International Trade’s Role in the World Today

14 January 2023•

No matter where we are around the globe, we always find a way to enjoy our Italian coffee, Darjeeling tea, or Wagyu beef, and we can thank international trade for that. International trade has been a cornerstone of the global economy for centuries as it allows countries to expand their markets and ensure that their goods are made available in regions and countries where otherwise would not be possible. In modern times, international trade has evolved to be an integral part of our everyday lives, connecting countries, businesses, and people in ways that would have been unimaginable a century ago, and with the ever-changing global economy, it can be difficult to keep up with the latest developments.

Lucidity Insights in partnership with Entrepreneur Middle East and DP World has published a deep-dive special report on ‘Innovations in International Trade’ covering the global trade industry, worth over US $22.3 trillion and accounting for more than 1/5th of the global economy today. In this Special Report, we learn about the evolution of International Trade over the past six decades, and a glimpse of where it’s going - in terms of technological innovations, business model shifts along the value chain, and trends – both influenced by the markets and current events, as well as by the titans in the trade industry themselves.

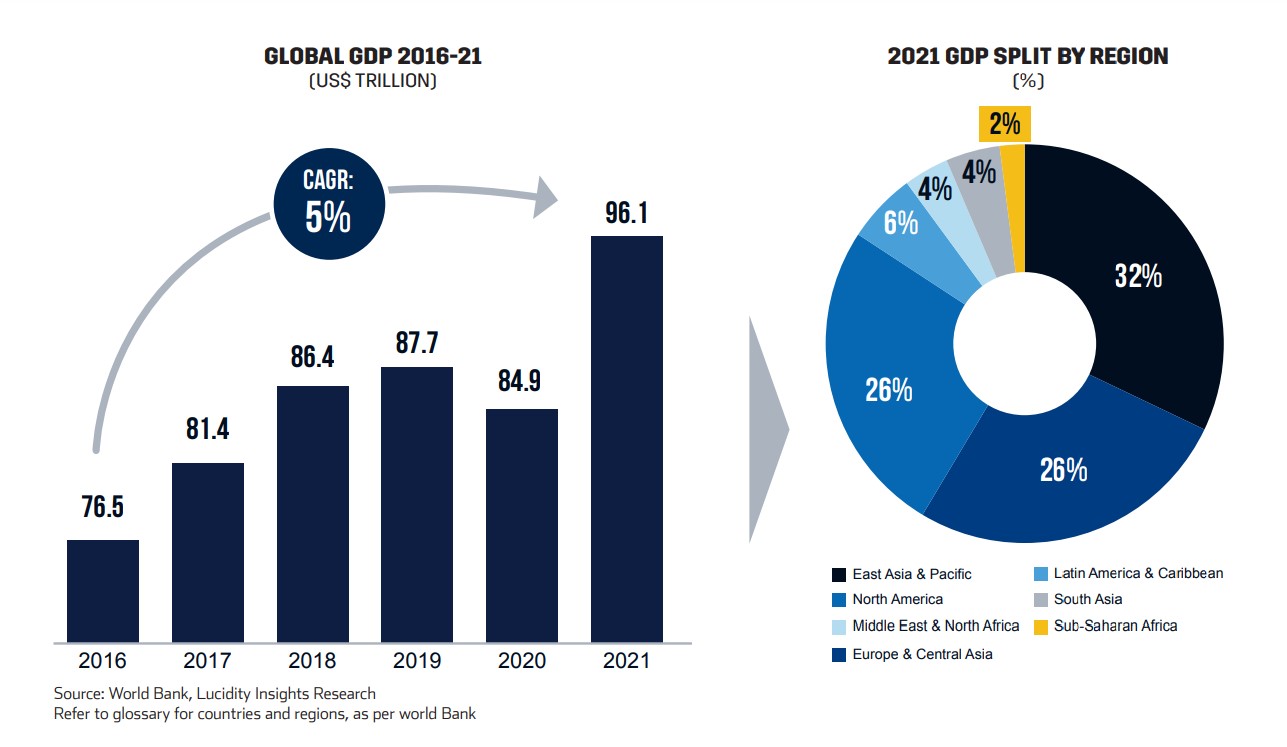

Trade has seen tremendous growth in recent years and now accounts for a quarter of Global GDP. By the way, the global GDP was US$ 96.1 trillion in 2021, a considerable 13% growth from US$ 84.9 trillion in 2020. Global GDP in 2021 was also just a shade under 5% CAGR from 2019, when pre-pandemic global GDP was US$ 87.7 trillion, indicating a relatively swift recovery – though many of us have not quite felt this ease just yet. In 2020, Covid-19 contracted GDP 3% from its 2019 value, and for many of us that lived through multiple lockdowns, the past few years have felt significantly more strained than the Global Financial Crisis in 2009. Interestingly, though the economic shocks felt from Covid-19 over the past two years have persisted, each shock was significantly smaller and a quicker recovery was felt than what the world experienced during the GFC. All that to say, economically speaking, the world has rebounded and recovered quite swiftly from the pandemic, despite their being some industries and economies that are struggling more than others.

