Here Are the 10 Graphs That Will Help Explain the Fintech Opportunity and Challenge in Africa

29 May 2023•

Africa has 1.4 billion people living on the continent, or 18% of the world’s population. Today, 90% of transactions in Africa use cash. It is also estimated that approximately 57% of Africans do not hold any kind of bank account, including mobile wallets. The opportunity, particularly for Fintechs, is massive.

The Power of Fintech in Africa

Fintech isn’t just about convenience and delivering a smarter, cost-effective solution to consumers here like in the rest of the world; instead, inherent to the market realities in Africa, Fintech presents an opportunity to reach hundreds of millions of unbanked and underserved people. Fintechs have the opportunity to achieve mass financial inclusion and take steps towards lifting another billion people out of poverty in the next decade, if they do the job that traditional banks have been unable to do.

In this article, you will gain insight into the fintech opportunities and challenges in Africa through 10 compelling graphs, illustrating the current situation.

1. Amazing Potential for Scalability

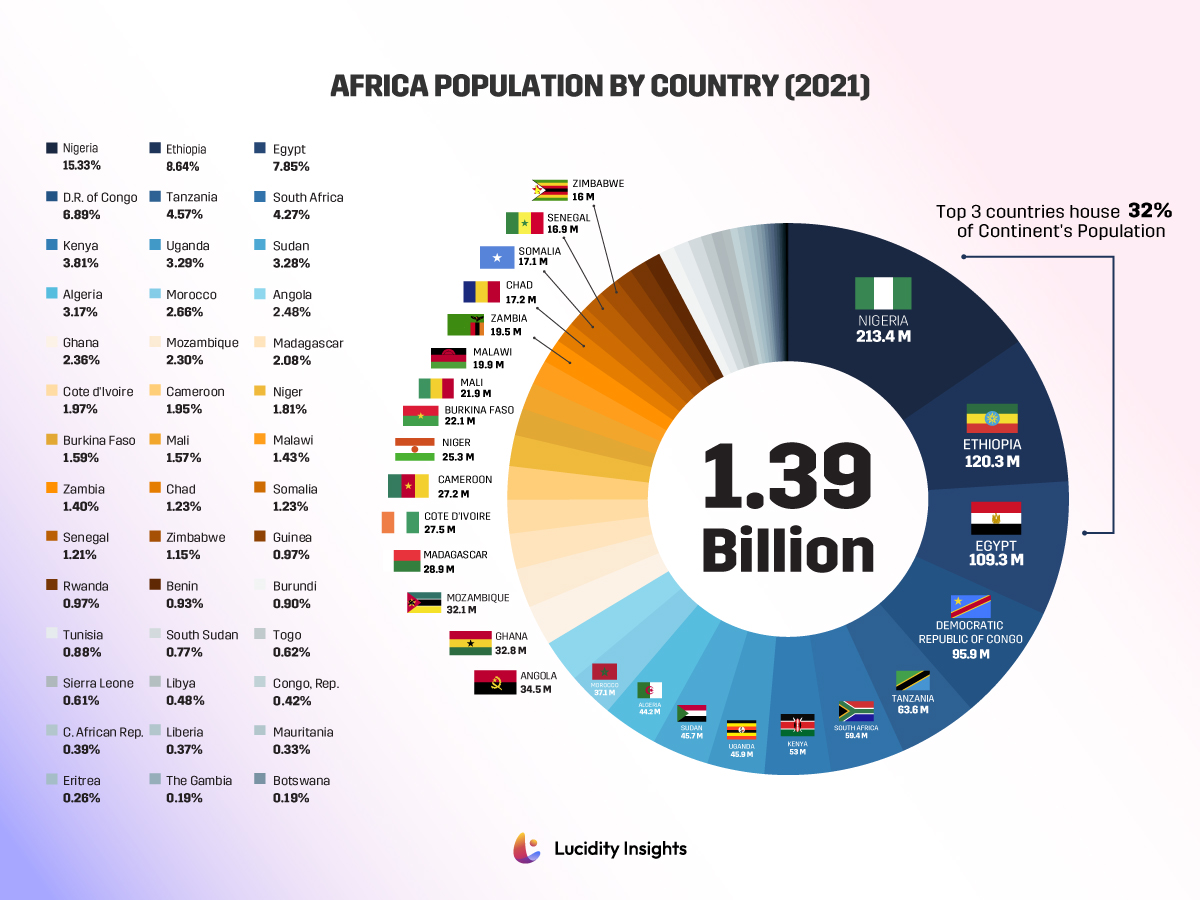

Infographic: Africa Population by Country (2021)

Africa has 1.4 billion people living on the continent, across 54 countries. That means 18% of the world population lives in Africa. Nigeria, Ethiopia and Egypt are the most populous countries on the continent with 213 million, 120 million and 109 million inhabitants, respectively. Botswana is home to the smallest population on the Continent, with just 2.6 million inhabitants.

