Data Points That Help Explain the Emergence of Foodtech

24 August 2023•

In this era of disruption, technology becomes our ally in overcoming food industry challenges. Welcome to Foodtech, where innovation reshapes agriculture and every industry facet, from farm to fork. Harnessing tech for selection, preservation, distribution, and safety, it adapts to changing habits, creating a modern food ecosystem. In this article, we'll provide data explaining the rise of foodtech.

- Food Security Issues that Foodtech Could Help Us Address

- The VC Winter is hitting Foodtech just the same as every other sector

- Fewer Foodtech Deals Signed, but Deal Sizes are Getting Larger

- Foodtech Exits Slowdown

- Alternative Proteins is the Foodtech Sub-Sector to Watch

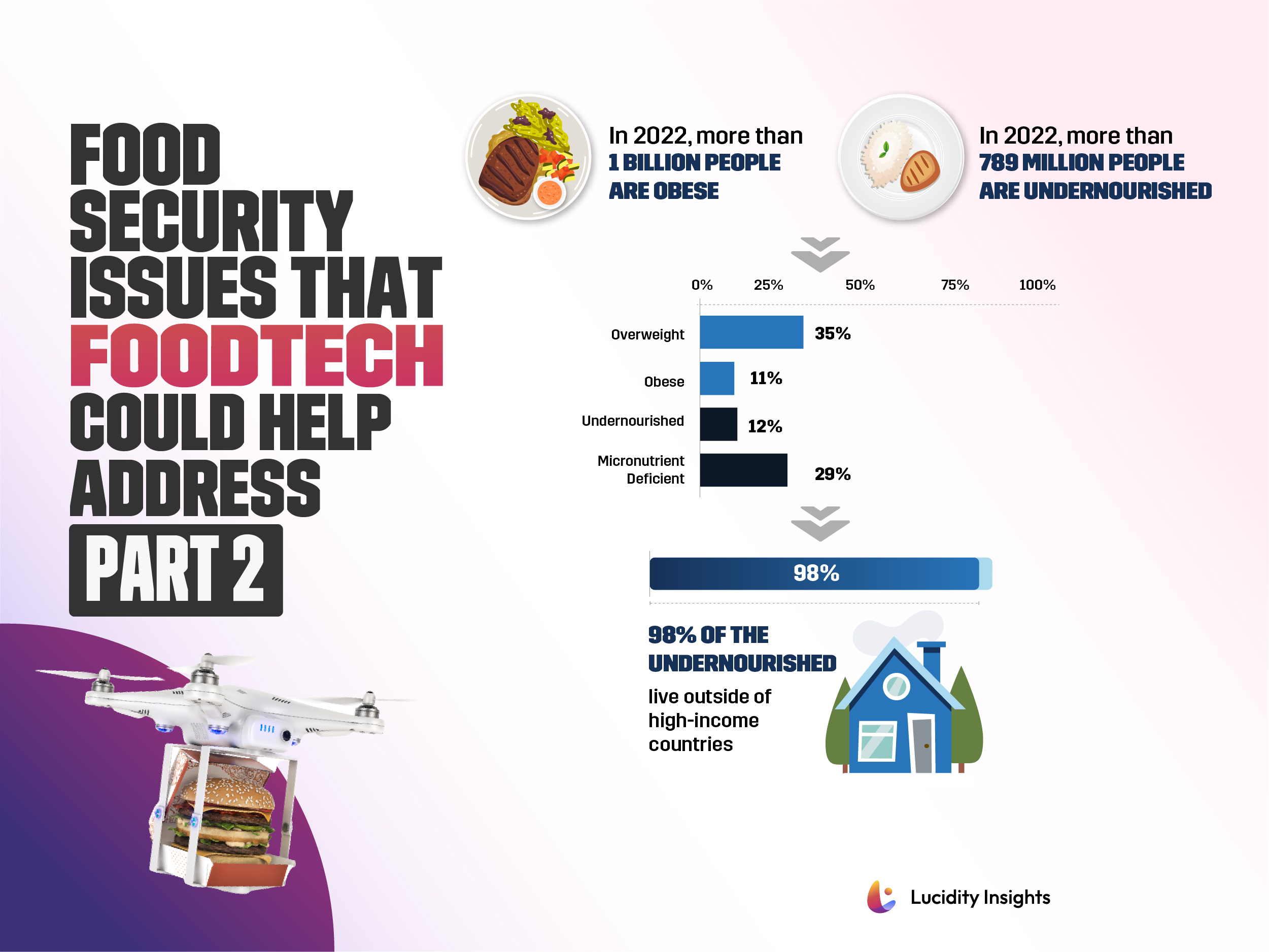

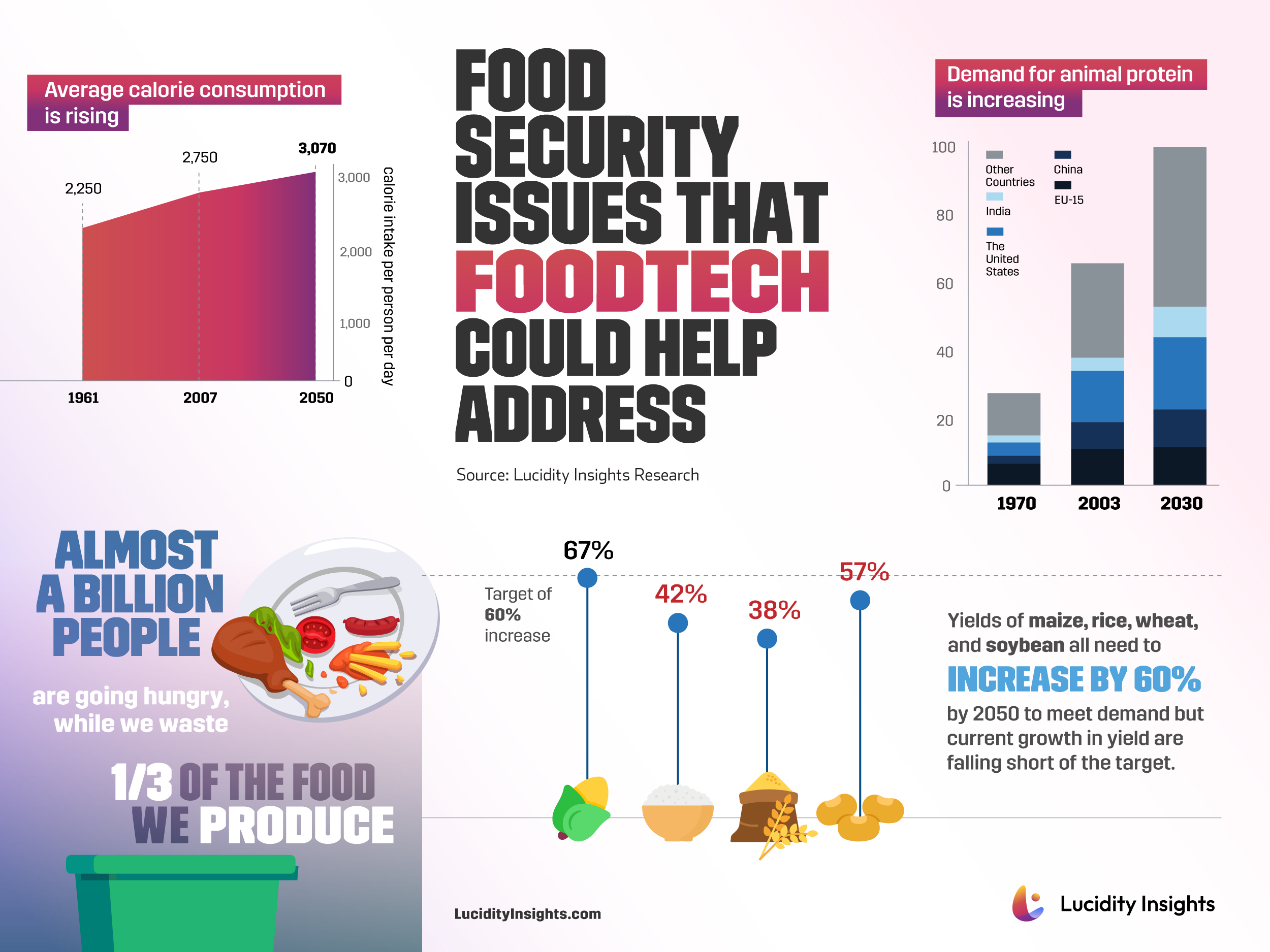

1. Food Security Issues that Foodtech Could Help Us Address

As our global population hurtles towards the 10 billion mark by 2050, the hunger for food is reaching unprecedented levels. It's no secret that the food and agriculture industry reigns supreme as the largest on our planet, catering to a loyal customer-base of 7.9 billion people.

But with this soaring demand comes a cascade of challenges that threaten to shake the very foundations of food production. From population growth to climate change impacts, food wastage in the supply chain to the environmental toll of production, and farming industries on the decline around the world driven by younger generations opting for non-agricultural career paths – the stakes have never been higher. That's why the convergence of food and technology has become an urgent imperative.