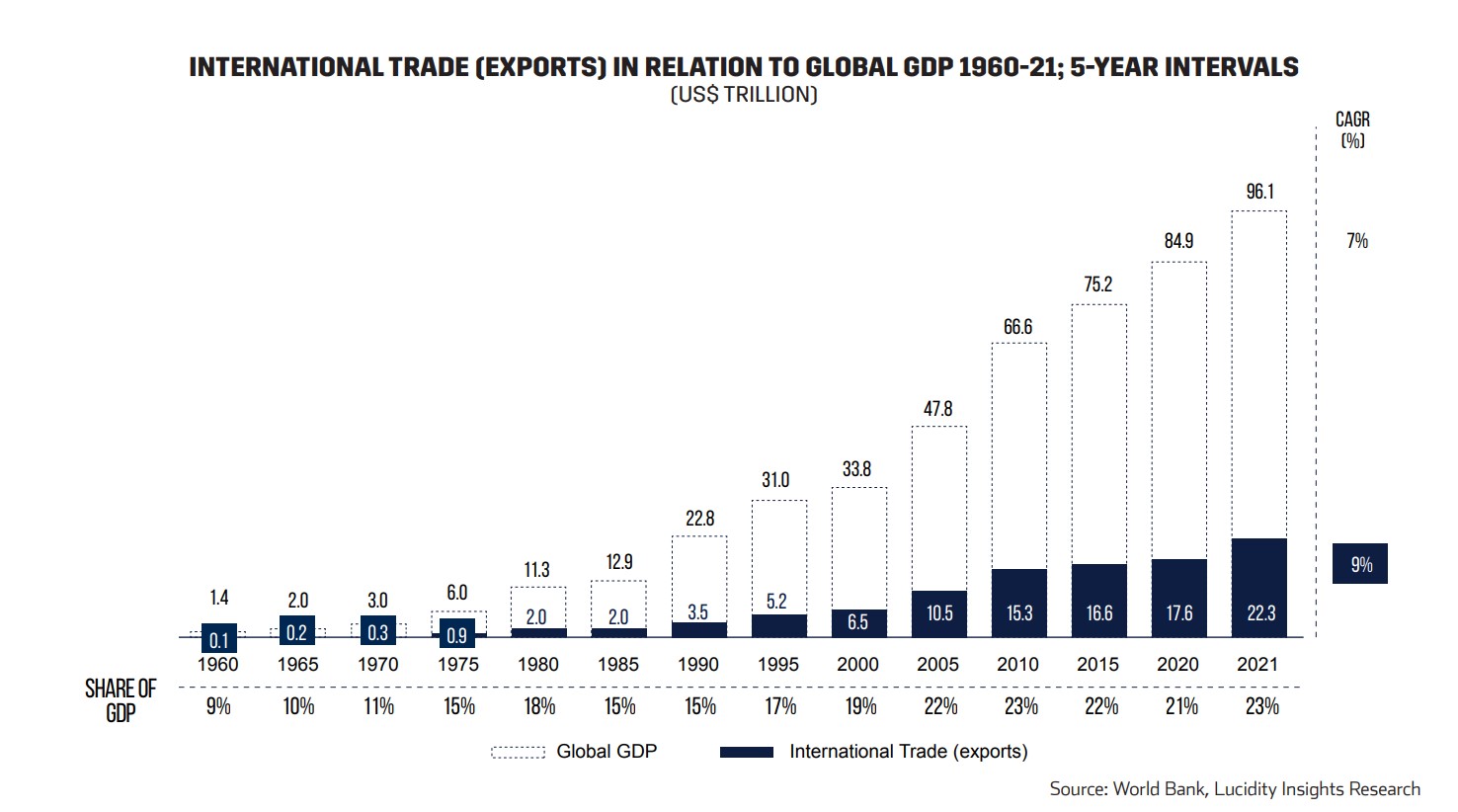

International trade (measured by exports) has grown at a faster rate than Global GDP over the past 60+ years, at 9% and 7% CAGR, respectively. While exports account for 23% of Global GDP, imports account for an additional 24%, totaling 47% if both imports and exports are combined. Most illustrative perhaps is the value of exports starting from $130 billion in 1960 and reaching well over $22 trillion in 2021, growing 170X over the last 61 years of international trade development.

International trade has had a dramatic impact on countries all over the world, but developing countries are definitely the cream of the crop in terms of growth. In 2000, only 1/3rd of the share of global trade was attributed to developing countries, but their share had increased dramatically to 48% by 2015. This increase indicates that countries recognize the role international trade plays in boosting domestic economy. As trade increases, income also increases due to rising demand, resulting in efficiencies and cost optimization. This lowers the resulting acquisition cost which further increases demand, in turn increasing employment potential and income as the economic trade cycle comes full circle.

