Saudi Arabia GDP 2024: Navigating Economic Challenges and Embracing Vision 2030 for a Resilient Future

25 March 2024•

2023 was truly a period of economic recalibration around the globe, influenced by rising inflation in developed economies and a series of monetary tightening measures by central banks. This adjustment came amidst geopolitical tensions, particularly in Ukraine and the Middle East, which disrupted global agricultural supply chains and incited a shipping crisis in the Red Sea.

Saudi Arabia's economy felt the brunt of these global shifts, navigating through the challenges with strategic adjustments and resilience. Looking ahead, the Saudi Arabia GDP 2024 outlook for Saudi Arabia is cautiously optimistic, as the Kingdom aims to rebound from these disruptions, focusing on economic diversification and leveraging strategic investments to align with its Vision 2030 goals.

Economic Contraction and Oil Sector Dynamics

The International Monetary Fund (IMF) in their January 2024 World Economic Outlook Update estimated a contraction of –1.1% in the Kingdom for 2023 down from 0.8% just 3 months ago. A stark contrast to the 8.7% growth seen in 2022; in fact, Saudi Arabia was the fastest-growing economy out of the G20 in 2022.

This contraction can be attributed primarily to the oil sector, where real oil GDP fell by around 7%, likely a direct result of the large cuts in crude oil production in May and July 2023, underscoring the volatility and challenges within the global oil market.

