Reef.io | Aggregating Protocols to Become the most user-friendly One-Stop-Shop Blockchain for DeFi

20 January 2022•

Denko Mancheski’s latest crypto project is Reef (reef.io). The founder and CEO named the project Reef because a reef is where all sea life come together, all in one place. He launched Reef in the “2020 Summer of DeFi” because he wants to create a symbiotic ecosystem for the world of crypto and DeFi. Denko sat down with us at our offices in Dubai to discuss the Reef project.

Today, Ethereum DeFi activities are fragmented and a pretty painful experience; it seems for every protocol or action you want to take – whether it be staking and lending, trading on decentralized exchanges, derivatives, payments or trading NFTs – there’s a separate decentralized app (DApp), and for every DApp, there are unique wallets and tokens that are needed to use each. Thus, Reef is an ambitious project that seeks to become the premiere blockchain for DeFi, NFT and gaming applications. These are all DApps that require high throughput because of the number of on-chain transactions required when adding and removing liquidity, trading, minting NFTs, buying NFTs, and even in-game actions like attacking a character. Reef seeks to create a seamless user-interface and user-experience to make it easier for people to use a blockchain DApp for the first time. This is made possible by the Reef team, now a legion of 35 developers, community managers, marketing, business development, and legal players, developing what they claim is the most advanced Ethereum VM-compatible layer 1 blockchain available today. In our interview with Mancheski, he also explains: “So much can be optimized on Ethereum, it makes sense for us to try. Ethereum gas (transaction) fees are so high, it’s creating major barriers to entry for retail investors. The governance structures have major room for improvement.” Mancheski is referring to Ethereum’s current Proof-of-Work consensus layer, which is extremely energy intensive and results in expensive and unreliable transaction fees. Ethereum has announced that it will try and implement a blockchain fork to begin transitioning to a more cost and energy efficient Proof-of-Stake consensus layer, but that remains to be seen. Mancheski claims that “Reef is taking the best of Substrate and Ethereum; our governance structure is based on a hybrid model which uses both Proof-of-Stake by nomination, as well as validators using a unique ‘Proof-of-Commitment’ protocol;” the latter is an invention by the Reef team.

Reef stands for “Reliable, Extensible, Efficient, and Fast.” Reef claims their blockchain is the “most advanced EVM compatible layer 1 blockchain, built using the Substrate Framework; it provides high scalability, enables low transaction costs, and allows seamless integration so developers can instantly migrate their DApps from Ethereum to Reef Chain without changing its codebase. Reef Chain is built to be self-upgradeable and has on-chain governance. Its Reef Token (REEF) has utility too, used for paying for transactions, running validator nodes by staking REEF Tokens, and voting on how Reef Chain should be run (for example, nominating and voting on which validator nodes should be part of the network). What’s revolutionary about Reef Chain is its ability to accept DApp codebases from Ethereum and other EVM chains today, along with new virtual machine support being built alongside it. This allows developers to tap into a large community hungry for low transaction fees, high scalability, and being able to natively participate in the operation of the blockchain by nominating validators, earning a portion of the transaction fees in the process. In essence, it allows developers building DApps to program in multiple (coding) languages.

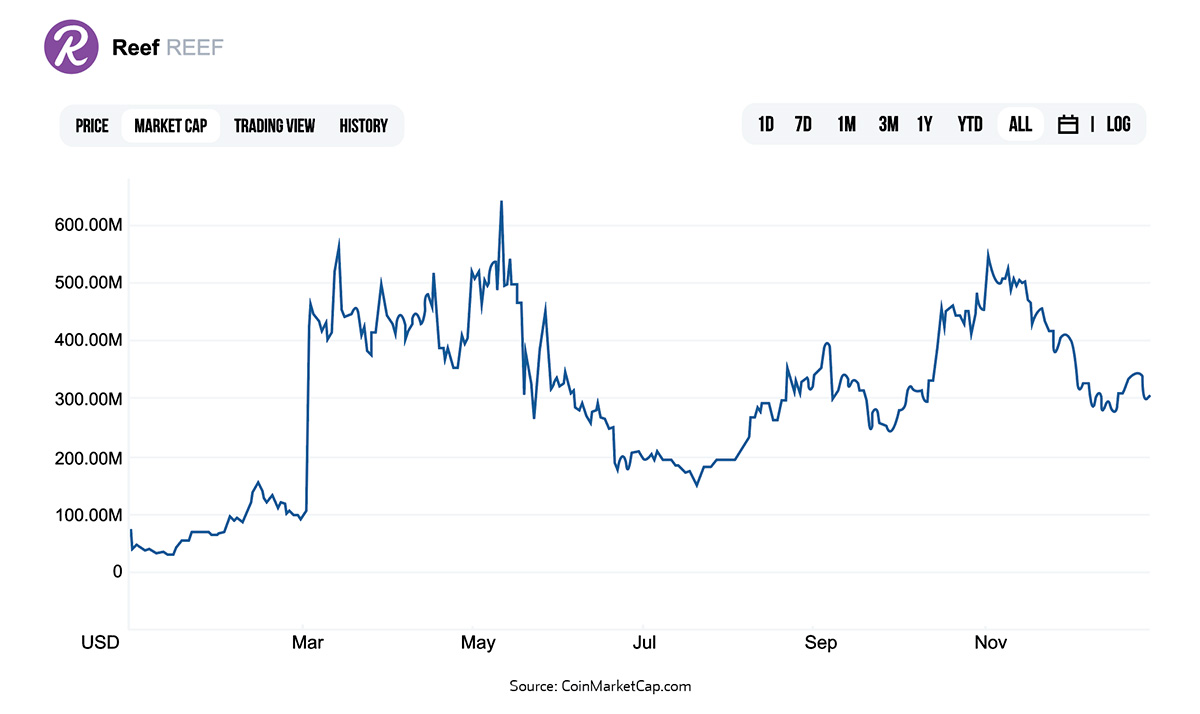

When asked how he would respond to those that say his project is too ambitious, especially when much smaller crypto-projects fail, Mancheski replies, “Every cycle you have different trends; right now it’s NFTs, tomorrow it will be something else. The cool thing about infrastructure projects is that they always survive because you will always need the layer on which the DApps will run. Because Reef is so flexible and adaptable to what the ecosystem needs, the technology can’t be deprecated; I expect Reef to be one of the top 5 blockchains in the world within the next 5 years. DeFi, NFTs and gaming are only becoming more common, and are all beginning to interact with each other where you can earn in-game items that are NFTs, and then lend out the items to others and get paid to do so. It’s a major catalyst for talented people to benefit from their gaming or financial acumen.” Many investors seem to agree, as Reef is backed by Funds and Venture Capitalists. That said, REEF token investors haven’t had a good run in 2021; REEF’s market cap reached an all-time high on May 11, 2021 at US$646 million, and then finished the year at US$236 million, a 63% drop. Mancheski doesn’t seem phased. He’s focused on the development of the project and launch, and I suppose all we can do is wait and see.

%2Fuploads%2Fcrypto-universe%2FThe-Crypto-Universe-cover.jpg&w=3840&q=75)