Clarity AI: Pioneering Precision in Global ESG Impact Assessment

15 December 2023•

In the realm of sustainable development, the quest to measure and assess Environmental, Social, and Governance (ESG) impacts confronts a complex global challenge. It’s a task that extends beyond the ledgers of publicly listed companies to the broader corporate world.

- Company Name: Clarity AI

- Sector: Sustainability technology

- Established: 2017

- Website: https://clarity.ai/

- HQ: New York, USA

- Fundraising: US $100 million

- SDG Goals:

In Frame: Rebeca Minguela, Founder and CEO of Clarity AI

In Frame: Rebeca Minguela, Founder and CEO of Clarity AI

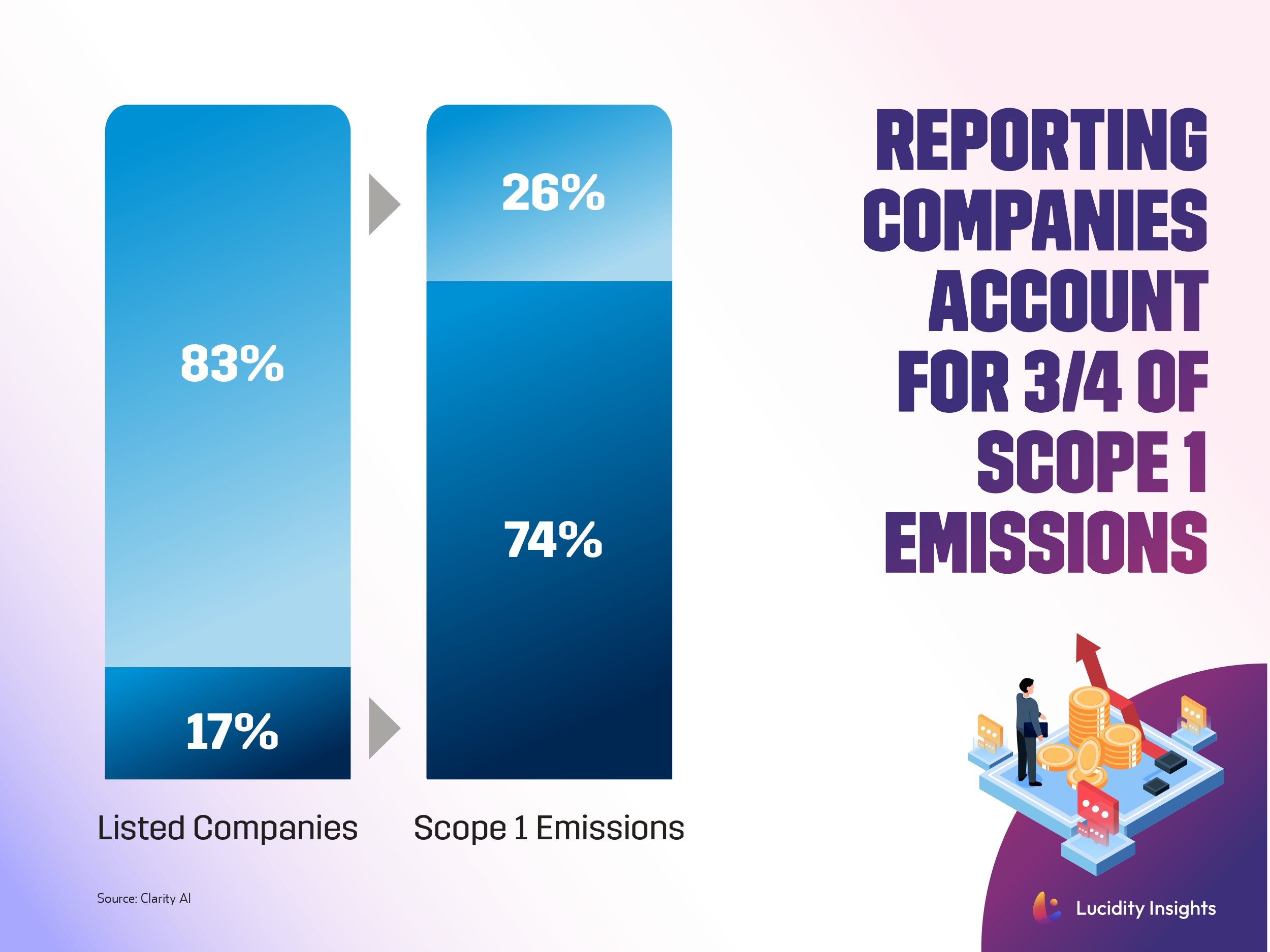

Reflecting on global corporate emissions, it’s notable that among the roughly 40,000 to 45,000 publicly listed companies (as estimated by the World Bank), only about 17% report their direct greenhouse gas emissions or Scope 1 emissions. While this fraction appears small, these companies are responsible for a substantial 74% of the Scope 1 emissions of all listed companies. However, while one may assume this coverage is sufficient for informed action, the real challenge lies in the reliability of reported figures.