Infobyte: Saudi Arabia Real GDP Annual Growth Rate

The Kingdom's Steadfast Commitment to Its Vision 2030 Objectives

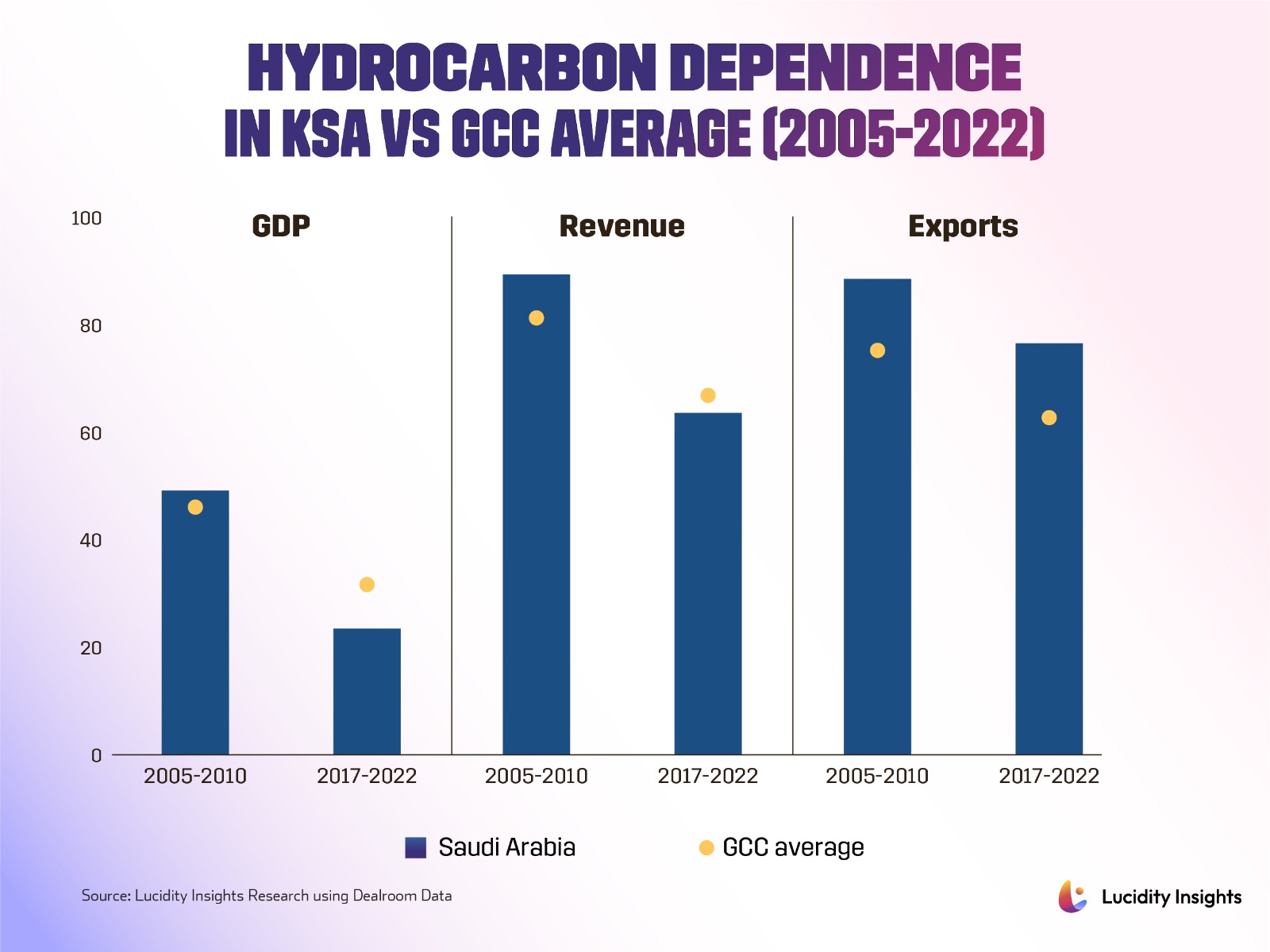

The Kingdom is working diligently to decrease the economy's reliance on hydrocarbons, which has dropped by 17 percentage points to an average of 22% of GDP between 2017 and 2022.

Infobyte: Hydrocarbon Dependance in KSA vs GCC Average (2005-2022)

Infobyte: Hydrocarbon Dependance in KSA vs GCC Average (2005-2022)

Manufacturing, tourism, and hospitality have been key sectors driving this shift. The Public Investment Fund (PIF) in accordance with the National Investment Strategy (NIS) have also been diversifying investments across various sectors, including tourism, logistics, transport, mining, and clean technology actively participating in this shift.

As exemplified in 2023, the Saudi Arabia GDP 2024 non-oil economy exhibited a robust growth of about 4%, propelled by private consumption. Households continued to explore new spending avenues, especially in the burgeoning sectors of entertainment and tourism. This surge in non-oil activity was instrumental in creating jobs, leading to a noteworthy drop in the Saudi unemployment rate to 8.6% in Q3 from 9.9% a year earlier. The labor market reforms played a significant role in this achievement, showcasing the government's commitment to diversifying its economy and reducing dependency on oil revenues.

2023 also saw the introduction of the Civil Transactions Law in June, which filled a crucial gap in the regulation of legal contracts and aimed to bolster business certainty within the Kingdom. This reform came on the heels of the new Companies Law implemented in January 2023, reflecting a commitment to align corporate practices with the broader objectives of Vision 2030 and enhance foreign investment attractiveness.

Saudi Arabia GDP 2024: Playing a Key Role in the MENA M&A Landscape

According to a recent EY report, the Middle East and North Africa (MENA) region witnessed a 4% increase in mergers and acquisitions (M&A) activity in 2023, reaching a total value of $86 billion. This uptick was largely driven by the strategic investments of sovereign wealth funds in national development.

The Gulf Cooperation Council (GCC) countries played a crucial role in this surge, orchestrating the bulk of the transactions. With 565 deals amounting to $83.2 billion, the GCC region demonstrated resilience, overcoming challenges such as regional geopolitical tensions and the higher cost of capital, while the rest of the MENA region deals with economic uncertainties. The United Arab Emirates (UAE) and Saudi Arabia accounted for the lion’s share of the GCC’s deals, accounting for 305 M&A transactions (54%), valued at $24.8bn.

According to EY, “Domestic deals dominated the region in terms of volume at 49%, while cross-border M&As contributed to 72% of overall value. With companies seeking to gain strategic advantages on a global scale, cross-border deal value rose by 14% y-o-y.” Sovereign wealth funds (SWFs), including Saudi Arabia’s Public Investment Fund (PIF), remained at the forefront of deal activity in the region, aligning closely with their countries' economic strategies. Significant capital was deployed across key sectors, with technology, chemicals, and energy & resources emerging as focal points of investment.

