January 2024 - Top 5 Funded Startups in MENAPT

07 February 2024•

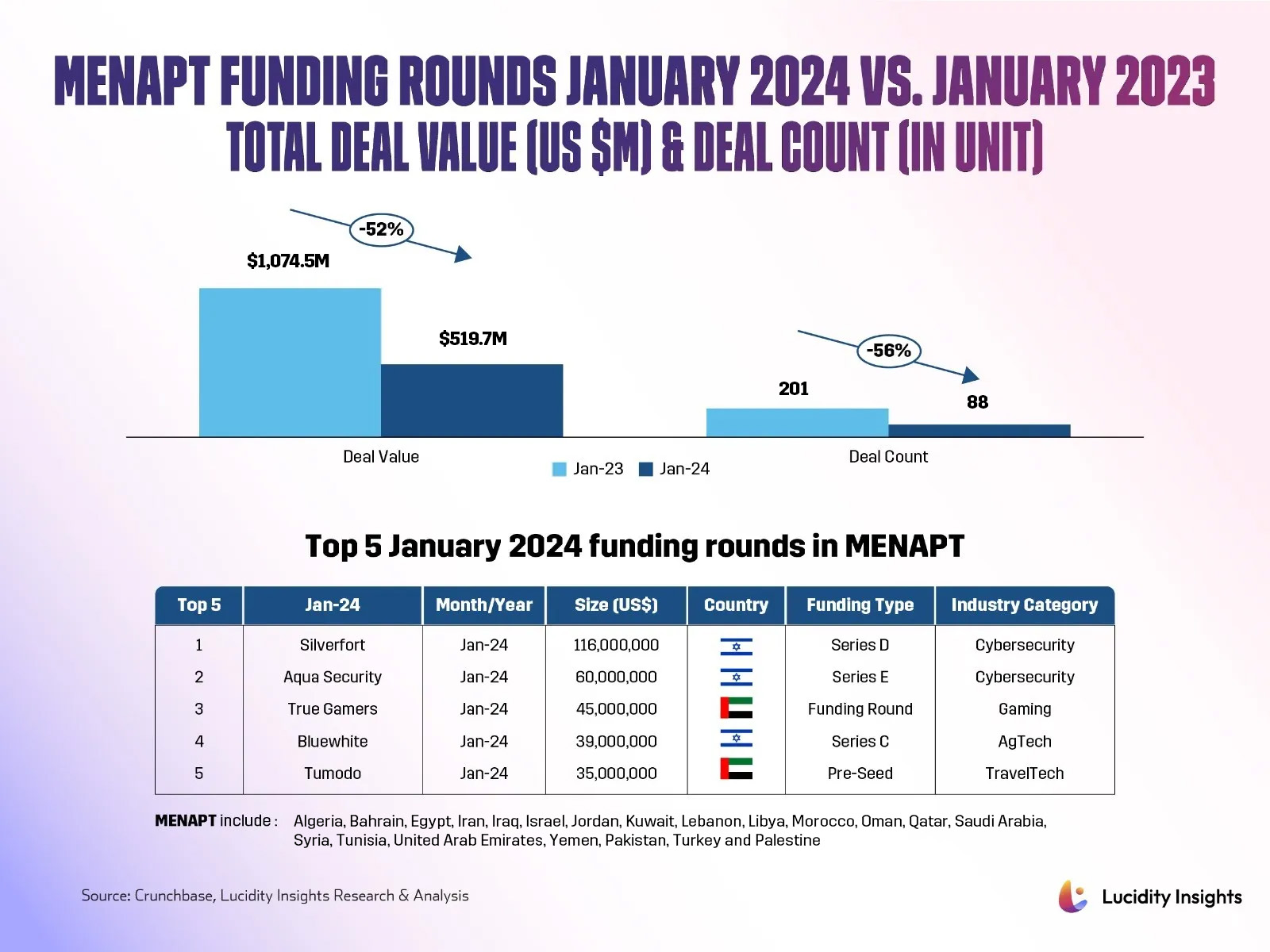

MENAPT venture funding in January 2024 presents a stark contrast to the same period in the previous year, with a significant contraction in both deal value and deal count. In January 2023, the total deal value stood at $1,074.5 million but sharply declined by 52% to $519.7 million within a year. Deal count also experienced a substantial decrease of 56%, plummeting from 201 deals in January 2023 to just 88 in January 2024.

This decline reflects a more conservative investment climate, likely influenced by economic headwinds and market uncertainties as investors are exercising greater due diligence in the region as of late, seeking out opportunities that promise resilience and growth potential in an increasingly cautious market environment. Nonetheless, a few startups managed to stand out raising sizable funding rounds including one mega round above $100 million.

Infobyte: VC Winter Persists: MENAPT's January 2024 Start-up Funding Plummets Over 50% Compared to Last Year

#1 - Silverfort | Cybersecurity

Tel Aviv, Israel | US $116 Million Series D

The two biggest funding deals headlining this year came into cybersecurity, despite funding for cybersecurity vendors having declined to $8.7 billion in 2023, a 40% decrease from 2022. Leading the pack is Silverfort with $116 million in its Series D mega round. Founded in 2016 in Tel Aviv, Israel, Silverfort is a cybersecurity player that has made a name for itself for revolutionizing the field of authentication. Through its network-based approach, Silverfort enables multi-factor authentication (MFA) across entire enterprise environments with a holistic approach which ensures that every access point, from legacy systems to modern cloud applications, is secured under a single, unified platform. By eliminating the need for direct integration with individual systems, Silverfort’s agentless and proxyless architecture simplifies the deployment process and extends MFA capabilities to assets that were previously difficult to secure, thus offering a more comprehensive and adaptive security solution.

