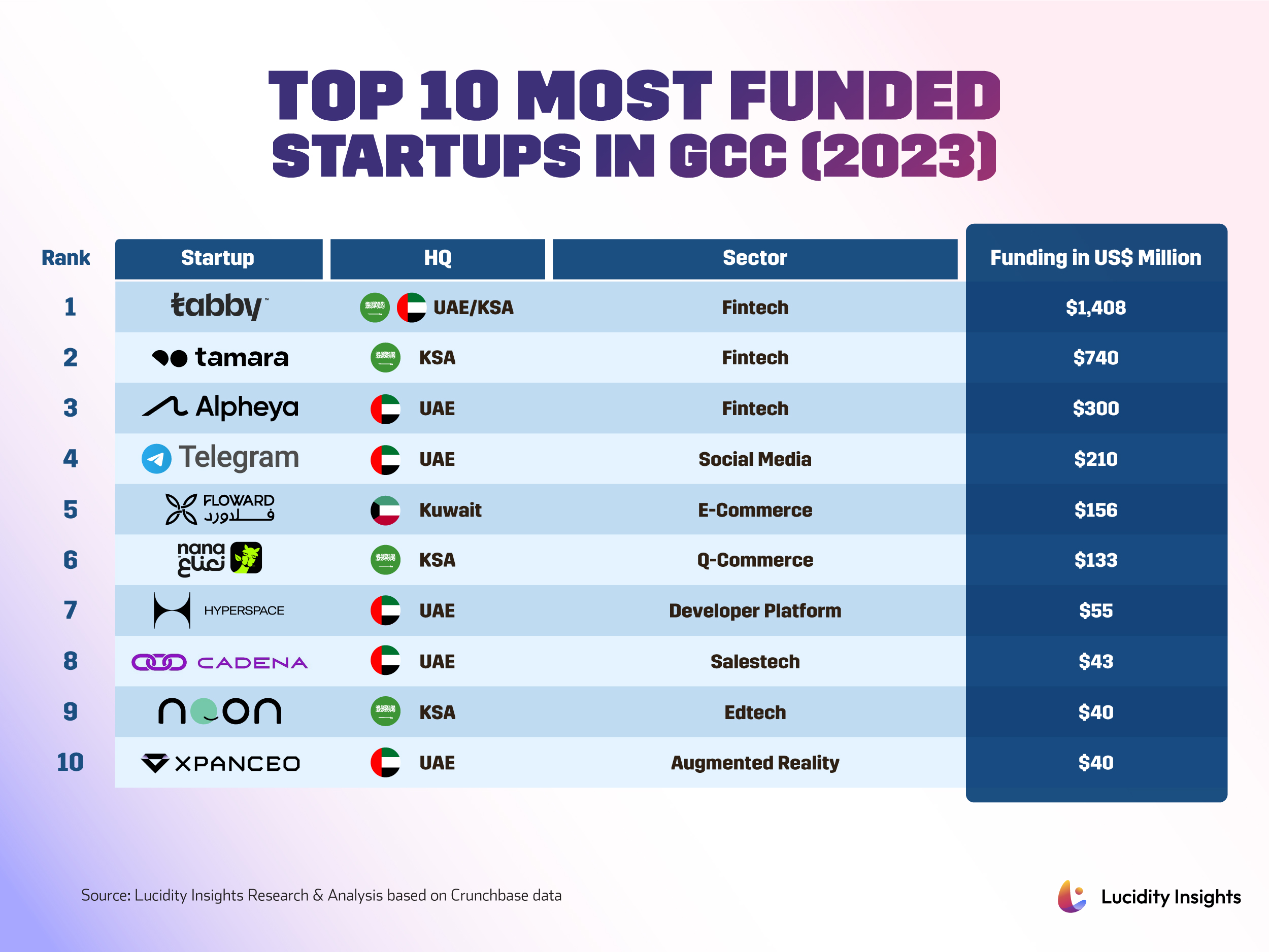

The Top 10 Most Funded Startups in GCC in 2023

08 July 2024•

The startup landscape in the GCC has seen a significant rise in the number of tech startups in recent years, a likely result of governments across the GCC having recognized the importance of diversifying their economies and promoting innovation as they have implemented initiatives and policies to support entrepreneurship while attract talent and investment from across the globe. FinTech was the most funded sector taking the top 3 spots in our top 10 list of most funded startups in the GCC in 2023. Saudi Arabia's tech start-up funding has skyrocketed up to 300% in the last five years, with the Kingdom taking first and second among other positions in our top 10 list, coming neck and at neck with the UAE as we move down the list.