The most significant transaction in Saudi Arabia—and the second largest in the GCC, trailing only behind the UAE's Apollo Global Management and ADIA’s acquisition of Univar Solutions for $8.2 billion—was the purchase of US mobile games developer Scopely. This acquisition, carried out by Savvy Games Group, a subsidiary of Saudi Arabia’s PIF, was valued at $4.9 billion in July 2023.

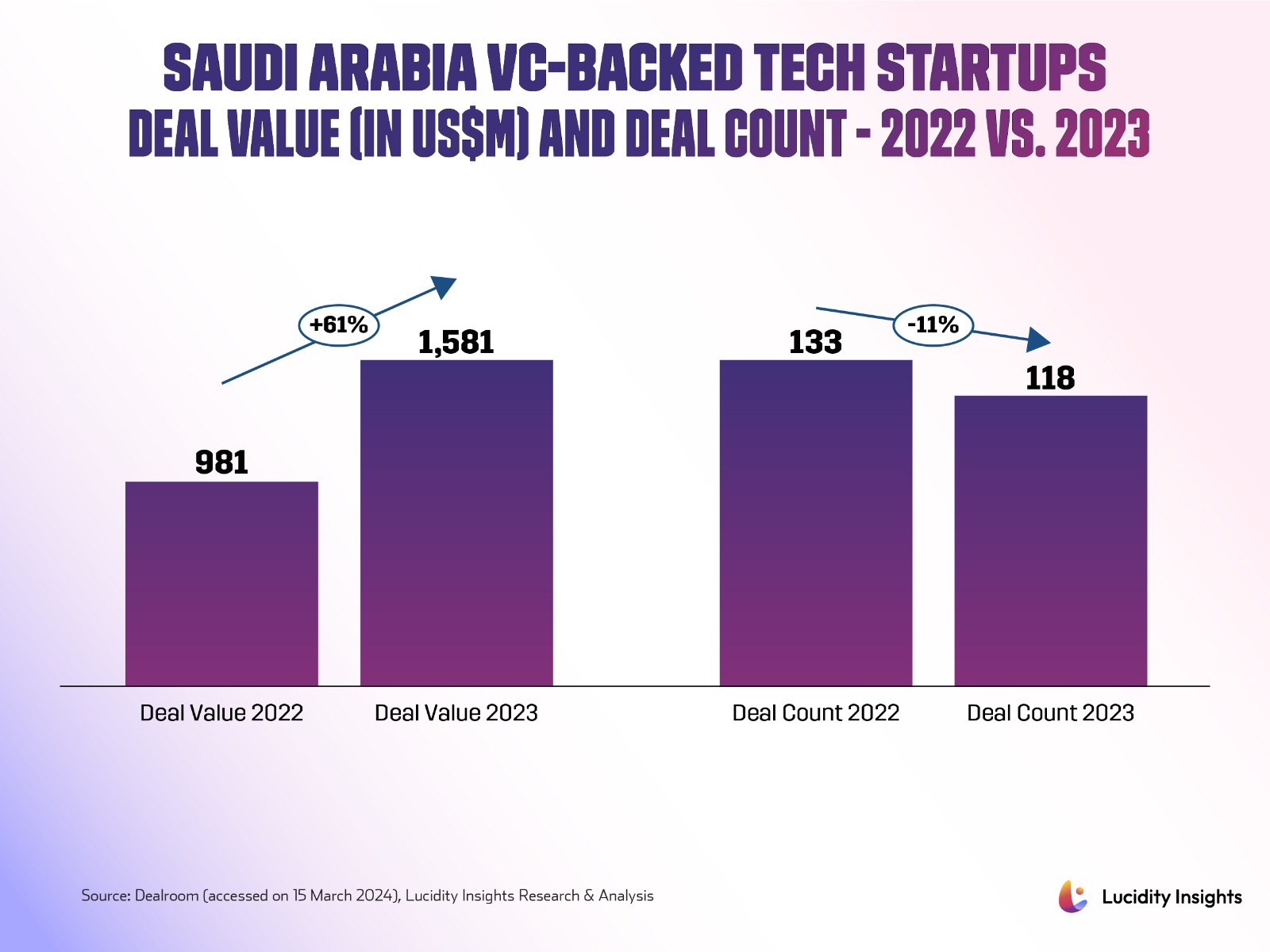

Saudi Arabia: A Flourishing VC Ecosystem Amid GCC's Investment Winter

In 2023, Saudi Arabia's venture capital (VC) scene emerged not just resilient but thriving. The Kingdom witnessed an unprecedented boom in its tech startup ecosystem, with 118 startups successfully securing funding. This amounted to a staggering US $1.58 billion in investments, representing a 61% surge compared to 2022. This growth is particularly noteworthy against the broader GCC region facing a severe VC winter, with total funding decreasing by 35% between 2022 and 2023. This stark contrast underscores Saudi Arabia's unique position and potential as a burgeoning hub for tech innovation and entrepreneurship.

Infobyte: Saudi Arabia VC-Backed Tech Startups Deal Value & Count - 2022 vs 2023

Infobyte: Saudi Arabia VC-Backed Tech Startups Deal Value & Count - 2022 vs 2023

Furthermore, the Saudi Arabia GDP 2024 is showing signs of a maturing startup ecosystem, marked by an increase in successful exits. The years 2022 and 2023 each recorded two noteworthy M&A — one domestic and one international. Additionally, the successful IPO of Jahez in 2022, raising US $430 million, highlighted the growing confidence in Saudi-based startups from both local and international investors.

Saudi Arabia's Economic Outlook for 2024: A Balanced View

The International Monetary Fund (IMF) has revised Saudi Arabia GDP 2024 growth projection to 2.7% for 2024, down from an earlier forecast of 4%. This adjustment primarily reflects strategic reductions in oil production, including both unilateral cuts and those coordinated through OPEC+. Despite this, the broader economic forecast suggests resilience, with expected rebounds in both monetary conditions and corporate profitability potentially elevating the Tadāwul stock market by an estimated 10%.

2024 is set to witness a surge in consumer spending across various sectors, notably banking, retail, technology, tourism, and consumer services. This growth aligns with the continued expansion of the non-oil private sector and a further reduction in unemployment rates, underscoring the success of Saudi Arabia's diversification efforts and labor market reforms.

