VC Perspectives on Middle East Fintech: Growth, Innovation & Financial Inclusion

01 April 2025•

The Middle East’s Fintech ecosystem has entered a transformative phase, marked by rapid innovation, increasing maturity, and a clear focus on financial inclusion. Over the past decade, Fintech has evolved from being a disruptive force to an indispensable enabler, addressing gaps left by traditional financial institutions and paving the way for economic growth.

The numbers speak to this evolution: the region is now home to over 1,500 Fintech startups, recorded $4.2 billion in funding in 2023, and boasts 7 IPOs and 30+ M&A exits since 2022. These achievements underscore the resilience and growth potential of a sector that has rapidly become a cornerstone of the region’s digital economy.

Driving Financial Inclusion for Consumers

One of the hallmarks of the Middle East’s Fintech revolution is its focus on democratizing access to financial services. For consumers, Fintech solutions are addressing the need for affordability, flexibility, and speed. BNPL leaders like Tabby and Tamara have redefined consumer payments, while innovative solutions like Keyper’s rent-now-pay-later model and Botim Ultra’s send-now-pay-later platform have emerged to meet the unique needs of the region’s diverse populations, particularly expatriates.

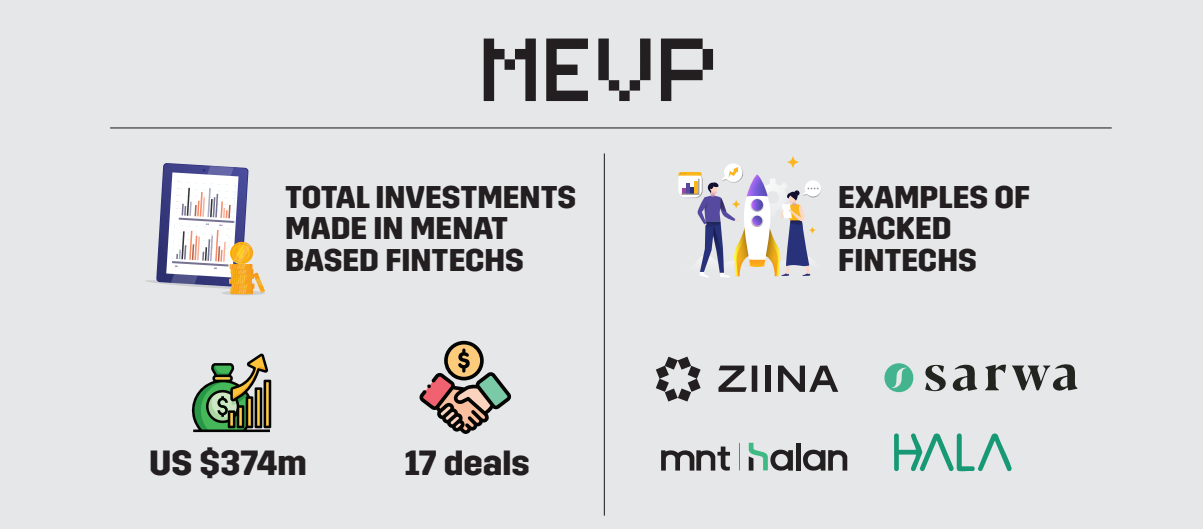

Embedded finance is accelerating this shift, with seamless financial services becoming part of everyday experiences. "Fintech providers today can offer bespoke, dynamic, on-the-fly financial solutions," explains Rabih Khoury, Chief Exit Officer at Middle East Venture Partners (MEVP), pointing to tools like digital debit cards from Xare and earned wage access platforms like Kamelpay, which empower previously unbanked workers to participate in the digital economy.

Middle East Venture Partners (MEVP) Team Members

Middle East Venture Partners (MEVP) Team Members

Empowering SMEs and Solving Operational Inefficiencies

The Fintech ecosystem is also reshaping how SMEs access financing and streamline operations. Traditional challenges such as working capital shortages and cross-border trade barriers persist. "In MENA, banks will not lend cross-border, even if the receivables come from governmentbacked entities," observes Rabih Khoury.

This gap has paved the way for Fintechs like Tenami Capital, which specializes in revenue-based lending, and Liquidity Group, which provides venture debt tailored to the region’s unique needs. Digital-first banks like Ziina and Wio Bank are also redefining SME financing by offering tailored, accessible, and scalable financial products that bypass the inefficiencies of traditional banking systems.

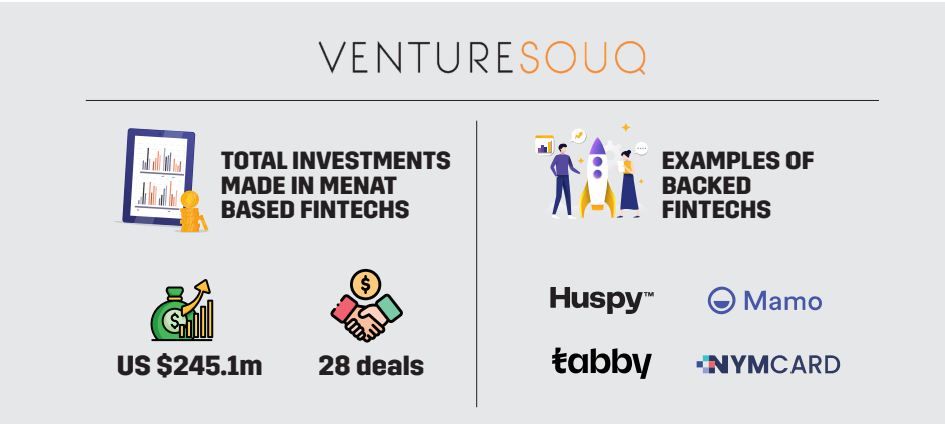

Operationally, Fintechs are addressing outdated and cumbersome backend systems in industries like trade finance, logistics, and manufacturing. "The Middle East is seeing the rise of Fintechs that recreate inefficient workflows and package them as improved ERP/CRM solutions, making connectivity with legacy systems a unique selling point," notes Sergiy Stupak, Senior Investment Manager at VentureSouq.