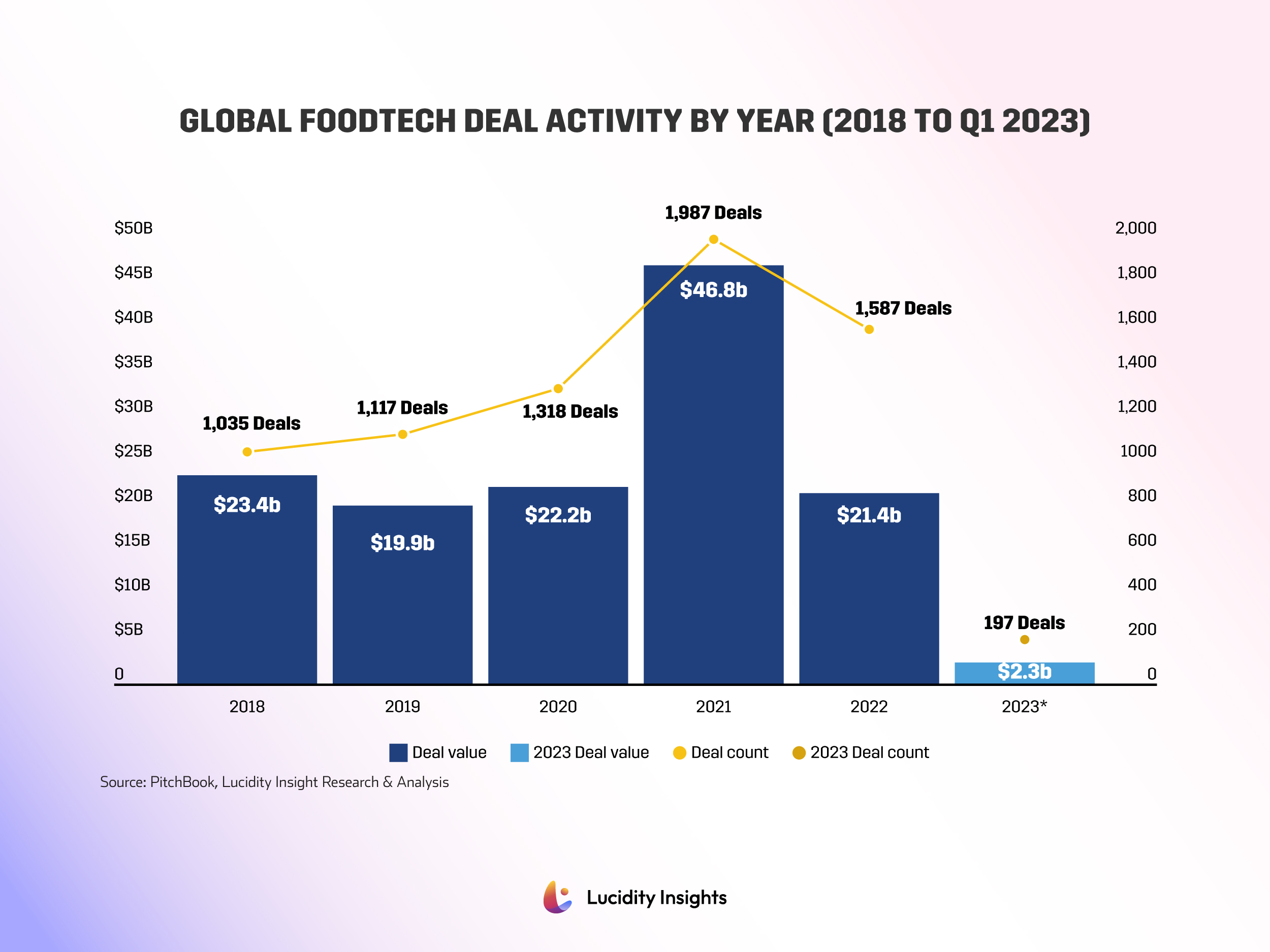

2. The VC Winter is hitting Foodtech just the same as every other sector

Infobyte: Global Foodtech Deal Activity by Quarter (2018-2023)

Foodtech fundraising has been on a decline since Q1 2022, after the sector fundraised a landmark US $14 billion in Q4 2021. Every quarter in 2022 saw a shrinking in funding, and the “VC winter” of 2023 is not slowing this funding freeze down. Q1 2023 saw the lowest investment into foodtech since Q1 2018, and the lowest number of deals signed since 2017.

3. Fewer Foodtech Deals Signed, but Deal Sizes are Getting Larger

Infobyte: Global Foodtech Deal Activity by Year (2018 to Q1 2023)

VC appetite for foodtech seems to be dwindling after the 2021 foodtech gold rush. 2023 is expected to see the lowest deal and funding activity since 2017. That said, investors that are still brokering deals in this space seem to be focusing on larger, less risky deals – as opposed to spreading money across smaller, newer ventures. Median deal size grew by 88% in Q1 2023 versus Q4 2022, reaching US $6 million.

