami Al-Helwah and Ahmed Al Samaani, Nana is a digital grocery shopping platform that fulfills daily, weekly, and monthly household grocery needs in Saudi Arabia and the broader MENA region. It operates as a dark store grocery delivery startup, ensuring quick delivery of groceries and other home essentials to customers within 15 minutes. The startup has to date delivered more than 45 million orders and boat more than 6000 thousand delivery drivers. With US $212.3 million in total funds, Nana plans to increase its market share to 40% by the end of 2026 further supported by its US $133 million Series C it raised from Kingdom Holding Company and Uni-Ventures in February 2023.

5. Noon - The Social Learning Platform

Established: 2013 in Riyadh, KSA

Sector: EdTech

Funding: US $41 million

HQ: Riyadh, KSA

Founded by Aldhalaan and Abdulaziz Alsaeed, Noon is a social learning platform that offers tutoring and educational content through a freemium model, granting all users free access to basic content while charging for private tutors and more advanced materials. Noon Academy allows students to join study groups, participate in competitions, and engage in live sessions with teachers, serving over 12 million students across Saudi Arabia, Iraq, Egypt, and Pakistan. Their total funding now amounts to US $62.4 million after a series B round led by Raed Ventures and Wa’ed Ventures in 2023 securing US $41 million, which will be used to enhance AI-powered solutions, offer personalized learning experiences, and fuel its global expansion to support up to 190 million students within the next two to three years.

6. Jisr

Established: 2016 in Riyadh, KSA

Sector: Human Resources, Enterprise Software, Human Capital Management

Funding: US $30 million

HQ: Riyadh, KSA

Founded by CEO Mohammed Akkar, Jisr is the first Saudi Arabian tech company focused on fully digitizing human resources operations in MENA. Their HR technology system streamlines HR processes such as recruitment, payroll and attendance to over 3,000 clients with 350,000 registered employees across 16 sectors. In 2023, Jisr raised US $30 million in a funding round led by Merak Capital, marking the largest series A funding round for a SaaS company in MENA. The new funds target the advancement of Jisr's HR technology system to make it simpler for organizations to recruit, develop their workforce, ensure wage protection, and more.

7. Lendo

Established: 2019 in Riyadh, KSA

Sector: FinTech

Funding: US $28 million

HQ: Riyadh, KSA

Founded by CEO Osama AlRaee and COO Mohammed Jawabri, Lendo is a shariah-compliant debt crowdfunding platform that focuses on digitally financing small and medium-sized enterprises (SMEs) in Saudi Arabia. The platform helps pre-finance outstanding invoices for businesses in Saudi Arabia as a community connecting creditworthy borrowers with sophisticated investors seeking alternative investments. Regulated by the Saudi Central Bank, Lendo has received the Excellence in Finance Leaders Award from FiNext Awards and raised a total of US $35.2 million to date after securing US $28 million in a Series B round led by Sanabil in 2023. The new funds will be used to expand into new marketsand launch new Shariah-compliant products to make financial services more accessible, affordable, and inclusive for everyone, both current and new clients.

8. Rewaa

Established: 2018 in Riyadh, KSA

Sector: E-Commerce, Enterprise Software

Funding: US $27 million

HQ: Riyadh, KSA

Founded by CEO Mohammed Alqasir and COO Abdullah Aljadhai, Rewaa is a retail management SaaS with a mission to become the retailer’s integrated technical partner by providing comprehensive technical solutions for business management across the Kingdom. The company Rewaa offers an omnichannel inventory management system, accounting, and point-of-sale (POS) platform that synchronizes inventory between online channels and physical stores, streamlining processes for retailers. In 2023, Rewaa raised US $27 million in a Series A funding round led by Wa’ed Ventures with participation from STC’s Corporate Innovation Fund as their first venture investment in Saudi Arabia since its launch. “This investment propels us toward our vision of becoming the optimal technological partner for small and medium-sized businesses in the retail sector. Through the creation of a globally competitive product, we aim to make a significant impact on retail merchants, empowering them to deliver unparalleled service with heightened efficiency,” said CEO Mohammed Alqasir.

9. Soum

Established: 2021 in Riyadh, KSA

Sector: E-Commerce, Online Marketplace

Funding: US $18 million

HQ: Riyadh, KSA

Founded by CEO Fahad Al Hassan, Bader Almubarak, and Fahad Albassam, Soum is an E-com startup that specializes in the resale of electronic devices. Soum provides a platform where users can monetize their secondhand products by selling them, while buyers can discover high-quality pre-owned items, including mobiles, tablets, gaming devices, laptops, smartwatches, and more. Its total funding amounts to US $22 million after a series A round led by Jahez International Company in 2023 secured US $18 million, which will be used to accelerate its expansion plans regionally and scale beyond its core vertical of secondhand electronics ranging from collectibles to cars.

10. FlyAkeed

Established: 2015 in Riyadh, KSA

Sector: TravelTech, Travel Management Solutions

Funding: US $15 million

HQ: Riyadh, KSA

Founded by CEO Bassam Almohammadi, FlyAkeed is a B2B2C enterprise SAAS that aims to revolutionize corporate travel experiences through seamless end-to-end automation projects. FlyAkeed provides automated travel and expense solutions for corporates and travel managers with a traveler-centric model that links travel policy, online booking, and expense management, creating a seamless omni-channel experience for business travelers. In 2023, FlyAkeed raised US $15.2 million in a Series A round led by PIF’s Sanabil Investments and Elm Company, which will be used to expand its digital offerings in its home market while integrating fintech technologies to enhance the traveler experience and help businesses better manage corporate travel.