Global Foodtech Unicorn Success Stories

24 August 2023•

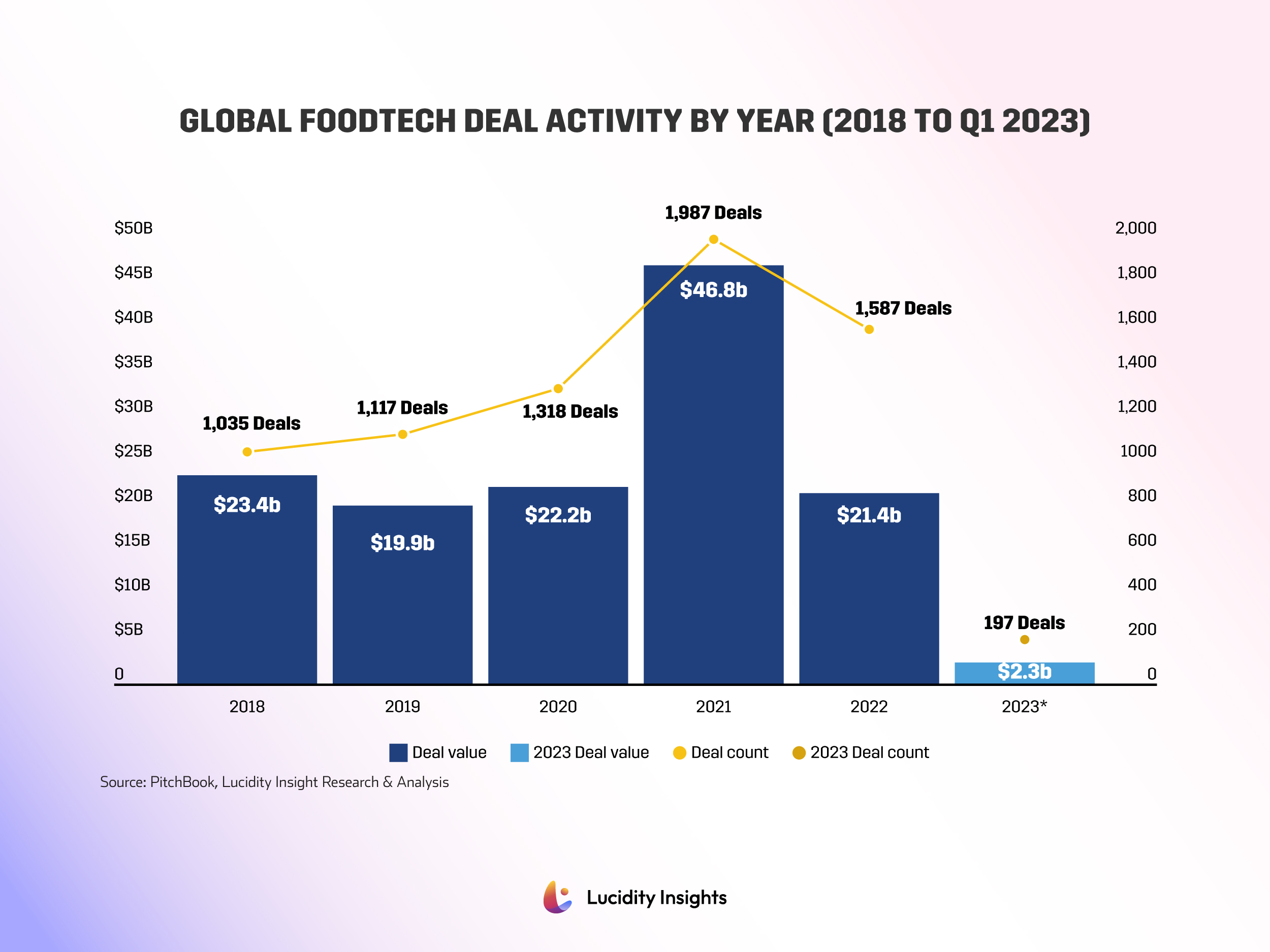

Foodtech is sizzling with over 10.5K+ startups vying to revolutionize our eating habits. These companies cover everything from online food platforms and IoT-enabled appliances to SaaS solutions. With a whopping $47B in funding across 2000 companies in its 2021 banner year, this sector is attracting major investments. Deal values in 2022 fell in line with five-year historical medians, but the deal count – though lower than 2021, was still the second largest on record in 2022. The industry is clearly suffering the same systemic challenges faced by other tech industries – from inflationary pressures to the drying up of VC capital injections throughout the VC winter that’s taking hold - however foodtech investors expect investment activity to recover as broader market conditions improve.

