Zbooni: How Dubai’s Homegrown Startup Has Introduced cCommerce to the Region

01 February 2023•

Founded in 2016, Zbooni was initially designed as a platform to assist online sellers with payment management. It was a business idea spawned when Zbooni Founder and CEO, Ramy Assaf, was trying to support his wife in her online business selling customized hats via Instagram.

Though she had the platform for advertising and marketing in an economy dominated by social media as ours is nowadays, the struggle of online payments was still an issue. “She didn’t have any way of capturing payments from customers like you would have with an e-commerce store, or keeping track of customer activity through a CRM,” Ramy explains. “We saw an opportunity to develop new tools for commerce within social and messaging apps, to reduce the frictions that businesses face in capturing orders, accepting payments, growing sales, and tracking their orders.” That’s when Zbooni was born as a software bridge between sellers, customers, and banks to make sales and process digital payments all at once.

Ramy gives credit where it’s due to e-commerce sites such as Shopify that have provided inspiration for their business, but by no means is Zbooni a “cut-and-paste” project. “There are certain things we learn through the lens of Shopify, how they build certain components and tackle their target markets, but Zbooni is built differently and not designed just for e-commerce websites.” Zbooni acts as a single software interface which facilitates real-time customer interactions to finalize sales through social and messaging channels like WhatsApp, where businesses and customers are spending increasingly more time. Business owners simply download the app, create an account, list the products for sale, and share a provided link with consumers via messaging services like WhatsApp, Facebook Messenger, and Instagram direct messages. Zbooni’s most attractive feature then comes as customers carry out the entire shopping trip per se without the need to download Zbooni or any external apps. The key is that even check-out takes place through whatever messaging chat that customers access the link from with payment via Visa, Mastercard, Apple Pay, and (Saudi) Mada cards.

Like other online sales platforms such as US-based Mercari, Zbooni has developed an internal screening process for merchant authorization and product authentication. Merchants must meet certain criteria for clearance to sell on Zbooni’s platform and maintain their presence on the system. The aim is to provide consumers with the credibility rate of a seller along with his products to allow educated, guaranteed purchases. Moreover, both merchants and customers are protected by anti-money laundering and antifraud machine learning and artificial intelligence tools.

However, unlike other online sales apps, the Zbooni app only needs to be downloaded by sellers, not their customers. The name of the game in any sector is efficiency – minimum input, maximum output - and the less customers need to do, the more they will buy. Zbooni has successfully introduced a new short-cut to online shopping that not many platforms have explored, setting it apart from most other online marketplaces.