2. Three Leading Markets Are Africa’s Market Makers

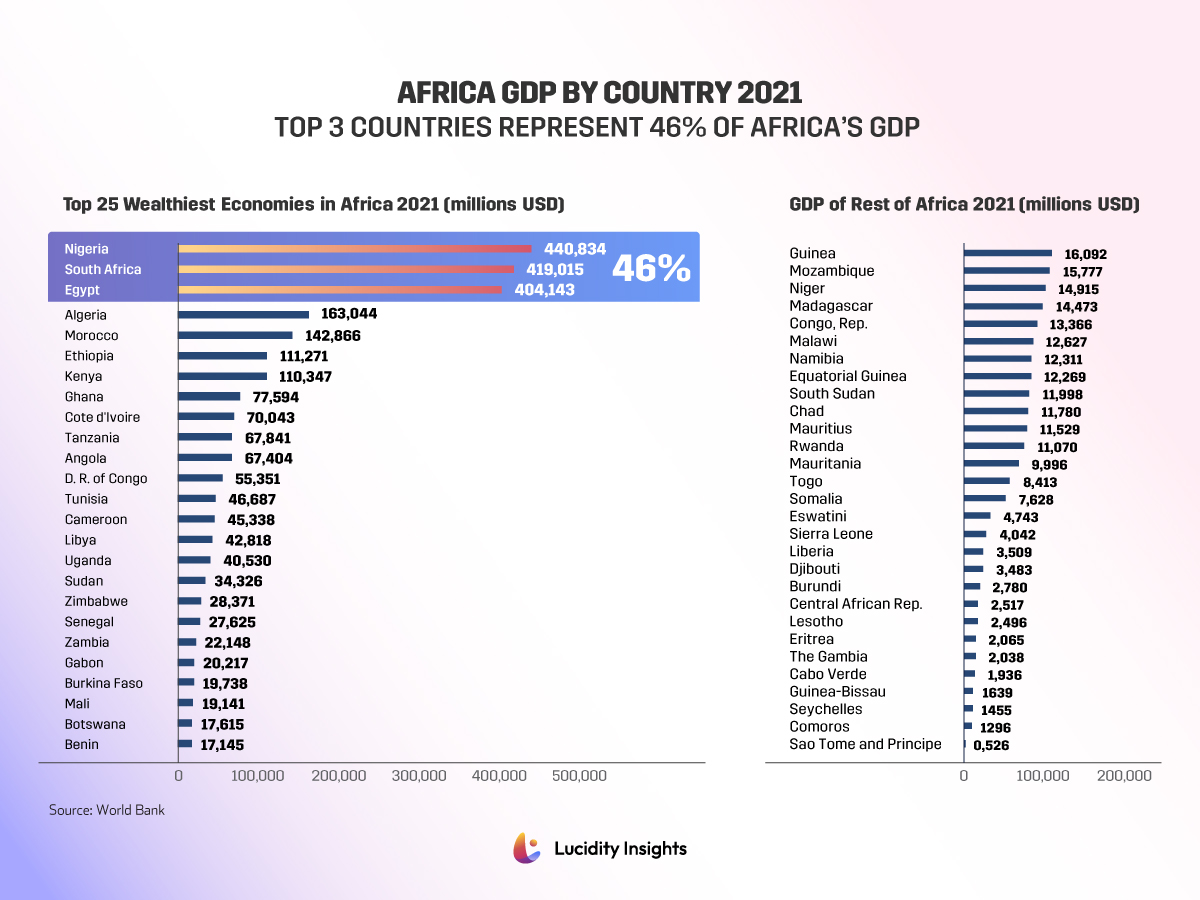

Infographic: Africa GDP by Country 2021

Three out of 54 Countries in Africa, Nigeria, South Africa and Egypt, account for 46% of the entire Continent’s GDP. Nigeria, Africa’s wealthiest economy is the 31st largest economy in the world in 2021, with an economy that is slightly smaller than Austria’s. That means, if you’re a fintech founder in Africa, you are looking at Nigeria, South Africa and Egypt to give you access to over 440 million consumers, and 46% of the continent’s wealth.

