Future Fintech Trends

05 June 2023•

Fintech and mobile money have played a pivotal role in bringing millions of Africans into the fold of formal banking systems, but this transformative journey is only in its early stages. As the financial services market is projected to reach a remarkable revenue of $230 billion by 2025, Africa is experiencing a remarkable surge in the annual emergence of new fintech companies.

To uncover the upcoming trends in the fintech landscape, the Lucidity Insights Research team has spoken with key stakeholders in African fintech and gathered valuable insights and perspectives from industry leaders, entrepreneurs, and experts. We present three trends that are expected to shape the future of fintech in Africa and beyond.

1. Inflation & the VC Winter Will Hit Emerging Market Startups

Inflation around the world, but particularly in the US, will continue to impact the entire world. Unfortunately, when the US is hurting, the pain spreads out across the world. When we ask the question ‘why is that?’, it primarily boils down to the fact that the US Dollar is still the de facto reserve currency worldwide. This means that Central Banks around the world are predominantly holding US Dollars as their reserve asset.

The US dollar has become the dominant global reserve currency due to several factors, including the size and stability of the US economy, the depth and liquidity of the US financial markets, and the status of the US Dollar as the world’s most widely used currency for international trade and transactions. In addition, many commodities such as oil and gold, are priced in US dollars, further increasing demand for the currency as a medium of exchange.