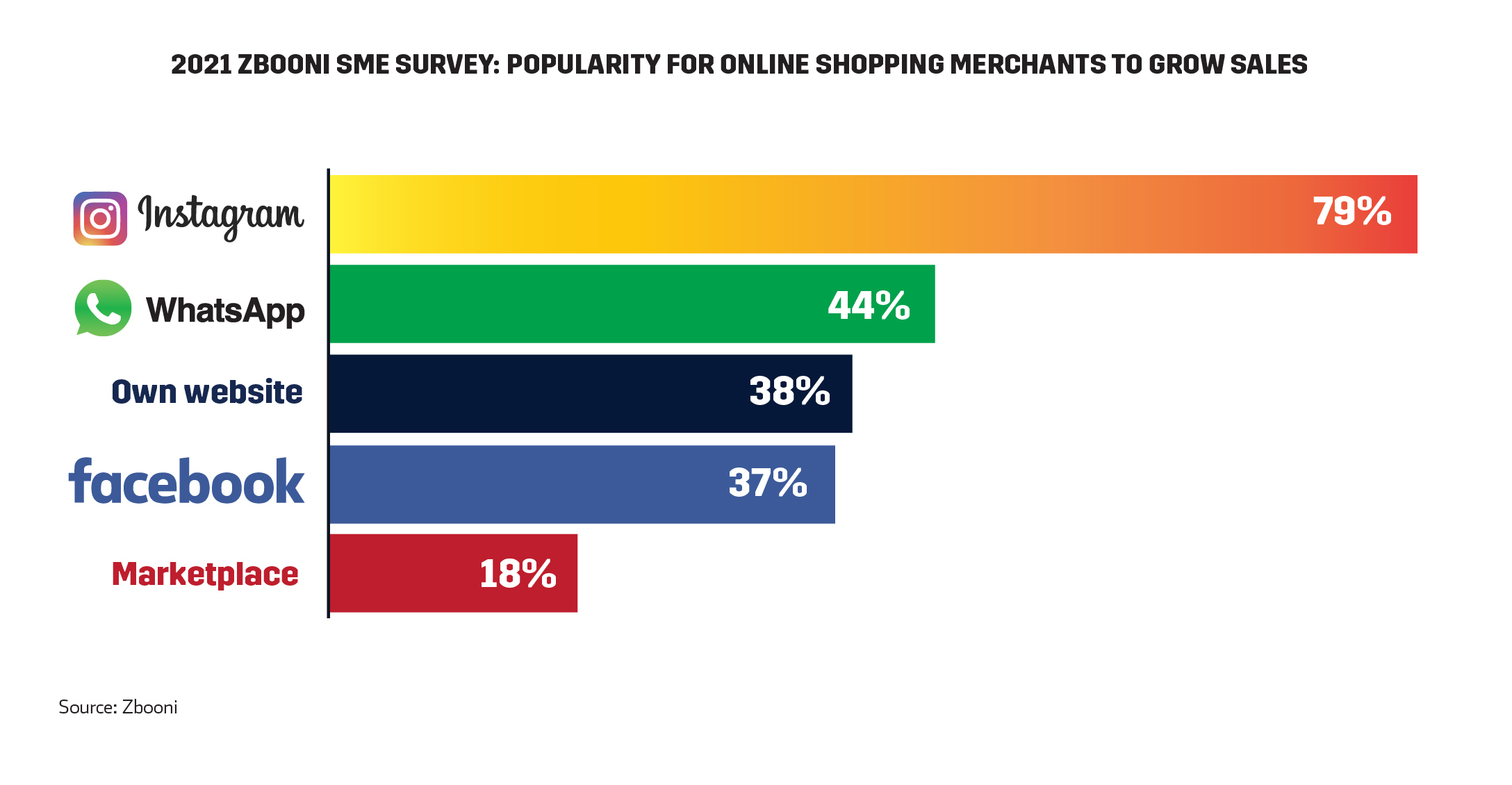

Zbooni’s 2021 SME survey defends their vision of social media-based shopping with reports that nearly 80% and 45% of online shoppers both browse and complete transactions via Instagram and Whatsapp respectively rather than stores’ own websites. Moreover, the ubiquity of WhatsApp for example as a B2C channel is remarkably different in MENA than in North America. “Mobile penetration is very high in MENA, which means we build mobile first (and only) for many use cases,” says Ramy. “Our cart software allows for ‘amending the price’ during sales, for example.” Negotiation is fairly typical for Middle Eastern shoppers and what some might even call tradition, but it’s not common when it comes to Western definitions of commerce. Zbooni’s fine-tuned itself so that MENA’s unique attributes in social media and shopping are now key driving factors for its success in the region.

One of the main factors contributing to Zbooni’s success in their early days, Ramy says, was the six-month incubation period at Facebook, now Meta. Zbooni was one of just eight startups from around the world to be incubated in the program where they developed their product and refined it alongside some of the brightest tech minds in California. Meta sought insights about a range of global markets and use cases through the lens of startups, who in return got more insight into how Meta foresaw their roles in the commerce roadmap.

Ramy also commends co-founder, COO Ashraf Atia, on his unwavering commitment to Zbooni and its customers. Despite dedicating a whole team to client sales and enquiries, Ashraf himself still connects with merchants daily to better understand their needs and improve the Zbooni experience. Since its establishment, Zbooni has grown into a business solutions platform complete with digital storefronts, data insights, and mobile invoicing.