Having just experienced 100% revenue increase year to year, Silverfort has earmarked the funding from its recent mega-round for internal growth, market presence expansion, and platform development. “Identity has become the weakest link in enterprise security, and solving it requires a new approach — a unified, end-to-end layer of security that covers all the silos and blind spots of the identity infrastructure,” co-founder and CEO Hed Kovetz commented on current attempts to provide identity protection through a single layer operating over all the distributed environments of the enterprise, extending identity protection to all resources.

#2 - Aqua Security | Cybersecurity

Ramat Gan, Israel | US $60 Million Series E

Coming in second is cybersecurity player Aqua Security with its $60 million Series E funding round. In addition to reaching unicorn status this year, the startup saw a 65% increase in new business last year, and was named to the Fortune Cyber 60 list of the most important venture-backed startups as well as GigaOm’s Radar for Container Security, an Overall Leader in the 2023 KuppingerCole Software Supply Chain Security (SSCS) Leadership Compass and a Representative Vendor in the Gartner® Market Guide for Cloud-Native. Aqua Security has specialized in securing cloud-native applications, focusing on containers, serverless computing, and Kubernetes environments since 2015. It provides full spectrum security from development to production, ensuring that applications are protected at every stage of their lifecycle.

"Investors continue to recognize Aqua's enormous potential and the surging demand for our solution,” said Dror Davidoff, co-founder and CEO of Aqua Security. “Eight years ago, we envisioned a world where all new applications would be built native to the cloud. Today, we are here in a market we pioneered with a purpose-built solution to protect customers' digital transformations. We are excited for what’s ahead in 2024.”

#3 - True Gamers | Gaming

Dubai, UAE | US $45 Million Funding round

Not far behind in the realm of entertainment, True Gamers made the spotlight with a $45 million investment earmarked for establishing a formidable presence in Saudi Arabia. Founded in the UAE only 5 years ago, True Gamers now has plans to open 150 centers across the KSA, melding entertainment, technology, and competitive spirit to capitalize on the burgeoning gaming and e-sports market in MENA. "Recognizing the tremendous potential of this market, we have embarked on a strategic expansion into the Kingdom, aligning with the ambitious Vision 2030 development plan," says True Gamers co-founder Vlad Belyanin, divulging their strategic blueprint for Saudi Arabia, which is anticipated to double the company's existing network.

#4 - Bluewhite | AgTech

Tel Aviv, Israel | US $39 Million Series C

Hot on its heels is Bluewhite, an AgTech startup building resilient farms in Israel that raised $39 million in its recent Series C round. The biggest of 4 funding rounds since 2017, this funding is going towards R&D investments, specifically to bring more data features into Compass, Bluewhite’s service stack, and continue enhancing Pathfinder, its autonomous hardware technology programmed across all field types and vehicles.

#5 - Tumodo | TravelTech

Abu Dhabi, UAE | US $35 Million Pre-seed round

Last but not least, is Tumodo, the UAE-based TravelTech startup that took flight with a remarkable $35 million pre-seed round after just a year up and running. With ambitions stretching far beyond its current scope, Tumodo aims to reach 25 countries by 2026, aligning with the surging global business travel market, which is projected to ascend from $933 billion in 2022 to pre-pandemic level of $1.4 trillion by 2024. The MENA region, in particular, exhibits rapid recovery dynamics, with its business travel market rebounding to 86% of its 2019 volume in 2022.

"Tumodo is the future of business travel," said Stan Klyuy, Chief Commercial Officer of Tumodo, emphasizing the platform's role in revolutionizing the MENA business travel landscape. "It is important for us to contribute to the MENA business travel market and make its recovery not only one of the fastest in the world but also to make this market the most technologically advanced. We help companies set up business processes and optimize the management of travel expenses, enhancing employee productivity and ensuring compliance with travel policies. This allows us to reduce the costs of business travel of our clients by 35% on average."

January 2024: The Take-Aways

This VC winter is a complex tale of cautious investment strategies amidst economic uncertainty, yet it is punctuated by sectors that continue to attract capital, signaling underlying strength and potential for growth. With cybersecurity taking both first and second place this January, the importance of digital security in a world where cyber threats are becoming more frequent and sophisticated is ever growing. Nonetheless, investments in AgTech and TravelTech reflect a strategic foresight into sectors expected to thrive post-recession, vital for sustainable development, and quick to recover in regions like MENA where we expect keen investor interest in sustainable and resilient market segments.

This shift indicates a broader global trend of investing in innovation-driven and essential sectors, highlighting an adaptation to the evolving economic landscape and regional market dynamics and shaping a future investment path that prioritizes sustainability, technological advancement, and market resilience.

%2Fuploads%2Fdubai-digitized-economy-2%2Fcover.jpg&w=3840&q=75)