The Challenges & Barriers Facing Impact Investing Today

19 December 2023•

In the aftermath of the pandemic, our world faces a myriad of challenges, ranging from geopolitical tensions to looming recessions.

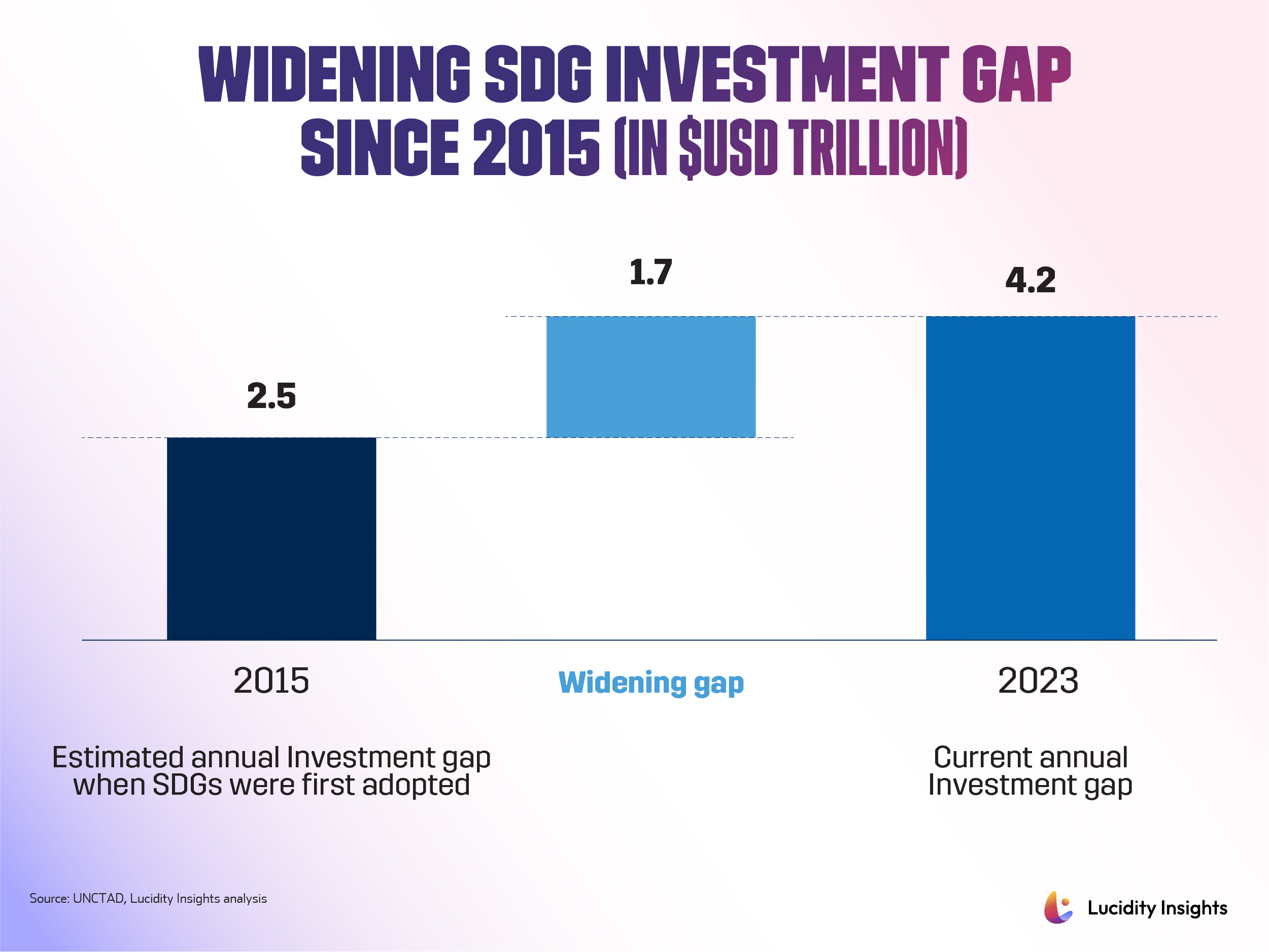

The critical mission to tackle climate change unfolds against a backdrop where emerging markets grapple with the complexities of energy shifts, food security issues, and rising debts. The COVID-19 pandemic has exacerbated the financial challenges in meeting the UN Sustainable Development Goals (SDGs), increasing the annual funding gap from US $2.5 trillion to an estimated US $4.2 trillion, according to the UNCTAD’s 2023 world investment report.

