The Case for Impact Capital Mobilization by Sovereign Wealth Funds

20 December 2023•

In the current global landscape, marked by a range of pressing challenges, Sovereign Wealth Funds (SWFs) are gradually emerging as potential catalysts in promoting sustainable development.

While traditionally conservative, emphasizing financial stability and risk aversion, SWFs are beginning to pivot. Their investment in projects adhering to environmental, social, and governance (ESG) criteria, though still relatively modest, is showing signs of growth. This shift, particularly noticeable in sectors such as climate and healthcare, could mean SWFs thanks to their unique position could play a more significant role in addressing sustainability challenges worldwide in the years to come.

Related: What is Impact Investing

Historical Context and Evolving Perspectives

According to a paper written by Bernardo Bortolotti, Giacomo Loss, and Robert W. van Zwieten, SWFs are believed to be in a unique position to strongly participate in addressing UN SDGs for 5 main reasons:

- The size of their assets, able to make meaningful contributions to Sustainable Development Goals (SDGs).

- Their role as universal asset owners with stakes in a wide range of sectors and markets.

- Their influence in driving sustainability across the investment cycle.

- The importance of assessing long-term risks like climate change due to their inter-generational investment horizon.

- Their diverse mandates within the public sector, such as fiscal revenue stabilization and national economic development.

With their distinct role, SWFs can invest for the public good while also securing long-term returns, similar to private firms, ensuring alignment with their financial objectives.

Related: What is Sustainable Development?

However, traditionally, SWFs have been bastions of conservative investment strategies, prioritizing long-term financial stability over rapid growth or risky ventures. This approach often resulted in a cautious stance towards sustainable investing. As recently as 2019, only a small fraction of SWFs were actively engaged in publishing sustainability reports (UNCTAD, 2020) or even integrating ESG principles into their investment strategies (State Street Global Advisors, 2019).