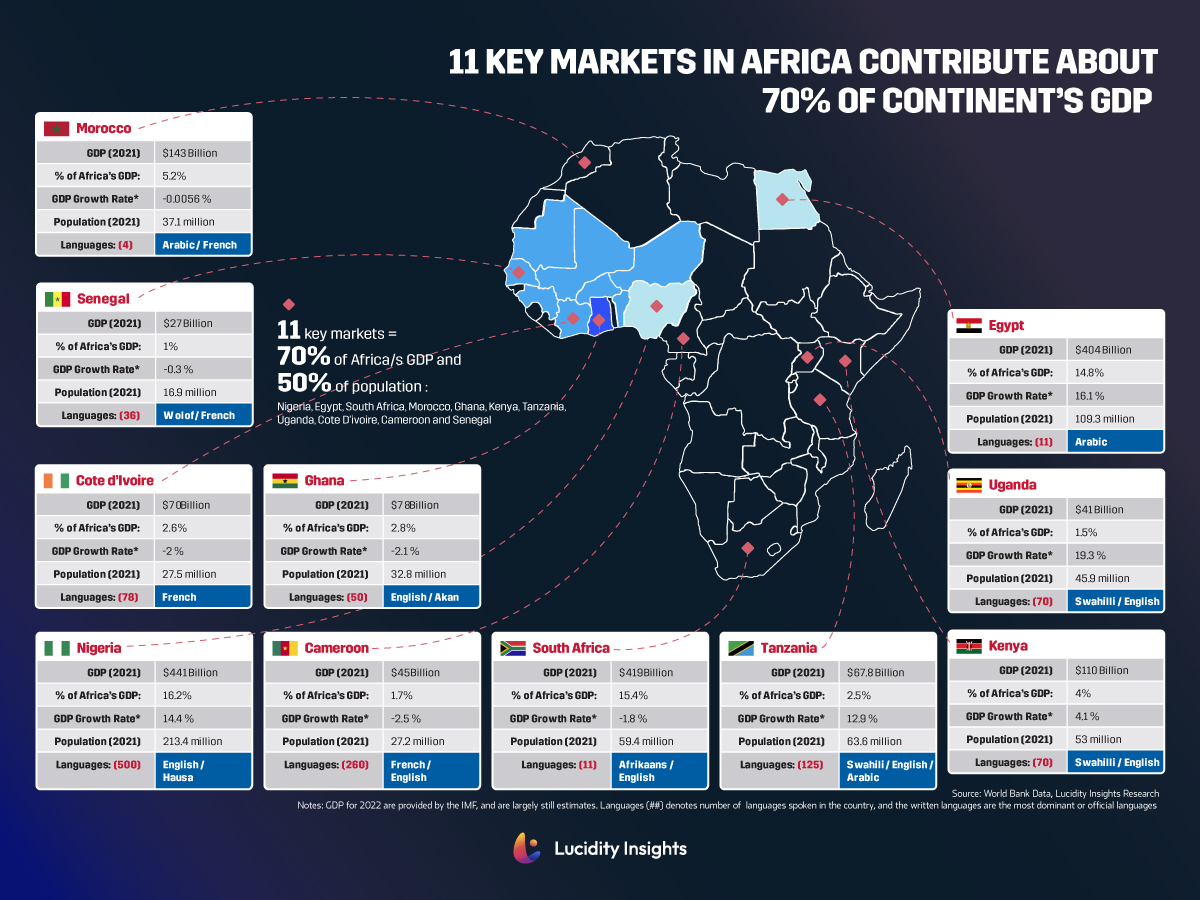

3. Africa Is Diverse, With ±2000 Languages Spoken Across the Continent

Eleven key markets in Africa contribute 70% of Africa’s GDP, and operate under 5 official languages between them, but for mass adoption to be considered, it’s important to realize there are nearly 2,000 unique languages spoken across the African continent, and at least 75 languages with more than 1 million native speakers. Nigeria alone is home to 500 different languages, which poses unique challenges for mass adoption of fintech and other product solutions in the country. Egypt on the other hand, is predominantly Arabic-speaking, which allows for easier product management and scalability.

