Dubai Chamber of Digital Economy Publishes 2023 Venture Report; Dubai adds 64 more scale-ups in 2022

19 June 2023•

Dubai Chamber of Digital Economy in partnership with Entrepreneur Middle East and Lucidity Insights recently published a Special Report titled “Dubai’s Venture Capital Ecosystem.” The special report details startup funding data from across the MENA region, focused primarily on scale-ups, which are defined as startups that have raised US $1 million in funding or more.

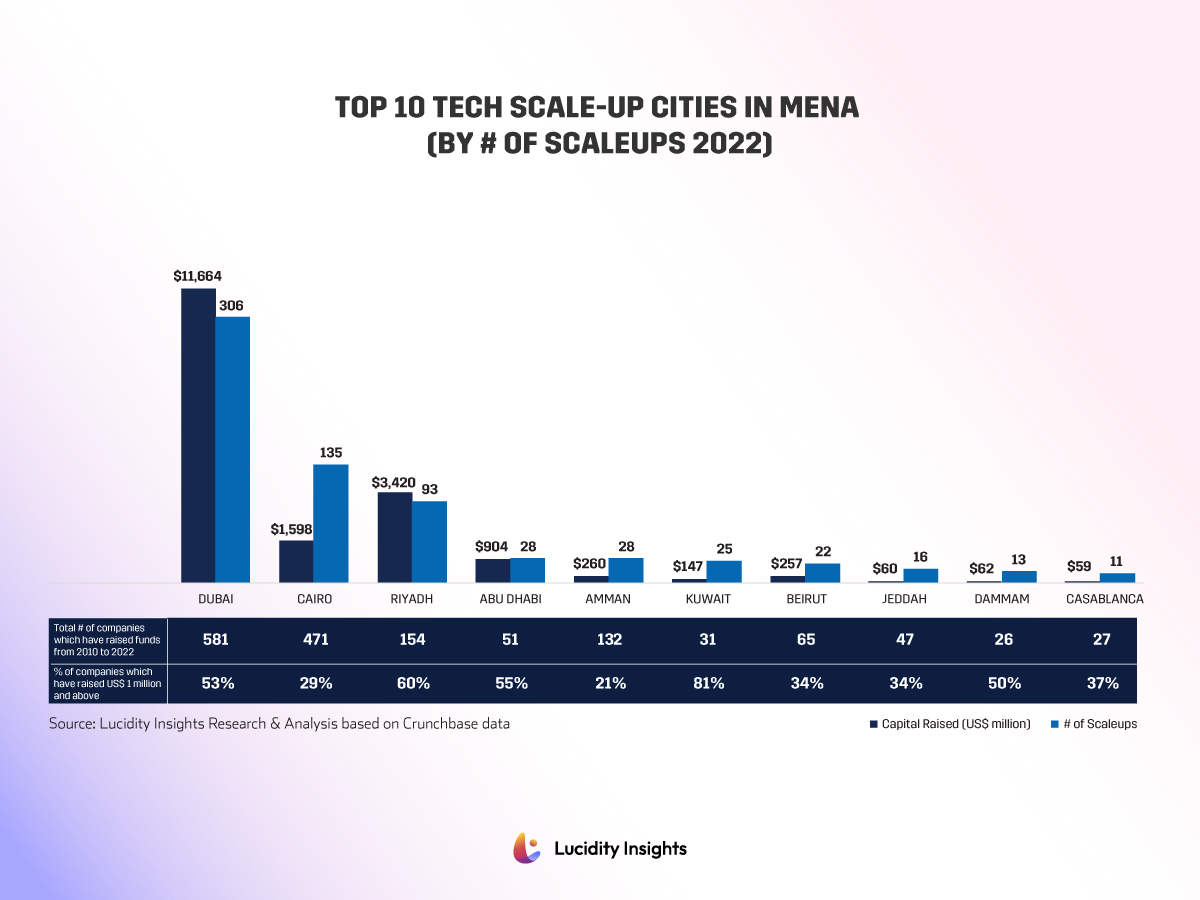

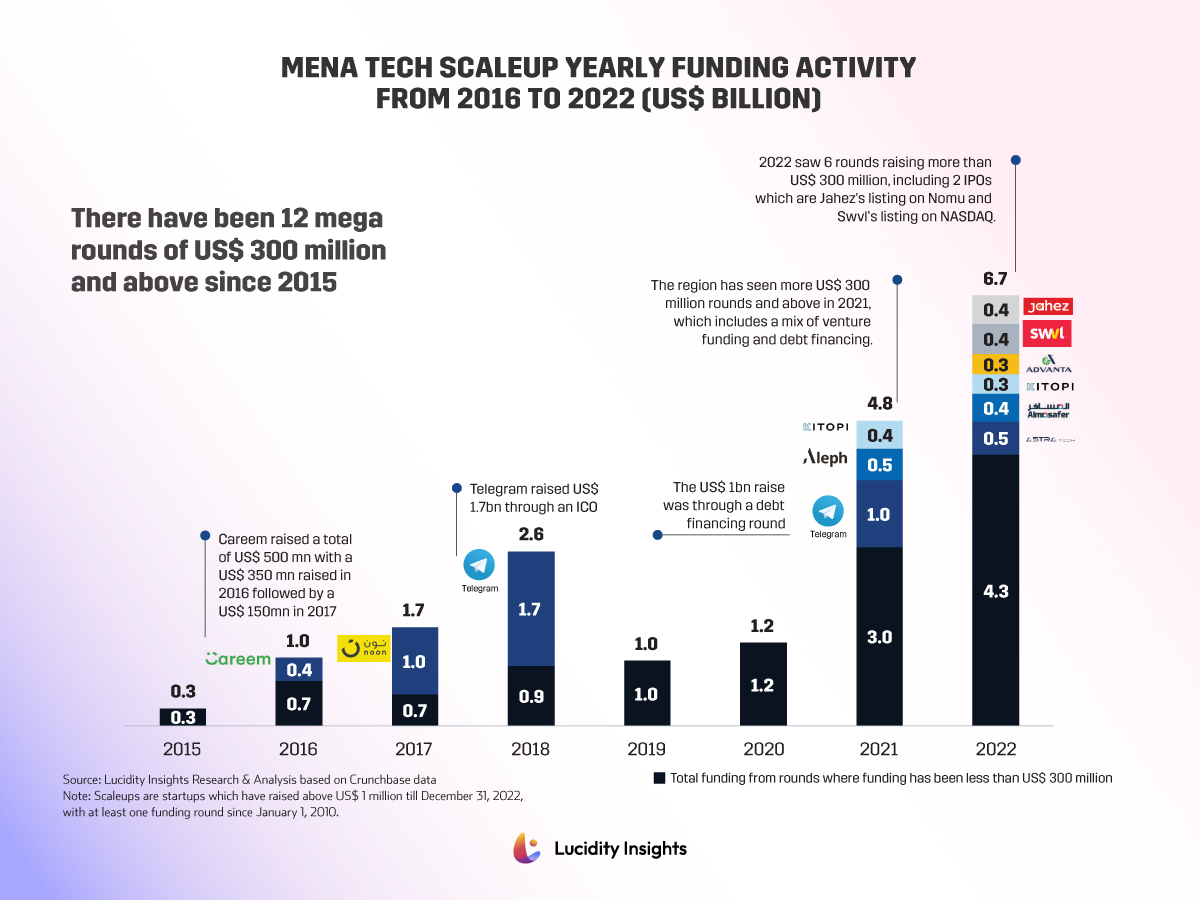

As of the end of 2022, the Middle East and North Africa (MENA) region, excluding Israel, was home to 749 scale-ups, collectively raising US $19.5 billion since 2010. In 2022, scale-ups across MENA raised over US $6.7 billion; that’s one-third of the region’s lifetime total. Last year, 158 new scale-ups were added across 19 countries in MENA. The report also found that 40% of these scale-ups call Dubai home, keeping the start-up capital crown firmly placed on the city’s head.

Dubai remains Top Tech Hub in Arab World

Of these 306 scale-ups that are headquartered in Dubai, 64 were added in 2022, indicating an acceleration of scale-up activity in the city. Cairo maintained its 2nd place ranking, with 135 scale-ups, nearly doubling the number of scale-ups in the Egyptian capital from the year prior. Riyadh solidified its third-place position with 93 scale-ups calling the Saudi capital home, adding 21 scale-ups in 2022.

His Excellency Omar Sultan Al Olama, Minister of AI, Digital Economy and Remote Work said of the report, “this report is not only evidence of the conducive environment Dubai has built for start-ups and scale-ups, it is also a testament to the emirate’s prominence as a digital business hub in the MENA region.”