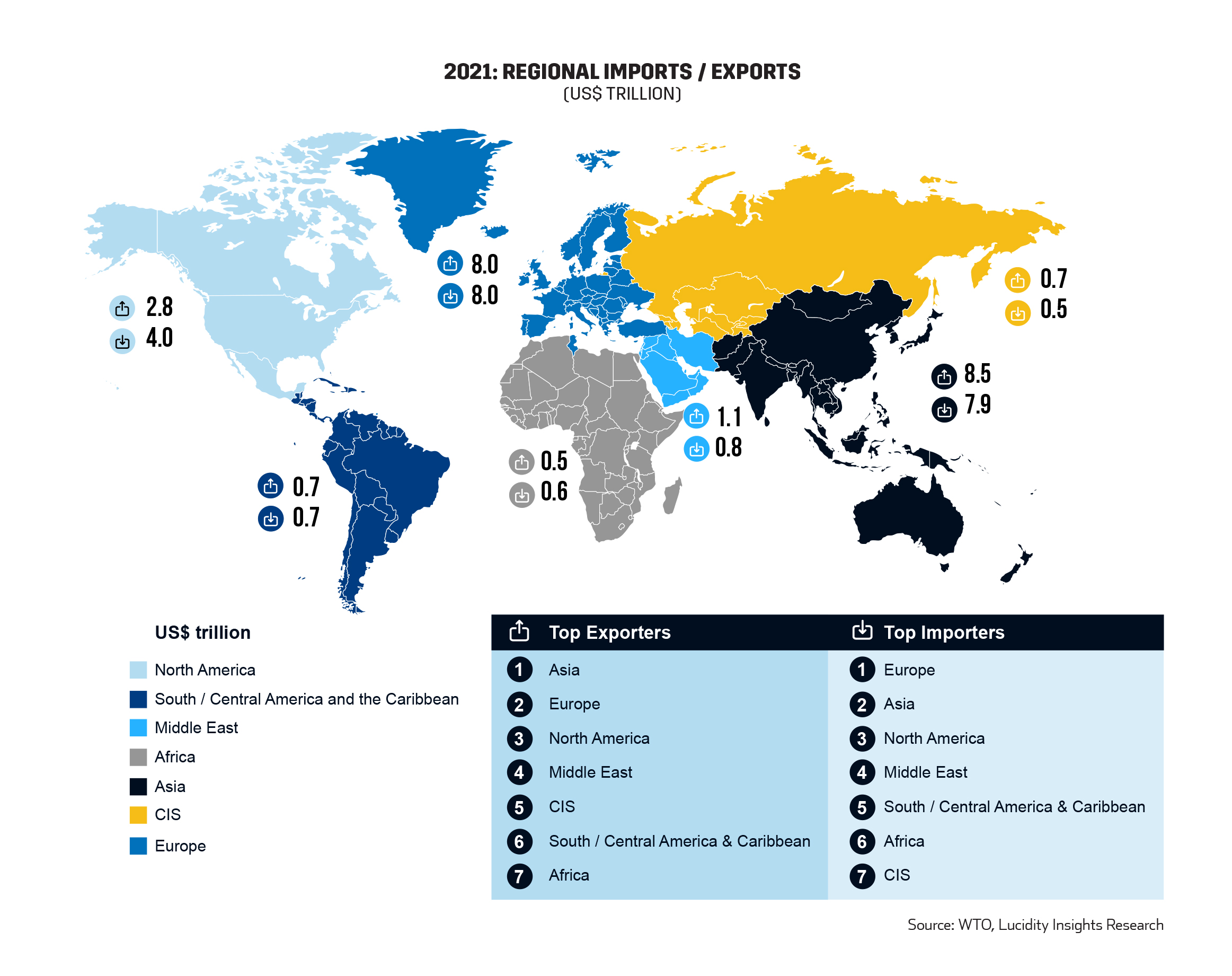

Asia ranks on top of the international trade pyramid primarily due to China’s dominance, ranking 1st in exports and 2nd in imports among all countries globally. As a region, Europe ranks 2nd in terms of exports while ranking 1st for imports. North America and the Middle East region rank 3rd and 4th respectively, for both imports and exports.

This trend is expected to change slightly going forward, as Asia is forecasted to significantly increase its own consumption, which may very well drive Asia to rank on top for both imports and exports in the coming years. As per a McKinsey report, Asia is increasingly becoming the world’s center, both in terms of production and demand, and is expected to constitute a large share of global metrics.

