KLAIM: Claims Management Platform Alleviates Cashflow Crunch for Healthcare Providers in the GCC

24 November 2023•

Amidst the height of global turmoil driven by the pandemic in 2020, two friends found themselves in conversation about the flawed healthcare sector, particularly within MENA.

Unnerved by the fact that healthcare providers often wait months to receive payment, Ghafoor Ahmad and Karim Dakki brainstormed a new approach that would become KLAIM. KLAIM was formed with the intention of enhancing the quality of medical care by streamlining the healthcare claims process. KLAIM would soon go on to radically reshape healthcare claims management in the Middle East, ensuring providers are paid swiftly and efficiently. “KLAIM was not about seizing a business opportunity, but a mission born out of personal conviction and shared values,” says Karim.

In Frame: Karim Dakki, Co-Founder & CEO of KLAIM.ai (left), and Ghafoor Ahmad, Co-Founder & Chief Revenue Officer of KLAIM.ai (right)

In Frame: Karim Dakki, Co-Founder & CEO of KLAIM.ai (left), and Ghafoor Ahmad, Co-Founder & Chief Revenue Officer of KLAIM.ai (right)

Where AI Meets Insurance Claims

Healthcare is an industry fraught with contradictions: patients seek high-quality, low-cost care; healthcare providers want prompt, accurate payments; and insurance companies try to keep costs down without compromising coverage. This tug-of-war creates a complex billing process that leaves healthcare providers in a constant state of financial unpredictability.

KLAIM offers an AI-powered management system that simplifies traditionally convoluted payment procedures, aligning the interests of all – from patients to providers and insurance companies. With automation tools for monitoring daily tasks such as operations and insurance claims, KLAIM provides healthcare professionals with instantaneous data analysis, record tracking, form submission, and financial reports to ensure seamless and efficient claim and revenue management.

The Healthcare Cash Crunch

KLAIM's innovation has been particularly resonant in the UAE, where an array of 99 different rejection codes lead to 15% of claims being rejected. This rejection rate is still a reduction from first-time rejection rates, which sits at about 30%. The payment cycle can also then drag from 60 to 90 days, and insurers take an average of 113 days to clear 90% of submitted claims. This also implies that anywhere between 5% and 10% of claims are written off. This leads to cash flow issues and eventual payment issues to staff, which need to be paid on time, invariably leading healthcare providers to consider taking on loans to run their business. This is a very different business reality from how business was conducted a short decade ago, when 70-80% of payments were made directly in cash by patients. However with the UAE’s mandatory requirement for healthcare insurance, this has changed.

"Before KLAIM, healthcare providers had limited options to accelerate these drawn-out payment cycles, contributing to unstable cash flows and diminished care quality," Karim tells us. But KLAIM’s entry offered an opportunity to healthcare providers, offering faster, more reliable claims payments and bolstering the industry's overall health.

Mission MENA

Insurance companies are also keen to partner with InsurTech companies. In Capgemini’s World InsurTech Report, 67% of UAE-based insurers expressed interest in collaborating with insurtechs back in 2020. This is precisely the time when KLAIM started operations in the UAE, with a seamless integration solution for implementers. According to Karim, the UAE’s national health exchange, in place for nearly a decade, played a key role in their decision to enter this market first. Next, KLAIM extended its operations to Saudi Arabia at the forefront of the nation's healthcare digitalization wave in 2022, thereby establishing a significant first-mover advantage.

Most recently, KLAIM expanded its presence to Oman, acknowledging the country's emerging focus on healthcare digitization marked by the development of DAMANI, Oman’s own national health exchange. The two largest markets in the GCC, which are the UAE and Saudi Arabia, contribute 95%, and 5% of KLAIM's revenues, respectively. Since its inception, KLAIM has purchased claims worth over AED 110 million and supported over 150 medical entities.