Zbooni has also expanded by catering to both traditional businesses as well as ‘casual’ merchants like social media influencers, and is, in principle, the first business in the region to transcend e-commerce into the sector of cCommerce (connected commerce) to assist in customer engagement and sales communications. This significance comes with the company’s claims that the cCommerce cart is, on average, 2.7 times larger than that of traditional e-commerce with a conversion rate 20 times greater than e-commerce.

Though Zbooni was barely established a mere two years before covid-19 hit, the pandemic only helped the uptake of Zbooni’s services. Digital sales channels and e-commerce itself was in effect the only means for small merchants to maintain operations during lockdowns.

Much of the Middle East was still behind many western markets in terms of conducting digital payments, preferring to utilize physical cash – but this changed during the pandemic. Social distancing and lockdowns only accelerated the region’s take-up of contactless payments and digital payments for orders.

According to Ramy, Zbooni thrived in this pandemic-driven transition with increased merchant demand, customer growth, and service expansion as well as internal software upgrades and product refinement. “Instead of Zbooni’s growth dropping off once Covid was “over”, we saw real stickiness and a continued momentum of that digital shift. In fact, we’re currently experiencing the steepest growth trajectory we have ever seen in our business,” he explains.

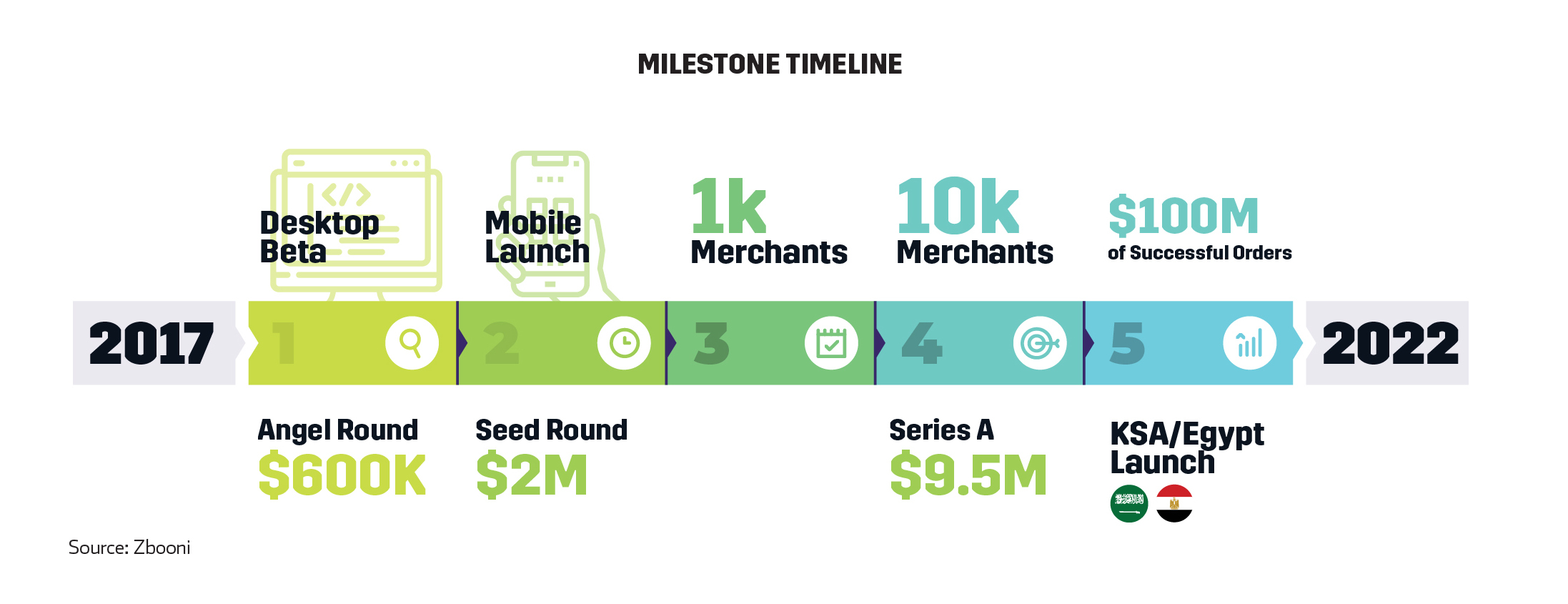

Zbooni was serving around 20 merchants in 2017, and from 2017 to 2021, grew almost 200x in terms of payment volume going through the platform. Today, they serve more than 10,000 merchants across four core markets having recorded a customer growth of 600 percent reaching over 150,000 clients in 2020.

To date, Zbooni has raised a total of over US$ 12 million, which has allowed Zbooni to hire new team members, expand beyond the UAE, Saudi Arabia, Lebanon, and Jordan into Egypt, and further develop their product with many consumer-centric updates. Zbooni raised US$ 2 million in 2019 through regional institutions including UAE retailer Chalhoub Group and private equity fund B&Y Venture Partners. In 2021, Zbooni closed a Series A round of US$ 9.5 million from international and regional funds. Zbooni’s latest expansion plans come with its official launch in Egypt, the third largest economy in the Arab world. With the support of its regional and global investors, Zbooni will cater to some 3.5 million small to medium size enterprises (SMEs) throughout Egypt to boost the economy at the core of its digital commerce.