Dubai has acted as a safe harbor for many regional start-up founders to relocate to, to get better access to talent, capital and mentorship. Every year, more and more investors have also been flocking to the city on the Arabian Sea, setting up funds and looking at opportunities to invest in across the region. For many cities across MENA, Dubai is a shining example of what it takes to become a global hub for entrepreneurship.

Why Investors Like Dubai

Tammer Qaddumi, Co-founder and General Partner of Dubai-based VentureSouq says this is all because “Dubai has done a great job of removing frictions… That’s a brilliant way to grow your business, or in Dubai’s case, your city; and as a result, it is attracting talent from all over the world.”

Dubai’s 306 scale-ups have collectively raised US $11.7 billion in funding over the course of the past twelve years from 2010 through to 2022. This sum represents 60% of total cumulative fundraising across all of MENA (excluding Israel). 2022 was also the second year in a row where Dubai-based startups raised over the US $1 billion mark.

The increase of mega-rounds (rounds raising $300 million or more) in 2022 helped, with four of the six mega-rounds, including AstraTech, Swvl, Kitopi, and Advanta, all being Dubai-based. The report also covers Dubai’s progress on becoming the preferred home-base for unicorns in the Arab world.

2022 also saw the most number of international investors investing in Dubai-based startups, increasing exponentially from prior years. Noor Sweid, Managing Partner at Global Ventures, commented saying, “we are seeing more and more international investors in the region, as they accounted for 48% of the total investors who have funded UAE-based startups in 2022.”

The Special Report gathered insights from some of Dubai’s and the Region’s most prominent Venture Capitalists and Digital Economy stewards including, but not limited to H.E. Omar Sultan Al Olama, Minister of State for Artificial Intelligence, Digital Economy and Remote Work Applications and the Chairman of Dubai Chamber of Digital Economy; H.E. Ahmad Abdullah Juma bin Byat, Vice Chairman of Dubai Chamber of Digital Economy; Dany Farha, Managing Partner of BECO Capital; Walid Hanna, Chairman & Co-CEO of Middle East Venture Partners; Tammer Qaddumi, Co-Founder and Managing Partner At VentureSouq; and Noor Sweid, Managing Partner at Global Ventures.

How Saudi & Neighbouring Markets Support Dubai's Growth

On Saudi Arabia’s strong startup ecosystem performance, most investors echoed BECO Capital’s Dany Farha when he said, “a thriving Saudi start-up ecosystem is a thriving regional start-up ecosystem. We should celebrate Saudi’s emergence – it’s great for attracting foreign investors to the region.”

