HealthTech in the Middle East and Africa

23 November 2023•

The MENA region’s healthcare market is projected to grow at 11.7% CAGR from US $185.5 billion in 2019 to $243.6 billion in 2023.

Current healthcare expenditure in the GCC was estimated to reach US $105 billion 2022. Demand for healthcare services in the region is soaring, unlocking immense investment opportunities. The UAE alone accounts for 25% of the GCC healthcare spending, with the government having historically been the primary investor; new data shows private sector participation has increased in the past decade. The latest research shows that the digital health market of the United Arab Emirates and Saudi Arabia could reach US $4 billion by 2026. The UAE has already registered 257 Healthtech startups.

Infobytes That Explain Healthtech in the Middle East & North Africa:

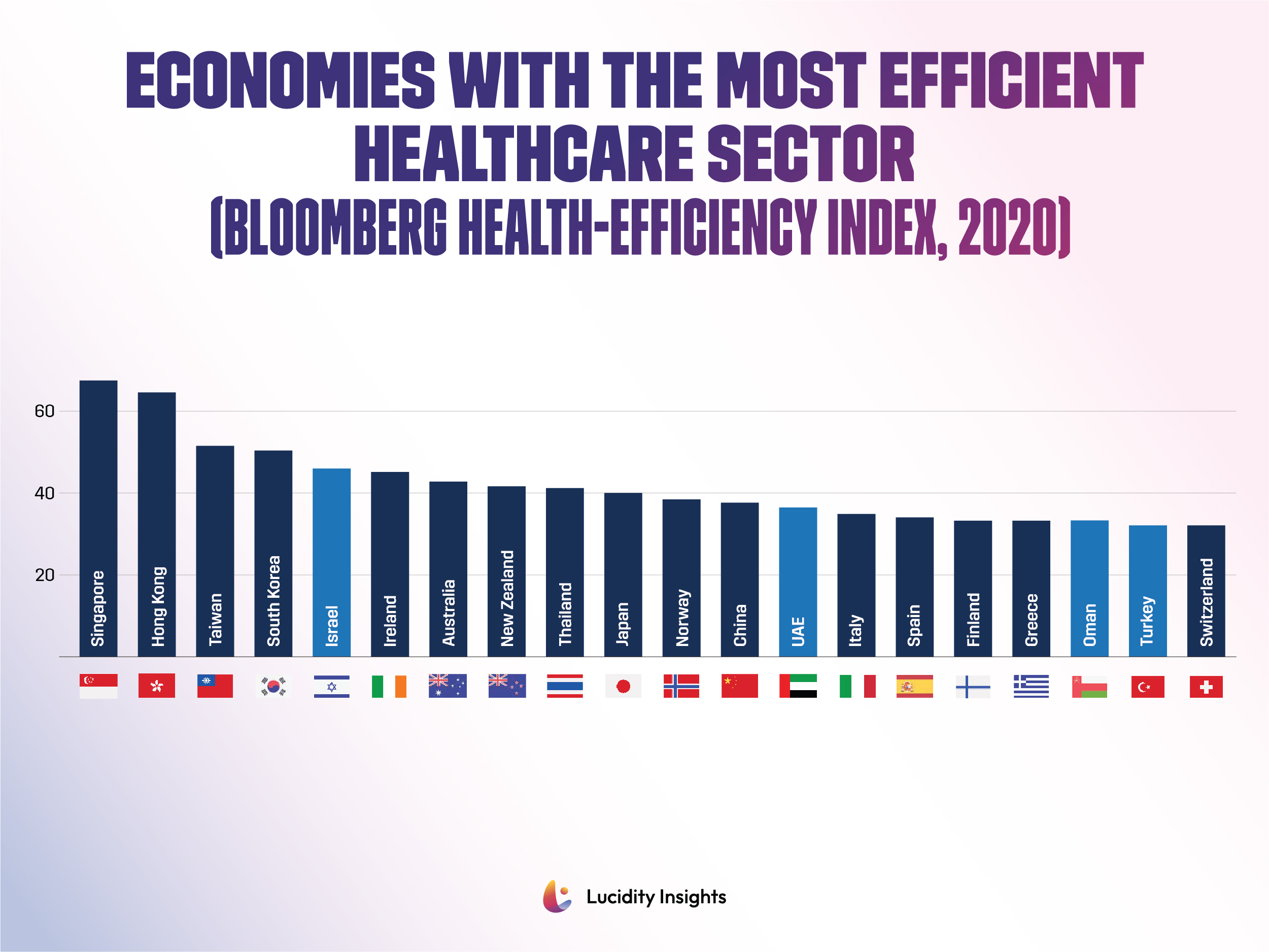

1. Israel, UAE, Oman and Turkey are in the top 20 world economies for healthcare efficiency

The Bloomberg Health-Efficiency Index, first conducted in 2013, tracks life expectancy and medical spending to determine which healthcare systems have the best outcomes around the world. Asian countries dominate, with Singapore, Hong Kong and Taiwan rounding out the Top 3 most efficient healthcare systems, followed by South Korea and Israel. UAE has the 13th most efficient healthcare system, and Oman and Turkey have the 18th and 19th most efficient healthcare systems in the world.

Infobyte: Economies with the Most Efficient Healthcare Sector

Infobyte: Economies with the Most Efficient Healthcare Sector

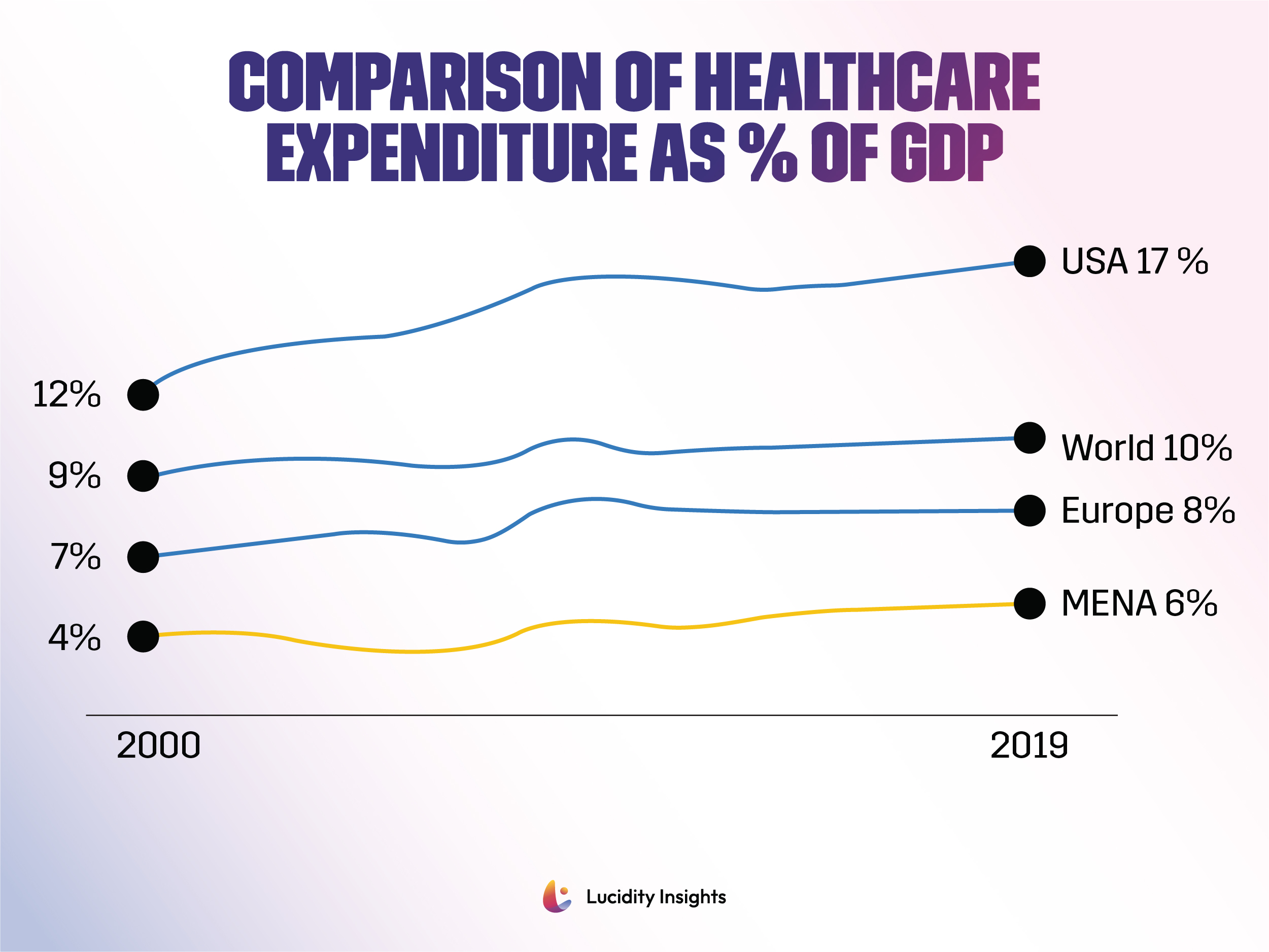

2. MENA has the lowest healthcare expenditure as % of GDP, but highest out-of-pocket expenses as % of expenditure; possibly in part due to younger demographics.

