Sawari Ventures: Pioneering VC Investments in Egypt's Tech Ecosystem

08 April 2024•

One of the first to start VC investments in Egypt, Sawari Ventures is a growth stage investment firm. The company has also enabled seed stage investments by founding Flat6Labs, which is a pioneer in the region.

- Year Established: 2010

- HQ: Cairo, Egypt

- AUM: $70 million

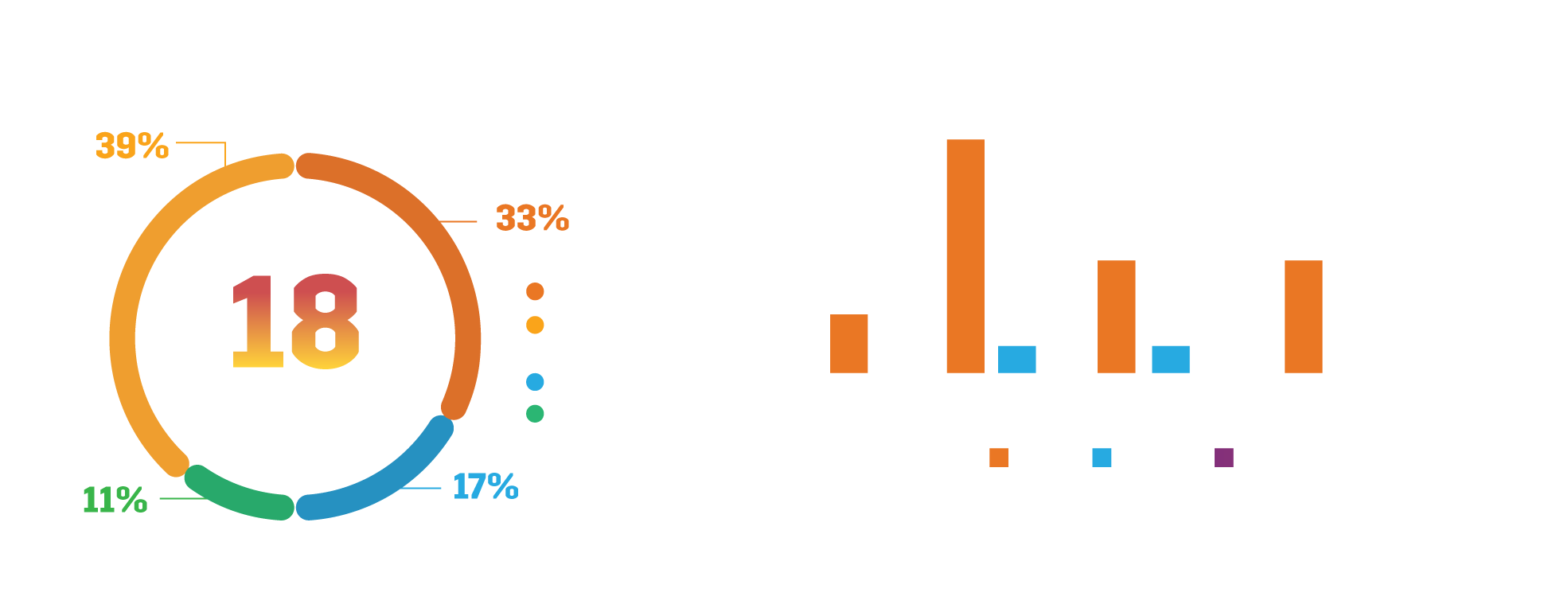

- # of Portfolio Companies: 18 (plus over 10 legacy investments)

- % of companies in Egypt: ~90%

- Avg # of deals per year: 4-6

- Number of exits*: 1 (plus 1 acquisition and 2 exits in the legacy portfolio)

- Funding Stage: Seed, Series A, Series B

- Ticket Size: US$ 1M – US$ 3M

- Team Size: 16

- Website: http://www.sawariventures.com/

Founded in 2010 by Ahmed El Alfi and Hany Al-Sonbaty, Sawari Ventures is one of the first VC firms established in Egypt, emerging from a vision to harness the untapped potential of North Africa’s knowledge and technology sectors. El Alfi and Al-Sonbaty were investment professionals in the Egyptian tech space for more than two decades prior to Sawari Ventures. Wael Amin, who joined as Partner in 2015, was previously the founder and CEO of tech company ITWorx, which made notable acquisitions in the Egyptian tech ecosystem.

Founded in 2010 by Ahmed El Alfi and Hany Al-Sonbaty, Sawari Ventures is one of the first VC firms established in Egypt, emerging from a vision to harness the untapped potential of North Africa’s knowledge and technology sectors. El Alfi and Al-Sonbaty were investment professionals in the Egyptian tech space for more than two decades prior to Sawari Ventures. Wael Amin, who joined as Partner in 2015, was previously the founder and CEO of tech company ITWorx, which made notable acquisitions in the Egyptian tech ecosystem.