The world is playing with a limited number of resources trying to address an unlimited number of problems. It is therefore crucial for everyone to get involved in impact investing, from governments to private markets, making sure that every dollar that is invested is making a positive impact, which is where too many ESG funds have gone awry.

“The reality is that there is an unlimited number of problems facing the world, with limited resources. We need real business models that can address some of these problems, and that’s why everyone needs to get involved.”

— Barbara Scheck, Visiting Professor of Business, Organizations and Society at NYU Abu Dhabi

Unlocking Potential: Tackling the Five Major Barriers to Impact Investing

1. Bridging the Funding Gap

Infobyte: Widening SDG Investment Gap since 2015

Infobyte: Widening SDG Investment Gap since 2015

In the shadow of the COVID-19 pandemic, a daunting challenge has come sharply into focus: the expanding financial gap in achieving the United Nations SDGs. The UNCTAD’s 2023 world investment report highlights a worrying surge in this gap, from US $2.5 trillion to an estimated US $4.2 trillion annually. This escalation calls for urgent, innovative strategies in impact investing to mobilize additional resources. With less than a decade left to meet the SDGs, there is a pressing need to address global issues such as climate change, healthcare access, and education quality. The goal is clear: to foster a greener, healthier world for all.

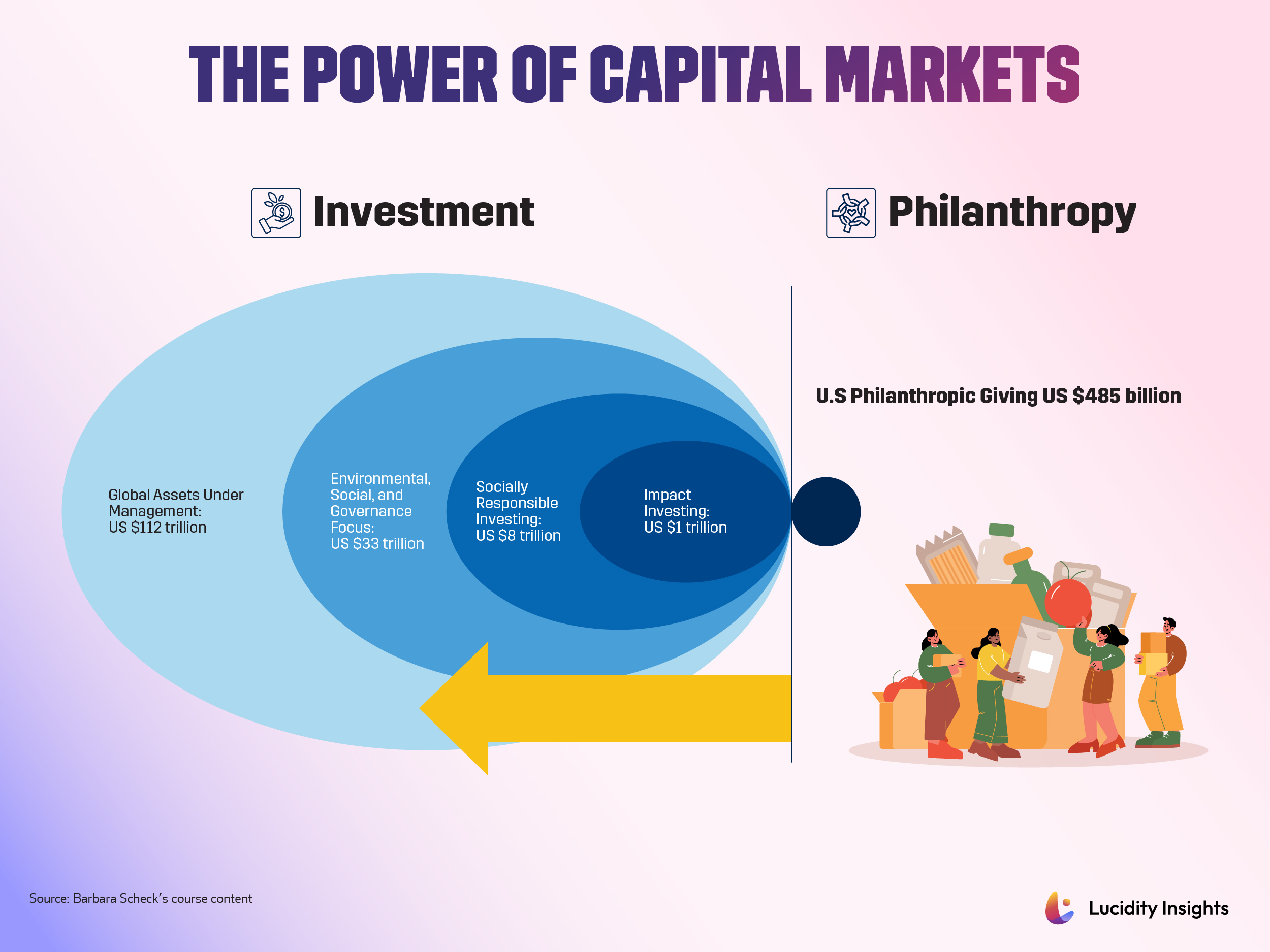

However, traditional funding methods like grants and donations are falling short. Although philanthropy and the public sector are vital, they alone cannot bridge this substantial financing gap. This situation underlines the necessity of tapping into private capital, which, while representing a massive funding gap, constitutes a fraction of total private wealth. The path forward demands a concerted effort to link impact investors with social impact opportunities, maximizing every dollar spent for the greatest impact.

Infobyte: The Power of Capital Markets

Infobyte: The Power of Capital Markets

Related: 5 Graphs About Impact Investing You Need to See

2. Scaling Impact Investing: Bridging the Gap Between Institutional Capital and Investment Opportunities