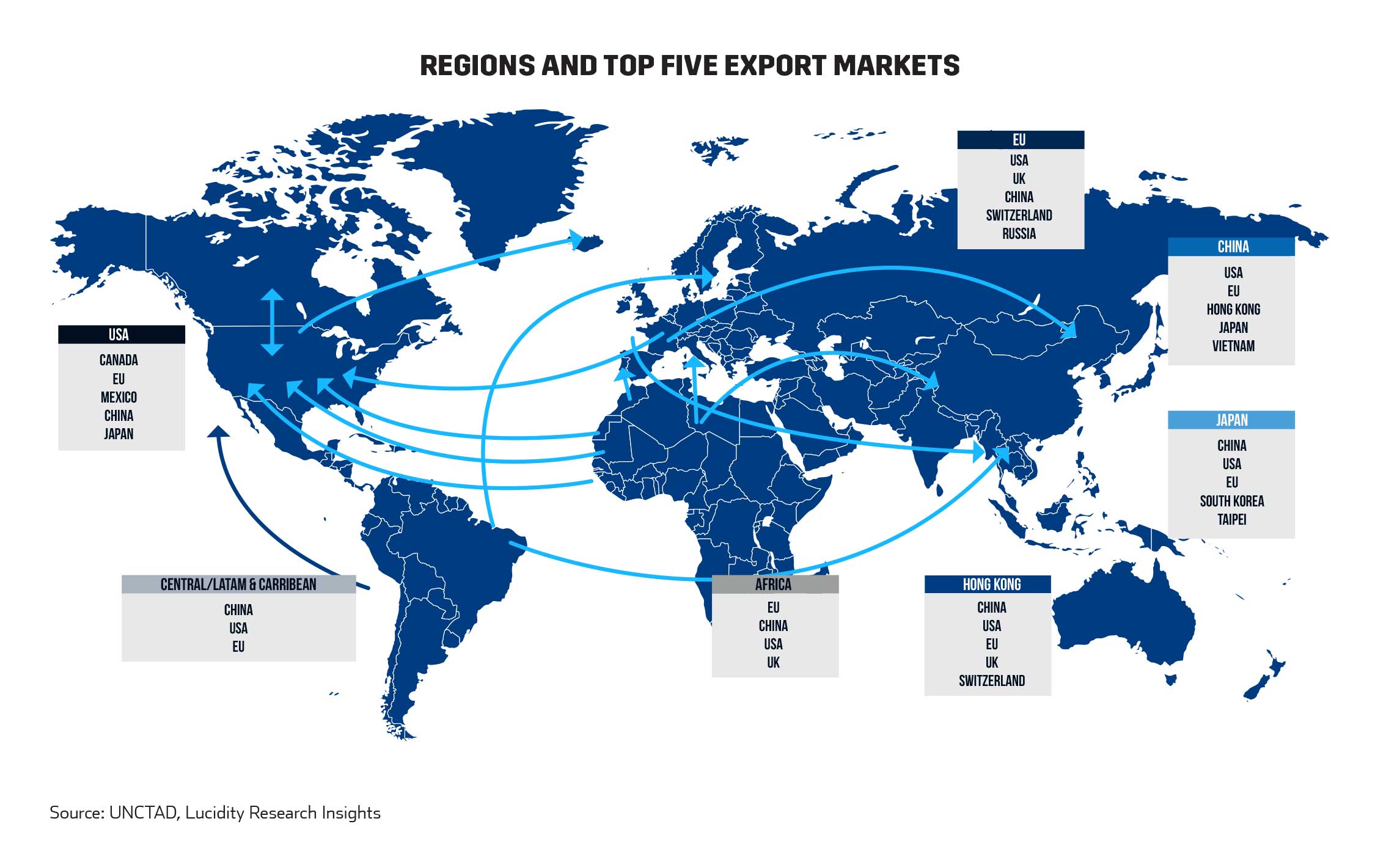

Considering trade flow, the majority of the trade is flowing to or from China, the USA, or the EU. China’s exports were US$ 3.4 trillion in 2021 (15.1% of global trade exports) followed by the USA that exported US$ 1.8 trillion worth of goods (7.9% of global trade exports). In the top 20 export nations, 7 European countries accounted for US$ 4.6 trillion worth of exports (20.6% of global exports). Germany and the Netherlands are top five exporting countries. Rounding out the top five is Japan accounting for US$ 0.8 trillion (3.4%) of exports.

Even the ports handling the largest volumes have shifted globally, with 14 of the top 20 ports being Asian ports. This is a complete reversal from a few decades ago, when in 1973, only 5 of the top 20 ports were present in Asia. The top 20 ports now handle 45% of total global container port traffic, amounting to 379 million containers (TEUs or twenty-foot equivalent), while the top 50 ports handle approximately two- thirds of the global port traffic.