With US $70 million AUM, Sawari has invested in 18 companies and 2 seedstage vehicles in the past five years, with a focus on growth-stage startups. Sawari’s partnerships with leading financial institutions demonstrate its strategic acumen and commitment to growing the SME sector. Accordingly, the firm has a dual fund structure, of which one is a Netherlands Incorporated North Africa Fund and another is an Egypt-incorporated Egypt Fund, which allows it to bring together international capital from DFI partners and domestic capital from local stakeholders. In fact its international investors include the likes of European Investment Bank, British International Investment, the Dutch Good Growth Fund and Proparco to name a few. Local LPs include National Bank of Egypt, Banque Misr, Banque du Caire, Suez Canal, and Misr Insurance Group. In April 2021, Sawari Ventures announced commitments of EGP 444 Million (equivalent to US $28 million at close) to close its Egypt-based fund. Alongside the Dutch Fund, with commitments totaling 42M USD to invest in Egypt, Tunisia and Morocco, the firm was able to invest roughly 60M USD into innovation across North Africa.

The firm aims to support founders that redefine industries, with a focus on fintech, deeptech, edtech and other tech-driven industries. While Sawari largely invests in growth stage companies, the founders, Ahmed El Alfi and Hany Al-Sonbaty, also co-founded Flat6Labs in 2011, an accelerator program and seed investor, to contribute to the strengthening of the region’s early-stage ecosystem.

The firm has also made a strong commitment to responsible investing, establishing a tailored framework to integrate ESG considerations into fund decision making and portfolio management. In 2023, Sawari Ventures joined the 2X Global community, affirming its commitment to gender equality and financial inclusion. 61% of its portfolio companies have at least one female senior manager.

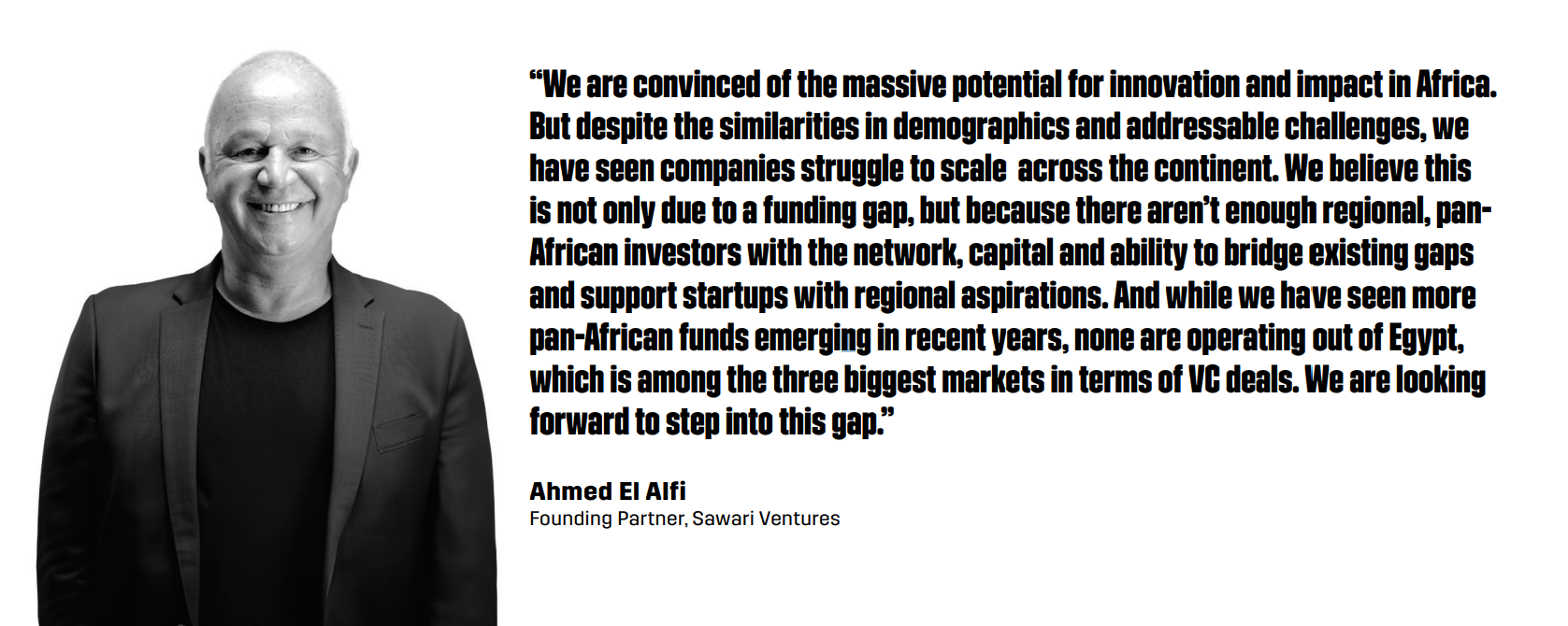

With the inaugural funds fully deployed as of 2023, Sawari has started fundraising for its upcoming Africa Fund. While maintaining a focus on Egypt and replicating the dual fund structure, the new fund will be adding investments in selected markets in East and West Africa (in addition to North Africa) to its investment strategy.

Visit Sawari Ventures’ Investor Page here

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)