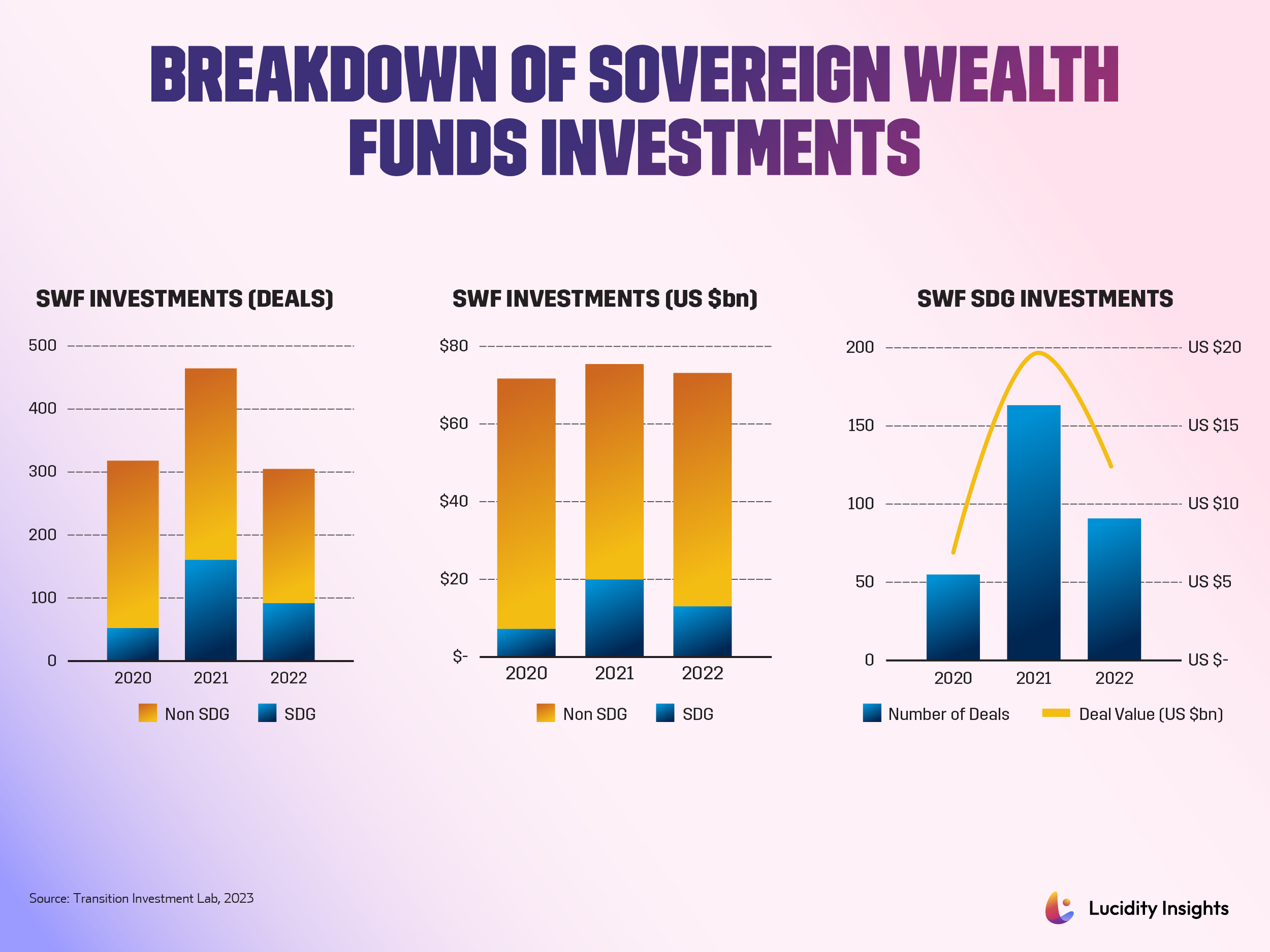

Infobyte: Breakdown of Sovereign Wealth Funds Investments

Infobyte: Breakdown of Sovereign Wealth Funds Investments

However, recent trends suggest a shift, with SWFs increasingly embracing investments aligned with environmental, social, and governance (ESG) criteria. Between 2020 and 2022, a shift in investment patterns emerged, with a growing portion of SWF transactions, 28% (310 out of 1092) of total deals representing 19% of total deal value, being marked as sustainable, totalling around US $39.3 billion (TIL, 2023). While the deal value remains somewhat limited, it is worth noting that the deal count and deal value exploded by nearly three-fold from 2020 according to an analysis done by the Transition Investment Lab in their 2023 annual report.