Infobyte: MENA Comparison of Healthcare Expenditure As % Of GDP

Infobyte: MENA Comparison of Healthcare Expenditure As % Of GDP

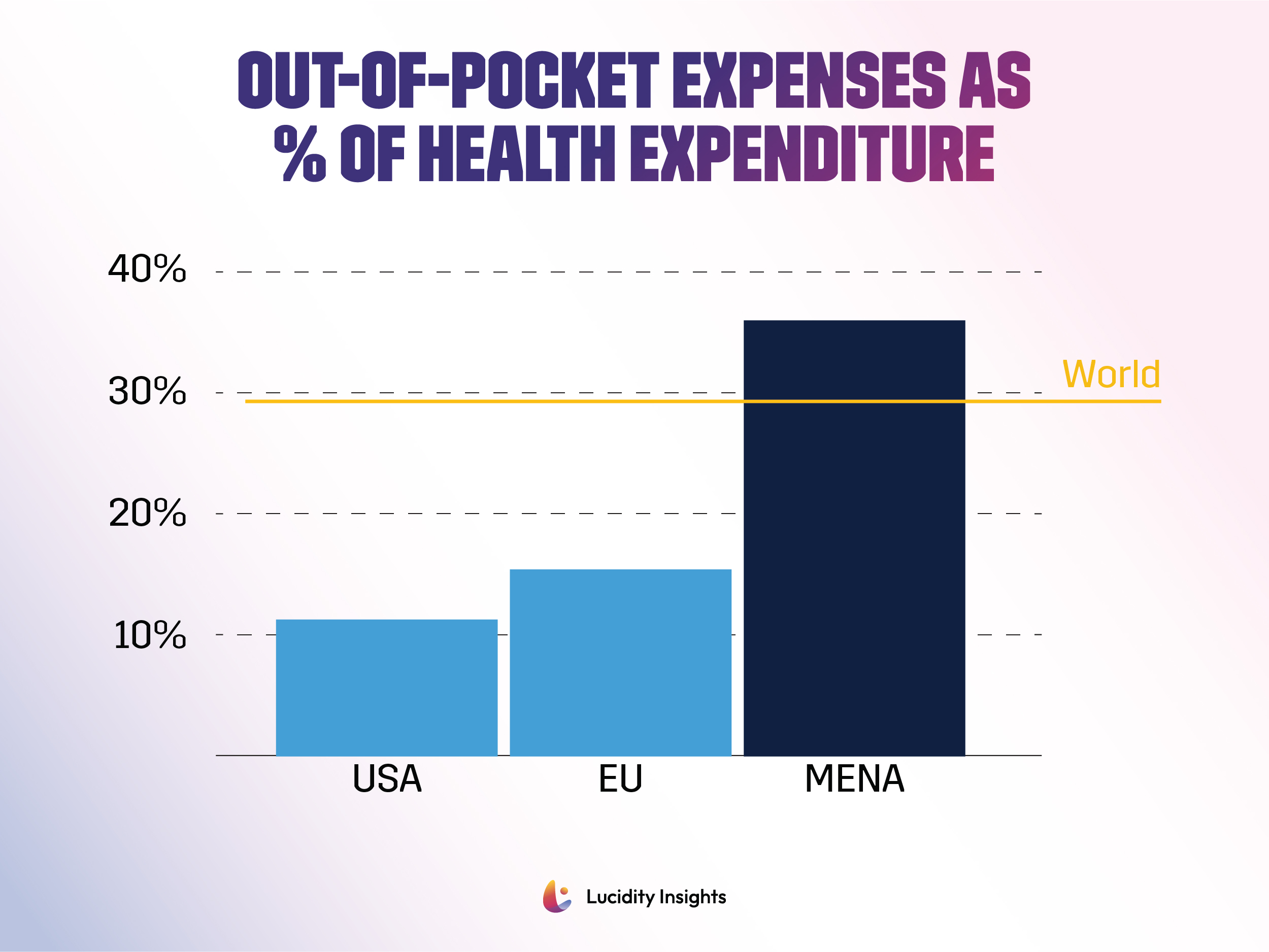

MENA has one of the highest out-of-pocket expenditures in the world. High out-of-pocket expenditures for healthcare is often associated with negative health outcomes. Due to poor habits on consumption spending and cases of impoverishment, prescribed treatment plans are often not complied to when we must pay 30% out-of-pocket for those drugs and treatments. Due to the cost that these treatments, screening and tests incur, individuals may be less likely to go to see a doctor for minor check-ups or for preventative medicine.