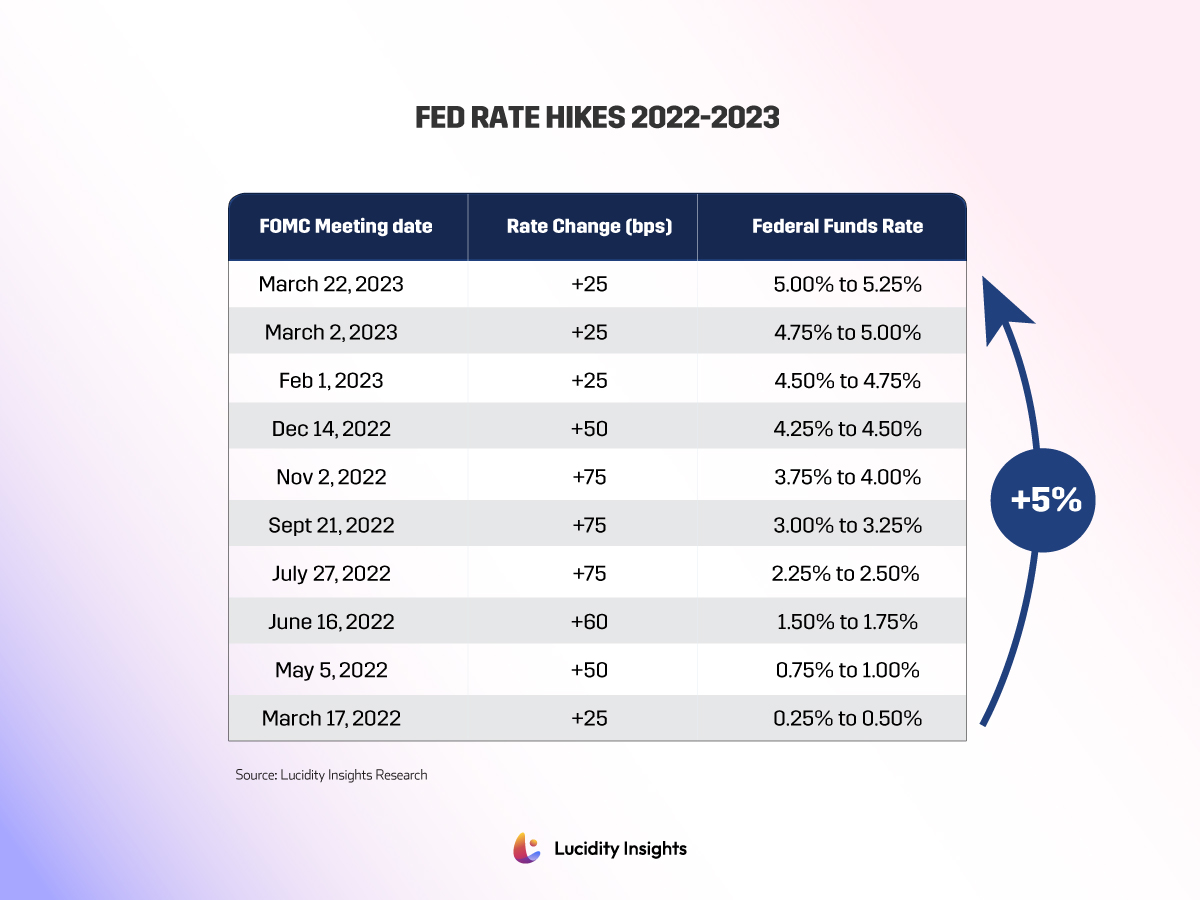

This also means that when the US is facing major inflationary pressures, such as what we have been seeing over the past year, and decides to continue increasing interest rates to bolster the US dollar, it simultaneously weakens emerging market currencies. We learned from the IFC’s Kareem Aziz, that this leaves many emerging markets vulnerable, and likely negatively affects emerging markets disproportionately. “Unfortunately, until the US gets a hold of inflation, the continued increase in interest rates will lead to vulnerabilities in markets like Nigeria, Turkey, Egypt and Pakistan.” He added, “This will also add pressure onto the global Venture Capital ecosystem, as VCs tend to hold US dollars in their funds. What that means is that VCs may hedge foreign currency risks, by only investing in more stable foreign markets where the currency is pegged to the US dollar and the country’s macroeconomics are sound.”

Table: Fed Rate Hikes 2022-2023

While start-ups around the world who are trying to fundraise are all feeling the effects of this Venture Capital winter, it is likely that start-ups outside of the US will have an even harder time attracting capital for exactly the aforementioned reasons. According to CB Insights, Q1 2023 saw funding drop by 30% Quarter-over-Quarter, compared to Q4 2022. African start-ups were hit 2nd hardest, next to Latin American start-ups, and on-par with Asian funding results.

Infographic: Q1 2023 vs. Q3 2022 Funding Drops

2. A Time for Consolidation

Inflation around the world, but Warren Buffet is famous for saying, “A rising tide floats all boats. Only when the tide goes out do you discover who’s been swimming naked.” As the buzz word amongst VC and investor circles replaces “growth” with “profitability,” it seems there will be a number of fintechs and other start-ups caught with their pants down.

Startups that had poor financial management will face hard-times into 2023 and 2024, and only the fit will survive. The rest will fall to the wayside. As capital continues to dry-up further in 2023, investors have echoed that they believe that the left-over dry powder will be consolidated and given to the top 1 or 2 market leaders across each sector and market. That capital is expected to be in large sums, meant to support the market leader cement their leadership position by going on an inorganic growth spree through a series of acquisitions. The question that lingers is, are you a fintech that’s about to be eaten, or about to do the eating?

Related: IFC on Fostering Financial Inclusion via Fintech Investments in Africa

3. More Tailored & Integrated Solutions for the Unbanked

The last decade saw 1 billion individuals go from the unbanked population to plugged into the financial system. This next decade will continue that trend, but will require more than mobile money and generic fintechs to continue reaching the unbanked still left out on the fringe.

The problem that stakeholders have voiced with regards to the current state of Fintechs in Africa, is that many of them are often trying to educate farmers on financial literacy, when it should be the other way around. Fintech founders and their teams should be educating themselves on the farmer and his needs, so that fintechs can design a solution that seamlessly embeds itself into the farmers life to make it easier and more convenient.

There will be more fintechs that are tailor-made for a specific customer profiles such as the rural farmer, the local bus driver, or for rural women. We will start seeing fintechs that are deeply invested in solving specific problems for very unique use cases that affect their customer. This will bring a new level of customer obsession to the fintech space in Africa in the coming years.

To read more about the drivers, barriers and the opportunity of fintech in Africa, as well as strides made towards financial inclusion – read the full report here.

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)