What is DeFi?

04 June 2022•

DeFi stands for ‘decentralized finance’. It’s an emerging fintech class of solutions and companies based on secure distributed ledgers similar to those used by cryptocurrencies.

Consumers using DeFi products and solutions hold their money in a secure digital wallet instead of using a bank, eliminating the numerous fees charged by banks and other financial institutions in the traditional banking system for holding an account or executing transactions. Not only is DeFi solutions cheaper, but the actual transfer of funds occurs within seconds or minutes – anywhere in the world, instead of hours and days we are accustomed to in the traditional banking system today. It’s a solution that is open to anyone with an internet connection, and does not require approvals.

The philosophy of DeFi is at the heart of the blockchain and crypto-craze, in that it removes the control that banks and institutions have on money in the current traditional system. In centralized finance, your money is being held by banks and corporations that are ultimately looking to make profits. Translation: the centralized finance system is riddled with service fees between all the stakeholders, visible and hidden. For example, when you use your credit card to buy your groceries, there are associated fees between the merchant (grocer), the acquiring bank, and the credit card network. DeFi and a decentralized financial system allows for a peer-to-peer financial network based on blockchain technology. Regardless of where you are in the world, so long as you have an internet connection, you can lend, trade, and borrow using software that records and verifies transactions based on a distributed financial ledger system.

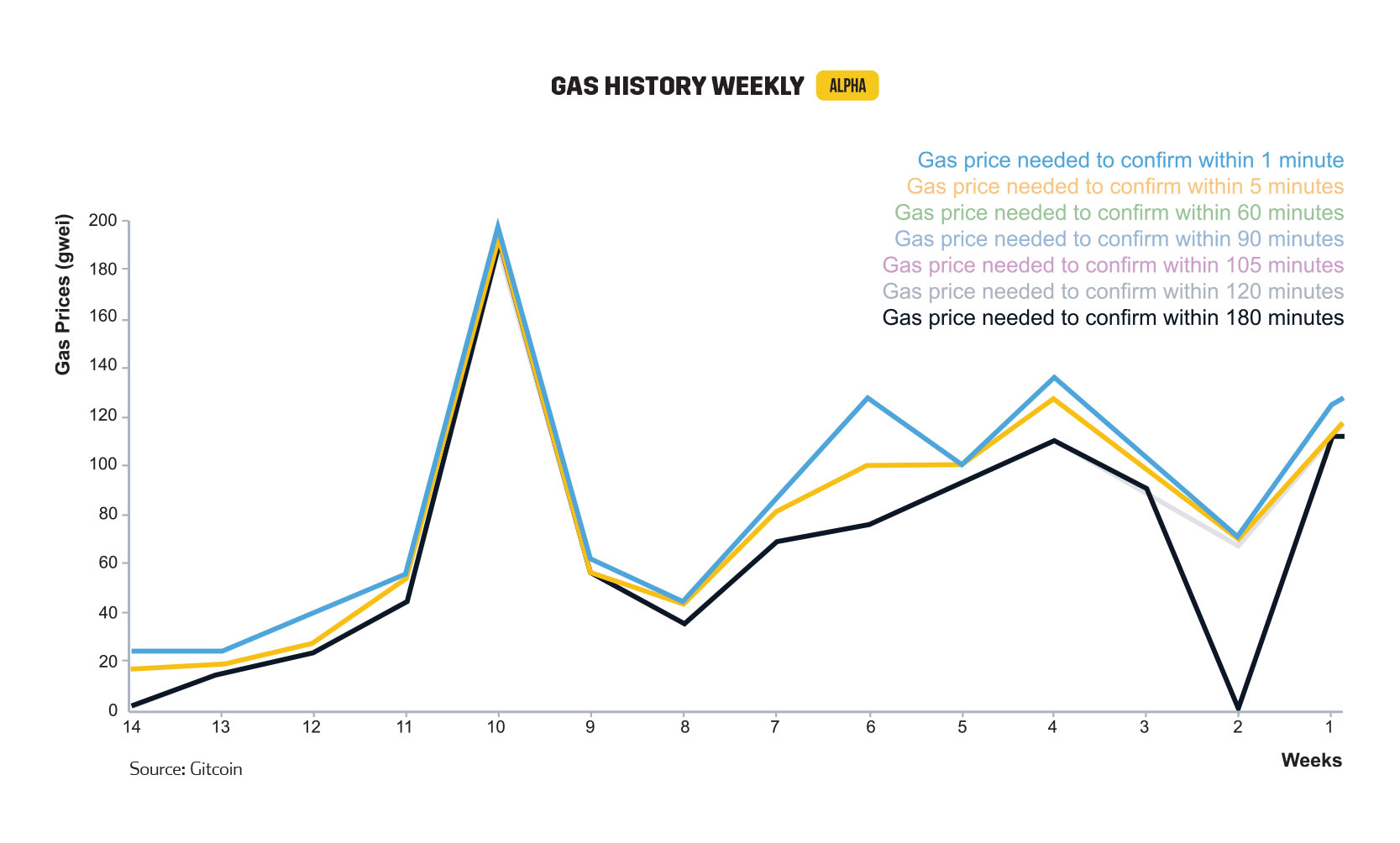

DeFi doesn’t mean that there are no fees associated with the transaction, but that there are more options, and often less expensive options than traditional finance, for the consumer. Transaction fees in the DeFi and crypto world are calculated in a fraction price of the token used to complete the transaction on such a blockchain. The tricky part about DeFi blockchain transaction prices, the most widely-adopted being Ethereum for dApps (decentralized apps, like DeFi), are not fixed. The amount of gas required for each transaction depends on both the supply and demand of the network’s miners for Proof-of-Work blockchains and the complexity of the transaction. Thus, smart contracts have peaks of high demand; as a network gets busier, so does the price of its native asset – and thus the transaction fees also climb. This can be seen on the graph above which illustrates transaction (gas) price variations on Ethereum’s blockchain over a 14 week period.

Crypto-enthusiasts tell us that DeFi is completely different to Bitcoin; while buying cryptocurrencies like Bitcoin is comparable to buying and holding gold and silver, DeFi is comparable to picking stocks, because every token represents a different business, complete with new business solution, business model, team and business plan. The world of DeFi is made up of enterprises that have crypto-enabled businesses and governance models. Here, we highlight a few players to illustrate the DeFi ecosystem.

%2Fuploads%2Fcrypto-universe%2Fcover1.jpg&w=3840&q=75)