6 Graphs that Map Out Foodtech in MENA

25 August 2023•

Foodtech in The Middle East & North Africa

Foodtech innovations are particularly important to the Middle East and North Africa (MENA) region; this is primarily because of the region suffering from the effects of increasing desertification. This translates to increasingly shrinking plots of arable land and water scarcity. These environmental factors have meant that the MENA region has increasingly become more dependent on food imports, especially in the GCC markets - which include Bahrain, Kuwait, Oman, Qatar, the United Arab Emirates, and Saudi Arabia. On average, the GCC countries import anywhere between 80-90% of their total food consumption. The region is investing heavily in agtech such as vertical farming, hydroponics, precision agricultural technologies, supply chain traceability, alt-proteins, and cold-chain logistics and infrastructure for reliable food distribution networks.

Six Graphs that Map Out Foodtech in the Middle East and North Africa

We take a look at 19 countries in the MENA region and their Foodtech startup and scaleup activity over the past 13+ years since January 1 2010. Geographies covered includes, Israel, the United Arab Emirates, Saudi Arabia, Egypt, Kuwait, Bahrain, Qatar, Oman, Jordan, Lebanon, Algeria, Morocco, Tunisia, Iraq, Iran, Syria, Palestine, Libya, and Yemen.

1. There are 138 Foodtech Scaleups across MENA that have fundraised US $1 million or more

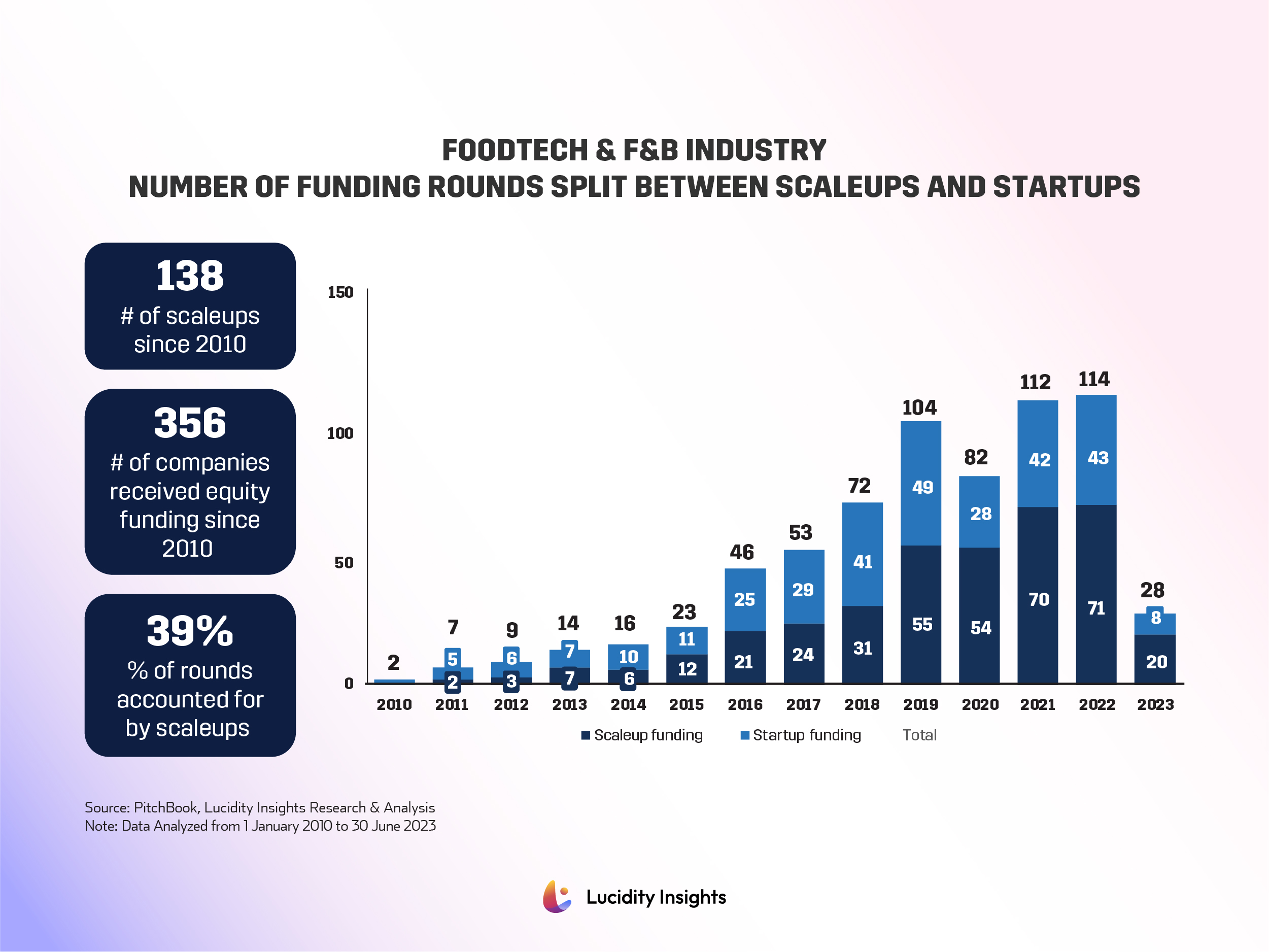

356 foodtech startups in MENA have received some form of funding since January 2010. Of these, 138 are scaleups that have raised US $1 million or more. The remaining 218 startups have either participated in rounds where funding value was undisclosed, or in funding rounds where the total amount raised was less than $1 million or raised funds through non-equity funding rounds such as grants and debt-financing.

Infobyte: Foodtech & F&B Industry Number of Funding Rounds Split Between Scaleups and Startups