Infobyte: MENA Out-of-Pocket Expenses As % Of Health Expenditure

Infobyte: MENA Out-of-Pocket Expenses As % Of Health Expenditure

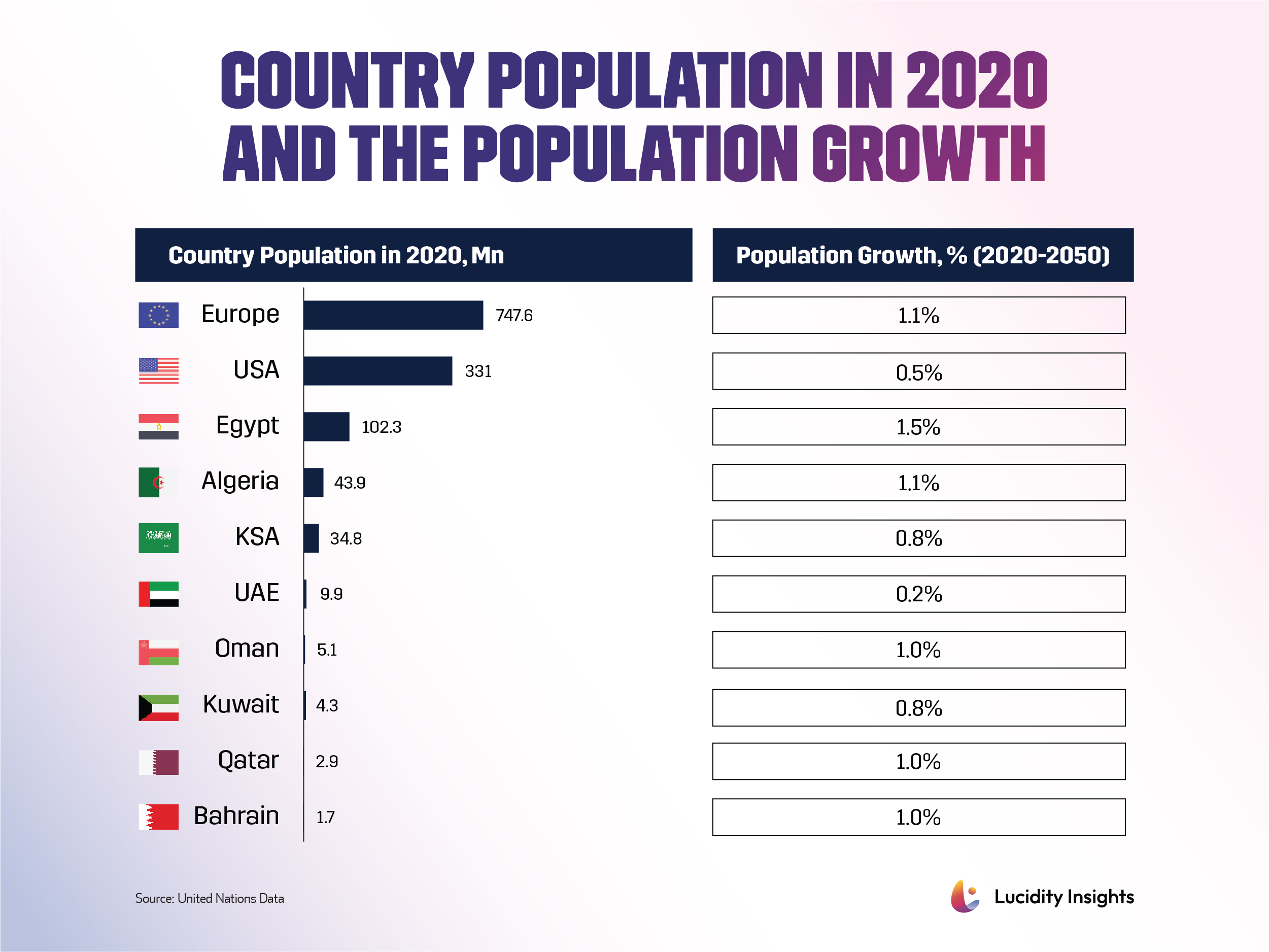

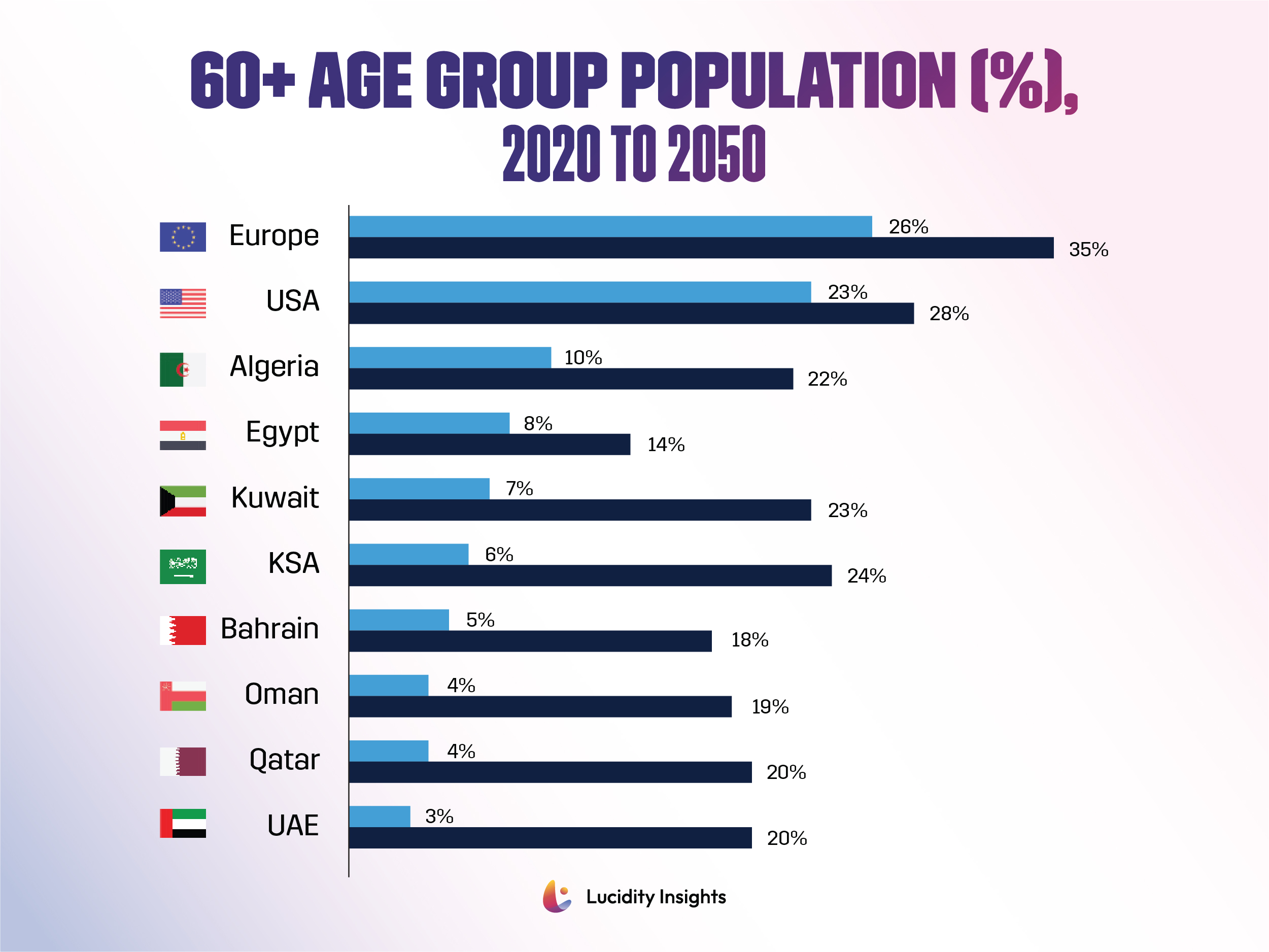

Of course, many argue that the MENA region has some of the youngest populations in the world, requiring infrequent access to healthcare services. Country demographics certainly play a role in how much a country spends on healthcare, as well as on their out-of-pocket payment policies. The region is likely to see a shift, particularly in the GCC over the next two decades, as countries like the United Arab Emirates will go from housing a population that is over 60 years old at 3% in 2020 to grow to 20% of the population by 2050.

Infobyte: MENA Country Population in 2020 and 2050 Growth Projection

Infobyte: MENA Country Population in 2020 and 2050 Growth Projection

Infobyte: MENA 60+ Age Group Population (%), 2020 to 2050

Infobyte: MENA 60+ Age Group Population (%), 2020 to 2050

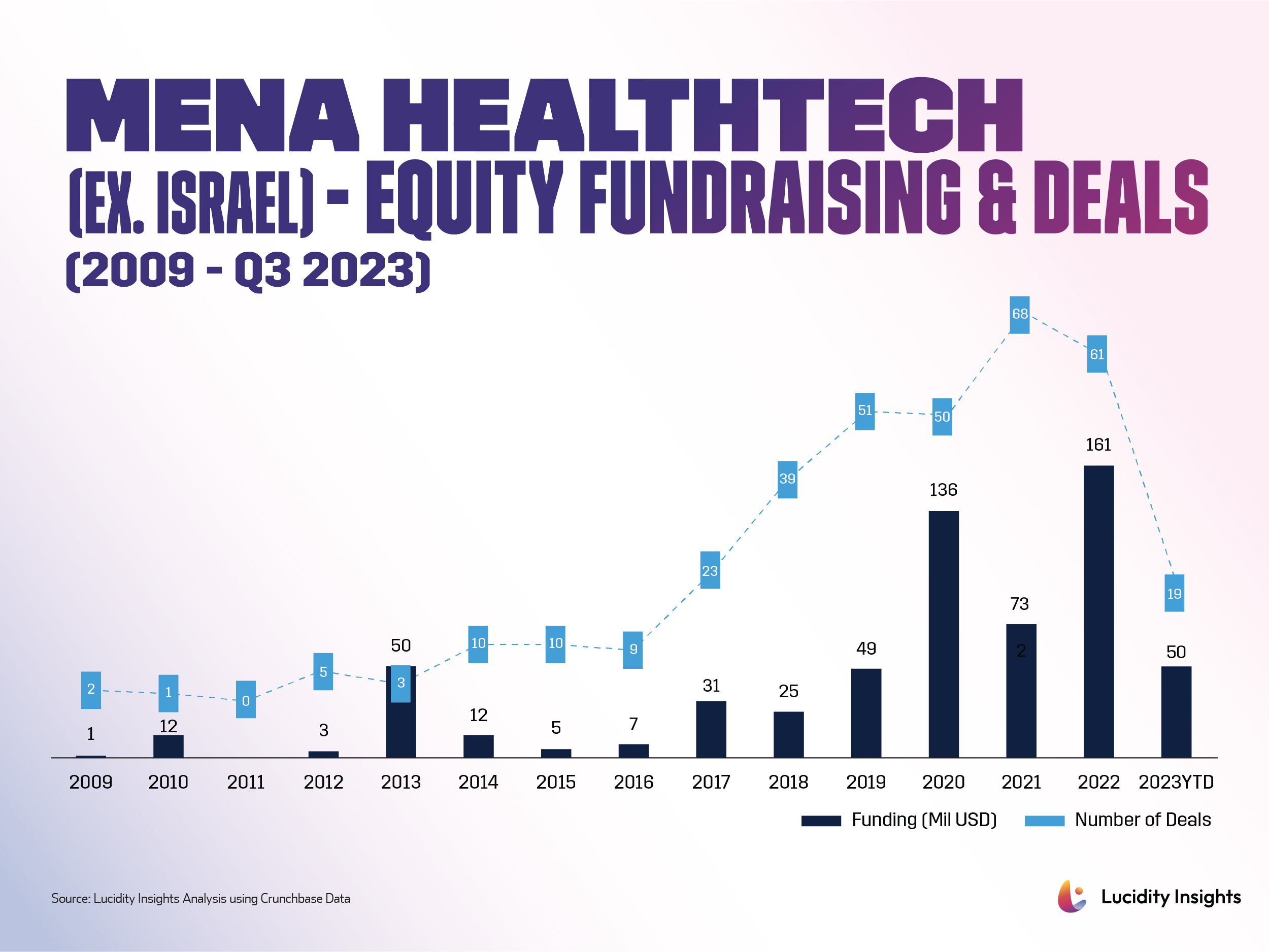

3. Healthtech Funding in MENA (ex. Israel) the past 15 years

Infobyte: MENA Healthtech (Ex. Israel) - Equity Fundraising & Deals (2009 - Q3 2023)

Infobyte: MENA Healthtech (Ex. Israel) - Equity Fundraising & Deals (2009 - Q3 2023)

