Meet the Fintechs Dominating Africa’s Unicorn List

31 May 2023•

The Land of Zebras and Unicorns?

Africa may not be the first place that comes to mind when you think of unicorns, but believe it or not, the continent is home to some pretty impressive startups that have reached billion-dollar valuations. And what’s more, a significant chunk of these unicorns are fintechs, indicating the growing importance of financial technology in Africa’s economic landscape.

Rise of the Fintech Unicorn in Africa

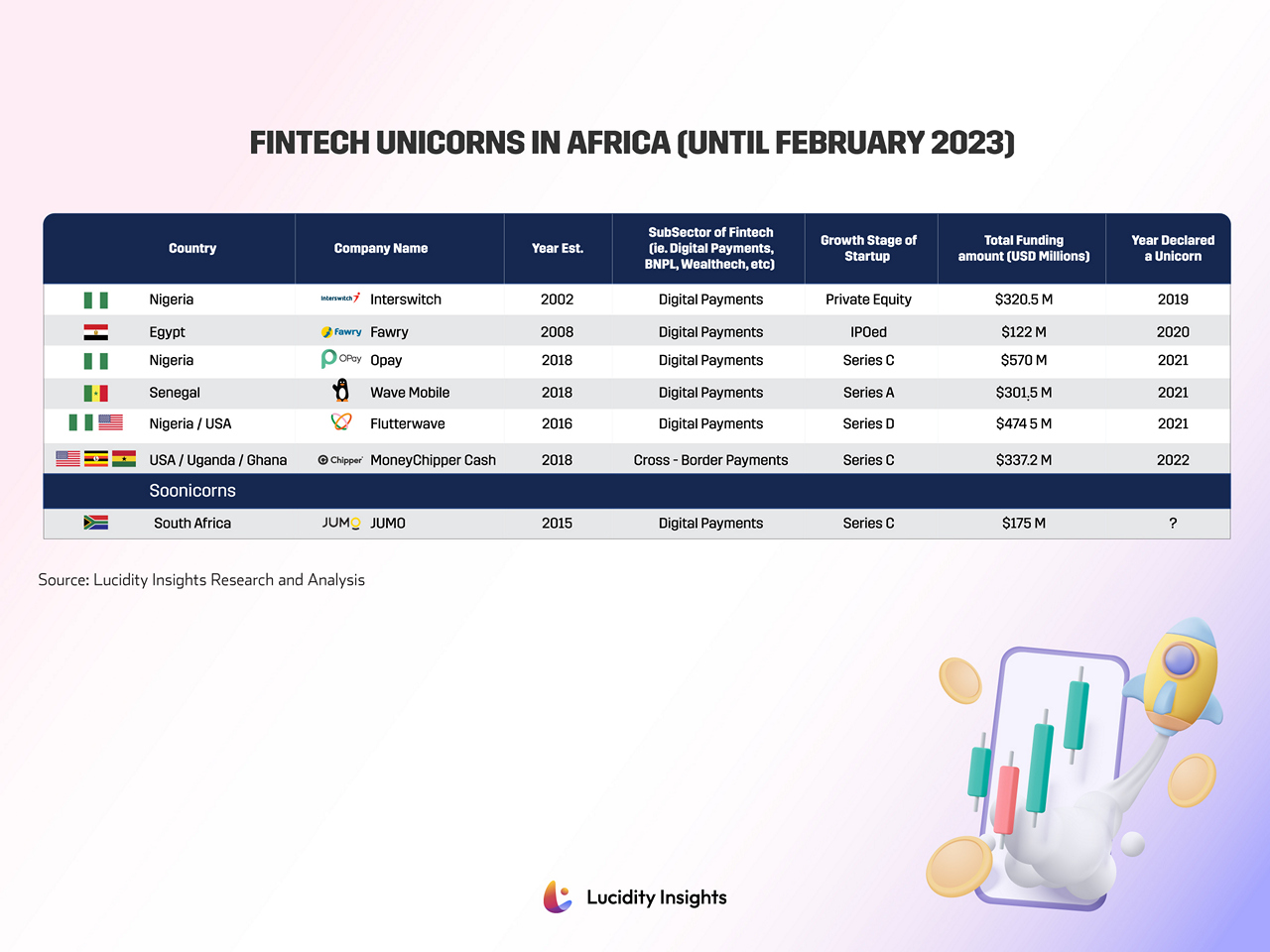

Globally there were 307 fintech unicorns as of Q3 2022, of which 6 can be considered African. (See table below, ‘Fintech Unicorns in Africa - as of February 2023’)

What Is a Unicorn?

A unicorn is a privately-held company that has a valuation of over US $1 billion. These are rare creatures indeed, and in Africa, they are even rarer. However, in recent years, the number of African unicorns has been growing steadily, and fintechs are leading the pack.

Here are some of Africa’s most prominent fintechs, in chronological order of their birth into unicorn-dom.