2. MENA Foodtech Scaleups have raised more than US $2.9 billion since 2021

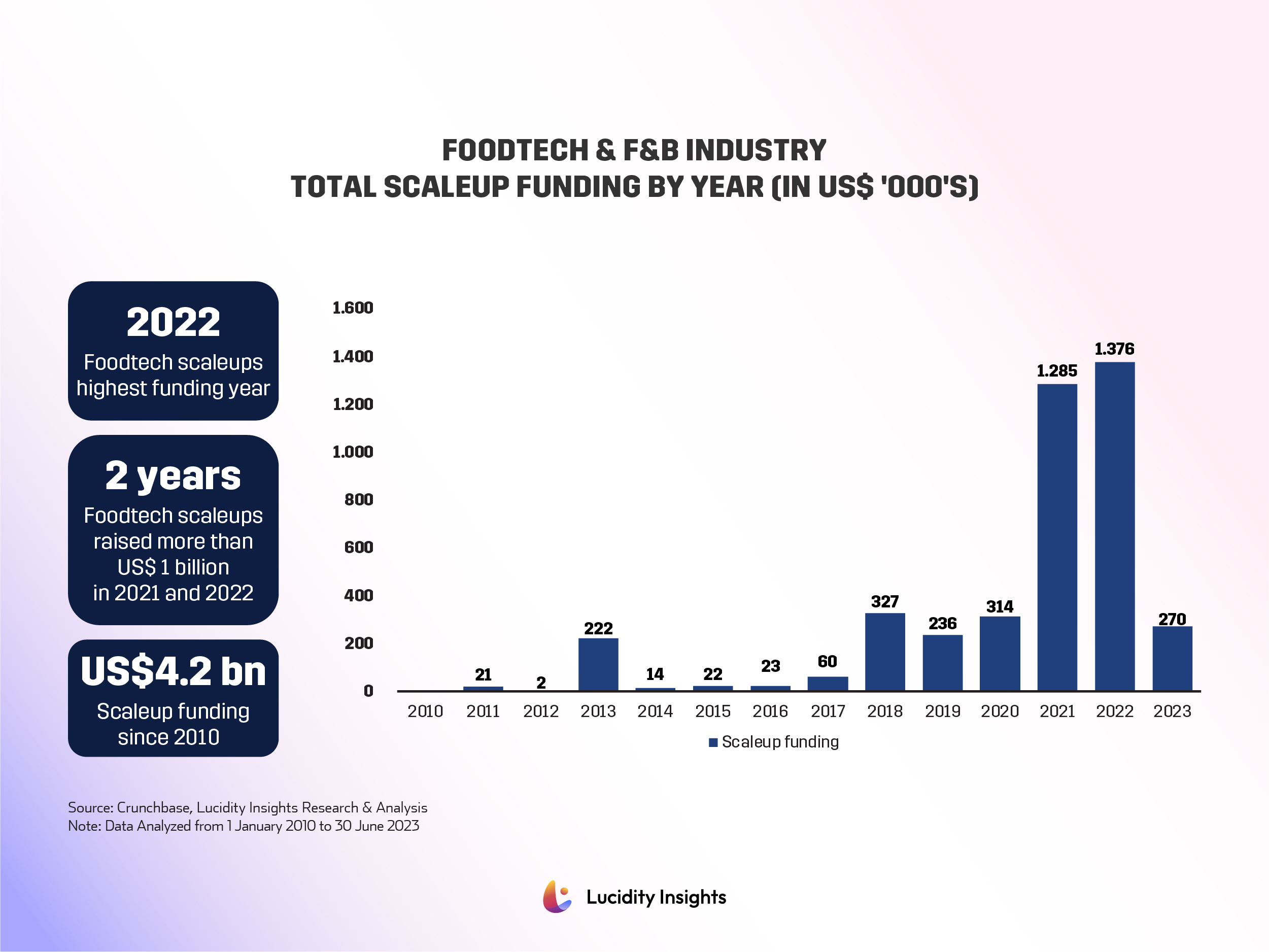

MENA Foodtech scaleups have raised over US $4.2 billion since 2010, of which 70% has been raised in the past two and a half years. Both 2021 and 2022 were years that saw Foodtech Startups raise over $1 billion across the MENA region.

Infobyte: Foodtech & F&B Industry Total Scaleup Funding by Year (In US$ ‘000’S)

