The Evolving Landscape of FoodTech: Challenges and Opportunities

29 August 2023•

The first rule of entrepreneurship taught at Ivy League schools like Stanford and MIT is: State the problem you are attempting to solve for and quantify it. Foodtech players around the world are trying to solve for a multitude of wide-reaching problems, not least of all being food security. Our global population is still growing, with forecasts expecting our global population to expand by 20% to reach 10 billion by 2050. This means that there is significant and growing demands being placed on our global food systems to produce enough food to meet this growing population, while there exists 1 billion people in the world that are going to bed hungry each night.

Food wastage is another challenge; over 30% of the food we currently work so hard to produce is wasted and thrown into the bin. Climate change, sustainability implications and supply chain issues are all variables in the overarching foodtech challenge as well. 26% of global GHG emissions are linked to our food systems, driven by land use, livestock, fisheries, crop production and our supply chains.

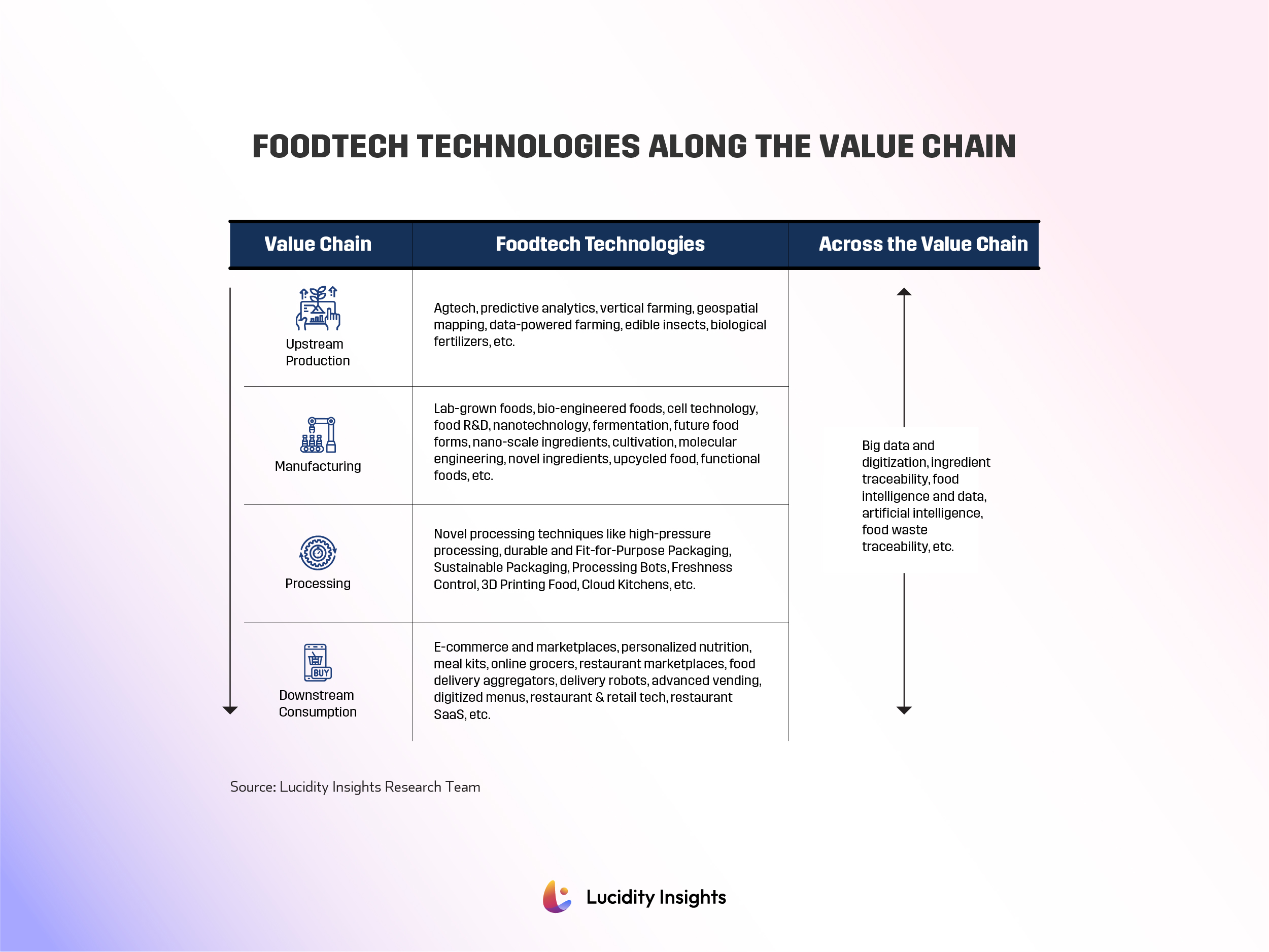

Startups working on alternative proteins like lab-grown meat and agtech’s involved in vertical farming using predictive analytics – are just some of the solutions on offer. These solutions are helping to reduce the strain on our arable land and provide scalable solutions for our growing appetites, while using the most efficient amount of water, energy, and fertilizers to do so. AI and ML-enabled agtech companies around the world are helping farmers to utilize data to help embed efficiencies into old-school farming techniques, and increase crop yields too.

Infobyte: Foodtech Technologies Along the Value Chain

Then there is the challenge of entire downstream industries, like F&B, which is notoriously one of the hardest industries to survive in, as a business owner. Back-office systems from procurement to staffing, are largely stuck in the dark ages of fax machines and phone-orders. Customers are also increasingly demanding and expecting every restaurant to have an e-commerce and online delivery channel, while expecting to have seamless digital payments experiences in-house. Quick commerce food delivery is expected, and has largely become a requirement for restaurants to survive. What’s more, customers expect most orders to be delivered in under an hour, with some cities having grown accustomed to orders reaching their door in under 30 minutes. There are foodtechs working on all of these challenges and solutions as well.