Infobyte: Reporting Companies Account for 3/4 of Scope 1 Emissions

Infobyte: Reporting Companies Account for 3/4 of Scope 1 Emissions

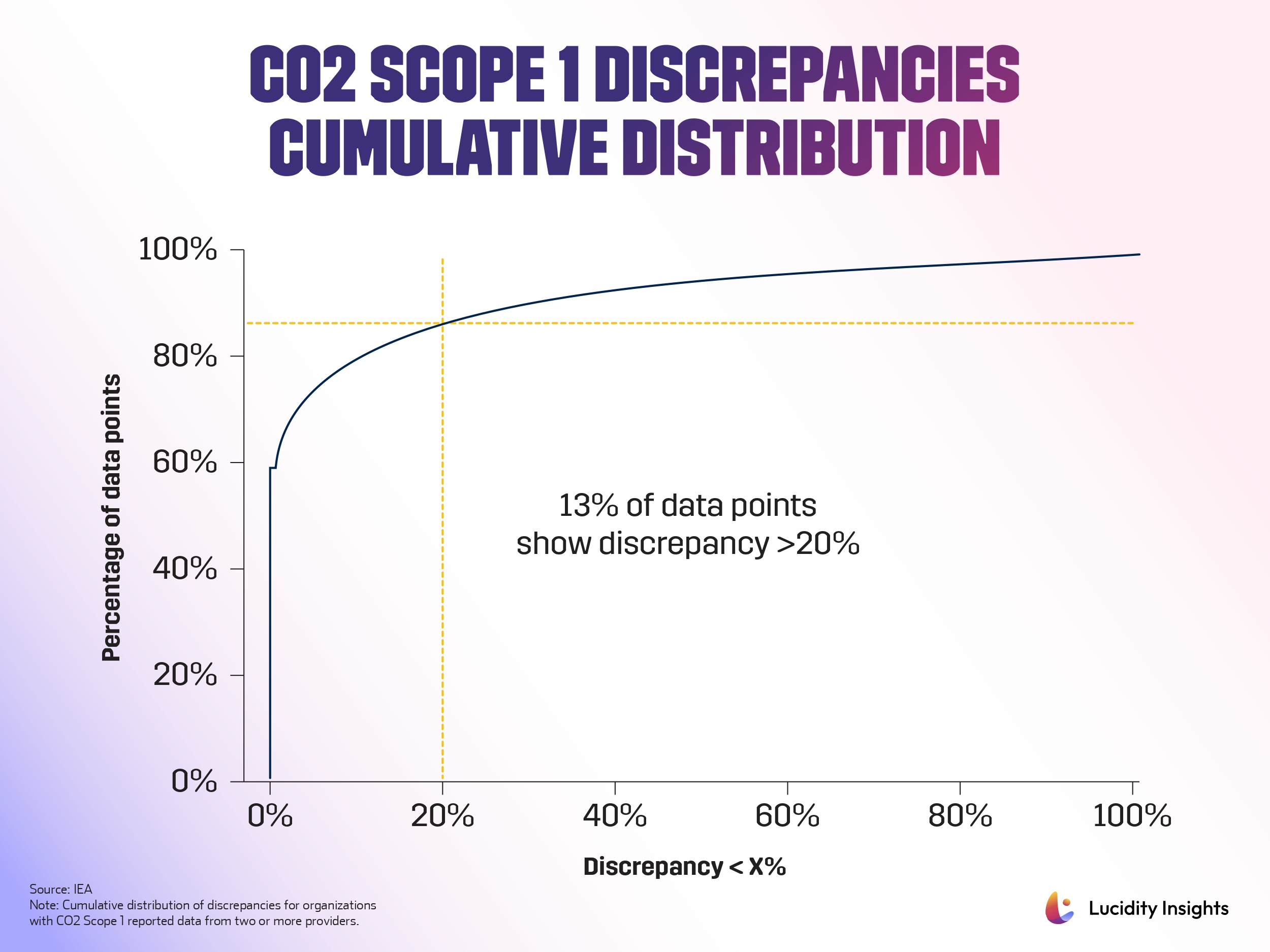

Discrepancies and inconsistencies in the data raise questions about its accuracy, highlighting a critical gap in our understanding and ability to effectively address corporate contributions to greenhouse gas emissions. A 2022 study by Clarity AI points out alarming inconsistencies in these reports, with over 13% of data points showing more than 20% variance when compared. This raises serious concerns about the accuracy of reported data, undermining the confidence of investors and stakeholders in their sustainable strategies.

Infobyte: CO2 Scope 1 Discrepancies Cumulative Distribution

Infobyte: CO2 Scope 1 Discrepancies Cumulative Distribution

The narrative extends beyond carbon footprints to the broader terrain of ESG assessments. These assessments, pivotal in guiding sustainable investments, often teeter on a tightrope between risk mitigation and true impact. A company might score high on ESG metrics yet leave a net-negative imprint on the environment or society, challenging the very essence of sustainability.

This issue is intrinsically linked to the global pursuit of the Sustainable Development Goals (SDGs), widely used by investors as a framework for impact investing. Without accurate, transparent, and genuinely impact-oriented measurements, there’s a risk of capital flowing into ventures that merely tick ESG checkboxes without meaningfully advancing the SDGs.

Related Video: What Is Sustainable Development?

As the global community grapples with these issues, the International Sustainability Standards Board (ISSB) and the European Union, through its Corporate Sustainability Reporting Directive (CSRD), are laying the groundwork for more standardized and comprehensive reporting, set to commence in the coming years. Yet, aligning these standards across diverse global entities remains a Herculean task, especially for multinationals straddling different regulatory landscapes.