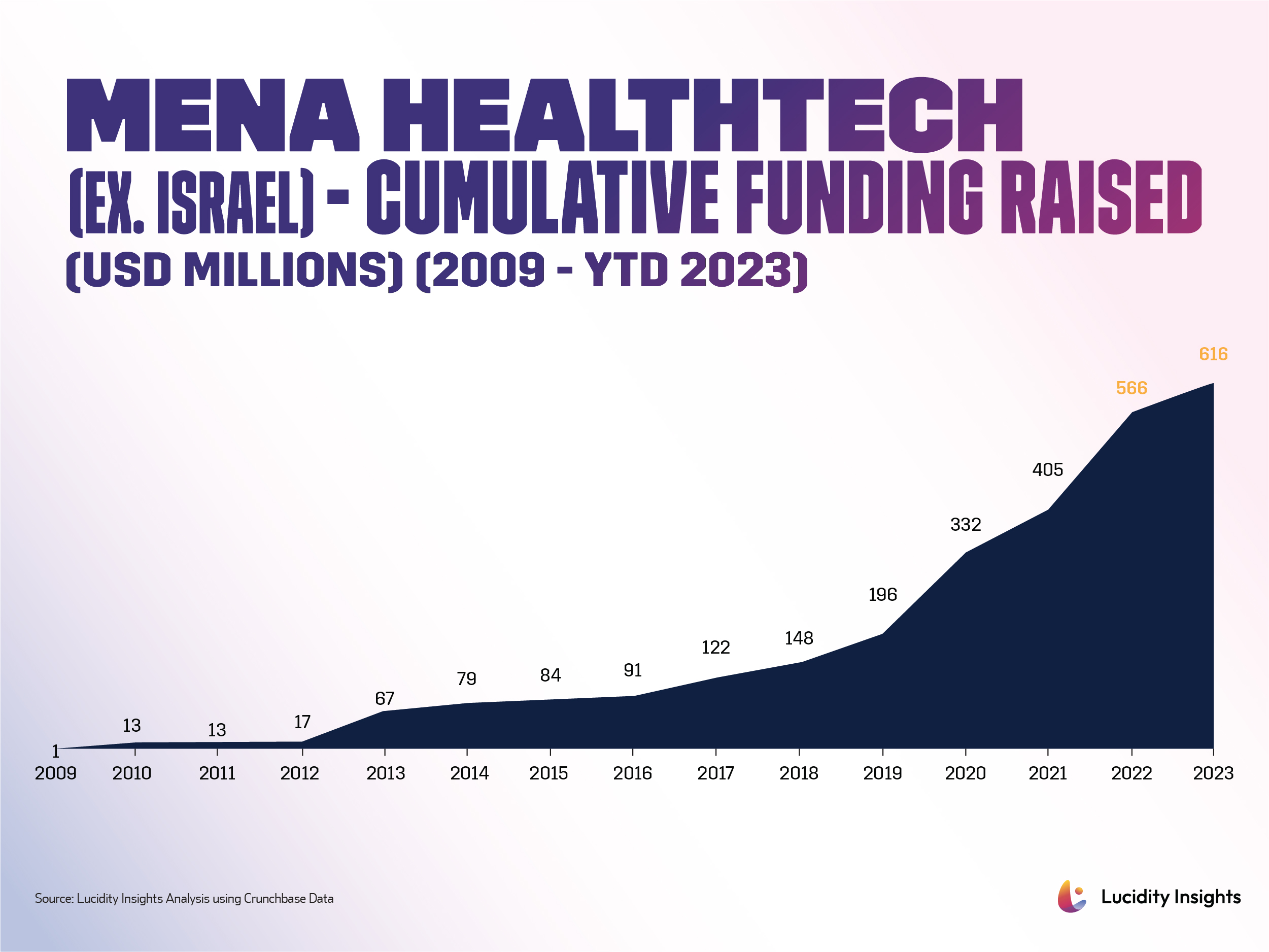

Infobyte: MENA Healthtech (Ex. Israel) Cumulative Funding Raised (USD Millions) (2009 - YTD 2023)

Infobyte: MENA Healthtech (Ex. Israel) Cumulative Funding Raised (USD Millions) (2009 - YTD 2023)

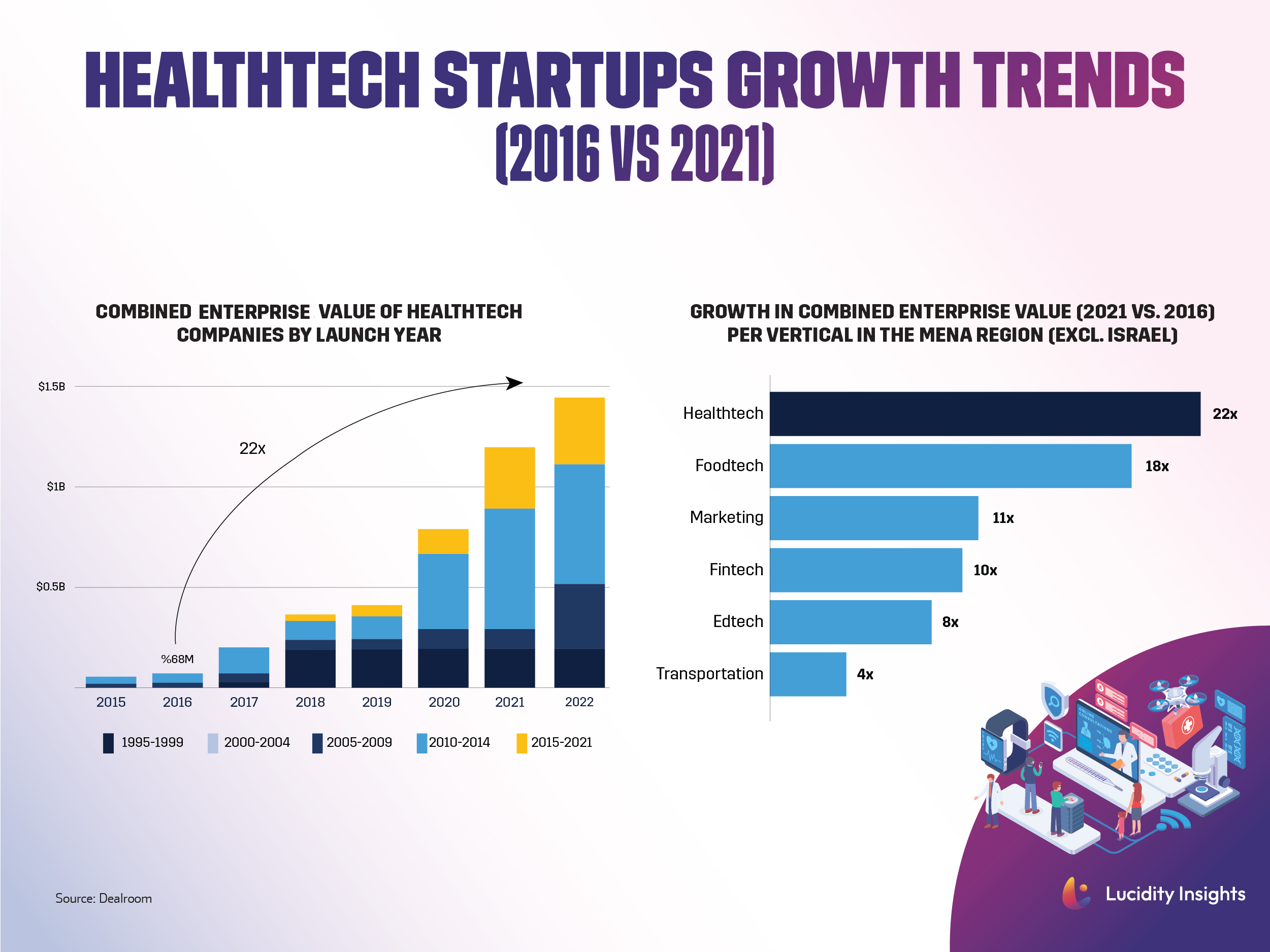

4. Healthtech companies in MENA (ex. Israel) have reached a combined value of over $1.5 Billion in 2022, a 22X increase since 2016

Infobyte: Healthtech Startup Valuations in MENA 2016 vs 2021

Infobyte: Healthtech Startup Valuations in MENA 2016 vs 2021

Healthtech has been exploding in the region, with valuations of healthtech startups seeing a significant jump since the COVID-19 pandemic started in 2020. Interestingly, though some startups that were founded in the 1990’s and 2000’s have also seen an increase in value, it is those companies that have been established since the 2010’s that are most highly valued today.