The challenge of scaling in impact investing, particularly in attracting institutional capital from sources like pension funds, insurance companies, and sovereign wealth funds (SWFs), presents a multifaceted dilemma. On one hand, there is a growing recognition among these large-scale investors about the importance of impact investing, not only for its potential financial returns but also for its alignment with broader ESG goals. However, funneling this capital into impact investments is not straightforward.

Related: The Case for Impact Capital Mobilization by Sovereign Wealth Funds

One of the primary hurdles is the relative scarcity of large, scalable investment opportunities that can absorb significant amounts of capital while also delivering measurable impact. Many impact investments are in niche markets or are structured as smaller projects, which may not be suitable for large institutional investors who typically seek sizable, stable, and long-term investment opportunities. For instance, while there are opportunities in renewable energy or affordable housing, they may not always be on the scale necessary to attract substantial institutional investment.

Moreover, the impact investing sector often grapples with a lack of standardized metrics for measuring and reporting impact, which can be a deterrent for institutional investors accustomed to clear, quantifiable returns. This lack of standardization can make it challenging to assess and compare impact across different investments, adding a layer of complexity to investment decisions.

To address these challenges, the impact investing industry needs to not only create more opportunities that can absorb large amounts of capital but also work towards standardizing impact measurement and reporting. This would provide the clarity and assurance that institutional investors require, thereby facilitating the flow of substantial funds into impact investments and contributing meaningfully to the achievement of global sustainable development goals.

Related: Clarity AI: Pioneering Precision in Global ESG Impact Assessment

3. The Evolving Landscape of Impact Measurement

In the world of impact investing, the quest to harmonize impact measurement frameworks is underway, yet it is marked by a sense of urgency as highlighted by Barbara Scheck. Scheck’s view stresses the importance of not delaying impact assessments in anticipation of perfect systems, but rather to start assessing impact, or the lack thereof, immediately. This proactive approach is essential in a domain where timely evaluations can significantly influence outcomes.