Amidst this backdrop, there’s also an emerging consensus that ESG disclosures must be subject to the same rigor and validation as financial statements, necessitating robust systems and methodologies. This evolution towards more reliable and universally accepted ESG reporting is not just a step but a leap towards aligning corporate conduct with the noble aspirations of frameworks such as the SDGs.

Companies like Clarity AI are at the forefront of this shift, employing advanced technologies like artificial intelligence to enhance the accuracy and depth of sustainability data. Founded in 2017 by Rebecca Minguela, Clarity AI emerged from the work developed during Minguela’s MBA at Harvard Business School. The idea was to genuinely assess the sustainability impact of a company’s core business functions and products, moving beyond superficial corporate sustainability images. This foundational work led to Clarity AI’s distinctive approach in the ESG landscape, focusing on enhancing the accuracy and transparency of sustainability data.

Today, Clarity AI boasts a significant presence in the market, with a client network in the investment industry managing assets exceeding US $50 trillion. The company also reaches over 150 million consumers through collaborations with platforms like Klarna and Aspiration. Recognized for its cutting-edge approach, Clarity AI has earned accolades from Forrester, Investment Week, and the World Economic Forum, and secured substantial funding since its creation.

Its most recent funding round included a US $50 million investment from SoftBank Vision Fund 2, BlackRock, Fifth Wall ClimateTech Fund, or private contributor Sir Jonathan Ive, Apple’s former Chief Design Officer, catapulting its valuation to US $450 million and affirming its innovative impact in the realm of sustainable investment.

Also Watch Related Video: Which Country Is the Leader in Climate Tech Funding?