When comparing the 5 year growth trends by sector between 2016 and 2021, Healthtech startups saw the highest valuation growth, followed by Foodtech and Marketing (SaaS) companies. This likely speaks to both the drivers presented during the pandemic which quickly educated both consumers and healthcare institutions on the value of technology to increase efficiencies, as well as the new technologies that have come online in the most recent years, which have seen an increase in business models coming to the MENA region that have already proven themselves on the global stage.

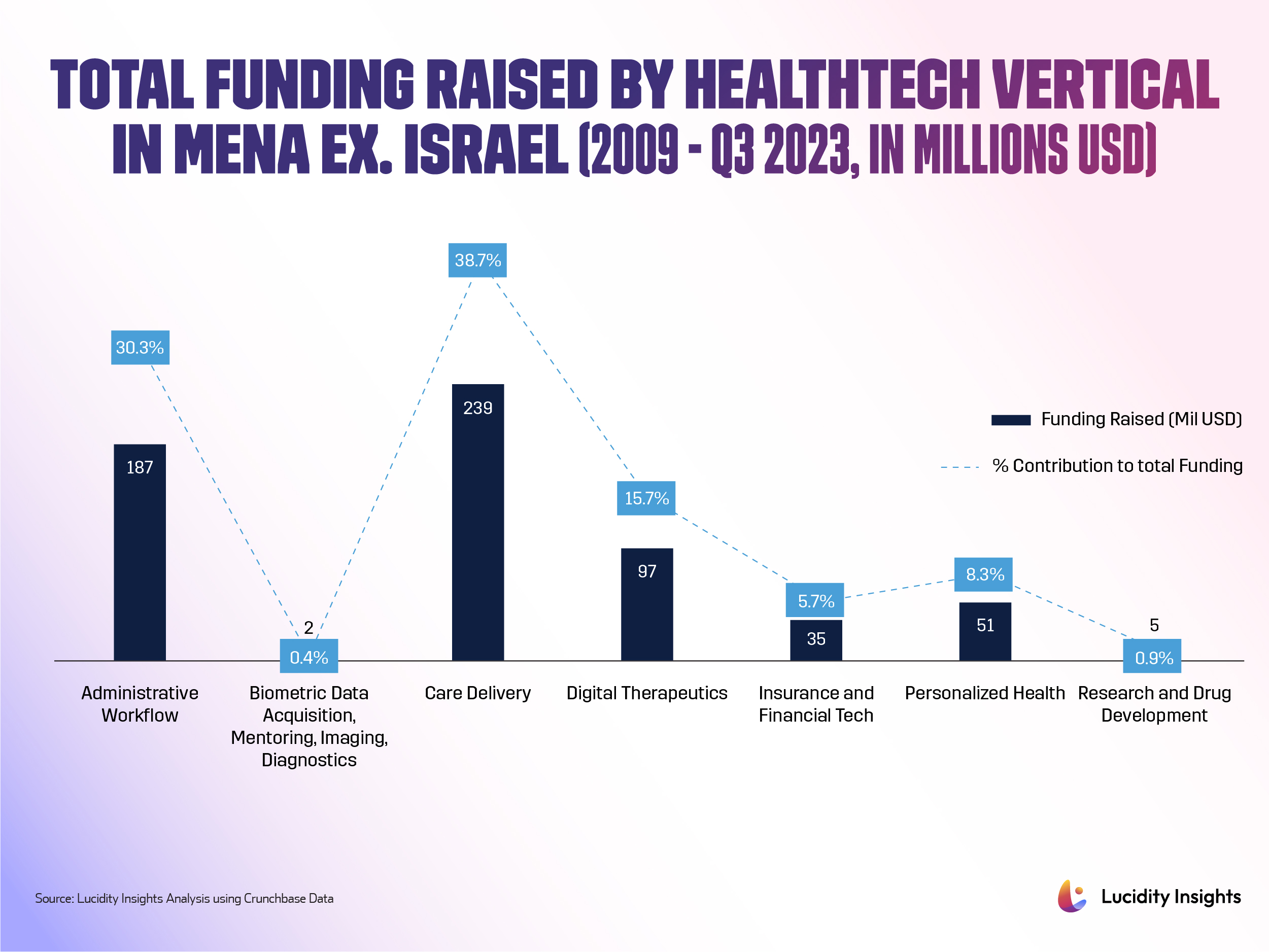

5. Following global trends, Care Delivery is the largest healthtech vertical in MENA, by funding raised

Infobyte: Total Funding Raised by Healthtech Vertical in MENA (Excluding Israel)

Infobyte: Total Funding Raised by Healthtech Vertical in MENA (Excluding Israel)

Care Delivery is the most funded healthtech vertical in MENA (ex.Israel), which represent 39% of all funding flows, followed by Administrative Workflow startups that have garnered 30% of VC funding. Digital Therapeutics rounds out the top 3 with $97 million USD invested, accounting for 16% of all VC funding in the region’s healthtech sector.

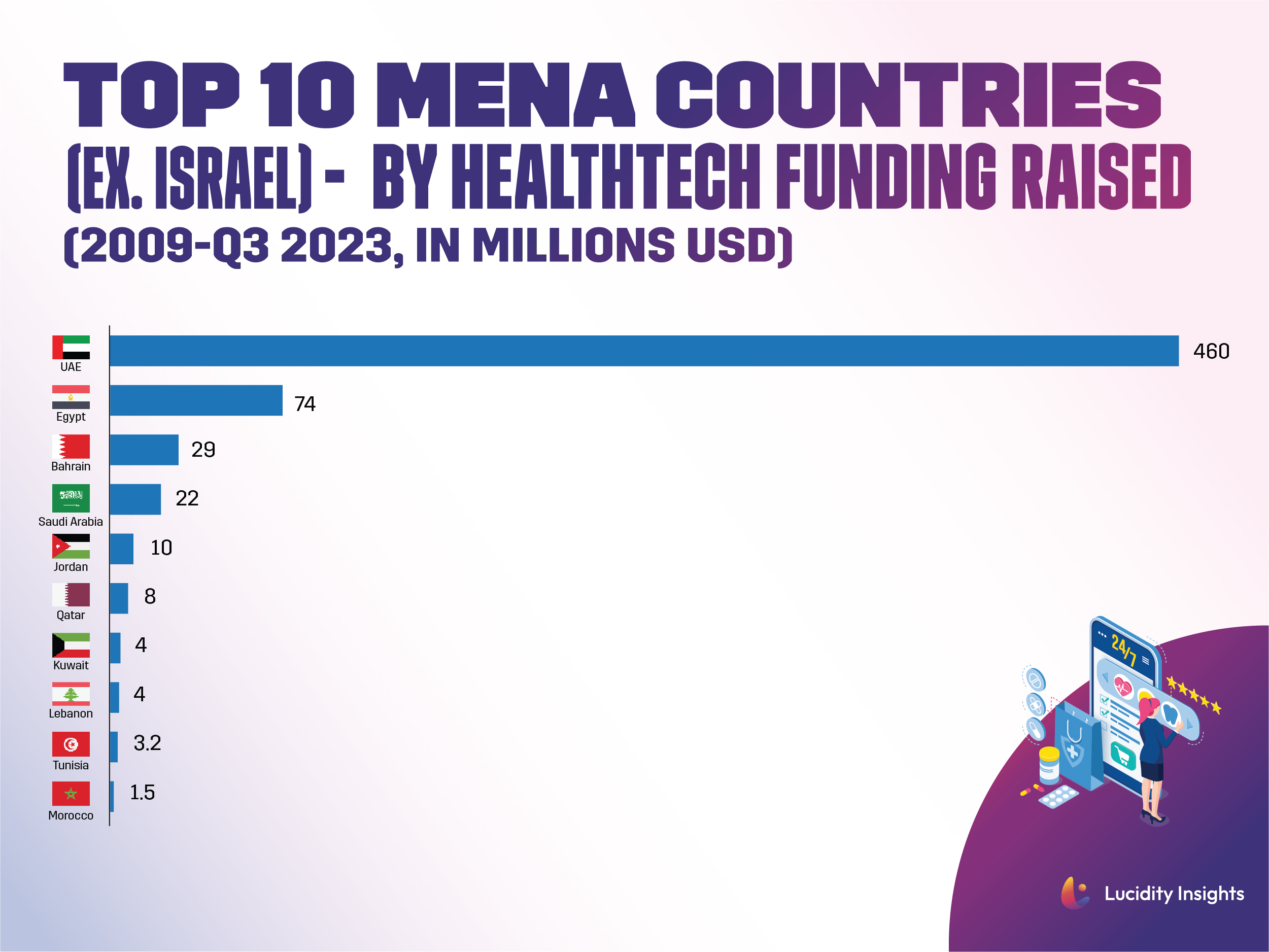

6. The United Arab Emirates is the Healthtech Startup Capital of the MENA region

Infobyte: Top 10 MENA Countries (Ex. Israel) by Healthtech Funding Raised (2009-Q3 2023, in Million USD)

Infobyte: Top 10 MENA Countries (Ex. Israel) by Healthtech Funding Raised (2009-Q3 2023, in Million USD)

The UAE is the undisputed healthtech startup capital of the MENA region, when excluding Israel. UAE healthtech startups have fundraised over US $460 million to date, 6.2X more funding than 2nd place Egypt. That means that 75% of all VC funding going to MENA healthtech are going to UAE startups.