1. Interswitch

Country: Nigeria

Year Established: 2002

Fintech Sub-Sector: Digital Payments

Growth Stage: Private Equity

Total Funding Amount: $320.5M

Year Declared a Unicorn: 2019

Interswitch is one of the oldest fintech ‘startups’ on the continent and the first fintech unicorn born out of Africa. Interswitch was first formed in 2001 by Techinvest Limited, Accenture, and a consortium of seven Nigerian banks to address the need for a nationwide electronic funds transfer, transaction processing, and switching entity in the country. Today, this Nigerian company is one of the largest integrated payment processing companies in Africa. Interswitch has raised a total of $320.5 million between several Venture, Corporate and Private Equity rounds. The company was valued at US $1 billion after Visa made a $200 million investment in 2019. They’ve gone on to raise an additional $100 million PE round in May 2022.

Of the unicorn valuation, Mitchell Elegbe, Founder and Group Managing Director at Interswitch Limited said, “From inception, we wanted to attain unicorn status because that benchmark is strong for brand equity in Africa. It helps to attract top talent and investors. But our focus has always been about building a long-term sustainable business.” It seems he’s in it for the long-haul, considering his tenure at Interswitch has already spanned two decades. \

2. Fawry

Country: Egypt

Year Established: 2008

Fintech Sub-Sector: Digital Payments

Growth Stage: IPOed

Total Funding Amount: $122M

Year Declared a Unicorn: 2020

Of course, Nigeria is not the only African country with fintech unicorns. Fawry is Egypt’s largest e-payment platform serving the banked and unbanked population. Established in 2008, Fawry’s primary services include enabling electronic bill payments, mobile top-ups and provisions for millions of Egyptian users. Other digital services also include e-ticketing, cable TV, and a variety of other services. The idea came to Fawry’s founder, Ashraf Sabry, when he realized how unproductive Egyptians were having to pay monthly bills by visiting various institutions in-person – having to pay your rent, cable, internet, electric and water bill, mobile phone, gas, and many other bills by physically driving around the city to make payment. He conceptualized a “one-stop-shop” digital bill payments system that could remove these two to three burdensome days every month off the average Egyptian.

Within 6 months of its first product launch in 2010, over 400,000 customers had used its service. By 2018, Fawry had processed over 600 million transactions with a total value of over US $1.1 billion, and profits of over US $5 million. According to the World Bank, 30% of Egypt’s population, or roughly 33 million Egyptians, is unbanked or financially disenfranchised. Products like Fawry support many of these cash-only users to get access to additional financial services. The Egyptian fintech IPOed in 2019 and was over-subscribed 30x over. Prior to IPOing, the company raised funds through multiple Private Equity rounds totalling $122 million. In August 2020, just over one year after going public, Fawry officially became Egypt’s first tech unicorn when its market capitalization hit US $1.07 billion.

Related: E-Payment Platform Fawry, Strives for Financial Inclusion of Banked and Unbanked Egyptians

3. OPay

Country: Nigeria

Year Established: 2018

Fintech Sub-Sector: Digital Payments

Growth Stage: Series C

Total Funding Amount: $570M

Year Declared a Unicorn: 2021

OPay is a Nigerian-based fintech platform, established in 2018, that offers a range of services from mobile payments, ride-hailing and food delivery. The startup became one of Africa’s most valuable fintech startups and officially became a unicorn in 2019, following a US $120 million Series B funding round led by Asian investors such as Sequoia China, Source Code Capital, and Softbank Ventures Asia. To date, OPay has raised an astounding US $570 million, making it the single most funded startup in Africa’s history.

OPay is currently valued at over US $2 billion. The company has grown rapidly, launching across tier 2 Nigerian cities as well as additional African countries, including Kenya and Ghana. OPay’s founding team is unique in that it is diverse with very targeted expertise; Yahui Zhou is a Chinese techpreneur with significant software engineering experience which he put to good use when he founded Opera Software in Norway, prior to founding OPay.

4. Wave Mobile

Country: Senegal

Year Established: 2018

Fintech Sub-Sector: Digital Payments

Growth Stage: Series A

Total Funding Amount: $301.5M

Year Declared a Unicorn: 2021

Wave went from a spinoff from Asia and Africa-focused cheap remittance company, Sendwave in 2017, to a mobile money service provider valued at US $1.7 billion in four short years. The unicorn status was awarded to Wave after it raised its US $200 million Series A round in September 2021, led by payments giant Stripe, Sequoia Heritage, Founders Fund and Ribbit Capital. This $200 million was the largest Series A fundraising round in Africa to date, and helps raise the company’s total fundraising to US $301.5 million, with 15 investors on their cap table.

The Senegalese startup is the first fintech unicorn out of francophone Africa, and it's no surprise – as a 2020 GSMA report suggested that Senegal was one of Africa’s fastest-growing mobile money markets. The company is also present in Côte d’Ivoire, and is considering potential expansions into Uganda and Mali.

5. Flutterwave

Country: Nigeria / USA

Year Established: 2016

Fintech Sub-Sector: Digital Payments

Growth Stage: Series D

Total Funding Amount: $474.5M

Year Declared a Unicorn: 2021

One of the most notable African unicorns is Flutterwave, a Nigerian fintech startup established in 2016, that provides payment solutions for businesses and individuals. Flutterwave’s payment gateway has become ubiquitous in Nigeria and is expanding rapidly throughout Africa. The company is known for its pan-Africa focus and developer friendly API. Flutterwave also has invested in advanced fraud detection algorithms and has formed partnerships with a range of global companies including PayPal, Alipay and Worldpay.