Related Video: The Role of SWFs in Mobilizing Impact Capital

Healthcare and Renewable Energy: Pioneers in SWFs’ Climate-Conscious Investment

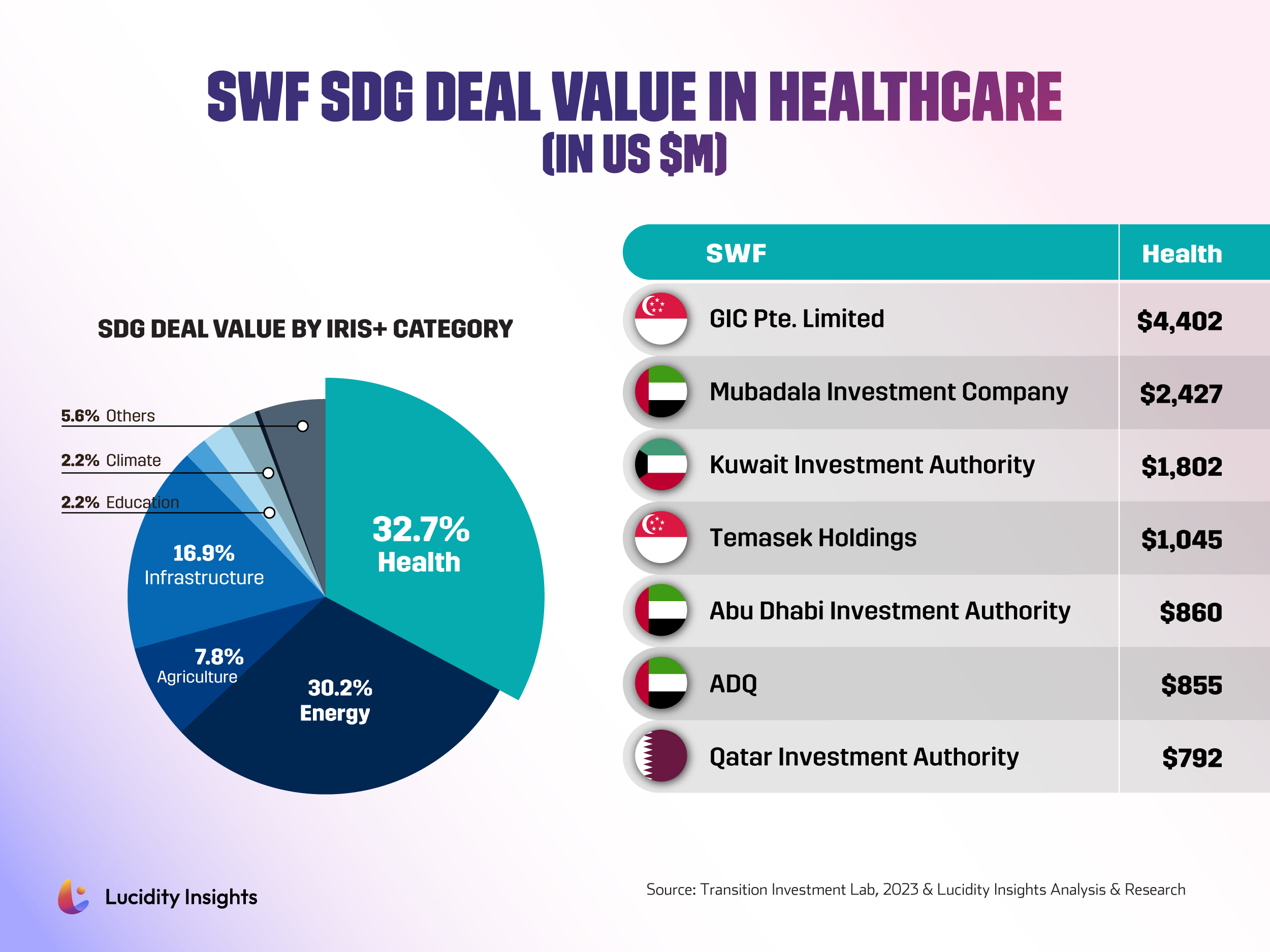

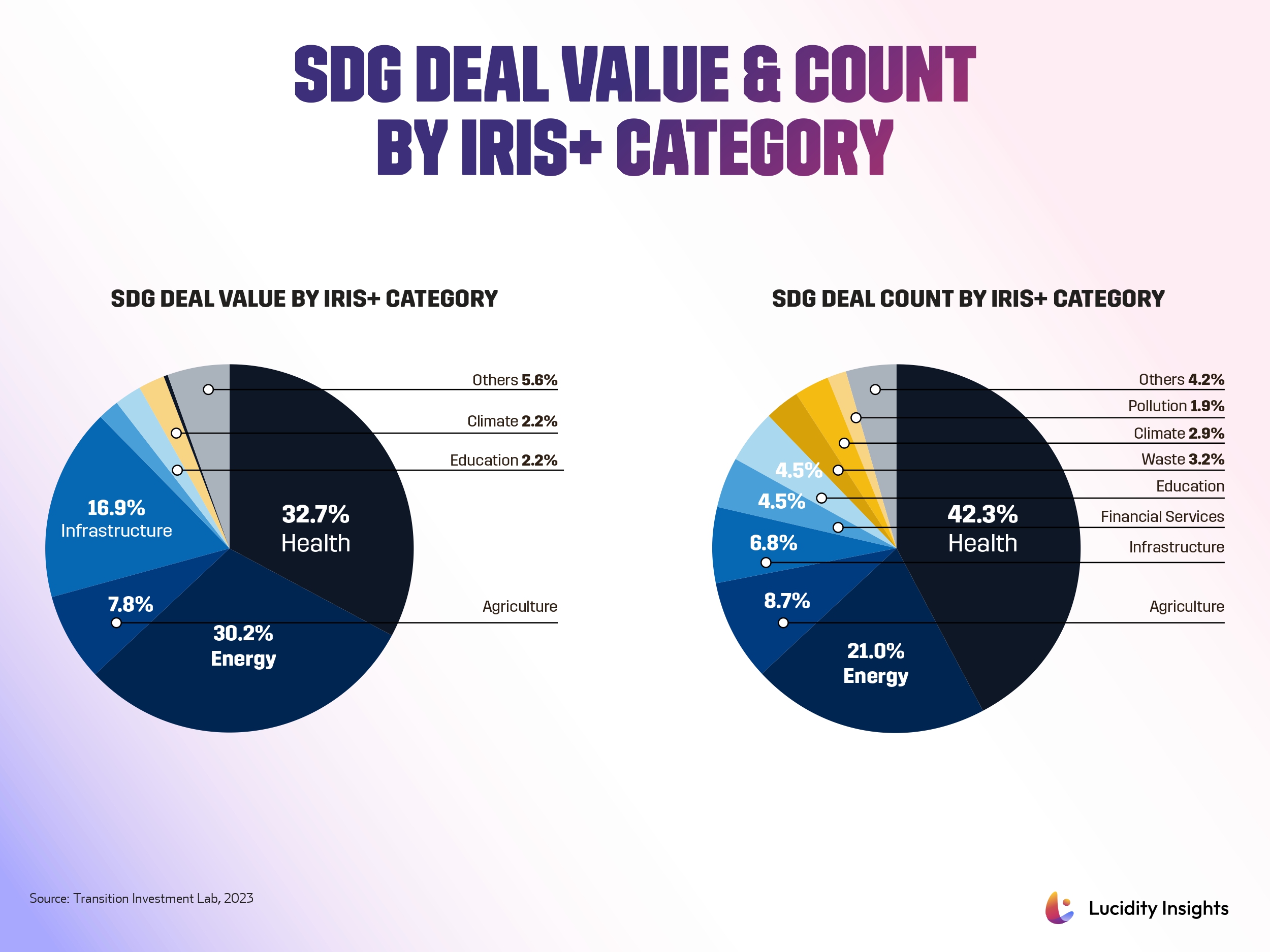

Sovereign Wealth Funds (SWFs) are increasingly directing their investments toward sectors pivotal for sustainable development, with healthcare and renewable energy at the forefront. The healthcare sector saw a remarkable rise in SWF investments during the COVID-19 pandemic, capturing 42% of SWF’s SDG-aligned deals. This accounted for 131 transactions and 34% of the SDG deal value, totalling USD 12.8 billion. Prominent investments by entities like Temasek in BioNTech, GIC in Medline Industries, and Mubadala Investment Company in Envirotainer exemplify SWFs’ swift response to global health crises, effectively blending public health goals with strategic financial investments (TIL, 2023).

Infobyte: SWF SDG Deal Value in Healthcare (in US$ Million)

Infobyte: SWF SDG Deal Value in Healthcare (in US$ Million)