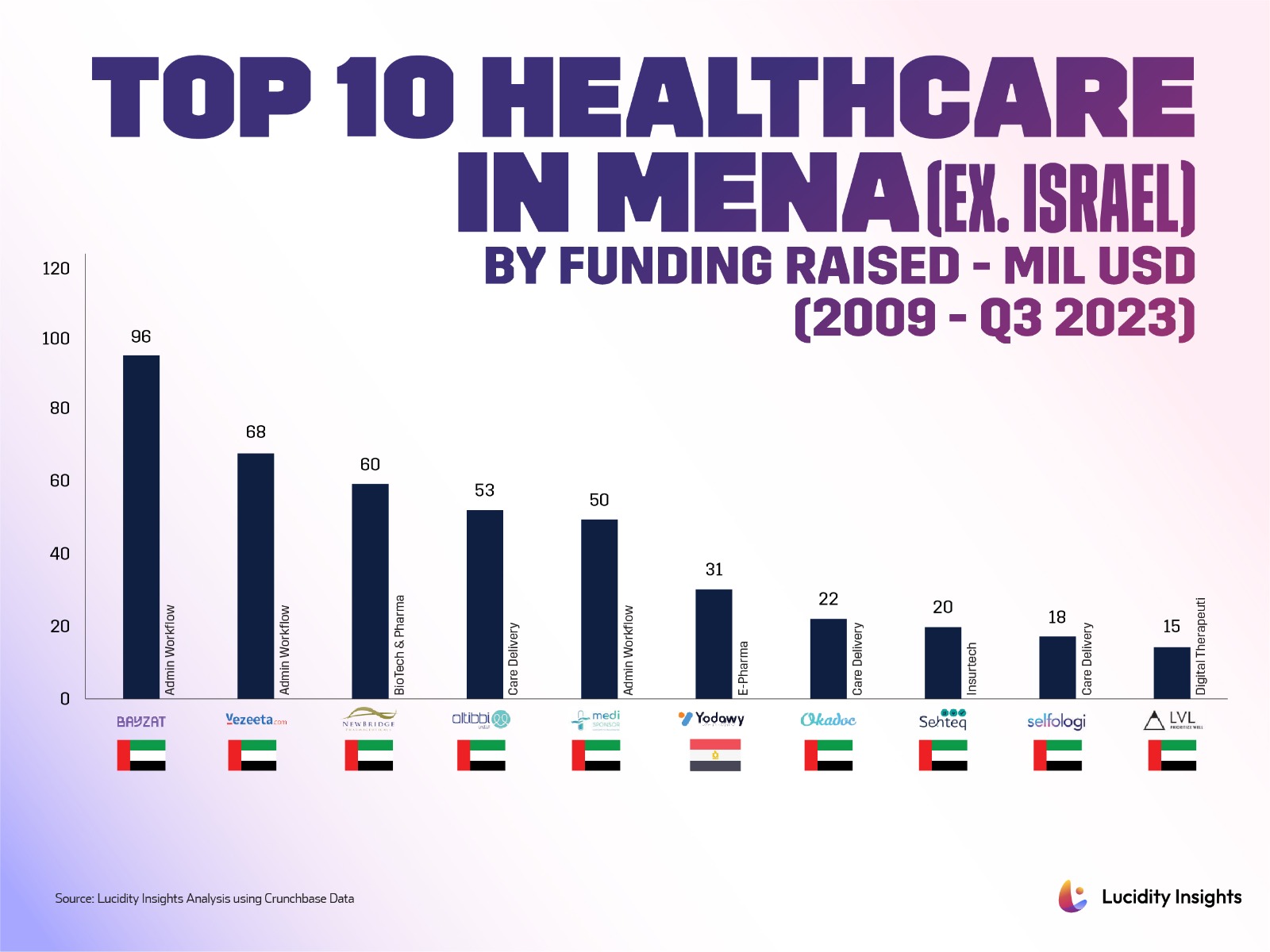

7. Nine out of ten of the most funded Healthtech’s in MENA (ex. Israel) are headquartered in the UAE

Infobyte: Top 10 Healthcare in MENA (ex. Israel)

Infobyte: Top 10 Healthcare in MENA (ex. Israel)

Nine out ten of the most funded healthtech startups in MENA (excluding Israel) are headquartered in the UAE. Admin Workflow that help book appointments with Doctors and clinicians online, followed by Care Delivery players that facilitate tele-medicine and online doctor appointments are the most well-funded sub-sectors. Bayzat and Vezeeta are both booking platforms leading the pack in fundraising with $96 million and $68 million raised respectively.