Flutterwave has raised over US $474 million, of which over-half ($250 million) was raised in their latest February 2022 Series D round. The startup also has a whopping 50 investors in its cap table, which is not an uncommon occurrence for African startups, for whom capital can be hard er to come-by. The company officially became a unicorn in March 2021, following a successful Series C funding round.

6. MoneyChipper Cash

Country: USA / Uganda / Ghana

Year Established: 2018

Fintech Sub-Sector: Cross-Border Payments

Growth Stage: Series C

Total Funding Amount: $337.2M

Year Declared a Unicorn: 2022

Though Chipper Cash is headquartered in San Francisco, its operations are primarily focused on Africa. The fintech company was also founded in 2018 by two African Entrepreneurs, Ham Serunjogi from Uganda and Maijid Moujaled from Ghana, which is also why it is widely considered an African unicorn. The company focuses on creating a cross-border mobile payments platform that makes it easier for people in Africa to transact with each other and the rest of the world; having met working in Silicon Valley, the two founders decided to address the challenges they personally faced when trying to send money to friends and family in Africa.

Sub-Saharan Africa is one of the most expensive regions to send money globally, which is why Chipper Cash’s play is to offer ‘best prices’ and facilitate money movement between Africa and the USA. The U.S. is roughly responsible for 30% of the international remittances to sub-Saharan Africa. In 2021, Chipper Cash was crowned a Unicorn, and in November 2022, the company received a US $2 billion valuation when it raised a US $150 million extension on its Series C funding round. After Chipper Cash raised its first $100 million Series C round, Serunjogi called his company “the most valuable private start-up in Africa.” To date, the company has raised a total of US $337.2 million in 7 rounds of funding; the startup has over 25 investors on its cap table.

Honorable Mentions: The Soonicorns

1. JUMO

Country: South Africa

Year Established: 2018

Fintech Sub-Sector: Digital Payments

Growth Stage: Series C

Total Funding Amount: $175M

Year Declared a Unicorn: ?

South Africa’s JUMO is another notable example, though it is undetermined whether JUMO has officially reached unicorn status just yet; but it’s safe to assume that JUMO is a ‘soonicorn’. Founded in 2015, JUMO offers digital financial services to entrepreneurs and small businesses in emerging markets. The company’s AI powered intelligent platform enables banks to reach millions of new customers with credit and savings products, which is a critical need in Africa – where there is great hopes that fintech can bridge the large financial inclusion gap. JUMO is focused on making it easier for capital providers to reach new customers at affordable prices, while making predictable returns – and the platform itself provides a full range of infrastructure and services that banks need in order to operate, from core banking to underwriting, KYC and fraud detection services.

JUMO has raised over US $175 million, with the last venture round of $120 million being raised in November 2021. By the end of 2021, JUMO’s platform has been used to make 120 million loans, totalling US $3.5 billion to more than 18 million people and small businesses in Ghana, Uganda, Kenya, Tanzania, Zambia, Côte d’Ivoire and Pakistan. Based on the number of eMoney subscribers on JUMO’s platforms, it has been estimated that JUMO’s annual lending volume could grow to $40 billion, following successful launches in Nigeria, Benin and Cameroon. JUMO is considered a soonicorn, though following a US $52 million funding round led by Goldman Sachs in March 2019, the investment bank publicly declared that JUMO would become Africa’s next unicorn. As of 2022, the Hurun Research Institute’s Global Gazelle Index still lists JUMO as a ‘Gazelle’, which is defined as a start-up founded in the 2000’s worth over $500 million, but not yet at unicorn status.

2. Paystack

Country: Nigeria

Year Established: 2015

Fintech Sub-Sector: Cross-Border Payments

Growth Stage: Acquired by Stripe in 2020

Many have said that Stripe’s acquisition of Nigeria’s payments start-up Paystack in 2020 was the turning point for African fintech. The deal was reportedly worth US $200 million, and it drove significant attention towards start-up investment and acquisition opportunities in Africa, especially when low interest rates pushed investors to search for higher-yielding investments. Almost predicting the future, many referred to Paystack as “the Stripe of Africa” before being acquired. When acquired, Paystack had approximately 60,000 customers, including small businesses, larger corporates, fintechs, educational institutions and online betting companies. Paystack is now operating independently, owned by Stripe. It is estimated that they are likely valued at over US $1 billion today.

Many More Soonicorns to Come

There are many other potential unicorns grazing in Gazelle laden savannas at the moment. Kuda Bank, Nigeria’s digital bank was valued at $500 million in 2021. Paystack is estimated to be worth somewhere in the ballpark of $1 billion today, but was acquired for $200 million by Stripe in 2020. Nigeria’s lending platform Lidya, African credit financing player Aella Credit, South Africa’s Lulalend and Yoco, as well as Egypt’s Paymob, Khazna, and MoneyFellows are all also vying to reach unicorn status.

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)