“Helping SMEs is in Zbooni’s DNA, and our estimates suggest that there are in excess of 10 million businesses who could benefit from cCommerce (connected commerce through social messaging apps),” says Ramy. Egyptian-American COO Ashraf is even more excited for this expansion to help support and inspire Egyptian businesses and entrepreneurs. He expects that the partnership with JumiaPay and National Bank of Egypt in 2022 will entice thousands of local Egyptian businesses to sell with Zbooni boosting his home country’s economy.

More than physical expansion within the region, the Zbooni team has also acknowledged the importance of broadening the range of products and services on offer to clients. Ramy reports a growth in the health and wellbeing related market including dietary products, nutritional guides, self-care workshops, and therapeutic readings. This is only one of the directions they plan on expanding into, to allow merchants of all trades the opportunity to excel and build a fruitful clientele. As a Dubai-based start-up taking on the region by storm, Zbooni showcases the Emirate’s own success story through the years.

When asked why Dubai specifically, he told us “Where else in the world can you have a microcosm of many of the world’s populations contained into one city?” Ramy explains that it made sense to start in a city with a diverse and digitally savvy customer base for product development and testing. Dubai is also home to some of the biggest investors and brightest tech minds in the world; a population that is also growing all the time. This not only provides access to some of the best talent in the region, but also puts you in close competition with the rest. “That demands worldclass products, and this forces you to be competitive and not cut corners if you want to thrive,” explains Ramy. “Events like Dubai Expo 2020 help shine a light on the city, creating an excitement amongst people about the extraordinary things to come in this land of opportunity.”

Ramy also told us about a few of Zbooni’s partnerships with the UAE government. They recently partnered with the Ministry of Community Development to help local Emirati businesses set-up and thrive digitally. Zbooni has also worked to support the Ajman Chamber of Commerce help its members go online.

In the next six months, the startup says we can expect more Zbooni partnerships within the UAE as well as growth in their newly established markets, namely Egypt, Saudi Arabia, and Jordan. Their plans are also jam-packed with game-changing enhancement features that will give businesses a further edge in acquiring customers, as well as new software product launches designed for a more international audience. The latest product is completely unique, and addresses needs of e-commerce merchants globally. “We are particularly excited about what’s to come in 2023,” says Ramy. “ The common thread across all our efforts is simple, we help merchants sell more.”

%2Fuploads%2Fdubai-digitized-economy-2%2Fcover.jpg&w=3840&q=75)