Investors find themselves navigating a complex landscape where comparing impact results with peers is a significant challenge due to the diverse and fragmented frameworks in use. This difficulty is compounded by the evolving and often unclear regulatory landscape, particularly in Europe, which adds to the complexities of accurate and consistent impact assessment.

However, as Scheck emphasizes, the need of the hour is not just to refine measurement frameworks, but to apply them immediately and across entire portfolios. This approach shifts the focus from individual investments to a comprehensive view of portfolio-wide impact, enabling a more accurate assessment of how investments collectively address global challenges.

The evolving scenario thus presents significant opportunities for leadership. Investors are in a position to pioneer the adoption of immediate and aggregated impact assessments. By doing so, they can contribute to building more comprehensive performance data and influence the development of a more consistent regulatory framework.

Related: The History & Evolution of Impact Investing

4. Venturing into the Uncharted: The Role of Additionality in Nurturing Novel Impact Investments

Additionality in impact investing represents a critical shift in the focus of investments toward ventures and sectors that are often overlooked or underfunded. This approach is about going beyond the mainstream, channeling funds into startups and initiatives that other investors may shy away from due to perceived risks or unproven markets. It involves stepping into areas where capital can make a significant difference by being the first or only investor, thus creating a net impact that wouldn’t have existed without such intervention.

The concept of additionality is particularly relevant in the context of attracting philanthropic endowments. These funds, traditionally used for direct charitable activities, are increasingly being recognized for their potential in impact investing. Philanthropic endowments can play a unique role in the impact investing value chain by providing seed capital to high-risk, high-impact projects that conventional investors might find unattractive. Their involvement can validate and de-risk such ventures, paving the way for more traditional forms of capital to follow.

Different forms of capital, from philanthropic funds to private equity, serve different roles in the impact investing ecosystem. While private investors may focus on scalable and financially sustainable models, philanthropic endowments can target their investments toward innovation, experimentation, and ventures that address critical but less popular causes. This synergy of different capital types is essential to create a comprehensive impact investing landscape, where various social and environmental challenges can be addressed effectively and sustainably.

In conclusion, additionality in impact investing is not just about funding; it’s about strategically placing capital where it can trigger change that would not otherwise occur. It challenges the status quo by supporting unconventional ideas and sectors, thus broadening the scope and depth of impact investing.

Related: What is Impact Investing?

5. Catalytic Capital: Enhancing Infrastructure in Emerging Markets

Catalytic capital, which embraces higher risks or lower returns for significant social and environmental impact, is bridging the crucial gap between needed investments and available funding across projects.

The involvement of development finance institutions (DFIs) and large financial corporations has traditionally dominated this space. However, the inclusion of philanthropic organizations and impact investors has introduced more flexibility and patience into these investments. Despite this progress, the fragmented nature of initiatives and their pilot-scale scope continue to pose challenges.

To maximize impact, a coordinated approach is essential, integrating innovative strategies like loan participation, guarantees, and securitization. Loan participations, for example, have seen a surge in interest, with funds like the ILX Fund aggregating DFI loan participations into Sustainable Development Goal (SDG) and climate funds. Guarantees have been instrumental in attracting institutional investors to emerging market infrastructure, such as the Green Guarantee Company which provided investment-grade guarantees for green bonds and loans. Catalytic capital can play a critical role in de-risking these portfolios, encouraging the development of first-time funds.

The transformative impact of catalytic capital extends beyond financial investment. It involves nurturing local market participants, such as developers and infrastructure operators, and building strong domestic and regional ecosystems for infrastructure development.

To effectively deploy catalytic capital, a shift from isolated projects to systematic, large-scale approaches is needed. This shift requires mobilizing institutional investments on a significant scale, in line with the urgency and magnitude of global decarbonization goals.

Next Read: The Case for Impact Capital Mobilization by Sovereign Wealth Funds

To read more about impact investing and the state of impact investing in the world today, download and read the Special Report here.

%2Fuploads%2Fimpact-investing%2Fcover19.jpg&w=3840&q=75)