Below is a table of the top 10 most funded startups in the GCC for 2023, showcasing their funding amounts:

Infobyte: Top 10 Most Funded Startups in GCC (2023)

#1 - Tabby

Established: 2019 in Dubai, UAE

Sector: FinTech

Funding: US $1,408 million

HQ: Riyadh, KSA

Tabby operates a financial platform that offers consumers a "buy now, pay later" (‘BNPL’) option to pay for online and offline purchases either in a deferred single payment or in multiple installments. Essentially, the platform provides flexible credit options for safe payments. It currently caters to four million active shoppers across the UAE, KSA, Kuwait, and Bahrain, selling 10,000+ global brands like H&M, Adidas, IKEA, SHEIN, and Bloomingdale’s. In 2023, Tabby raised US $700 million and US $350 million in Debt Financing from JP Morgan and Partners for Growth respectively, as well as US $58 million series C round from Partners for Growth and a US $50 million series D round from Wellington Management, achieving unicorn status with its funds raised totaling up to US $1.7 billion. The new funds target the expansion of Tabby's financial services amidst increasing demand for its BNPL solutions from its 10 million consumers and 30,000 retail partners.

#2 - Tamara

Established: 2020 in Riyadh, KSA

Sector: FinTech

Funding: US $740 million

HQ: Riyadh, KSA

Tamara operates a "buy now, pay later" (‘BNPL’) platform for both merchants and customers, aiming to empower people in their daily lives by revolutionizing how they shop, pay, and bank. The BNPL options are available during online checkout (for e-commerce) and via in-store QR codes (for brick-and-mortar stores), allowing shoppers to divide the cost of online purchases into interest-free installments or pay the entire amount after a specified period. Today, they serve over 10 million users and have partnered with 30,000+ merchants across the KSA, UAE, and Kuwait, and reported six times annual run rate revenue growth in less than two years. Tamara became Saudi Arabia's first fintech unicorn of 2023 after raising US $400 million in Debt Financing from Goldman Sachs and Shorooq Partners, as well as a US $340 million series C round led by Sanabil and Saudi National Bank in December. The new financing will fund new products and services, expanding beyond BNPL to capitalize on opportunities in shopping, payments, and banking services in Saudi Arabia and throughout the GCC.

#3 - Alpheya

Established: 2023 in Abu Dhabi, UAE

Sector: FinTech

Funding: US $300 million

HQ: Abu Dhabi, UAE

Alpheya offers a complete line of cloud-native, AI-powered wealthtech solutions with a platform that provides client relationship management, financial planning, portfolio construction, trading, and digital portals. Alpheya boasts a unique data model that offers comprehensive, real-time business insights as well as a collection of financial products, models, and research accessible through its platform. Alpheya garnered 1 million users within the first five days of its release and is expected to see an annual growth rate of 37.3% by 2030. Its venture round in 2023 garnered US $300 million from BNY Mellon and Lunate to initiate the servicing of its clients starting in 2024.

#4 - Telegram Messenger

Established: 2013 in Dubai, UAE

Sector: Social Media

Funding: US $210 million

HQ: Dubai, UAE

Telegram Messenger is a cloud-based, cross-platform, encrypted instant messaging (IM) service. Available on Android, iOS, Windows, macOS, Linux, and web browsers through registration on a smart phone, Telegram allows users to exchange messages, share media and files, and hold private and group voice or video calls, as well as public livestreams. In January 2021, Telegram was the most downloaded app in the world, and as of March 2024, the platform has more than 900 million monthly active users worldwide, making it the most popular instant messaging application in parts of Europe, Asia, and Africa. In 2023, Telegram raised US $210 million in debt financing through bond sales from several investors including its founder and chief executive Pavel Durov, bringing its total funds raised to US $3.2 billion. Telegram has been unprofitable to date, so the new funds are intended to bring it closer to the "break-even" point, as Durov claims the app is "closer to profitability in absolute numbers" than competitors like Twitter and Snap.