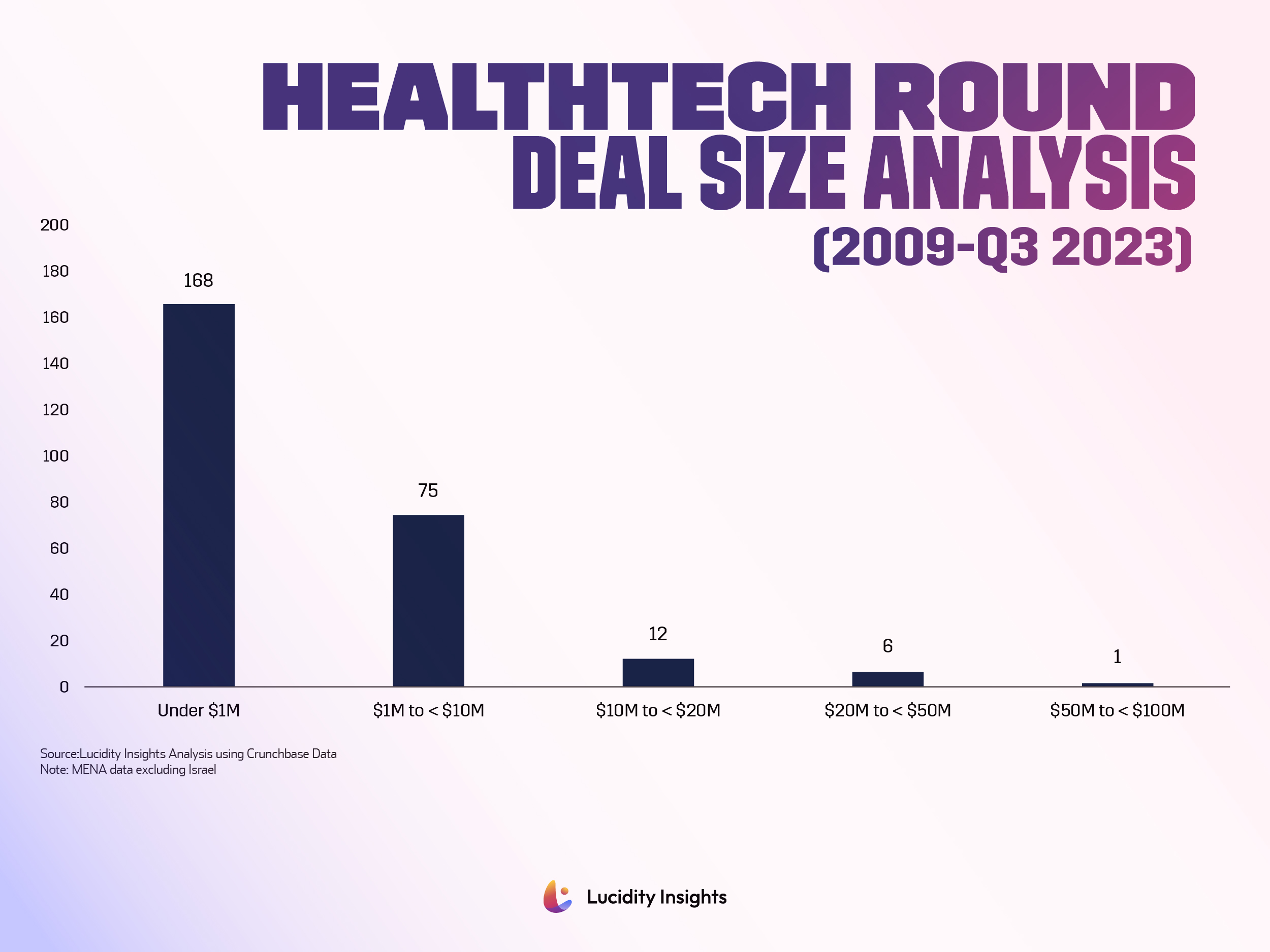

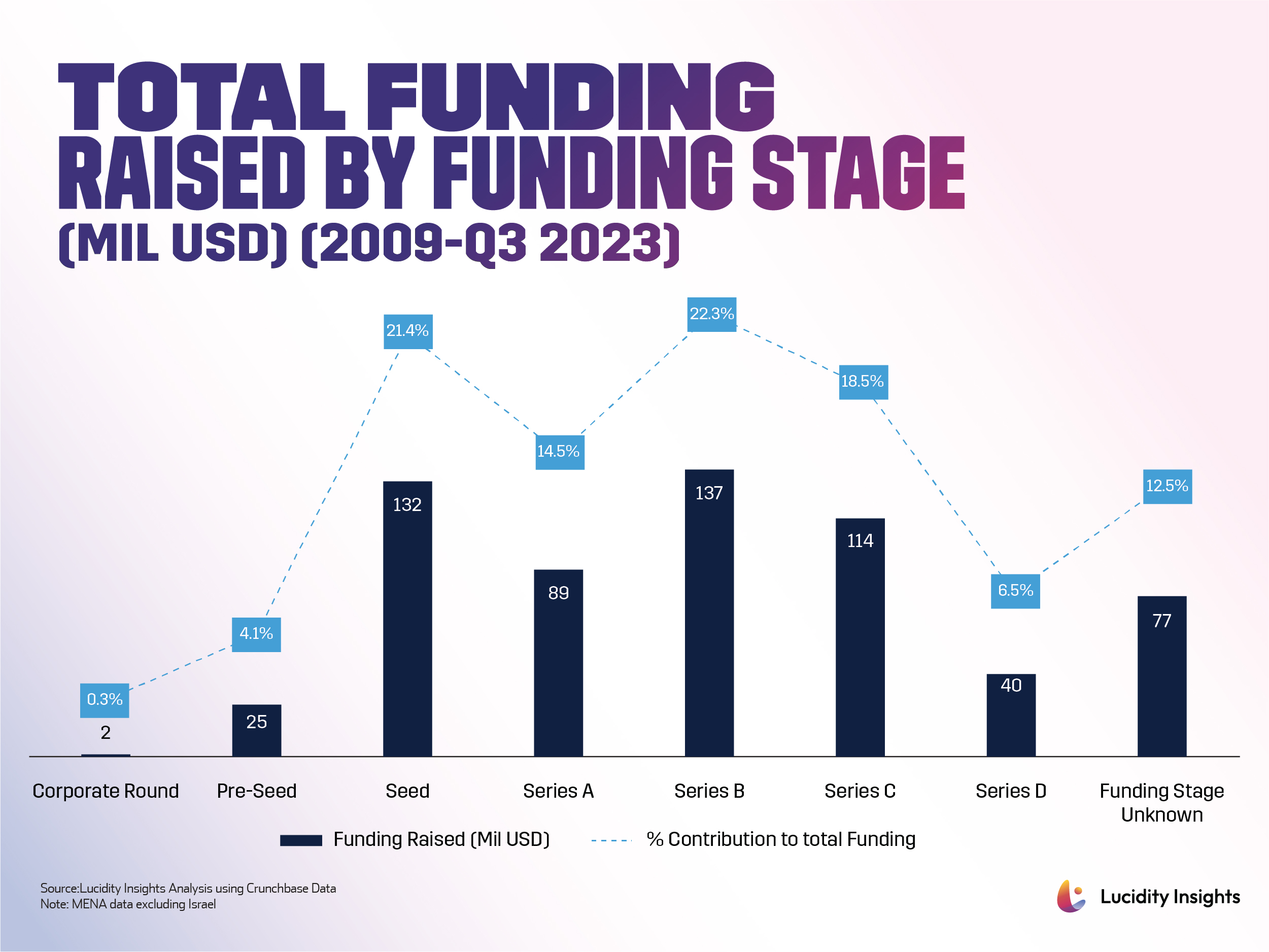

8. 93% of Healthtech funding rounds in the MENA region are below $10 million, with Seed and Series B raising the most funding in total to date

Infobyte: Healthtech Round Deal Size Analysis (2009-Q3 2023)

Infobyte: Healthtech Round Deal Size Analysis (2009-Q3 2023)

Infobyte: Total Funding Raised by Funding Stage (Mil USD) (2009-Q3 2023)

Infobyte: Total Funding Raised by Funding Stage (Mil USD) (2009-Q3 2023)

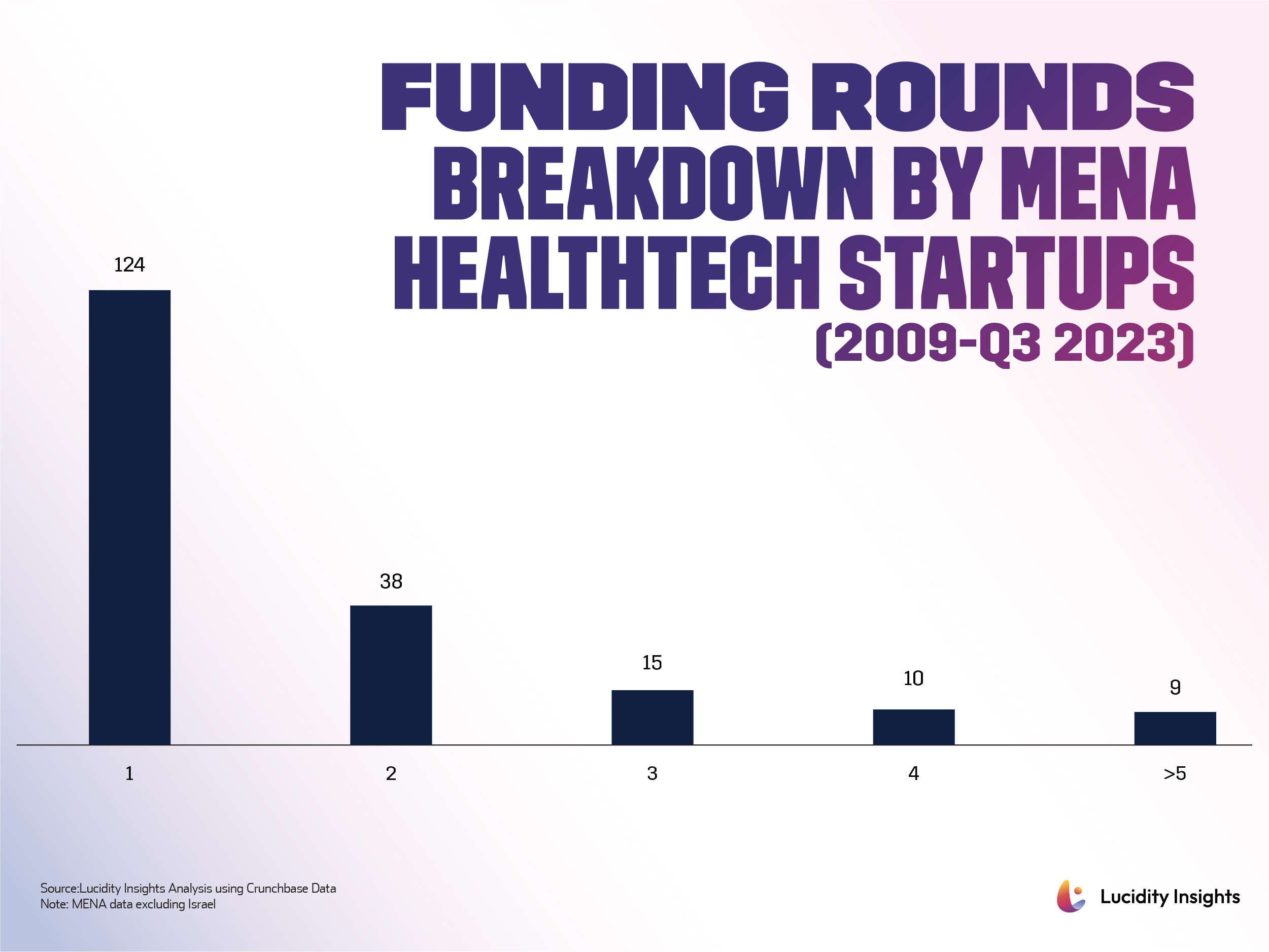

9. 38% of Healthtech Startups in MENA (excl. Israel) have successfully raised 2 or more rounds

200 healthtech startups in the MENA region (excl. Israel) have successfully raised at least one round of funding. 38% have successfully raised two or more rounds of funding. 17% have successfully raised over three rounds of funding, and 10% have successfully raised 4 or more rounds. This tells us that there is a healthy maturation of healthtech startups in the region, though there is still significant room to grow.

