The World’s Leading Universities for Entrepreneurs

06 October 2023•

Top 10 Universities for Entrepreneurship 2023 (based on graduate founders and funds raised)

Infobyte: Top 10 Universities for Entrepreneurship 2023 (based on graduate founders and funds raised)

Infobyte: Top 10 Universities for Entrepreneurship 2023 (based on graduate founders and funds raised)

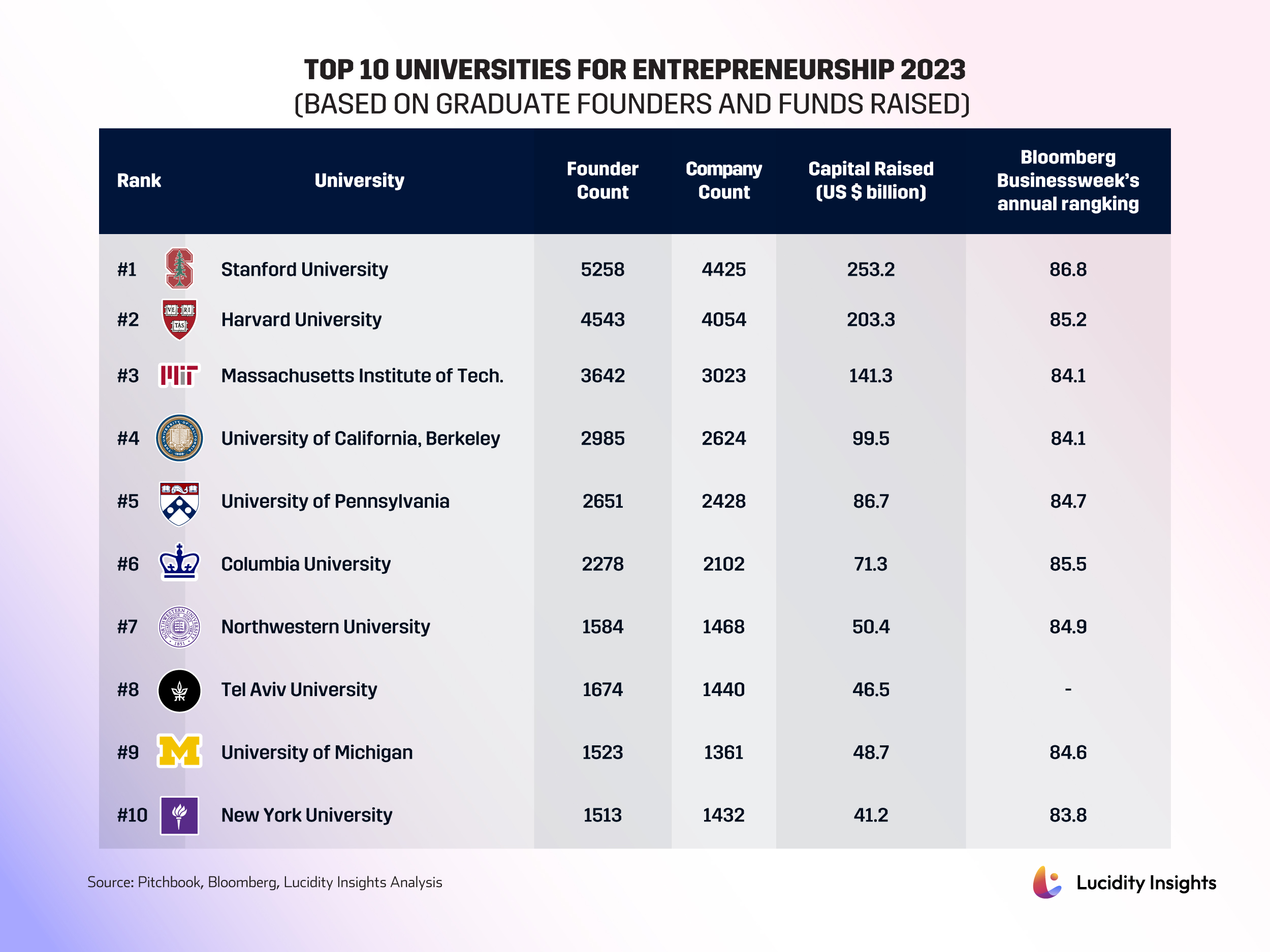

Stanford and Harvard Top the List

In a recent analysis of global universities by Pitchbook.com, it was revealed that Stanford and Harvard lead the pack as the alma maters of the most business founders across undergraduate, graduate, and MBA programs alike. Stanford and Harvard graduates consistently outperform other universities in the number of alumni founders, companies created, and capital raised. Stanford graduate founded companies have raised over $253 billion cumulatively. Harvard graduate founded companies raised $200 billion cumulatively, a square $50 billion less.