4. Literacy Rates Among Greatest Challenge to Achieving Scalability

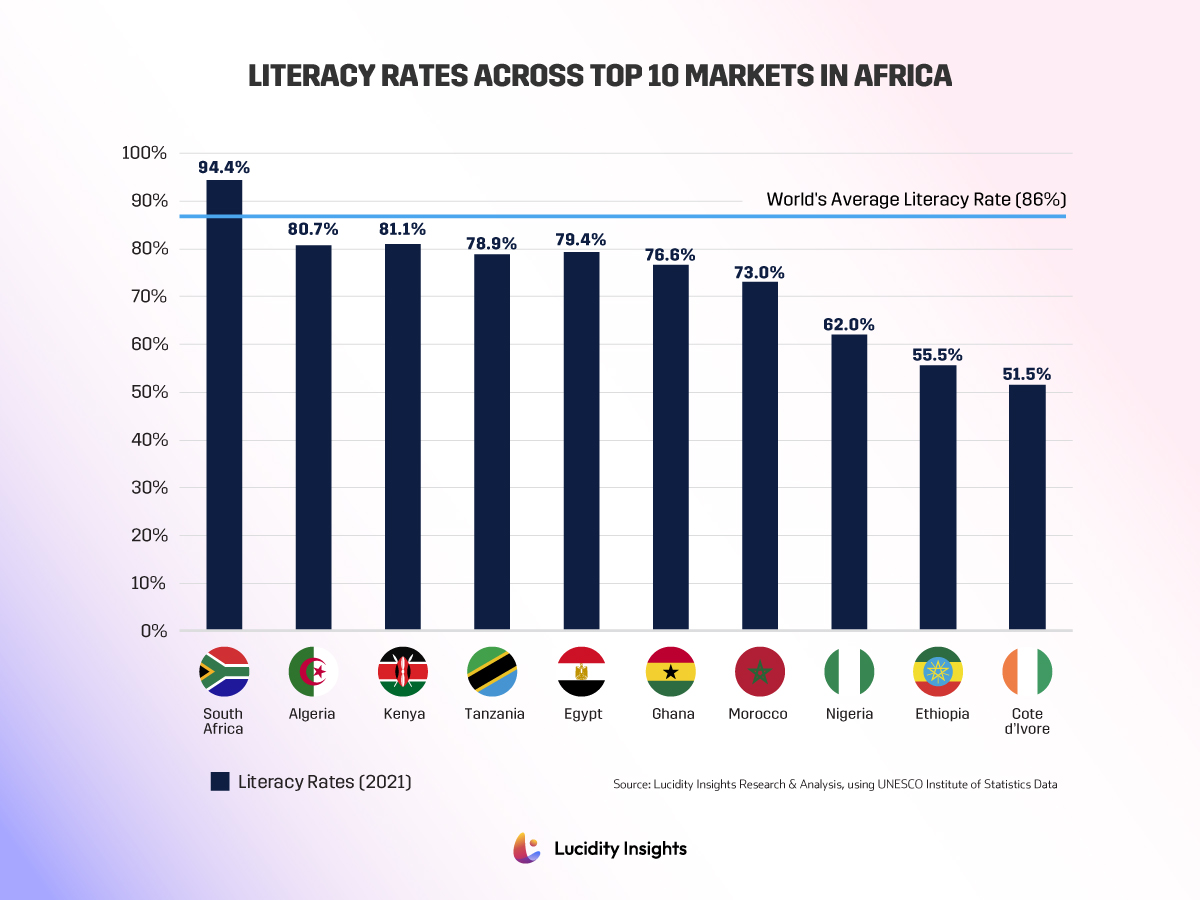

Infographic: Literacy Rates Across Top 10 Markets in Africa

One of the toughest challenges facing fintechs and banks trying to make a dent in financial inclusion is literacy rates across Africa. We’re not talking just about financial literacy here, but general literacy. South Africa having the highest literacy rate in Africa (94.4% of South Africans 15 years and older are literate) is just one of the likely reasons why the country was the first among African nations to develop a tech and fintech ecosystem. 72% of Egyptians are considered literate, while only 62% of Nigerians are considered literate. The following chart maps out the literacy rates of the top 10 wealthiest nations in Africa, which ranges from 94.4% to 51.5%. The country with the lowest literacy rate on the continent is Burkina Faso, where only 36.9% of the population aged 15 years and over is considered literate.

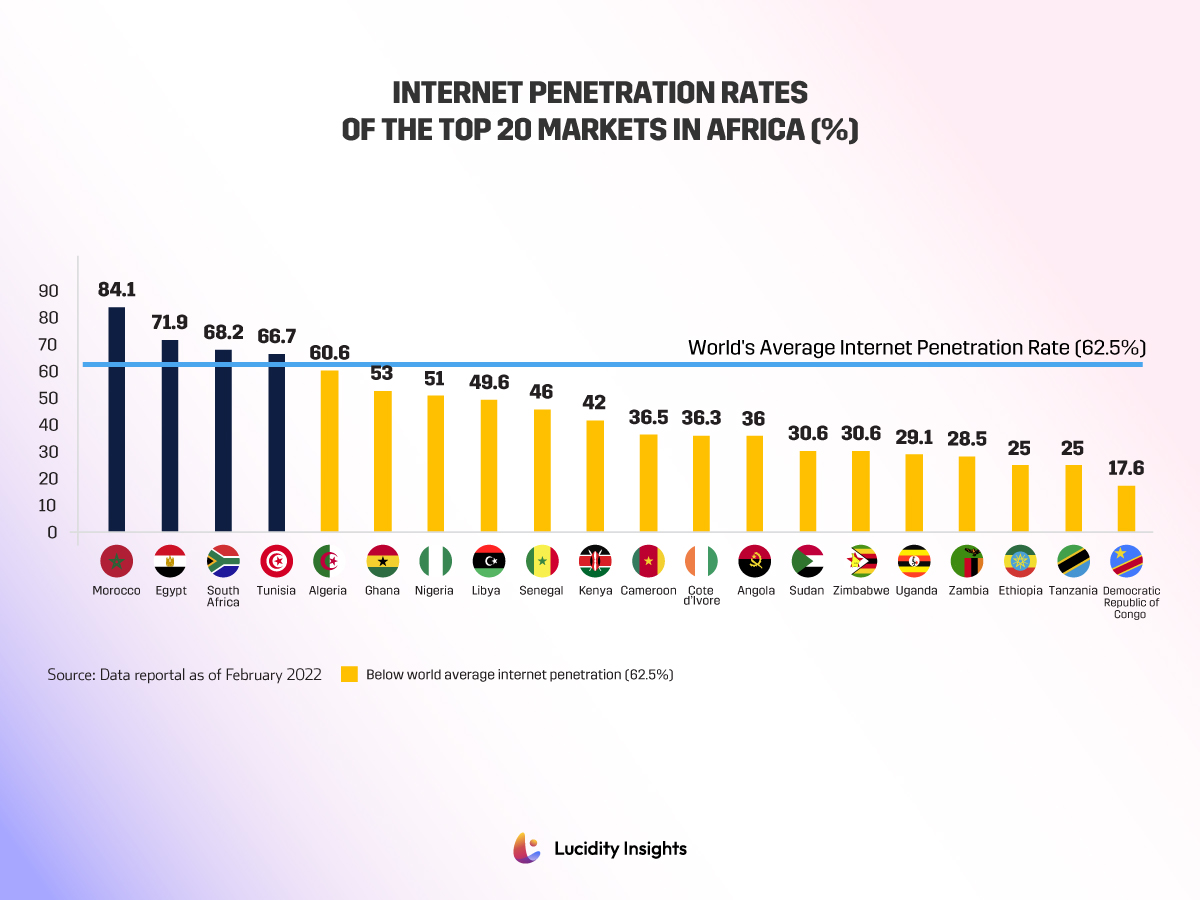

5. Low Internet Penetration Rates Still Shrink the Total Addressable Market

The above chart illustrates the internet penetration rates of the 20 wealthiest markets in Africa, and only 4 countries – Morocco, Egypt, South Africa and Tunisia – have achieved higher rates of internet penetration than the world average (>62.5%). Only half of Nigeria’s 213 million population has access to the internet, immediately removing them from current fintech’s reach. This is why many international development organizations, including the IFC, are investing in infrastructure players, that can make internet accessible to all. It is imperative, in order to reach the unbanked and underserved in rural communities across Africa. The lowest internet penetration rate on the continent is Eritrea, where only 1% of the population has access to internet due to strong governmental restrictions.