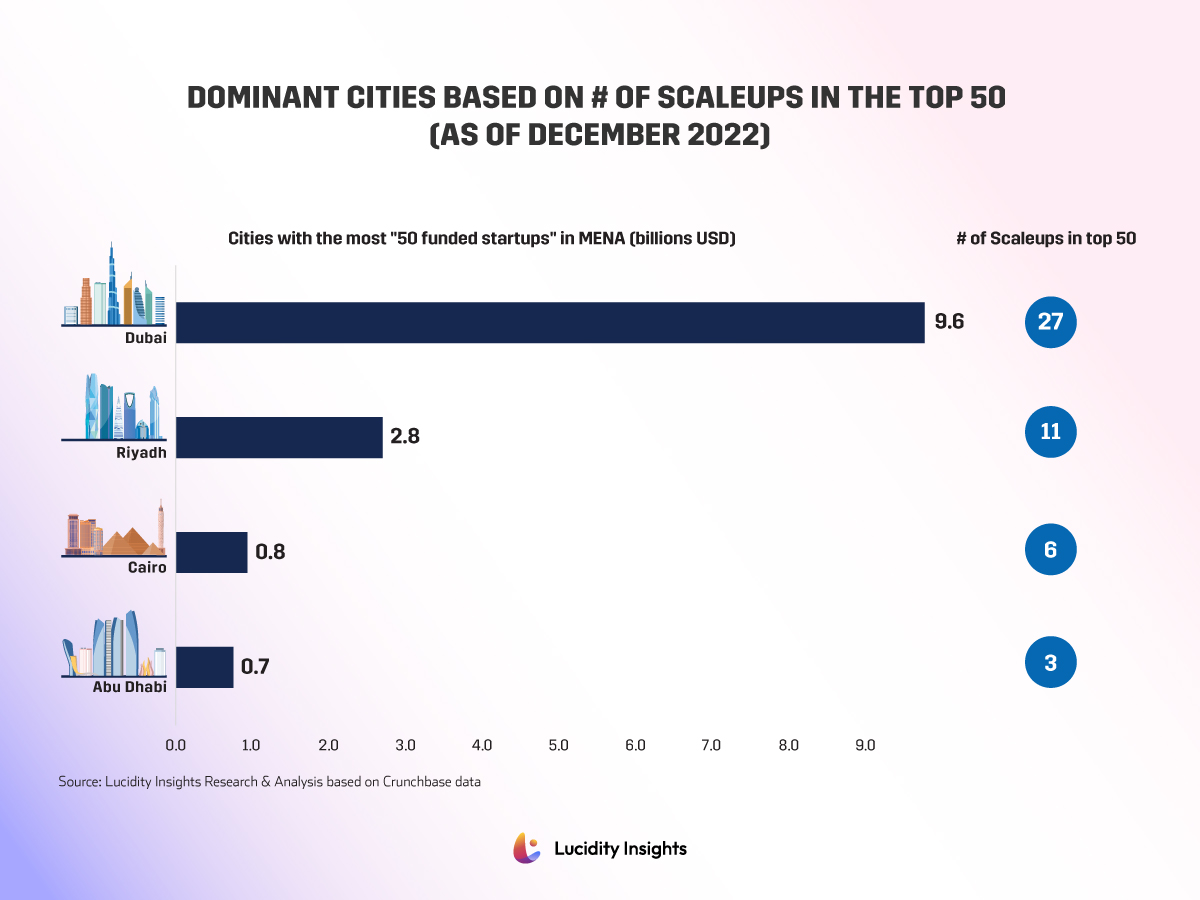

The Special Report also highlights the Top 50 most funded startups in MENA. 30 out of the Top 50 most funded startups in MENA call the United Arab Emirates home. Telegram Messenger took the top spot after US $2.7 billion from ICO proceeds and debt-financing. Noon came in second after it reportedly raised US $1 billion in funding, followed by Kitopi’s US $804 million raise. Careem and Swvl round out the Top 5. The Top 5 most funded startups in MENA list is also indicative of Dubai’s position as the region’s leading startup hub. Three of the top 5 were born and raised out of Dubai; Noon arguably was also born out of Dubai though it moved its headquarters to Saudi Arabia to secure funding and base itself closest to its largest customer base in the region. Swvl was a startup born out of Egypt, but it relocated its headquarters to Dubai when it was raising pre-IPO rounds.

The report points out that it is not just venture capital funding that Dubai-based startups are attracting. Dubai-based scale-ups also enjoy the lion’s share of all other types of funding, which include Private Equity (PE) rounds, Corporate rounds, and “others”, which includes debt-financing, equity crowdfunding, grants and convertible notes.

Dubai Startups Need Viable IPO Exit Pathways

His Excellency Ahmad Abdullah Juma bin Byat commented on the issue around the viability of IPO exits for local startups. Only 12% of total capital raise since 2010 has been from successful IPOs in the region, and none have listed on the Dubai Stock Exchange. “Our local and regional stock markets need to reinvent themselves and focus immediately on this growing digital segment through separate platforms built with digital companies’ needs in mind, before it’s too late,” heeded H.E. bin Byat.

Farha agreed stating, “A viable path to IPO is an important attribute of a mature startup ecosystem for which attracting foreign investment is also imperative to bring true and deep liquidity into our stock exchanges.”

Another sentiment that all investors seemed to agree on was that there are expected headwinds in 2023. Walid Hanna from MEVP stated, “We have witnessed a decrease in the valuation hype, the market has corrected, and there might be a slight ‘funding winter’ as the ecosystem matures and becomes more competitive.” He continued, “to mitigate these risks, it will be important for the government to continue to support and invest in the startup ecosystem, and for the VC community to remain nimble and responsive to the needs of the market.”

Despite Dubai’s strength as a startup ecosystem thus far, there was also a clear indication that Dubai and the entire region had much more room to grow. H.E. bin Byat put it best when he said, “Globally VC funding totalled to something around US $470 billion in 2022, which is just 12%% of the global Private Equity and M&A deal activity – there is huge room for growth here.”

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)