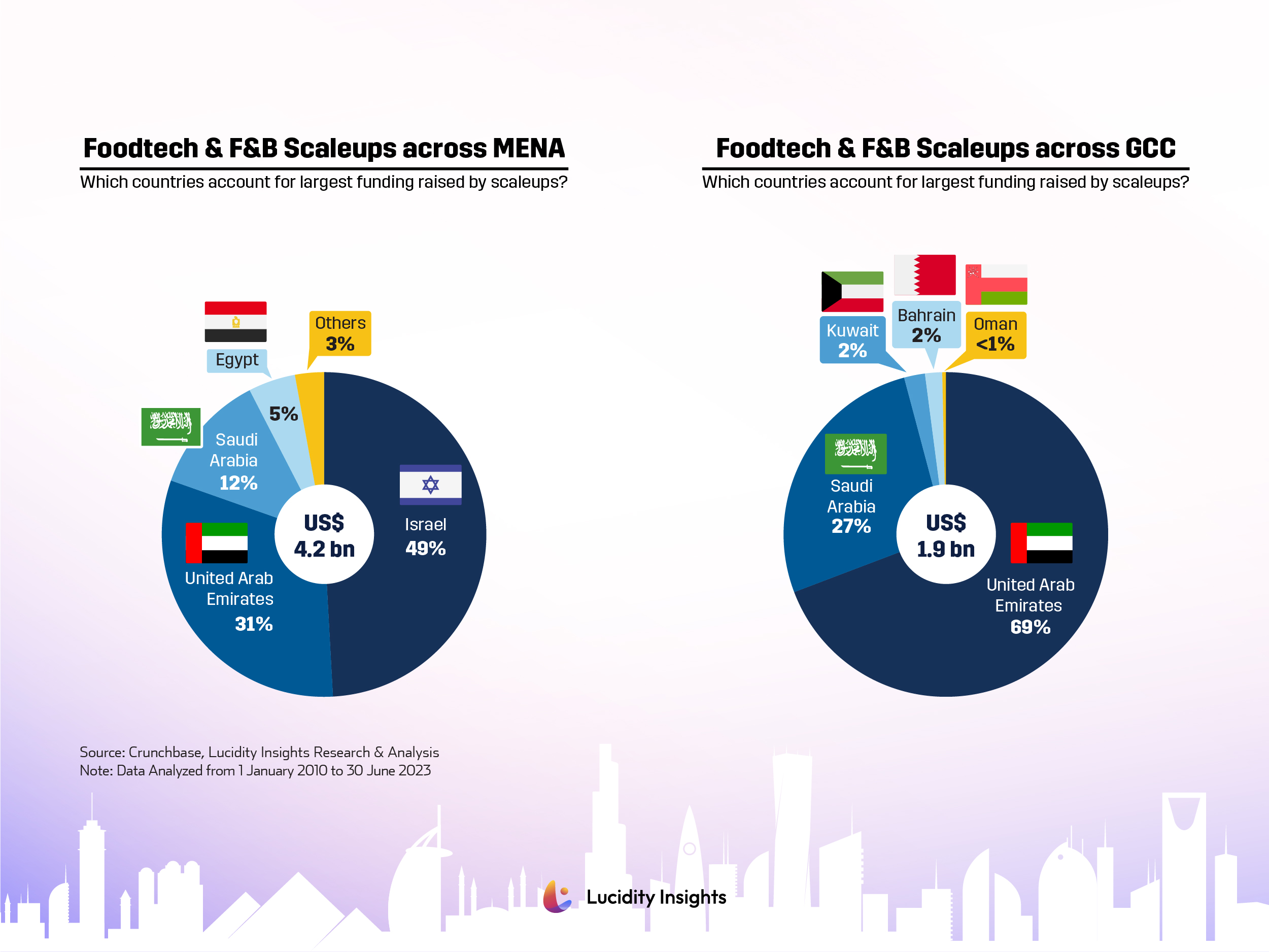

3. Israel and the UAE based startups account for 80% of all MENA Foodtech Fundraising

Israel based foodtech scaleups raised approximately half of all regional funding (49%) followed by UAE-based scaleups, which raised 31% of all funding from across the region. UAE based foodtech scaleups account for 70% of all funds raised by GCC-based companies followed by Saudi Arabia and Egypt.

Infobyte: Which MENA Countries Account for Largest Funding Raised by Foodtech Scaleups?