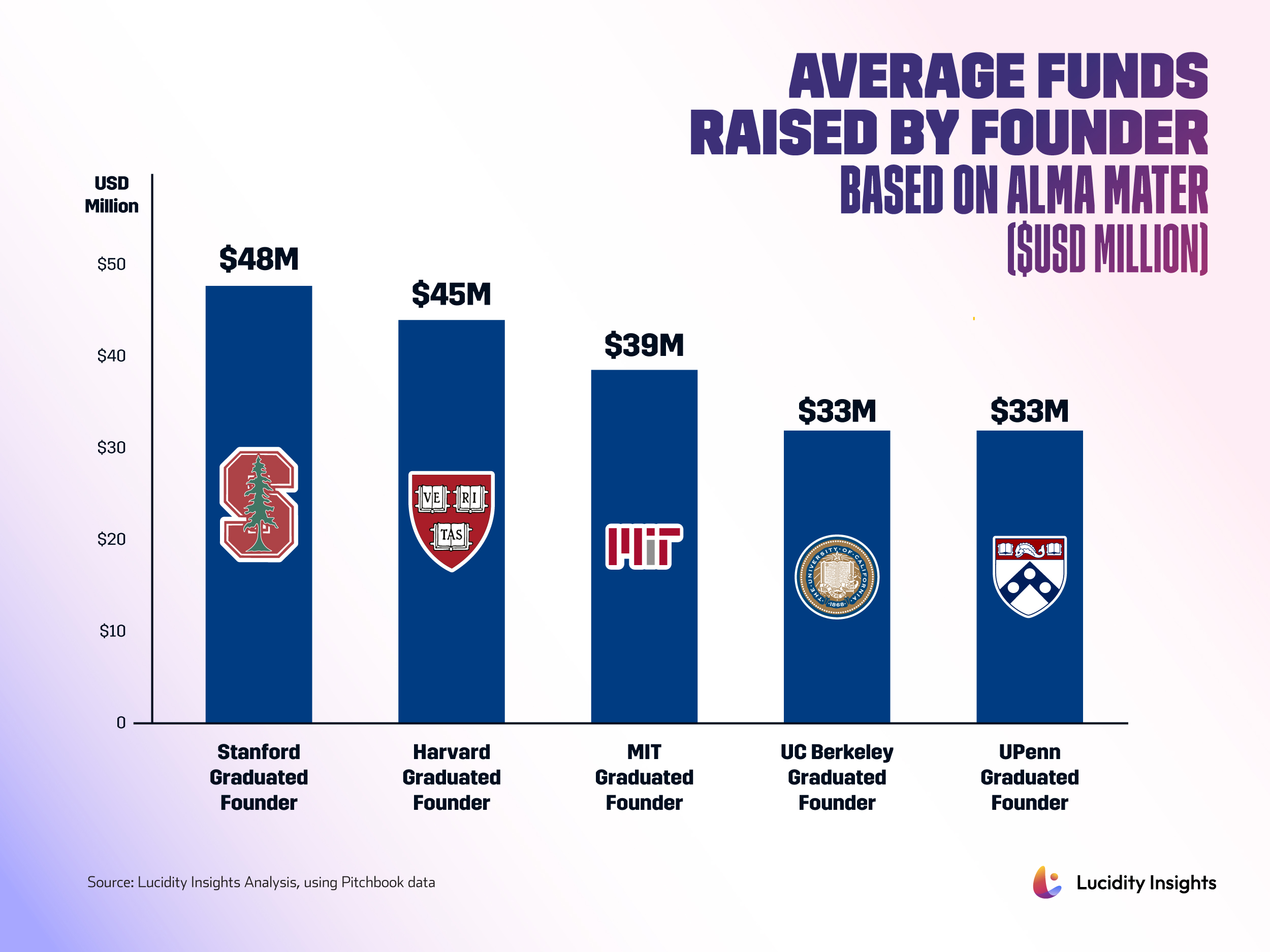

If the Data Could Speak…

Crude math that averages out the total funds raised by Stanford graduates, tells us that each Stanford graduate founder raises $48 million, on average. Harvard graduate founders raise on average $45 million. MIT graduate founders raise $39 million on average; UC Berkeley graduate founders raise $33 million on average; and finally, UPenn graduate founders raise $33 million on average. Now, that’s crude math and statistics, but further analysis requires some hard questions. For example, “is the amount of funding raised by a startup a real determinant or leading key performance indicator for that startup’s success?” It seems the industry measures and applauds many startups based on the amount they’ve raised – perhaps because that is what is most measurable and most public. Key indicators such as high revenue growth rates, healthy profitability, low customer acquisition costs, and low employee turnover rates are kept confidential – as they are considered “trade secrets” that, if leaked, could erode competitive advantages.