Infobyte: Funding Rounds - Breakdown by MENA Healthtech Startups (2009-Q3 2023)

Infobyte: Funding Rounds - Breakdown by MENA Healthtech Startups (2009-Q3 2023)

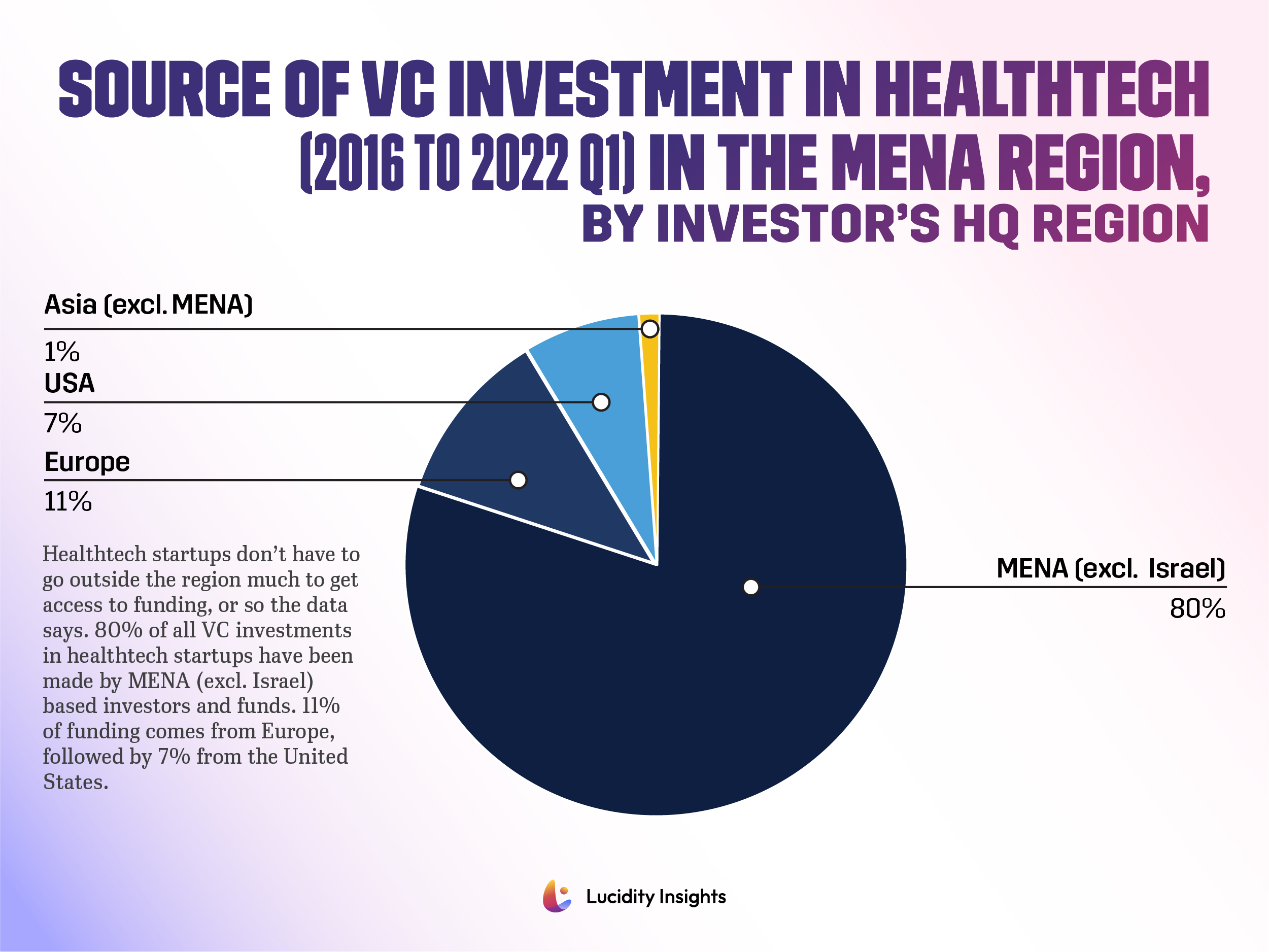

10. Healthtech Investment in MENA is dominated by domestic investors

Infobyte: Source of VC Investment in Healthtech Startups in the MENA Region (2016 to 2022 Q1)

Infobyte: Source of VC Investment in Healthtech Startups in the MENA Region (2016 to 2022 Q1)

Healthtech startups don’t have to go outside the region much to get access to funding, or so the data says. 80% of all VC investments in healthtech startups have been made by MENA (excl. Israel) based investors and funds. 11% of funding comes from Europe, followed by 7% from the United States.

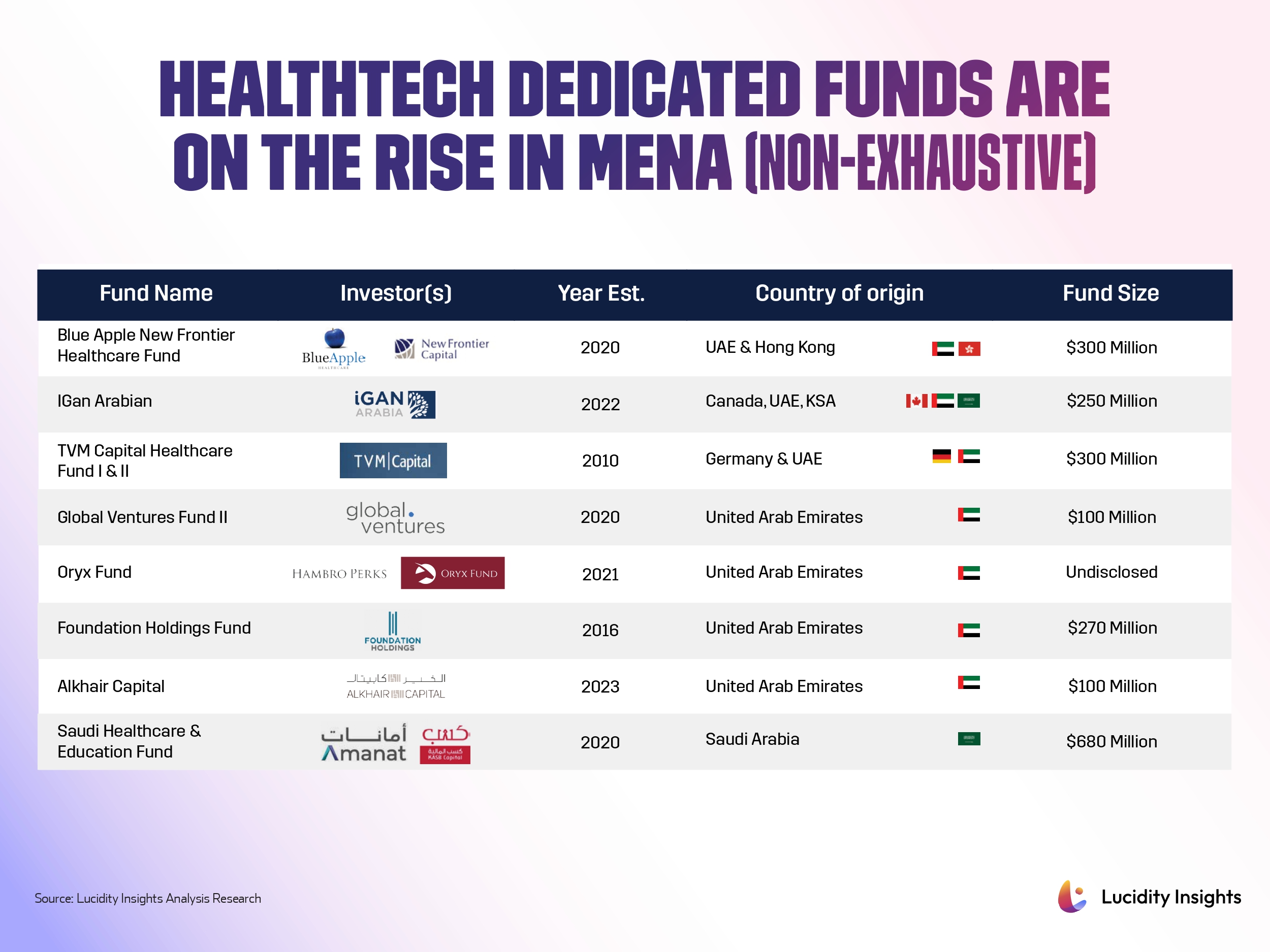

Dedicated healthtech funds were largely unheard of prior to the pandemic, but today, there are over 8 funds dedicated to healthcare and healthtech investments, with a combined total of over $2 billion USD.

Infobyte: Healthtech Dedicated Funds Are on the Rise in MENA

Infobyte: Healthtech Dedicated Funds Are on the Rise in MENA

Next Read: Meet some of the latest healthtech players making waves in the region: KLAIM.AI, Avey, WebOps

To read more about the transformative innovation of digital health in 2023 – read the full report here.

%2Fuploads%2Fhealthtech%2Fcover18.jpg&w=3840&q=75)