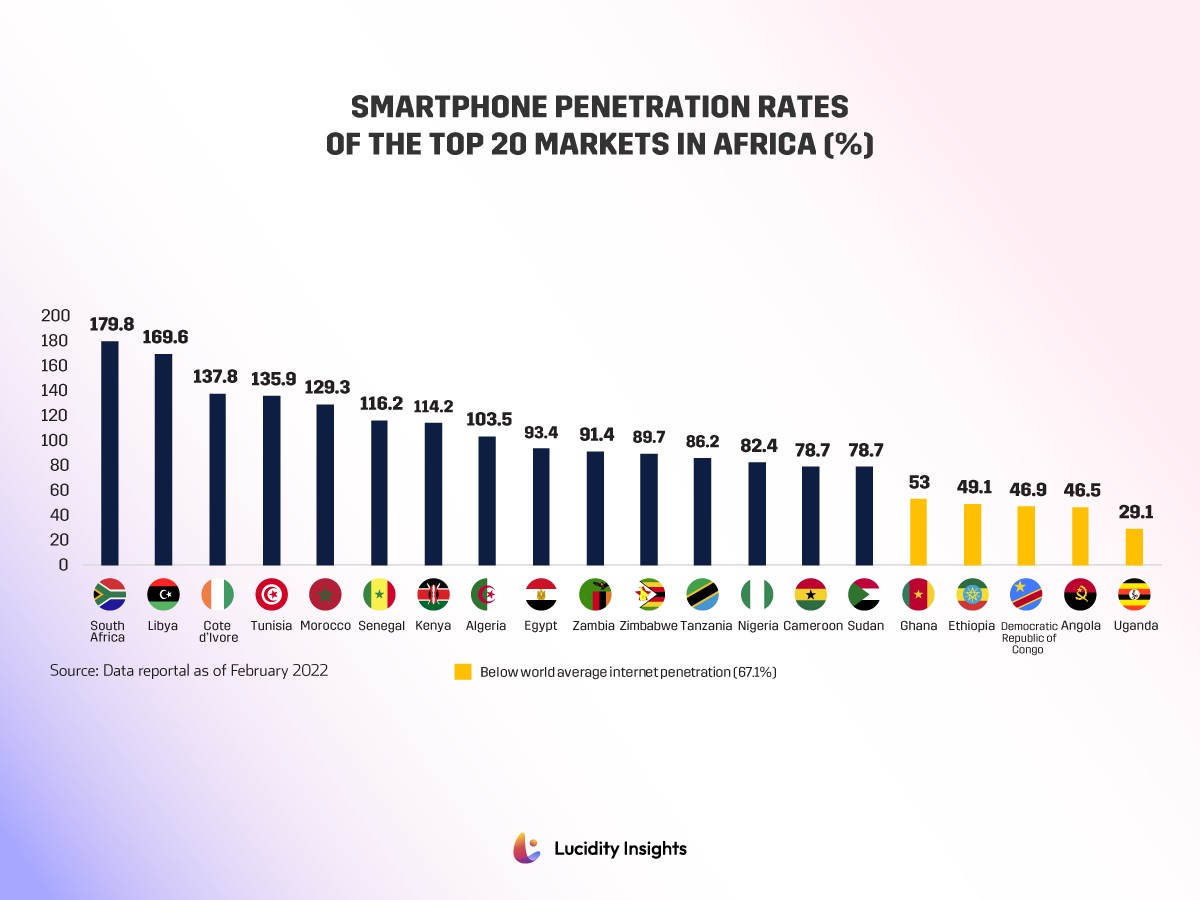

6. What Smartphone Penetration Means & Doesn’t Mean In Africa

Infographic: Smartphone Penetration Rates of the Top 20 Markets in Africa (%)

Smartphones are essential for accessing digital financial services, such as mobile banking apps and mobile money platforms. A challenge to smartphone penetration data in Africa, is the fact that many individuals who might possess a smartphone in Africa, may possess a smartphone without the financial means to procure a data subscription for internet connectivity on the phone, making the smartphone useless in being a financial inclusion enabler. For this reason, a country like Tanzania may have 86% smartphone penetration rates, but only a 25% internet penetration rate. In rural areas, instead of smartphone adoption, most have older feature phones, which don’t have the capacity to run applications on it. With the above-mentioned data limitations in mind, the top 20 wealthiest countries in Africa are doing relatively well with smartphone penetration rates, with 15 out of 20 of these countries being above the world average of 67.1%. According to the GSMA, Nigeria tops Africa’s smartphone connections with 163 million subscribers. South Africa has 107 million subscribers, while Egypt has 102 million subscribers.

Related: The future of fintech may well be in Africa.

