Healthtech’s Fast VC Winter Recovery in a Post Pandemic World

21 November 2023•

Healthtech is burgeoning the world over.

Whether we’re talking about telehealth and other forms of optimized healthcare delivery, digital therapeutics, drug discovery, personalized medicine – such as those geared towards DNA and blood testing for reproductive health or personalized care – insurtech or admin workflow SaaS companies that help optimize booking doctor appointments… there is a lot going on in the healthtech and digital health space.

As of February 2023, there were 140 healthtech unicorns globally. Healthtech happens to be the 3rd most unicorn-producing sector. What’s more, 39% of healthtech unicorns reach unicorn status within five years, with another 40% reaching unicorn status between year 6 and year 8. Despite the current funding crunch and challenging business climate, healthtech has proven to be the most resilient sector, with digital health funding and deals being the first to stabilize in Q1 2023.

Related: Meet the Top 5 Global Healthtech Unicorns

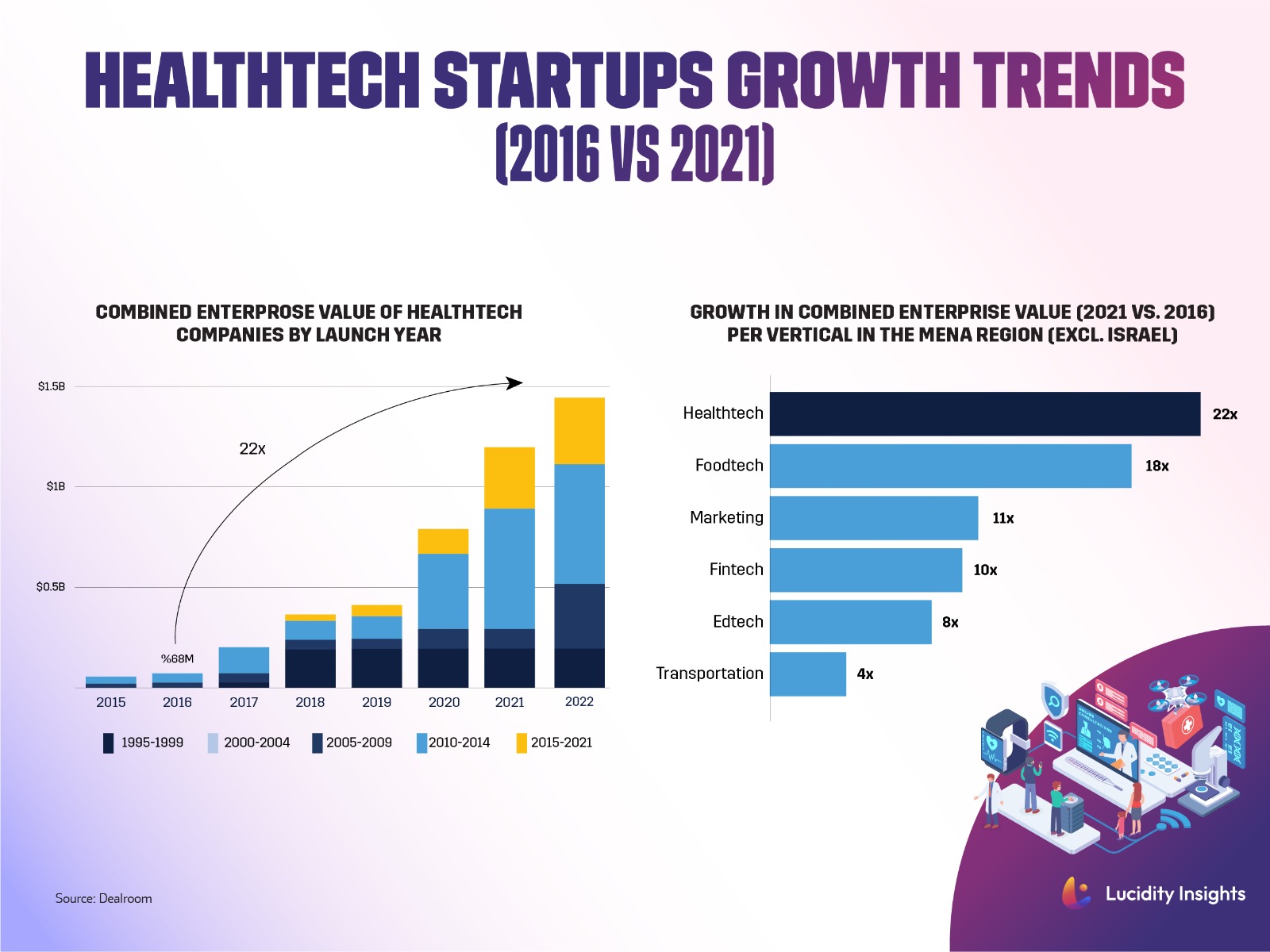

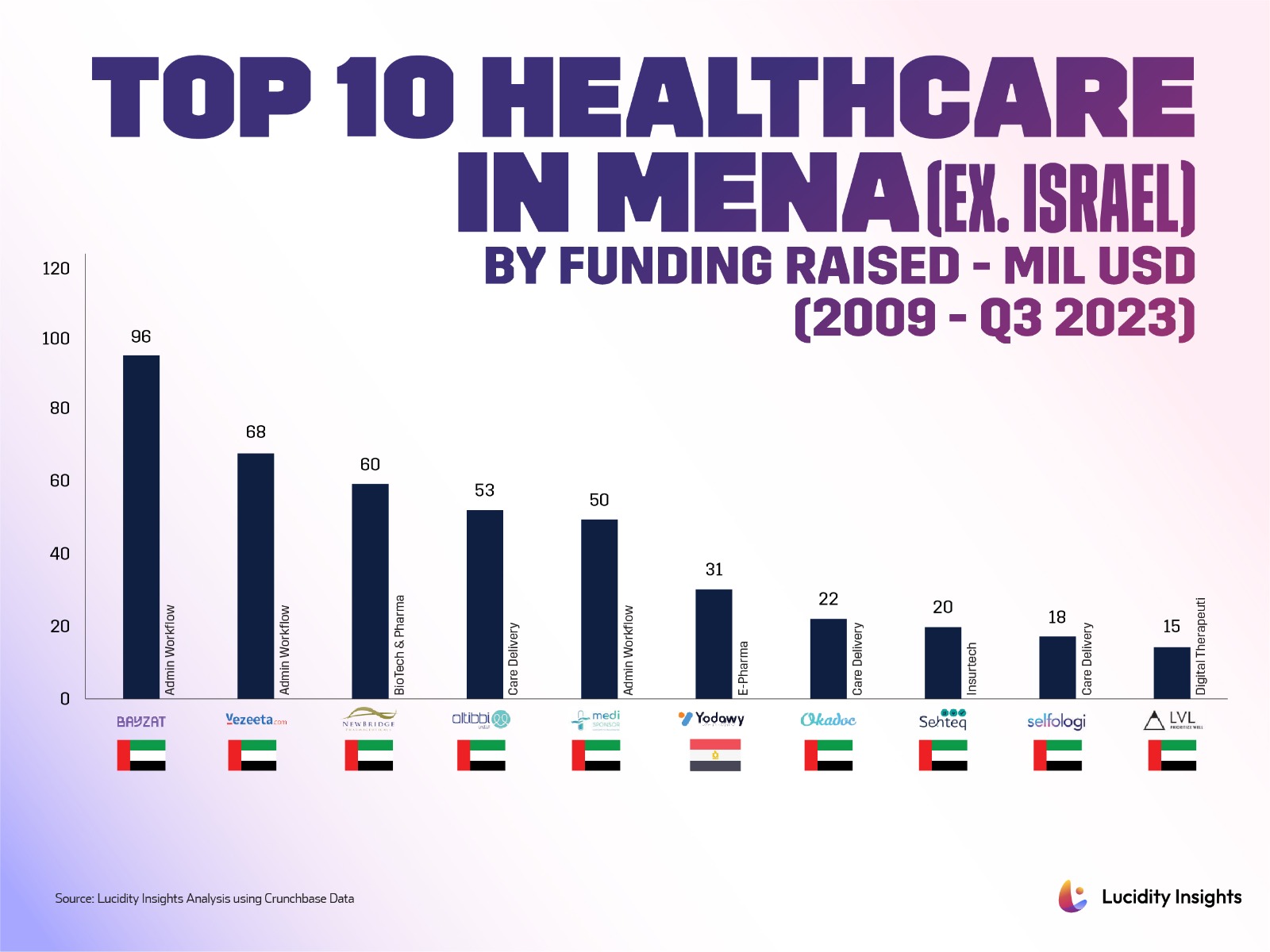

In the MENA region, healthtech players have seen the steepest rise in valuations, which is also part and parcel to why there has been an influx of dedicated healthcare and healthtech funds in the region. But funding is still relatively low compared to other sectors, with a cumulative raise by MENA (excl. Israel) healthtech startups totalling to