Foundation Ventures: Empowering Egypt's Tech Innovators

17 April 2024•

Foundation Ventures is an early-growth stage venture capital fund focused on investments in Egypt. The fund is in a partnership with US-based VC, HOF Capital and Egyptian PE company, BPE Partners.

- Year Established: 2019

- HQ: Cairo, Egypt

- AUM: N/A

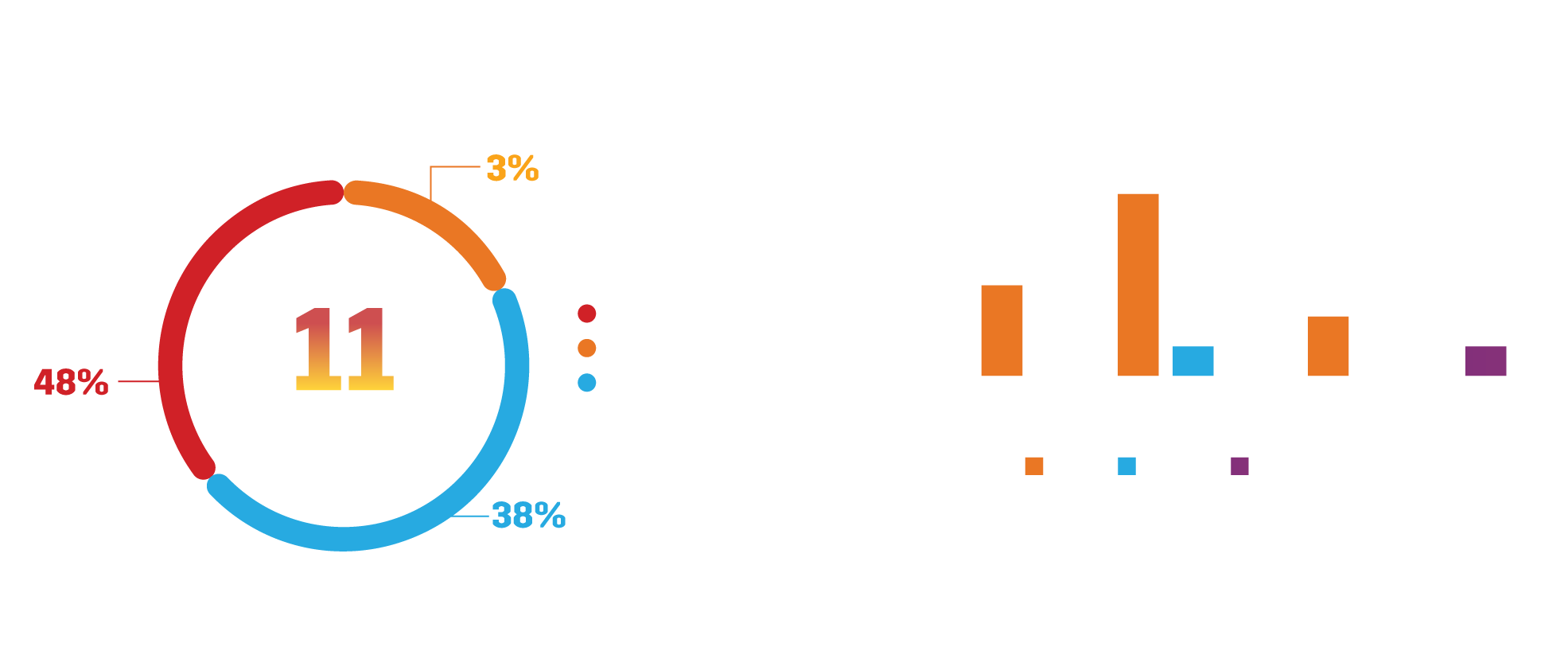

- # of Portfolio Companies: 12

- % of companies in Egypt: 85%

- Avg # of deals per year: 4

- Number of exits: N/A

- Funding Stage: Pre-Seed, Seed, Series A

- Ticket Size: N/A

- Team Size: 7

- Website: http://www.foundationventures.com/

In the heart of Egypt’s bustling startup ecosystem, Foundation Ventures emerged in 2019, a brainchild of Mazen Nadim, Omar Barakat, and Ziyad Hamdy. The partners of this venture fund come from varied expertise, brought together by a shared vision and a diverse array of experiences. At the core of Foundation Ventures lies a bold mission: to elevate tech startups from nascent ideas to titans of industry.

The fund begins this journey with an initial investment of $500,000 with the potential for increased support in future funding rounds. Foundation Ventures’ investment strategy is versatile, transcending sector boundaries in a region where market specialization is still emerging. They’re always attuned to evolving market and consumer trends, seeking out promising opportunities in a wide array of sectors.

At the heart of Foundation Ventures’ early-stage investment strategy is a deep appreciation for the founders themselves. Recognizing these individuals as the vital force of any startup, the fund pays special attention to their vision and drive. Foundation Ventures understands that it’s the founders’ unique insights and dedication to solving critical problems that set a company apart.

By identifying and supporting these dynamic individuals, the firm doesn’t just invest in a business; it invests in the people who can steer these businesses to success. Ziyad emphasizes this ethos, asserting that their commitment extends beyond financial support. Foundation Ventures provides these visionary founders with an ‘unfair advantage’ by granting them access to a rich network of partnerships, a diverse customer base, and industry-specific resources, ensuring they have a competitive edge in the market.

Mazen Nadim reflects on their investment strategy, noting that they prefer to be early movers in promising ventures, rather than following trends set by others. This proactive approach is complemented by their willingness to participate in structured deals, believing in the power of collaboration for the ecosystem’s growth and maturity.

Foundation Ventures have a longterm investment vision, both for their portfolio companies and the broader region. Despite Egypt’s economic challenges, Mazen affirms their commitment to long-term investing. He acknowledges the impact of the current crisis on valuations but sees this as an opportunity for businesses to become more resilient and efficient, primed for rapid expansion. He highlights Egypt’s significant tech talent and potential, underscoring the fund’s optimism about the region’s future.

Looking forward, Foundation Ventures is poised to support the next wave of disruptors. With their commitment and strategic approach, they are not just participating in Egypt’s tech evolution; they are actively shaping a new era where every investment is a landmark in a history of innovation and growth.

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)