Infobyte: Average Funds Raised by Founder Based on Alma Mater ($USD Millions)

Infobyte: Average Funds Raised by Founder Based on Alma Mater ($USD Millions)

It seems most would argue that the more funding a startup raises, would indicate that there is more interest from investors; and thus, if we assume investors are conducting their due diligence and vetting all startups equally, there might be greater viability of businesses that are coming out of some alma maters than others. Others might argue that graduating from big schools simply gives you a stronger network with greater access to capital, and is no real indicator of actual on-the-ground success of the startup that gets funded.

For budding entrepreneurs looking for top business schools to go to, they may deduce that going to Stanford or Harvard might give them more access to capital than other school networks for their future startup idea; perhaps that’s what they are paying for, beyond their education. For venture capitalists and investors, they might surmise that there is a premium being paid out to Ivy League founders, and perhaps more cost-conscious startups and founders could be found elsewhere, providing a greater ROI. When economists look at the data, many see the power of social networks. Ask a psychologist, and perhaps they will question the implicit biases in society that might ease the flow of capital to graduates from one school over another. However you interpret the data, one thing is for certain: the numbers are nothing short of impressive.

Related: DIEZ and MIT Launch an Innovation Accelerator

A Middle East University Ranks in Top 10

Bloomberg Businessweek’s annual Business-School Rankings also seem to strongly align, almost seamlessly with, PitchBook's analysis; but there was one noticeable omission. Tel Aviv University, despite placing 8th in PitchBook's global ranking based on founder count, does not appear in Bloomberg's Business School Rankings. This is due to the fact that Bloomberg's rankings do not seem to include schools in the Middle East and North African region currently. Perhaps data such as that found from the Pitchbook data will encourage Bloomberg and others to adopt a more inclusive and comprehensive global perspective in future rankings.

To MBA or Specialize in a Graduate Program?

Interestingly, despite Stanford being ranked as the world's top MBA program by Businessweek for five consecutive years now, when you delve deeper, there are more Harvard MBA founders than Stanford MBA founders. However, Stanford's graduate programs – outside of its MBA programs – that span all their educational departments, not just business - seem to be the incubators for a significantly larger pool of Stanford founders. In fact, there were 42% more Stanford graduate founders (that graduated from programs outside of Stanford’s MBA program), than second-place MIT.

While the University of California at Berkeley’s undergraduates seem to have founded the most startups and companies, they typically raise less capital than Stanford and Harvard startup founders. This indicates that while Berkeley fosters a strong entrepreneurial spirit, there may be more to learn in terms of capital raising strategies for these young founders. Alternatively, many UC Berkeley alums may claim that “they can do it, for less.”

Outside of the United States, INSEAD, the University of Oxford, Tel Aviv University, Imperial College London, and the London Business School were among the top quartile of the rankings. This suggests that these institutions are also nurturing environments for aspiring entrepreneurs and establishing international business hubs around the globe.

Findings Exactly the Same for Female Founders

Pitchbook’s female founders list largely mirrors its global findings, with female founders graduating most often from Stanford and Harvard. Stanford female founders were further able to out-raise capital compared to their counterparts from other universities, demonstrating the strength of the networks and knowledge gained at this institution.

It’s important to note that these schools seem to be able to nurture founders and create companies beyond the business realm, and from all disciplines. These universities have adopted a multidisciplinary approach, ensuring their education is top notch, no matter what field; and have simultaneously created opportunities for interdisciplinary founderships. The most common, of course, is the MBA that finds a Computer Science co-founder, but there are many other cases, spanning healthcare and medicine, real estate, foodtech, banking and fintech, law, construction and engineering, and so much more. It seems the name of the game is collaboration and cooperation, across departments, educations, and disciplines.

Related: Middle Eastern Women Making Waves in Silicon Valley

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)