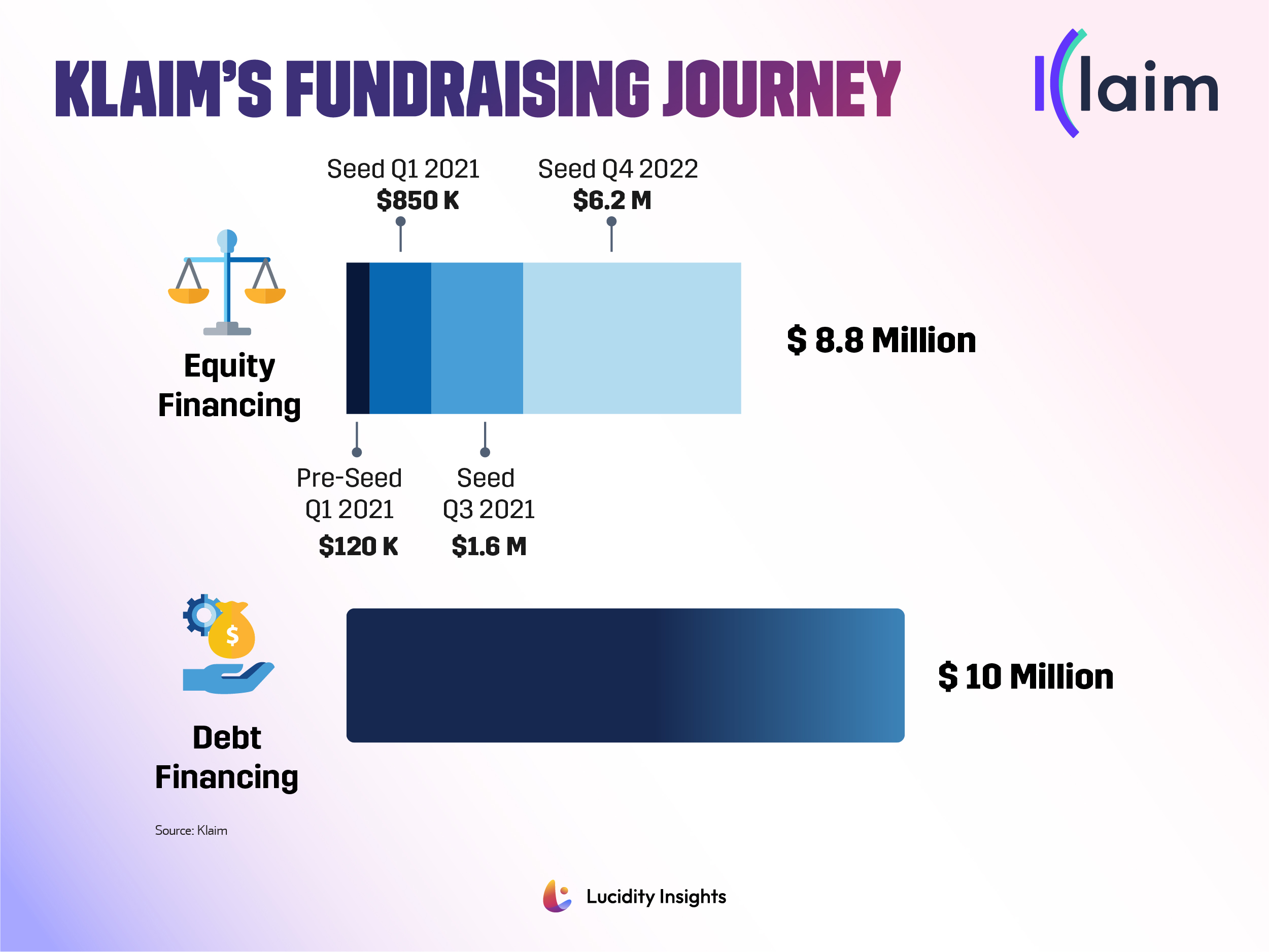

Infobyte: KLAIM’s Fundraising Journey

Infobyte: KLAIM’s Fundraising Journey

With its goal to streamline the labyrinthine healthcare claims process, KLAIM has raised over $8 million in equity funding, and $10 million in debt funding, and has $40 million in commitments for additional debt funding from various investors. The team are now working to secure a Series A round of equity financing to bring the solution to more healthcare providers across the Middle East.

First Mover Advantage

We asked Karim, how does KLAIM differentiate itself from other startups in the claims management space? “By leveraging specialized technology and a deep understanding of healthcare ecosystems, we position ourselves strategically in emerging markets to gain first-mover advantages.” KLAIM also navigates the myriad of challenges in the healthcare industry to offer solutions that are tailored to the specific needs of each market, giving them that competitive edge.