The integration of Fintech into SaaS platforms is another game-changer. By embedding payment and lending capabilities directly into operational software, Fintech-SaaS convergence is helping businesses accelerate cash cycles, enhance financial visibility, and reduce reliance on legacy systems.

Accelerating Economic Growth with Cash Velocity

One of the most profound impacts of Fintech in the Middle East has been on the velocity of cash—the speed at which money moves through the economy. "An increased velocity of cash has positive multiplier effects, reducing the need for working capital, improving valuations, and making capital more efficient," explains Rabih Khoury. This dynamic is especially evident in sectors like e-commerce and food delivery, where instant payouts to workers and small businesses improve cash flow and create significant competitive advantages. By enabling faster economic cycles, Fintech solutions are not only fueling individual business success but also driving systemic economic benefits.

Technological Innovation: The Next Wave of Growth

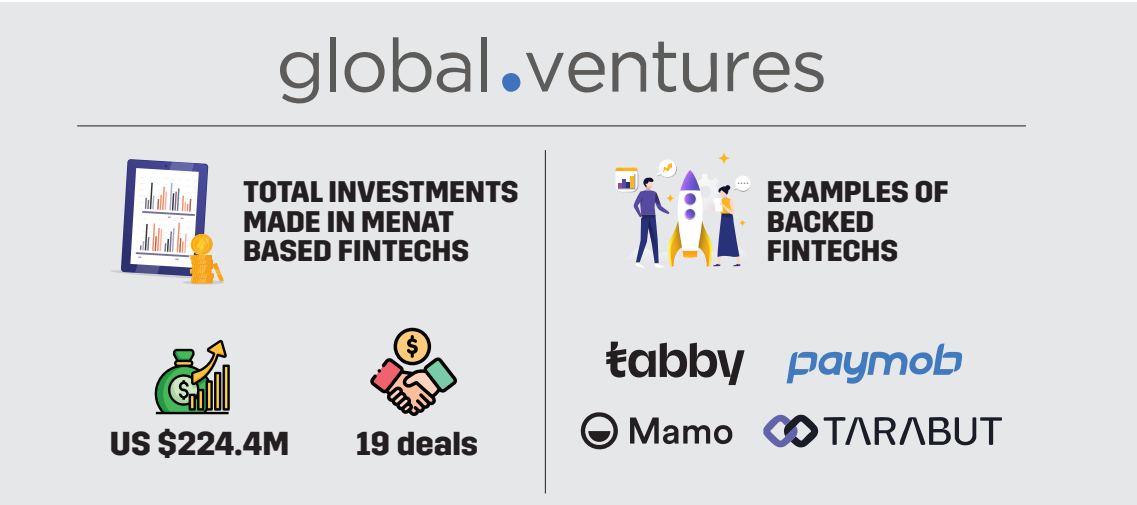

As the Middle East’s Fintech ecosystem matures, the next wave of growth will be driven by cutting-edge technologies. "Advancements in generative AI, APIs, robotic process automation, distributed ledger technologies, and privacy-enhancing computation will underpin the next decade of fintech innovation," says Said Murad, Senior Partner at Global Ventures.

These innovations will provide the foundation for secure, scalable, and synergistic financial ecosystems. AI, in particular, is enabling hyperpersonalized financial products, enhancing compliance workflows, and streamlining operations, while blockchain and privacy-preserving technologies are making systems more transparent and secure.

Regulation and Open Banking: The Road Ahead

Supportive regulation continues to play a pivotal role in shaping the region’s Fintech landscape. Open banking frameworks in Saudi Arabia and the UAE are creating greater financial interoperability, enabling startups to build seamless, innovative solutions. Meanwhile, embedded finance is enabling Fintechs to integrate their services directly into non-financial platforms, driving convenience and broadening access.

The Rise of Second-Generation Founders

The ecosystem is also benefiting from the emergence of second-generation founders, who are leveraging their experience at first-generation Fintechs to build companies that address inefficiencies they witnessed firsthand. These entrepreneurs bring unique insights, technical expertise, and a global mindset, accelerating the sophistication of the Middle East’s Fintech ecosystem and ensuring its competitiveness on the global stage.

VentureSouq Team Members

VentureSouq Team Members

Looking Ahead: 2025 and Beyond

"2025 will be the year of Fintech," predicts Rabih Khoury, as key trends such as AI-driven solutions, open banking, and embedded finance continue to redefine the financial ecosystem in the Middle East. Emerging sectors like trade finance, wealthtech, and insurance are expected to become focal points of innovation, drawing both local and international investment. These advancements will not only address structural gaps but also unlock new economic opportunities for businesses and consumers alike.

"With a dynamic population and supportive regulatory environments, the Middle East promises to become a hub for Fintech innovation, mirroring successes in markets like China, India, and Brazil," adds Said Murad.

The Middle East’s Fintech journey has been one of transformation, ambition, and relentless innovation. By empowering consumers with greater access to financial services, solving long-standing challenges for SMEs, and embracing cutting-edge technologies, the region has laid the foundation for a Fintech ecosystem that is both inclusive and resilient. With its unique combination of entrepreneurial talent, regulatory foresight, and a technology-first approach, the region is poised to remain at the gain further momentum as a of global hub for financial transformation, defining what the future of Fintech looks like for years to come.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)