Clarity AI stands out through its innovative use of AI and machine learning, addressing common issues in ESG data reporting such as human error, inconsistent categorization, and incomplete disclosures. It leverages machine learning algorithms developed with inputs from sustainability experts and employs advanced natural language processing (NLP) techniques for data collection. This approach has expanded its coverage from 19,000 to over 70,000 companies, 430,000 funds, and 400 national and subnational governments. Clarity AI’s platform distinguishes by its ability to provide fully-packaged sustainability tech solutions to customized solutions that address specific needs. This flexibility enables it to serve a wide array of use cases and client types, from investors to consumer platforms, to support their decision-making processes and reporting requirements.

Clarity AI’s collaborative efforts further its mission to enhance sustainable investment practices. A notable partnership with GIST Impact focuses on biodiversity assessment and reporting. This collaboration aims to help clients identify their exposure to companies negatively impacting biodiversity, a vital component in mitigating environmental risks. This partnership reflects Clarity AI’s commitment to providing data that is company-specific, geographically accurate, and covers a broad spectrum of biodiversity impact drivers, aligning with the latest regulatory developments like SFDR and recommended disclosures by the Taskforce on Nature-related Financial Disclosures (TNFD).

Advancing ESG and Sustainability in Saudi Arabia: Clarity AI’s Collaborative Efforts

More recently, the Global AI Summit held in Riyadh highlighted the growing importance of AI and data in various sectors, including sustainability, and Clarity AI’s recent engagements with key Saudi institutions underscore its commitment to this cause. Saudi Arabia, a nation traditionally reliant on oil, is now keen on diversifying and adopting sustainable practices as part of its National Transformation Program.

Rebeca Minguela, founder and CEO of Clarity AI, said: “Making strides forward in ESG (environmental, social, and governance) and sustainability is an important part of Saudi Arabia’s National Transformation Program, and there is a clear commitment to building a business ecosystem which rewards companies and investors with the aim to create value beyond just financial returns.”

Together with the Saudi Tadawul Group, MENA’s leading stock exchange which has a market capitalization of close to US $3 trillion, Clarity AI is focused on enhancing data-driven sustainable business practices and is set to offer environmental and social insights while fostering transparency and accountability in business practices. They aim to educate regional companies on sustainability issues, aiding in monitoring and reporting compliance with national and international frameworks.

The Urgency of Impact Measurement: Clarity AI’s Call to Action

Clarity AI’s platform is instrumental in combating “impact washing” and enhancing ESG and net impact insights across various asset classes. Its approach is seen as a vital step in mainstreaming impact assessment and integrating it into the broader financial industry. The platform’s scalability and comprehensive coverage make it a valuable tool for investors and other stakeholders to make informed decisions that align with societal and environmental goals. Clarity AI’s strategic alliance with BlackRock, a significant investor in the company, underscores the rising demand for such solutions as demonstrated in the integration of Clarity AI’s advanced capabilities into BlackRock’s Aladdin platform.

“The imperative is to begin the process of impact measurement now, even if initial methods aren’t flawless. A starting point, no matter how imperfect, provides a foundation for refinement and better-informed decisions, as opposed to not having any benchmark at all.”

— Angel Agudo, Board Director and Head of Product at Clarity AI

This integration allows Aladdin’s clients to comprehensively assess a wider range of companies, meet disclosure requirements, and construct portfolios that prioritize sustainability. Clarity AI, with its pioneering technology, influential partnerships, and extensive data coverage, is revolutionizing sustainable investment practices. By offering accurate and actionable insights on the environmental and social impacts of diverse entities, Clarity AI is tackling current ESG assessment challenges, setting the stage for a future where investment practices are both sustainable and transparent. Clarity AI emphasizes the urgency and importance of initiating impact measurement immediately, laying the groundwork for continuous improvement and more informed investment decisions in the future.