#5 - Floward

Established: 2017 in Kuwait City, Kuwait

Sector: E-Commerce

Funding: US $156 million

HQ: Riyadh, KSA

Founded by Abdulaziz Al Loughani, Khalid Albader, Mohammed Al Arifi, and Taiba Al-Humaidhi, Floward is a leading online flowers and gifting company in the Middle East and the UK that offers a variety of gift products including fresh flowers, plants, chocolates, perfumes, and cakes. The company operates in around 40 cities in nine countries, and its app has been downloaded more than a million times, with over a million customers browsing per month. Floward has raised a total of US $186.3 million to date after securing US $156 million from Aljazira Capital and STV in 2023 to expand its gifting verticals while enhancing customer experience through the application of AI and ML.

#6 - Nana

Established: 2016 in Riyadh, KSA

Sector: Q-Commerce

Funding: US $133 million

HQ: Riyadh, KSA

Founded by Sami Al-Helwah and Ahmed Al Samaani, Nana is a digital grocery shopping platform that fulfills daily, weekly, and monthly household grocery needs in Saudi Arabia and the broader MENA region. It operates as a dark store grocery delivery startup, ensuring quick delivery of groceries and other home essentials to customers within 15 minutes. The startup has to date delivered more than 45 million orders and boat more than 6000 thousand delivery drivers. With US $212.3 million in total funds, Nana plans to increase its market share to 40% by the end of 2026 further supported by its US $133 million Series C it raised from Kingdom Holding Company and Uni-Ventures in February 2023.

#7 - HyperSpace

Established: 2020 in Dubai, UAE

Sector: Developer Platform

Funding: US $55 million

HQ: Dubai, UAE

Founded by Alexander Heller, Desi Gonzales, and Rama Allen, HyperSpace is a permanent ticketed experiential attraction developer aiming to create innovative attractions that blend the digital and physical worlds in the GCC. HyperSpace develops and operates immersive experiences, bridging the gap between digital and physical entertainment. Their latest attraction is a digital theme park called House of Hype covering 60,000 square feet in Riyadh to combine content creation, gaming, music production, and immersive theater. HyperSpace secured US $55 million in series A financing led by Galaxy Interactive in 2023, bringing its total funds to US $66 million, of which the new financing will be used to boost existing offerings while also expanding its global footprint with plans to open a third site in the US.

#8 - Cadena

Established: 2017 in Dubai, UAE

Sector: Salestech

Funding: US $43 million

HQ: Dubai, UAE

Founded by Sid Dhamija and Yusuf Al Hasan, Cadena is a global leader in international business development, providing robust tools and services to streamline the process of overseas revenue growth with a hybrid solution that combines local sales expertise, AI-driven prospecting tools, and CadenaPay invoice factoring, a unique solution focused on getting service providers paid on time. In 2023, Cadena raised US $43 million in its series A funding round led by ADCN for a total funding of US $75.3 million. It also received the “Best Service Provider 2023” award during CSSCOPE 2023 in Hangzhou, China, for supporting overseas growth for Chinese companies.

#9 - Noon - The Social Learning Platform

Established: 2013 in Riyadh, KSA

Sector: EdTech

Funding: US $41 million

HQ: Riyadh, KSA

Founded by Aldhalaan and Abdulaziz Alsaeed, Noon is a social learning platform that offers tutoring and educational content through a freemium model, granting all users free access to basic content while charging for private tutors and more advanced materials. Noon Academy allows students to join study groups, participate in competitions, and engage in live sessions with teachers, serving over 12 million students across Saudi Arabia, Iraq, Egypt, and Pakistan. Their total funding now amounts to US $62.4 million after a series B round led by Raed Ventures and Wa’ed Ventures in 2023 securing US $41 million, which will be used to enhance AI-powered solutions, offer personalized learning experiences, and fuel its global expansion to support up to 190 million students within the next two to three years.

#10 - Xpanceo

Established: 2021 in Dubai, UAE

Sector: Augmented Reality

Funding: US $40 million

HQ: Dubai, UAE

Founded by Roman Axelrod and Valentyn Volkov, Xpanceo is a deep tech startup that aims to revolutionize computing through an innovative and intuitive product: smart contact lenses. These lenses seamlessly merge biotechnology and electronics, creating an invisible, weightless interface that offers night vision, health monitoring, and augmented reality content viewing among other advanced features. In 2023, Xpanceo closed its seed round at US $40 million from Opportunity Ventures in Hong Kong, with which the company aims to merge all their gadgets into one, providing users with an infinite screen!

%2Fuploads%2Fdubai-digitized-economy-2%2Fcover.jpg&w=3840&q=75)