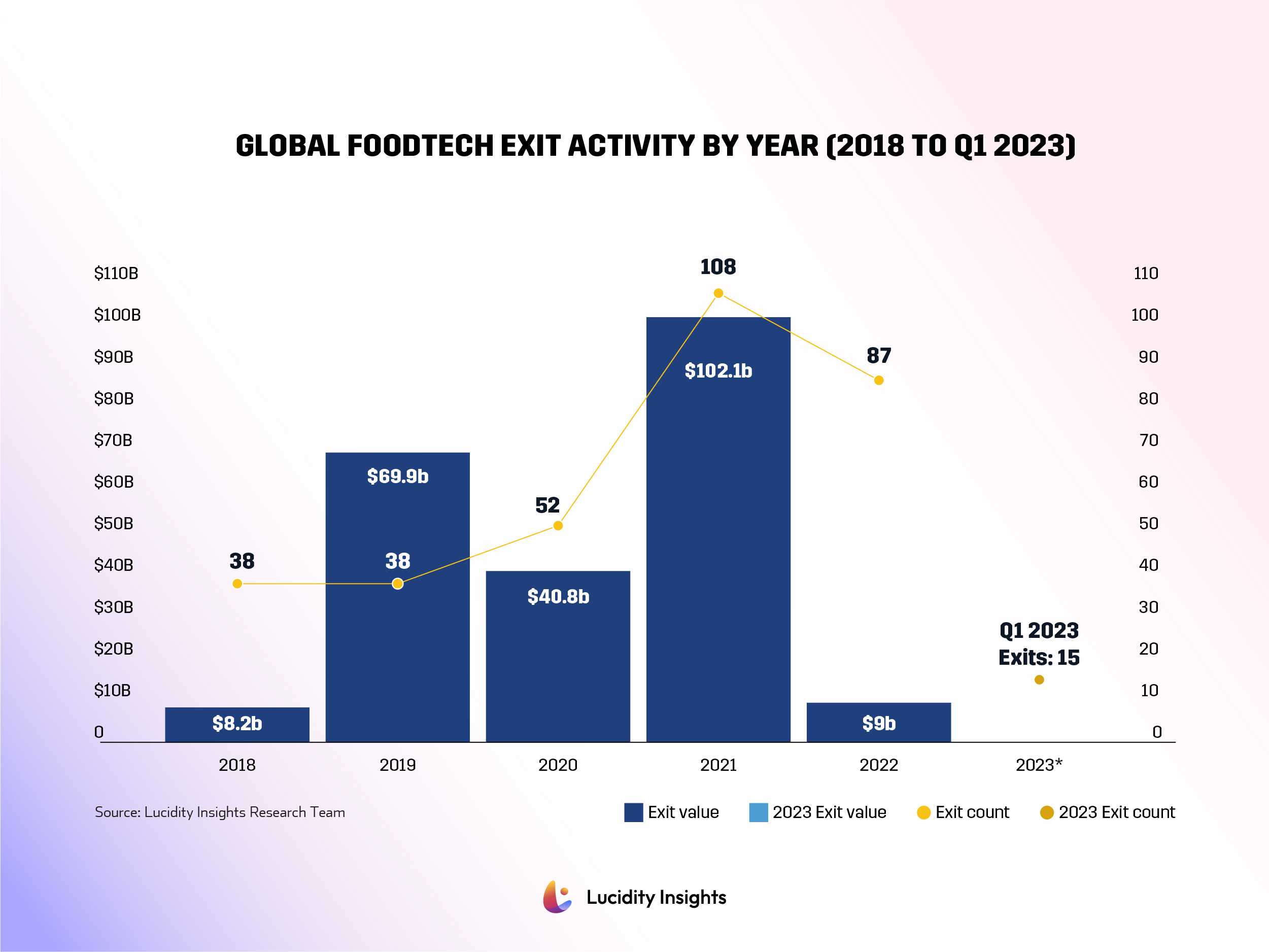

4. Foodtech Exits Slowdown

There were a total of 15 exits for VC-backed foodtech startups worth less than a combined $1 billion in Q1, continuing the trend seen in Q4 2022. There were no IPOs and only one buyout, leaving M&A deals to make up the majority of exits during the quarter. The M&A market remains bearish due to higher interest rates. Exit activity is expected to remain subdued until the IPO markets heat up again

Infobyte: Global Foodtech Exit Activity by Year (2018 to Q1 2023)