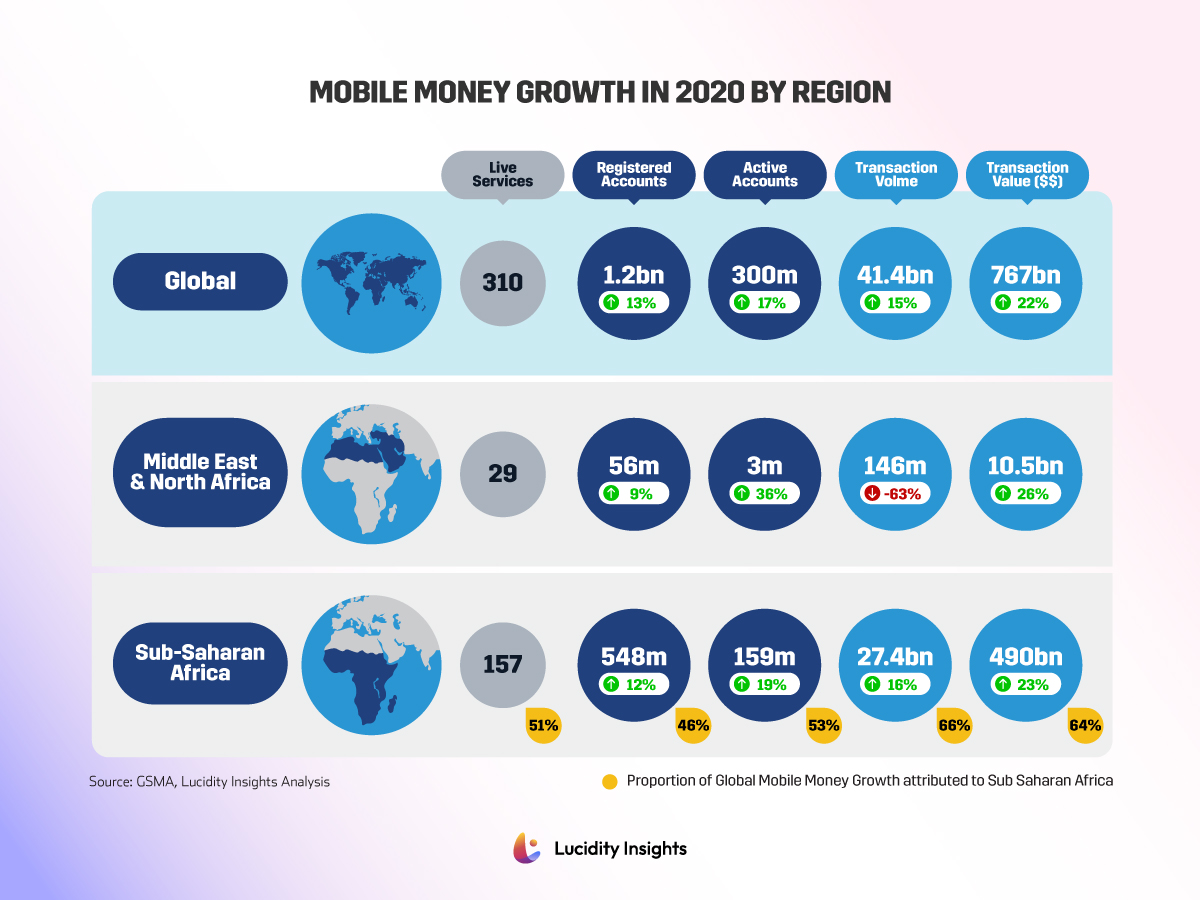

7. Sub-Saharan Africa Constitutes >64% Of Total Global Mobile Money

Infographic: Mobile Money Growth in 2020 by Region

Half of all registered and active mobile money accounts in the world are based in Africa. In 2020, more than 27 billion transactions and US $490 billion was processed in Sub-Saharan Africa. The World Bank argues that mobile money can help to reduce poverty by increasing access to financial services and reducing transaction costs for low-income households. They also argue that mobile money has the potential to facilitate financial inclusion particularly for women, who often face barriers to accessing formal financial services.