just over US $600 million. Admin workflow players like Bayzat and Vezeeta lead the way in terms of fundraising, having raised $96 million and $68 million to date. Care Delivery is the second largest sub-segment in the region, with players like Altibbi and Okadoc leading the way with tele-medicine products.

Infobyte: Healthtech Startup Valuations in MENA 2016 vs 2021

Infobyte: Healthtech Startup Valuations in MENA 2016 vs 2021

There’s still significant room for growth, with no healthtech raising a mega-round to date, despite 17% of the region’s healthtech startups having successfully raised 3 rounds or more. The race of the soonicorns is still on-hand, as the mantle for the “first healthtech unicorn in MENA” is still up for grabs.

The United Arab Emirates is the dominant backdrop for healthtech in the region, with 75% of all MENA (excl. Israel) VC healthtech funding going to UAE based startups. It will come as no surprise then that nine out of ten of the most wellfunded startups in MENA also fly the UAE flag. Egypt and Saudi are also growing their healthtech startup ecosystems.

Related Video: What are the top sectors in Egyptian Startups?

Infobyte: Top 10 Healthcare in MENA (excluding Israel)

Infobyte: Top 10 Healthcare in MENA (excluding Israel)

To read more about the transformative innovation of digital health in 2023 – read the full report here.

Next Read: Disruptive Healthtech Sectors: The 7 Hottest Sub-Sectors

%2Fuploads%2Fhealthtech%2Fcover2.jpg&w=3840&q=75)