5. Alternative Proteins is the Foodtech Sub-Sector to Watch

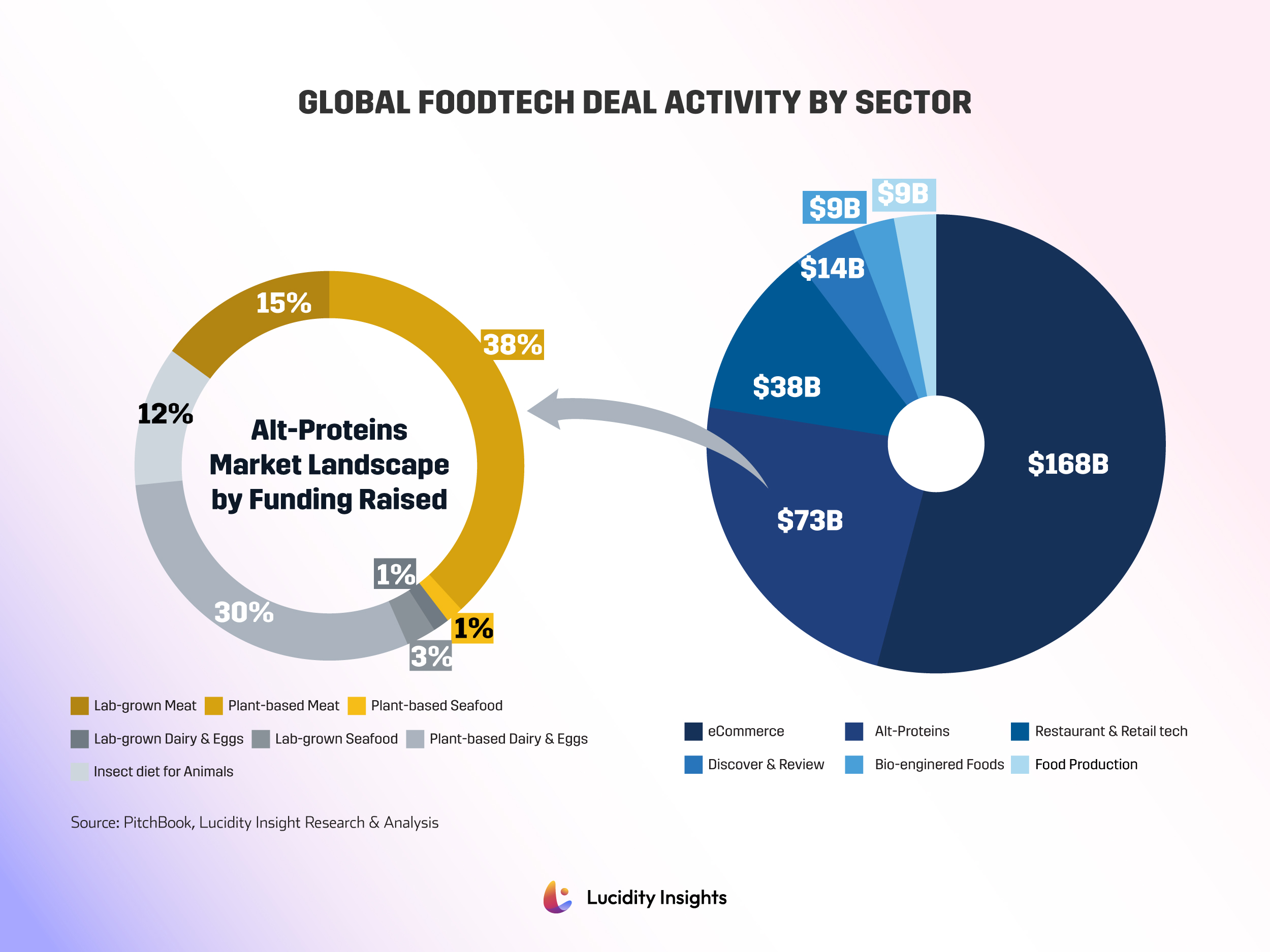

Infobyte: Global Foodtech Deal Activity by Sector

Ecommerce foodtech startups continue to raise the most, but Alt-Proteins is the fastest growing segment today. Alternative proteins are plant-based and foodtech alternatives to animal proteins. This includes plant-based meat, plant-based seafood, and plant-based dairy and egg replacements. It also includes labgrown meat, seafood, dairy and eggs. Foodtech playes are using plants like grains, legumes and nuts, fungus (mushrooms), algae, and insects, and even fermented proteins too.

Investors are keen to fund this sector, as the United Nation’s Food and Agricultural Organization (FAO) claims that food production will need to increase by 56% if the population reaches 9.7 billion by 2050. Meal replacement protein players and niche segments like fermented proteins have started to make their mark with notable raises over US $200 million in Q1 2023.

Next Read: Global Foodtech Unicorn Success Stories

%2Fuploads%2Ffoodtech-2%2Fcover15.jpg&w=3840&q=75)