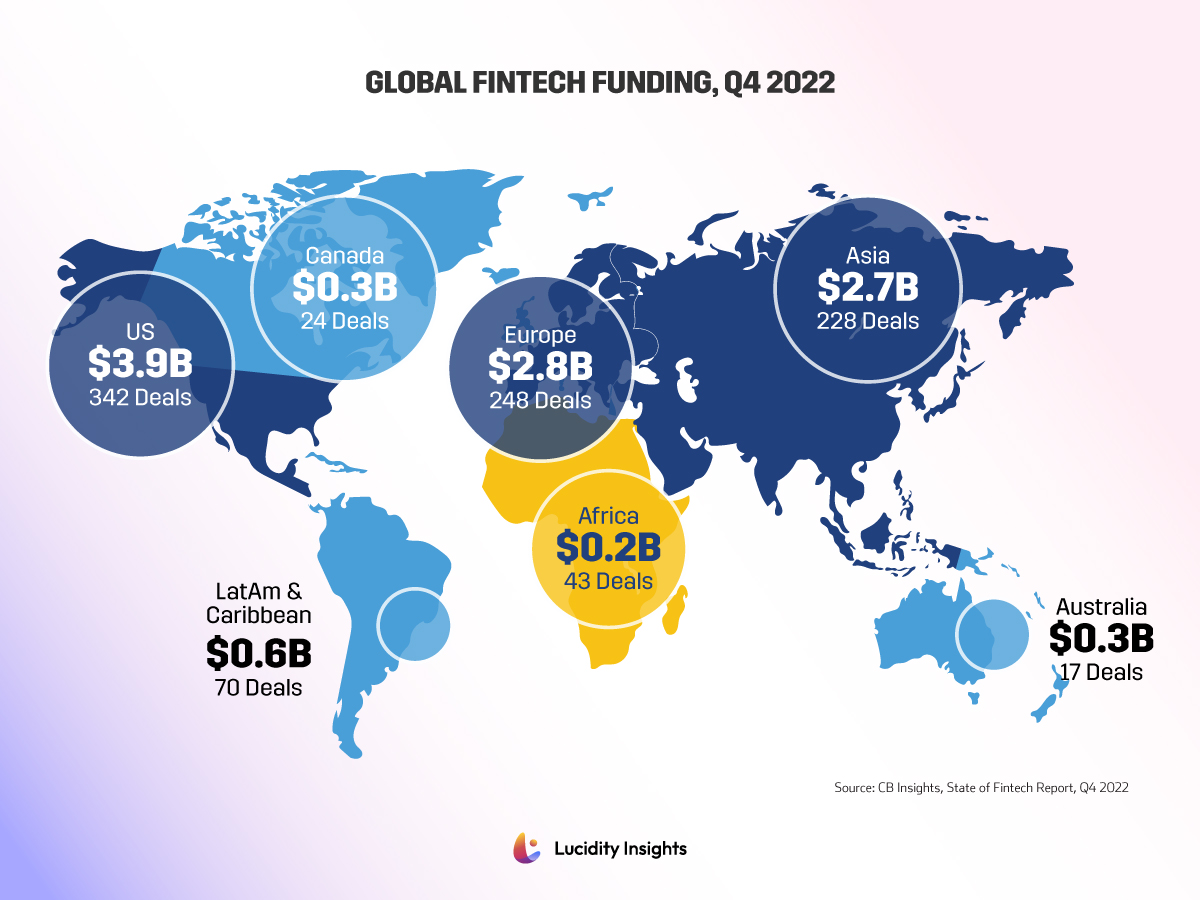

8. Africa’s Fintech Ecosystem Is Small and Growing

Infographic: Global Fintech Funding, Q4 2022

In Q4 2022, Africa constituted 4.4% of global Fintech venture capital deal flow, and 1.9% of total global fintech fundraising. In those 3 months, the continent’s startups attracted over $200M, 1/3rd less than that raised by Canadian Fintechs; though that value was raised across nearly double the number of Canadian startups in the same time period. That means lower ticket sizes and likely earlier stage startups in Africa are attracting funding today.

