What is Impact Investing?

14 December 2023•

Impact investing stands at the crossroads of philanthropy and traditional investment, offering a dynamic approach to achieving both financial returns and measurable social and environmental impact. It’s not just about making a profit; it’s about making a difference.

Core Principles of Impact Investing

At its heart, impact investing is guided by a few key principles:

• Intentionality: Impact investments are made with the explicit intention to generate positive, measurable social and environmental impact alongside a financial return.

• Return Expectations: Unlike philanthropy, impact investing expects a financial return, ranging from below-market to market-rate, depending on the investor’s goals.

• Range of Asset Classes: Impact investments span across various asset classes, including but not limited to private equity, debt, and real assets.

• Impact Measurement: A distinctive feature of impact investing is the commitment to measure and report the social and environmental performance of investments. This accountability is essential for understanding the effectiveness and scope of the impact.

• Additionality: Additionality is a fundamental principle in impact investing that underscores the need for investments to create real and measurable positive changes that otherwise would not have occurred. Impact investments should go beyond business as usual and should be characterized by their capacity to generate new solutions, address social or environmental challenges, or accelerate progress toward desired outcomes.

How does Impact compare to Traditional and ESG Investing?

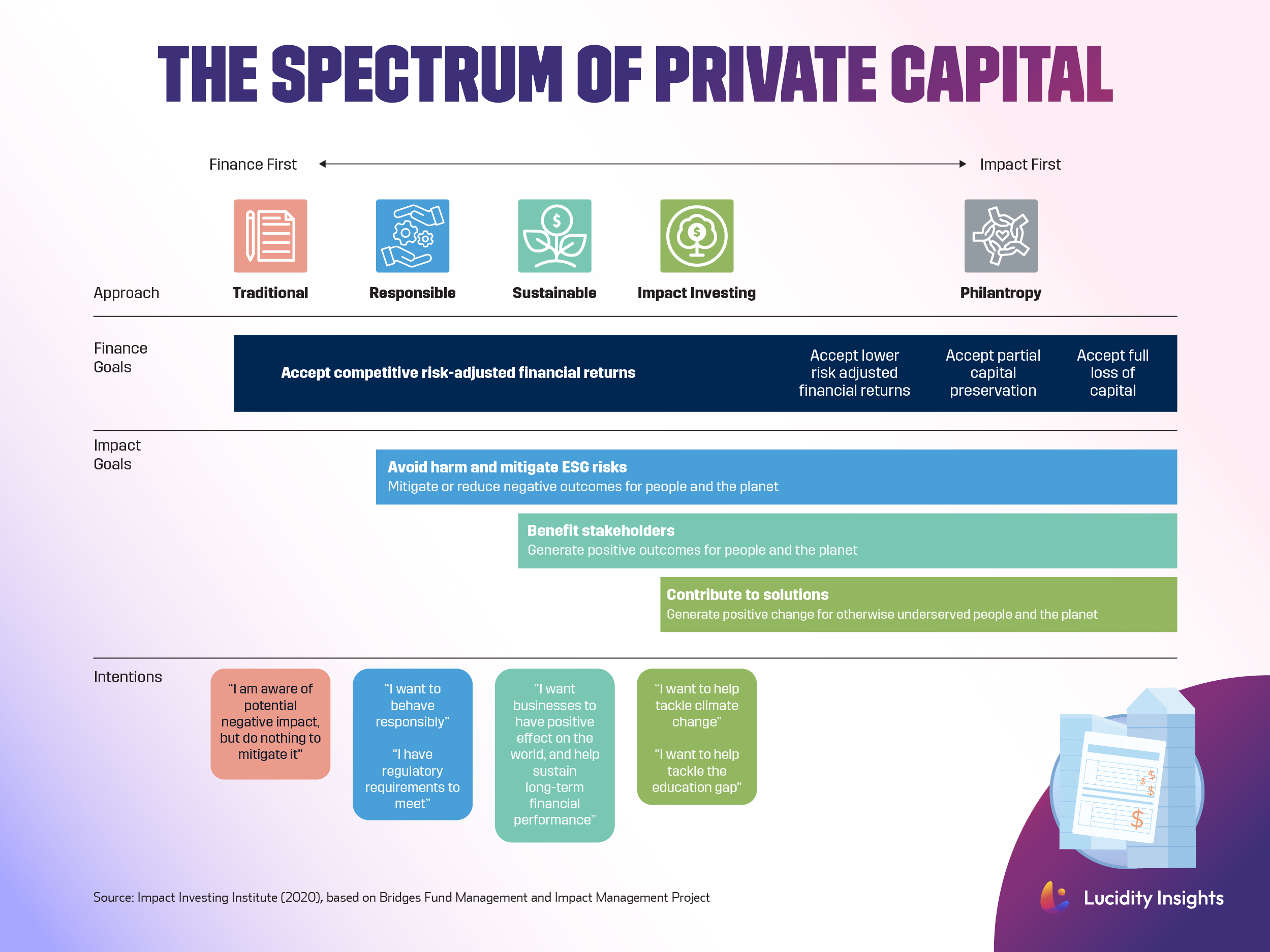

While traditional investments focus primarily on financial returns, ESG investing fundamentally aims to do both well and good, thereby achieving a double-bottom line. This approach was inspired by the United Nations’ Principles for Responsible Investment, initiated in 2005. However, while ESG investing incorporates ethical considerations into investment decisions, its focus is not necessarily on creating additional impact. ESG investments might avoid harm or support general good practices, but they don’t always aim for or measure specific, additional impacts.

Terrence Keeley, a former executive at BlackRock and the author of ‘Sustainable: Moving Beyond ESG to Impact Investing’, raises a critical point about the effectiveness of ESG investments. He argues that only a minimal portion of these investments truly achieve double-bottom-line outcomes. Keeley goes a step further, highlighting that about US $40 trillion in investments, originally intended to yield these dual benefits, fail to do so. He categorizes this amount as “the greatest misallocation of financial assets in history.”

This is where the concept of additionality sets impact investing apart from ESG by emphasizing the direct, tangible impacts of investments. It ensures that impact investing goes beyond passive screening or risk mitigation, actively contributing to positive change. As Barbara Scheck, a professor at NYU Abu Dhabi, puts it, “Impact investors need to boldly fund ventures that tread where others haven’t, ensuring a real additionality in investments.”

On the other side of the spectrum of private capital, there is philanthropy. Philanthropy remains a vital and active component within the impact investment ecosystem, continuing to fulfill essential roles, particularly in areas where returns on investment may not be immediately evident or measurable. Unlike the startup and venture capital sector, which has developed a multi-layered funding structure ranging from angel investors and incubators to various stages of venture capital firms, Scheck explains that philanthropy hasn’t seen a similar evolution.

Watch Video: What’s the Difference?: ESG, Impact, and Traditional Investing

This gap has led to situations where many promising initiatives, initially supported by philanthropic funds, struggle or cease operations due to the lack of sustainable, follow-on funding mechanisms. Therefore, while philanthropy is far from obsolete, there is a clear and pressing need for innovation and restructuring in this space to ensure continuity and greater impact of philanthropic endeavors.

Infobyte: The Spectrum of Private Capital

Infobyte: The Spectrum of Private Capital

To read more about impact investing and the state of impact investing in the world today, download and read the Special Report here.

%2Fuploads%2Fimpact-investing%2Fcover19.jpg&w=3840&q=75)