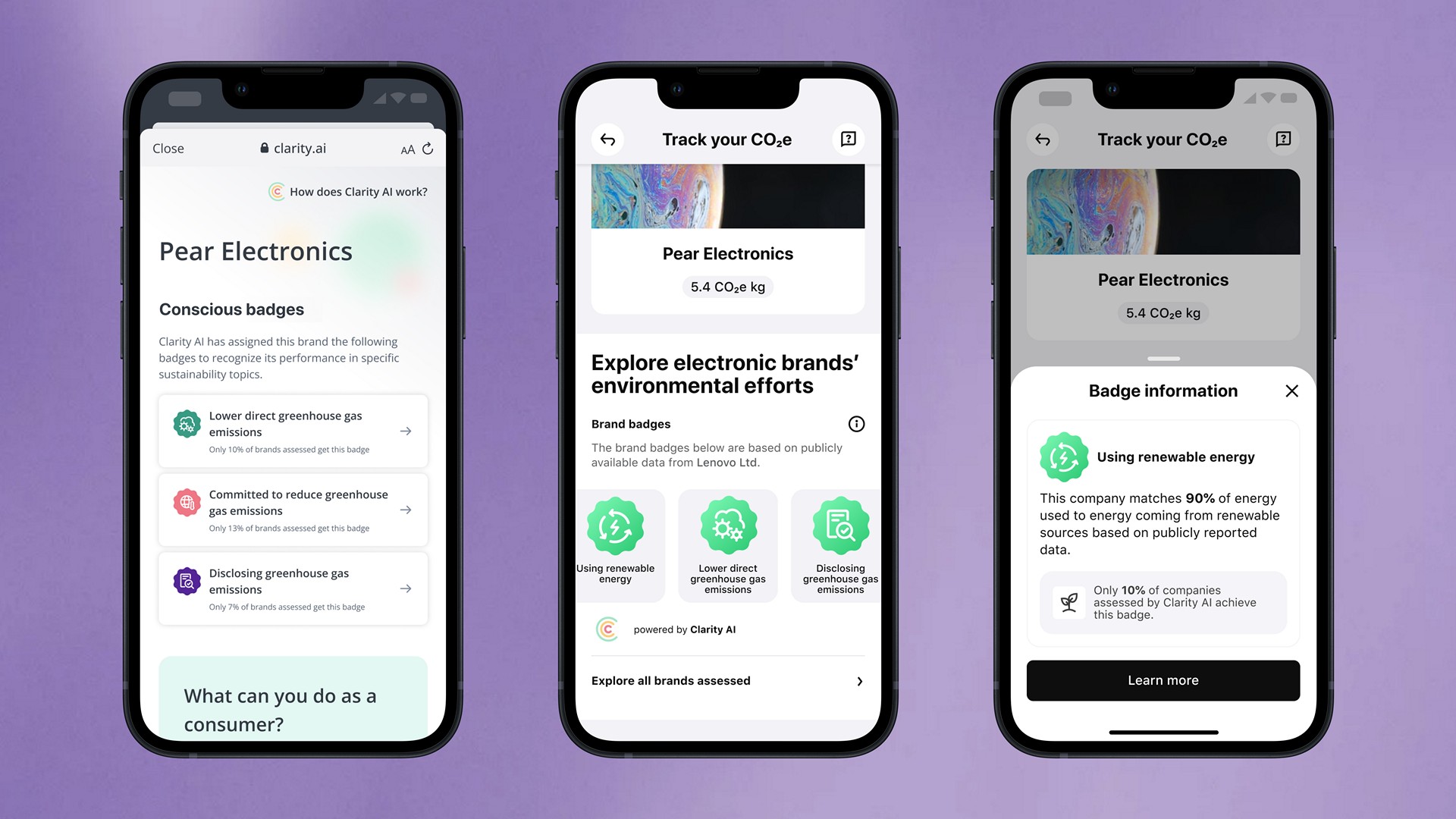

Clarity AI has also introduced consumer-focused sustainability to its offering. Klarna is a Swedish fintech that provides online financial services such as payments for online storefronts, direct payments, and post-purchase payments. This year saw the launch of “conscious badges” on the Klarna App in response to the increasing consumer demand for transparency in the environmental impact of purchases. Through Clarity AI technology, electronics brands can earn up to 5 badges based on their greenhouse gas emissions and renewable energy use.

For more information, check out: https://clarity.ai/

To read more about impact investing and the state of impact investing in the world today, download and read the Special Report here.

Next Read: Creating Impact: A comprehensive Special Report on The Business of Impact Investing

%2Fuploads%2Fimpact-investing%2Fcover19.jpg&w=3840&q=75)