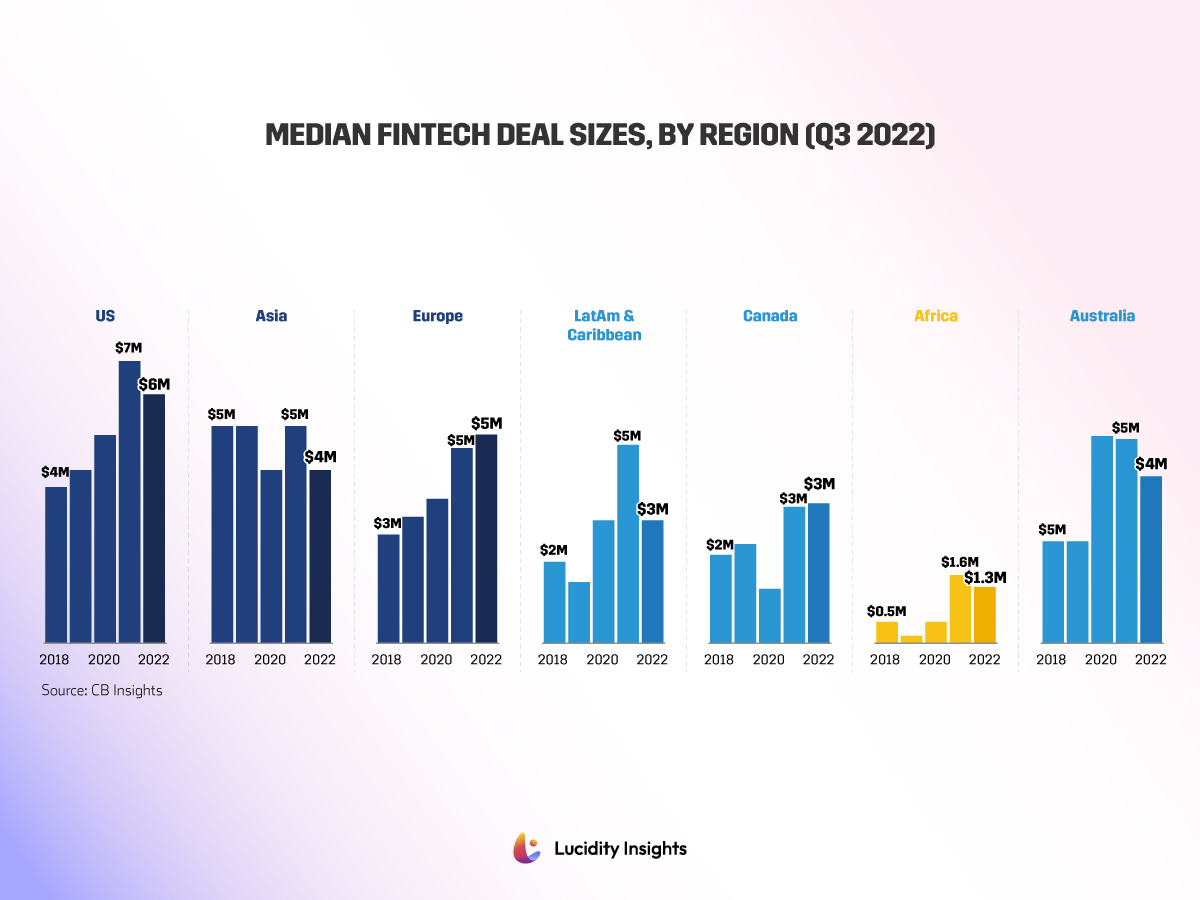

9. Low Deal Sizes, but Growing Fast

Infographic: World’s Median Fintech Deal Sizes, by Region (Q3 2022)

Africa continues to have the lowest deal-size across the world for Fintech Investments but has shown the fastest growth since 2018 – with average cheque sizes growing from $500,000 in 2018 to a high of US $1.6 Million in 2021.

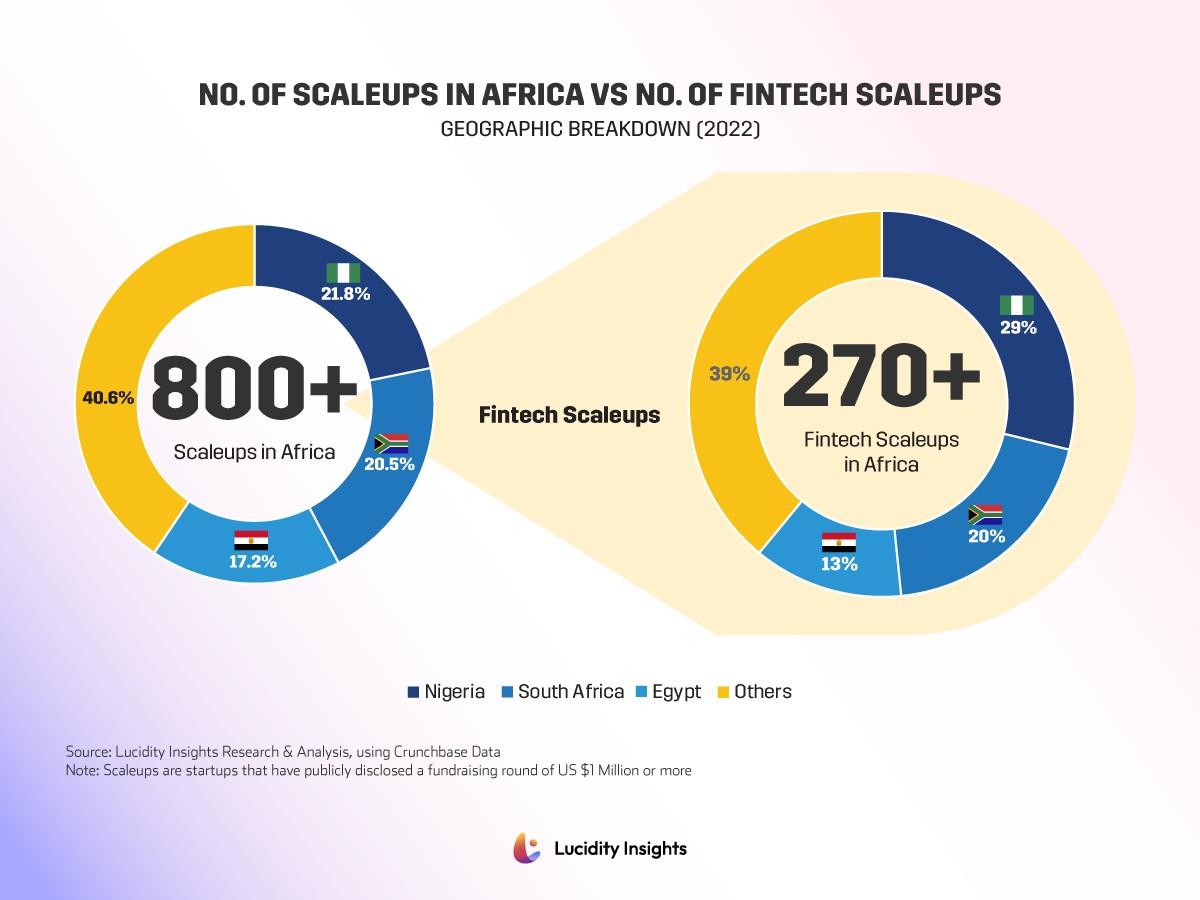

10. Over 800 African Scale-Ups Have Raised $1 Million or More; 34% Are Fintechs

Infographic: Number of Scaleups in Africa vs Number of Fintech Scaleups in Africa

There are thousands of startups across the African continent, with over 800 scale-ups. Scaleups are startups that have successfully raised over US $1 Million in funding and publicly disclosed these figures. >34%, or over 270 of those 800+ scaleups are Fintech players. Nigeria, South Africa and Egypt are collectively home to 60% of all scaleups across the African continent, and 62% of all the fintechs in Africa.

Next Read: IFC on Fostering Financial Inclusion via Fintech Investments in Africa

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)