Infobyte: SDG Deal Value & Count by Iris+ Category

Infobyte: SDG Deal Value & Count by Iris+ Category

Watch Video: SWFs Embrace Renewable Energy

Global Reach and Geographical Distribution of SWF’s SDG Investments

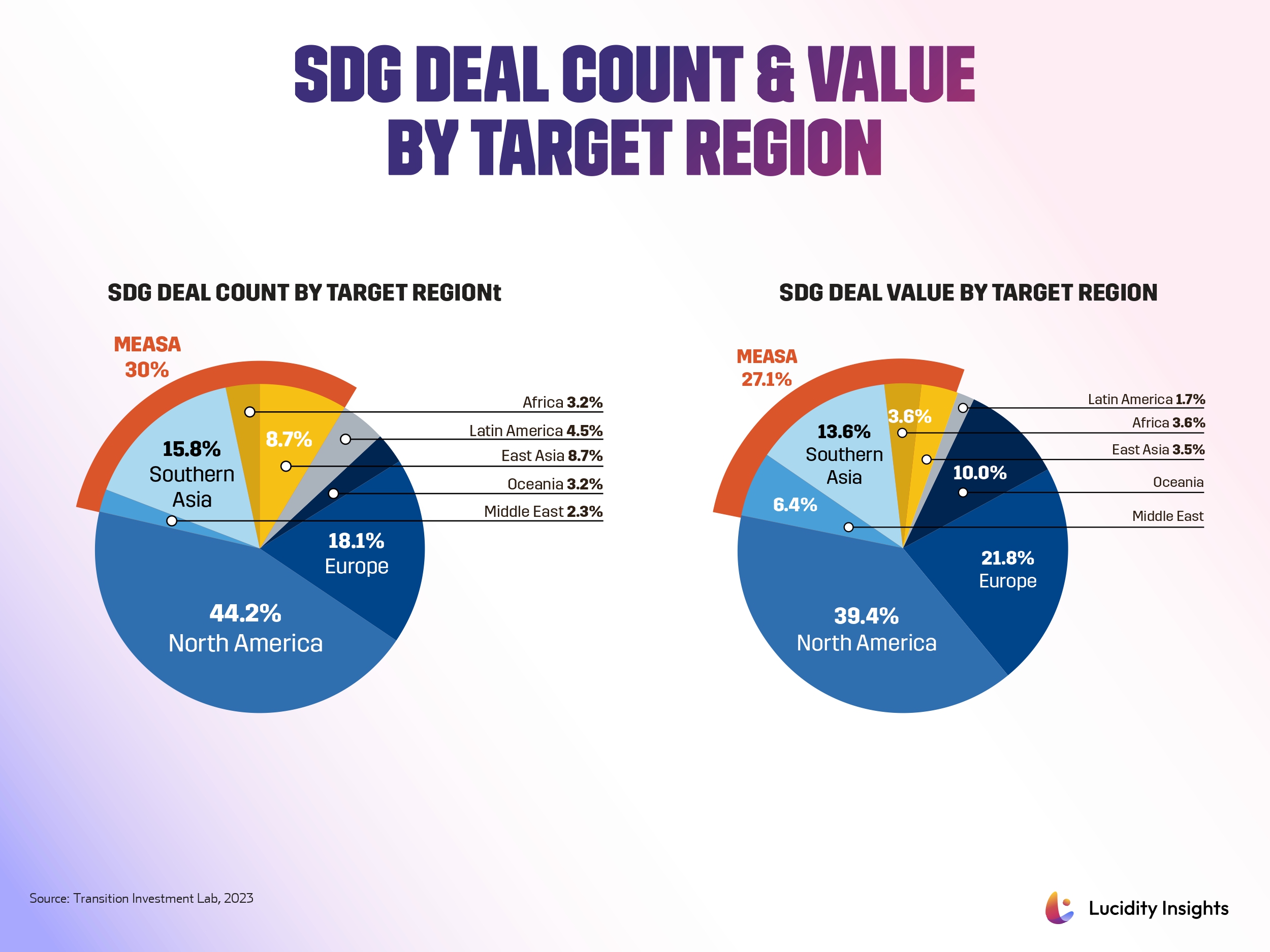

The journey of SWFs in sustainable investing paints a compelling global story, highlighted by their diverse geographical presence and impactful deals. North America stands out as the leading region for SWFs’ SDG investments, boasting 44% of the deal count (TIL, 2023). Here, healthcare, a sector making up 18.3% of the United States GDP in 2021 (CMS, 2021), and the traditionally vibrant North American energy sector, play significant roles.

Infobyte: SDG Deal Count and Value by Target Region

Infobyte: SDG Deal Count and Value by Target Region

The Middle East, Africa, and Southern Asia (MEASA) region follows, showcasing its growing market potential and abundant investment opportunities with 21% of SDG deals (TIL, 2023). Europe trails closely behind in deal count and value, indicating a steady interest in sustainable ventures across these regions.

Diving deeper, the MEASA-based SWFs, particularly those from the UAE, Saudi Arabia, and Singapore, dominate in terms of both the volume and value of SDG investments. Their investments are not only substantial in their home region but also extend significantly to North America and beyond, underlining their global influence.

Infobyte: League Table by SWF SDG Deal Value

Sovereign Wealth Funds as Catalysts for Sustainable Futures

The transformation of SWFs into leaders of sustainable and impactful investing could represent a major shift in global finance. While SWF deal activities remain a relatively modest portion of their overall investment during the period, a broader look at trends suggests an increasing SWF inclination towards sustainable investment sectors.

While SWFs have substantial financial capabilities and intergenerational investment horizons, they are not the sole solution to global challenges. Nonetheless, their contributions during the pandemic, particularly in financing vaccine development and manufacturing, have been significant, yielding considerable, though often unrealized, financial gains.

The evolving alignment of SWFs with SDGs, especially in sustainability and climate change mitigation, is a promising sign. As these themes gain importance, it’s anticipated that SWFs will further align their investment strategies with the SDGs, moving from a stance of relative isolation to being recognized as key contributors to addressing some of the planet’s most pressing issues. The successful evolution of SWFs in sustainable investing is likely contingent on their ability to pair developmental returns with financial gains that justify the risks involved. The future direction of SWF investments will be crucial in determining their role in navigating and resolving global sustainability challenges.

Several of them contributed to saving the day when it came to funding the development and quickly scaled-up manufacturing of covid-19 vaccines during the pandemic, reaping material financial (but, in many cases, unrealized) gains in the process.

— Bernardo Bortolloti, Executive Director, Transition Investment Lab, NYU Abu Dhabi

Next Read: Diversity Driven: Transforming the Landscape of Impact Investing

%2Fuploads%2Fimpact-investing%2Fcover19.jpg&w=3840&q=75)