Related: Yango Delivery: The First Choice for Last Mile Delivery

All in all, foodtech is an exciting tech-space to be in at the moment. Personalized nutrition is becoming more available, kitchen robotics are enhancing speed and consistency of food output.

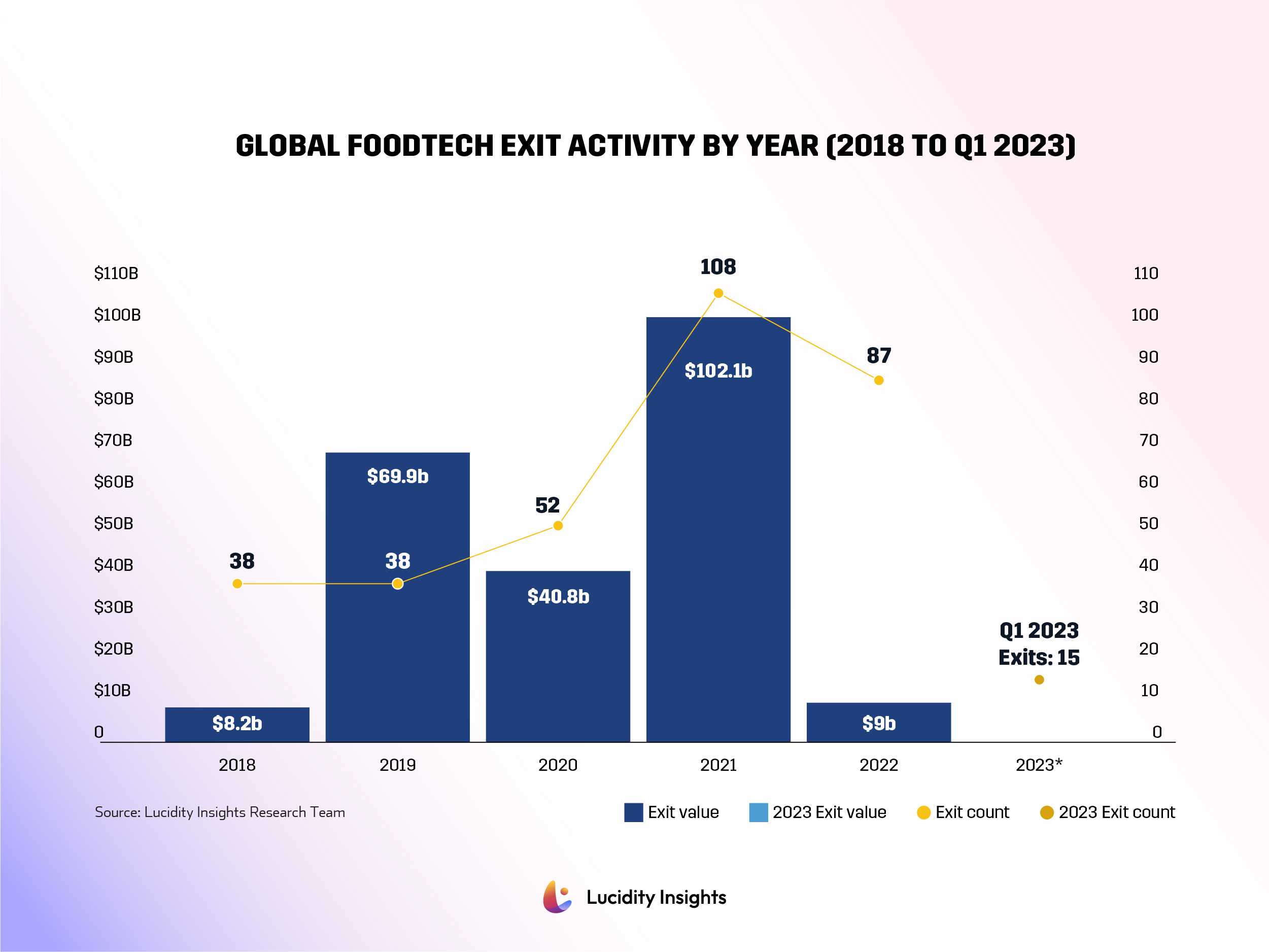

But foodtechs have not been unscathed from the current VC winter the world is experiencing. After the pandemic created a blockbuster fundraising year for foodtechs in 2021, funding has been drying up for the sector since the early part of 2022. Q1 2023 funding for foodtech globally hit a near five-year low. Exits are slowing down, from IPOs to M&A – with analysts expecting things to slow down further in 2023. The market landscape is expected to look quite different in a year or two’s time, as profitable businesses work on efficiencies, and startups put to the profitability stress-test are left to the wayside.

Infobyte: Global Foodtech Deal Activity by Quarter (2018-2023)

Infobyte: Global Foodtech Exit Activity by Year (2018-2023)

Here in the Middle East, our data analysis shows that foodtech funding has largely remained stable during this time, with declines in funding being very low, to date, in comparison to global figures. Food delivery, q-commerce, cloud kitchens and B2B Marketplaces being the driving sectors in the region. But we have reasons to be proud, some of the world’s top emerging foodtech startups, based on the amount of funding raised, come from this region, including Kitopi, Believer, Pure Harvest, nana, and Foodics. Read on to learn about their stories.

To read more about the future of food and the growing business of foodtech – read the full report here.

Next Read: Meet Some of the Biggest Foodtech Unicorns Making Waves in the Global Foodtech Industry

%2Fuploads%2Ffoodtech-2%2Fcover15.jpg&w=3840&q=75)