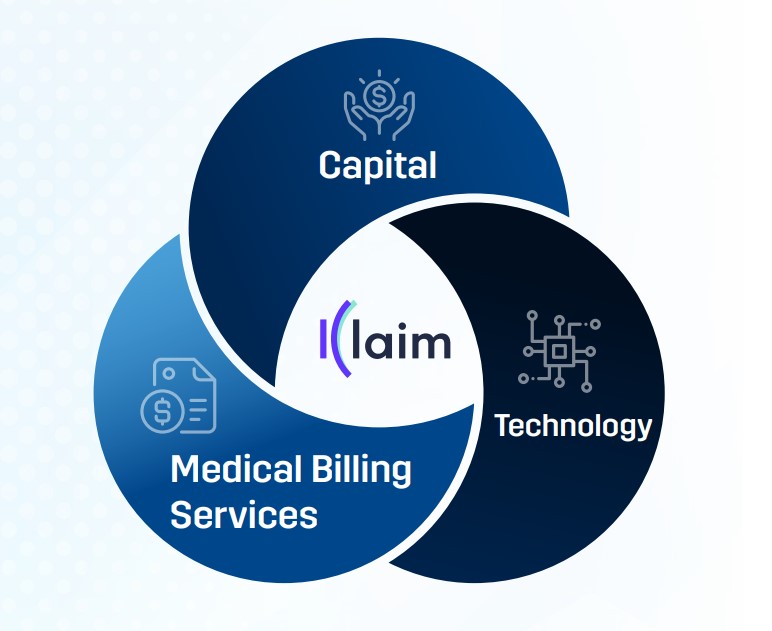

KLAIM's unique strength lies in its three-pronged approach:

Capital: KLAIM buys claim receivables, pouring instant money into healthcare providers' operations. This capital injection lets healthcare institutions provide top-notch care, without financial difficulties.

Technology: Through advanced, AI-driven revenue cycle automation, KLAIM makes for faster and on-point claims processing, leading to a reliable and smooth payment cycle.

Medical Billing Services: KLAIM goes above and beyond with its comprehensive medical billing services, covering everything from medical coding to denial management. Their team handles the tricky billing process, allowing healthcare providers to dedicate time and resources to patient care.

Future Plans

KLAIM recently partnered with Dubai Healthcare City (DHCC), the emirate’s enabling healthcare freezone, which will give DHCC stakeholders and partners preferential subscription rates to KLAIM’s propriety platforms. This collaboration aligns with the DHCC’s progressive strategy to attract top-tier expertise and expand its array of services and technologies.

“KLAIM technology will be another asset in our enabling ecosystem to allow business to thrive and our ongoing efforts to attract the best in class global and regional healthcare names to Dubai Healthcare City as part of the emirate’s goals to become a leading global healthcare destination,” said Salim Dahman, Director of Marketing and Communications at Dubai Healthcare City Authority.

KLAIM’s co-founders have also expressed an interest in entering the US market within the next 3-5 years, drawn to its vast and intricate healthcare system, technological readiness, and substantial volume of processed claims. While the healthcare industry is plagued by several challenges, such as regulatory complexity, interoperability, fraud and abuse, existence of manual processes, and ensuring data privacy and security, KLAIM is confident that with the union of capital, advanced technology, and specialized services, it is a gamechanger in the industry.

For burgeoning entrepreneurs in the Middle East, KLAIM’s founders are a testament to the significant impact of uniting skill, passion, and conviction to usher in transformative change, influencing global standards and empowering both healthcare providers and patients alike. When we ask them for a word of advice? They say: “Understand the cultural landscape. Build strong local networks. Stay resilient and adaptable. Prioritize innovation.”

In Frame: Jaffer Bin Jaffer, Director, DHCC (left) and Karim Dakki, CEO of KLAIM (right)

In Frame: Jaffer Bin Jaffer, Director, DHCC (left) and Karim Dakki, CEO of KLAIM (right)

To read more about the transformative innovation of digital health in 2023 – read the full report here.

Next Read: Disruptive Healthtech Sectors: The 7 Hottest Sub-Sectors

%2Fuploads%2Fhealthtech%2Fcover2.jpg&w=3840&q=75)