Related: Global Foodtech Deal Activity by Year (2018 to Q1 2023)

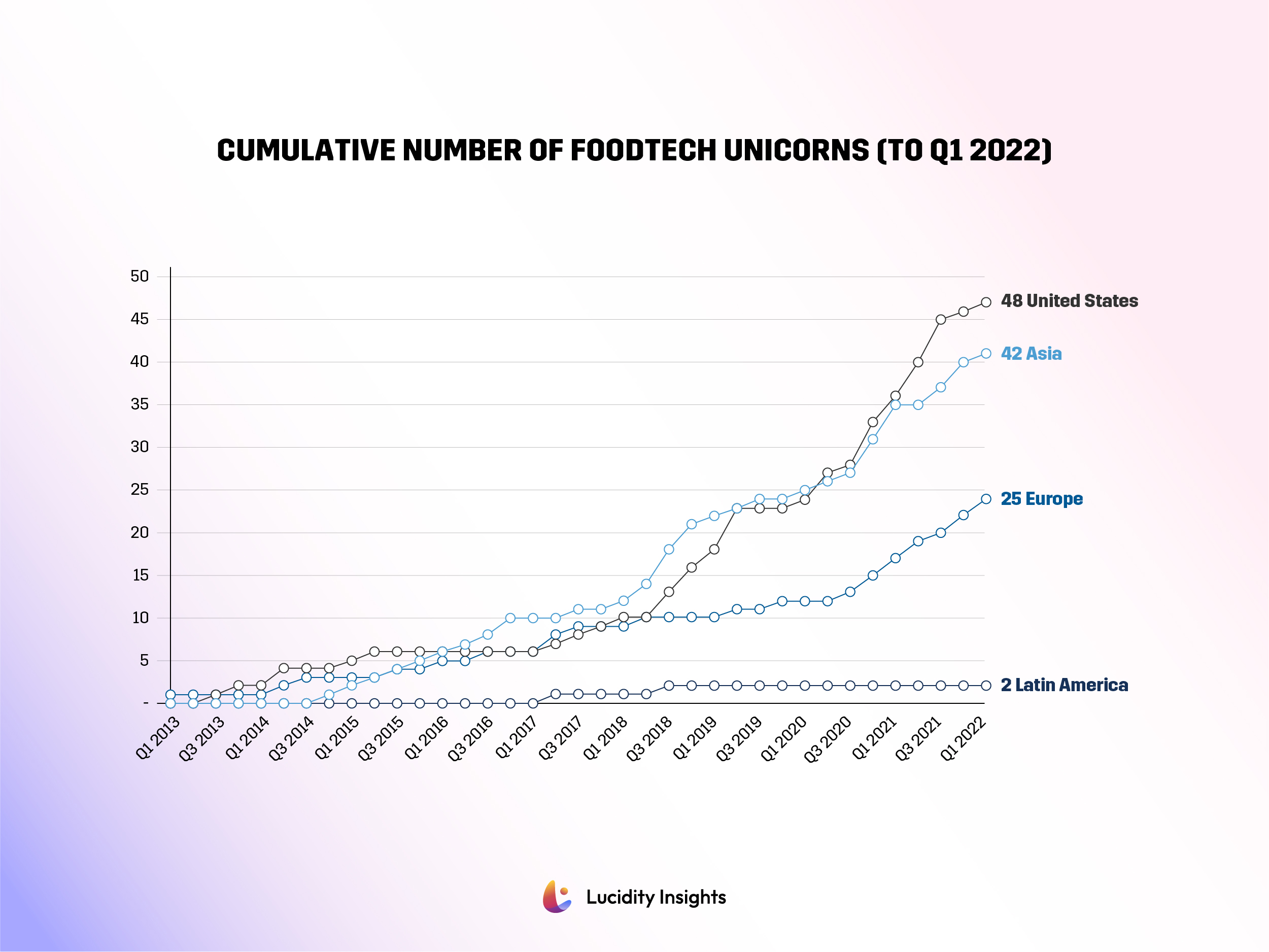

In 2021, more than half of fundraising deals sealed went towards online grocers, foodtech apps and marketplaces. In 2022, the only segment to see positive deal value gains YoY was the bioengineered foods segments – which includes functional foods, future food forms, molecular engineering, novel ingredients and upcycled foods. This might also explain why only 9 new foodtech unicorns were minted in 2022, compared to 35 in 2021. At the end of 2020, there were 64 foodtech unicorns, with half of them being food delivery players. The number of unicorns has nearly doubled in the past two years; by the end of 2022, the world was home to 124 foodtech unicorns. The US and Asia are home to a disproportionate number, with 75% of all foodtech unicorns calling these markets home.

Infographic: Cumulative Number of Foodtech Unicorns (to Q1 2022)

Next Read: Meet Some of the Biggest Foodtech Unicorns Making Waves in the Global Foodtech Industry

%2Fuploads%2Ffoodtech-2%2Fcover15.jpg&w=3840&q=75)