The international oil market continues to play a pivotal role in shaping Saudi Arabia's economic landscape. The Kingdom's deliberate adjustments in oil production, aligned with OPEC+ agreements, are designed to stabilize global supply and demand dynamics. These efforts, combined with Saudi Arabia's aggressive push towards economic diversification and attracting foreign direct investment (FDI), underscore a strategic shift towards bolstering non-oil sectors.

Particularly noteworthy is the mergers and acquisitions (M&A) activity within these emerging sectors, which is poised to garner sustained international attention. This reflects the Kingdom's escalating allure to global investors, signaling a broader economic transformation.

On the venture capital (VC) and tech ecosystem front, 2024 is shaping up to be another year of promise. By March 15, 2024, Saudi Arabia has already captivated US $203 million in VC investments, marking a strong outset for the year. This early success not only reaffirms sustained investor confidence in Saudi Arabia's tech startup ecosystem but also suggests a trajectory of continuous growth and vibrancy.

Saudi Arabia faces several challenges in 2024, including pressures from increased oil production by non-OPEC+ countries and geopolitical tensions. The potential shift in U.S. monetary policy might indirectly benefit Saudi's non-oil export competitiveness due to the dollar peg, yet the Kingdom's fiscal policy is anticipated to lean towards more conservative economic support. This strategic shift emphasizes the importance of ongoing reforms and initiatives like the Regional Headquarters Program, aimed at further diversifying the economic base and enhancing global competitiveness.

While immediate growth may slightly diverge from the ambitious targets set by Vision 2030, Saudi Arabia GDP 2024 and its strategic focus on amplifying investments in human capital, infrastructure, and technology sectors, coupled with enhancing labor market participation (especially among women), remains pivotal. These efforts are essential for achieving sustainable economic growth and diversification, ultimately aligning with the Kingdom's long-term objectives.

Read More: What Are the Future Trends in the Saudi Start-up Investment Landscape?

%2Fuploads%2Fsaudi-venture%2Fcover11.jpg&w=3840&q=75)