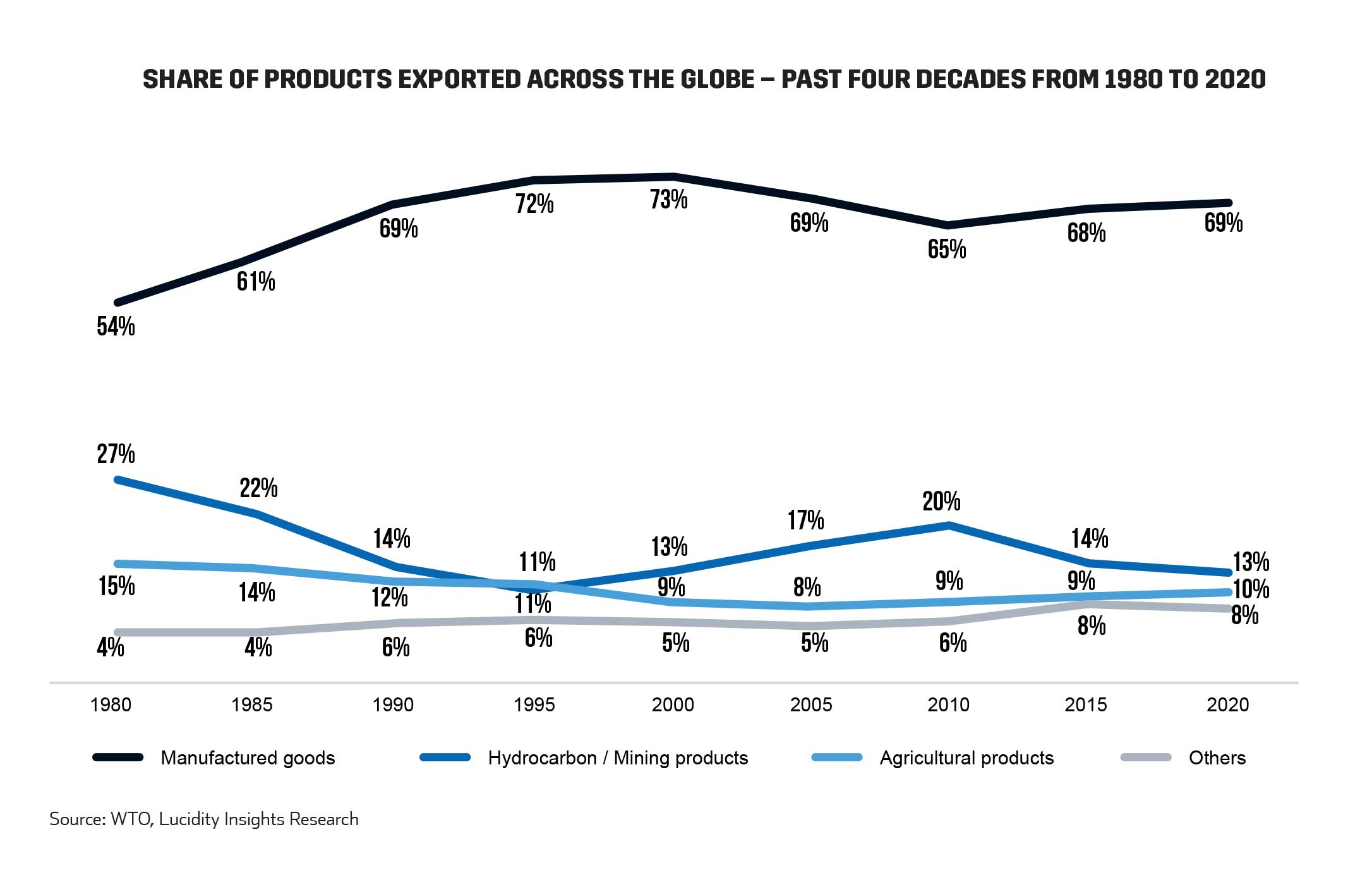

Manufactured goods currently comprise around 70% of all goods exported across the globe, followed closely by hydrocarbon and mining products. In comparison to data from 40 years ago when manufactured goods comprised 54% of all exports while hydrocarbon and mining products comprised 27%, this significant growth is attributed to greater value addition in the manufacturing process globally, coupled with the integration of global value chains for easier and more efficient production in bulk. Global value chains (GVC) refer to international production sharing where production is broken into activities and tasks which are carried out in different countries. It is estimated that firms participating in GVCs account for 70% of all trade while the remaining 30% can be credited to final goods which are meant for consumers.

Trading in goods is seeing innovations in the movement of goods and the handling and storage of goods, with TradeTech and LogisticsTech reaping benefits from incumbents and start-ups for solutions that provide convenience of booking, enhancing visibility, improving connectivity and automation. Additionally, for handling goods, efficiency and minimizing human errors are the focus areas where stakeholders, managing warehouses, and ports play a big role. As such, port operators are investing in start-ups focused on solutions to problems ailing the ports segment of international trade.

Some port operators are also focused on engaging new age technologies, like what Dubai Ports World Group is doing through its partnership with Virgin Hyperloop to setup ‘Cargospeed’. DP World has also been aggressive in its growth and using new technologies to manage each stage of the supply chain. The Group has introduced World Logistics Passport, a first-of-a-kind logistics loyalty program, which already accounts for 47% of world trade, and is set to grow to 75% by 2025.

%2Fuploads%2Finnovations-international-trade%2FInnovation-International-Trade-cover.jpg&w=3840&q=75)