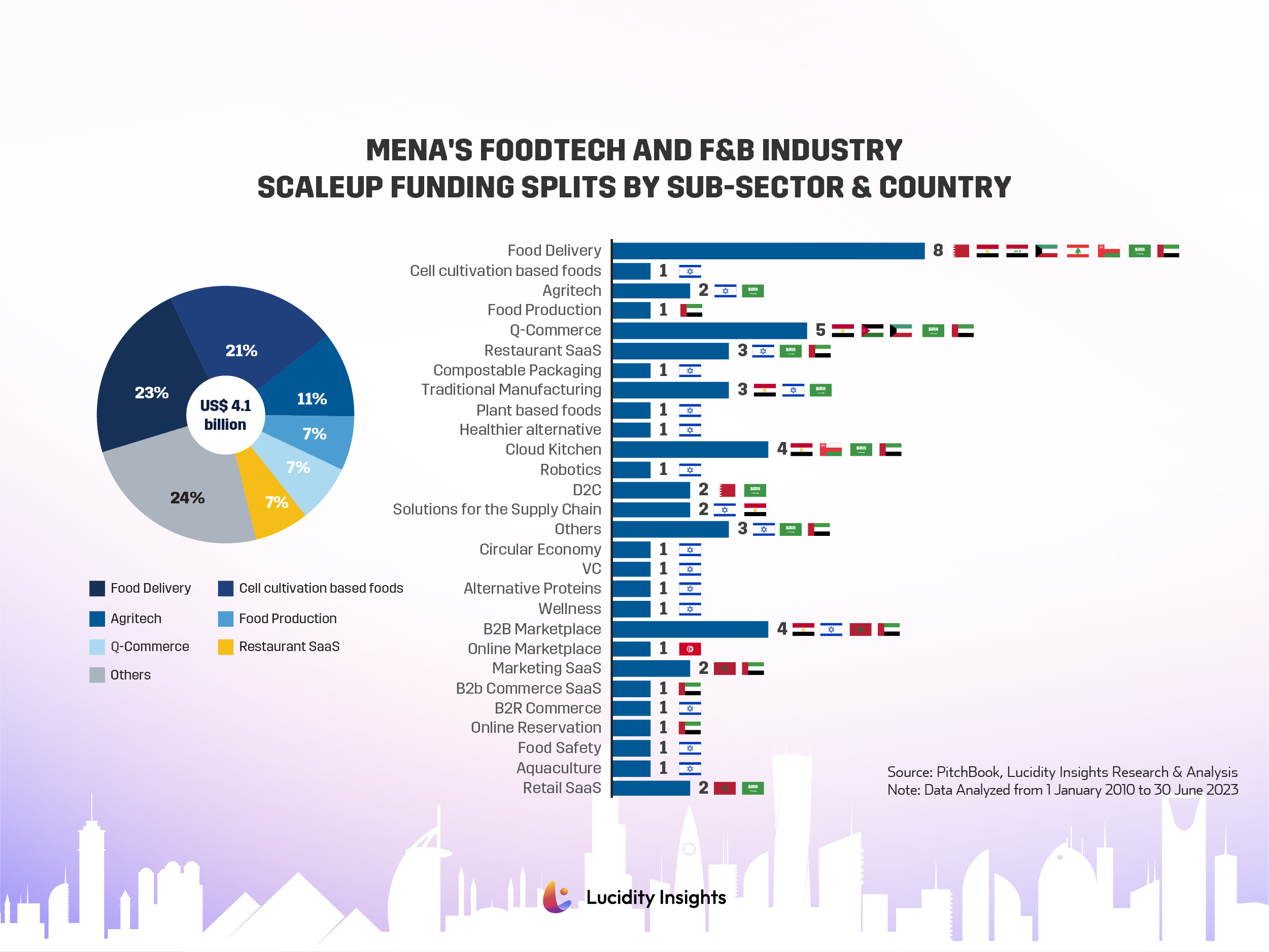

4. Food Delivery, Q-Commerce, B2B Marketplaces and Cloud Kitchens are the Most Common Foodtech Segments in MENA getting investor attention

Food delivery scaleups are the most common foodtech startup across the MENA region, that have managed to raise over US $1 million. Q-commerce follows, which stands for “quick commerce”, or rapid fulfilment orders. Think of ultra-fast delivery of goods and services to consumers on-demand. Cell-cultivation based foods production startups are not very across MENA, but the few that exist in the region are garnering a significant chunk of the foodtech funding being distributed across the region.

Infobyte: MENA’s Foodtech and F&B Industry Scaleup Funding Splits by Sub-Sector & Country

5. Average Funding Round Sizes have grown consistently across Seed, Early Stage and Late Stage

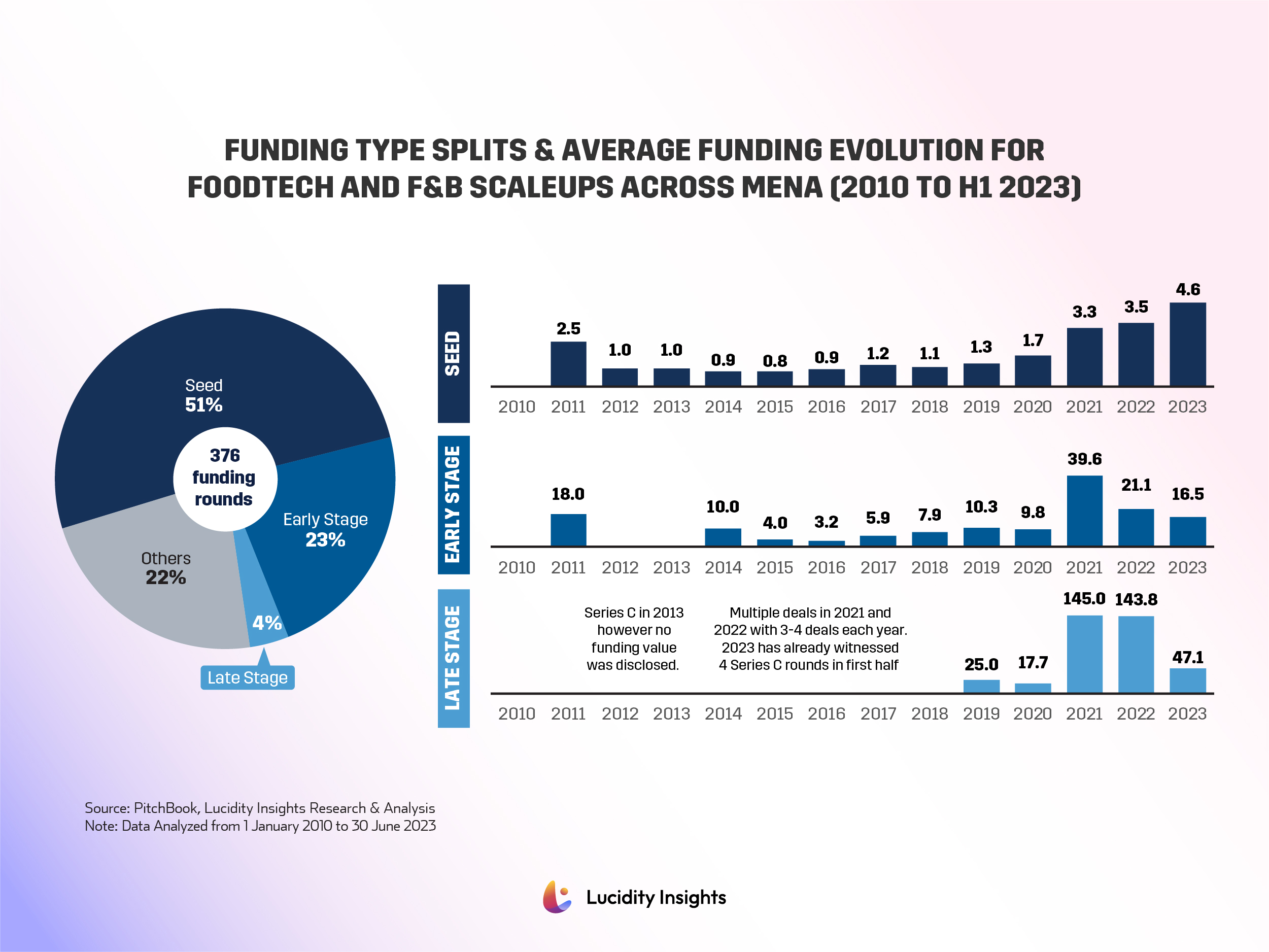

MENA Foodtech Scaleups have had 376 funding rounds since 2010, of which seed stage rounds accounted for the majority at 51%. The average funding round size has grown across each stage over the past 13 years. Seed stage funding round has grown from an average $1 million through the 2010’s to reach $4.6 million in 2023. Early stage foodtech funding sizes have varied over the years in MENA, starting with a high of $18M in 2011, but then dropping to an all-time low of $3.2M average round in 2016, to reaching an all-time high of $39.6M in 2021. Early stage round sizes have stabilized back down to $17-20 Million in recent years. Late stage funding rounds didn’t begin until 2019, and has varied in average funding round sizes from $18M to $145M in the past 5 years.

Infobyte: Funding Type Splits and Average Funding Evolution for Foodtech and F&B Scaleups Across MENA (2010 to H1 2023)

6. UAE & Saudi Startups Dominate the Top 5 Most Funded Foodtech Scaleups in MENA List

The most funded Foodtech startup in MENA is Dubai-based KITOPI, having raised over US $800M. Second placed Believer Meats from Israel raised less than half of KITOPI, at $388M. Abu Dhabi’s Pure Harvest is among one of the world’s most well-funded agtech players.

Infobyte: Top 5 Most Funded Foodtech Scaleups in MENA (2023)

Next Read: Revolutionizing the Foodtech Industry: Emerging Trends in 2023

%2Fuploads%2Ffoodtech-2%2Fcover15.jpg&w=3840&q=75)