5 Graphs About Impact Investing You Need to See

13 December 2023•

Over the past 20 years, impact investing has undergone a remarkable evolution, driven by a confluence of societal, economic, and technological factors. Here are 5 data points you need to know about the state of Impact Investing today.

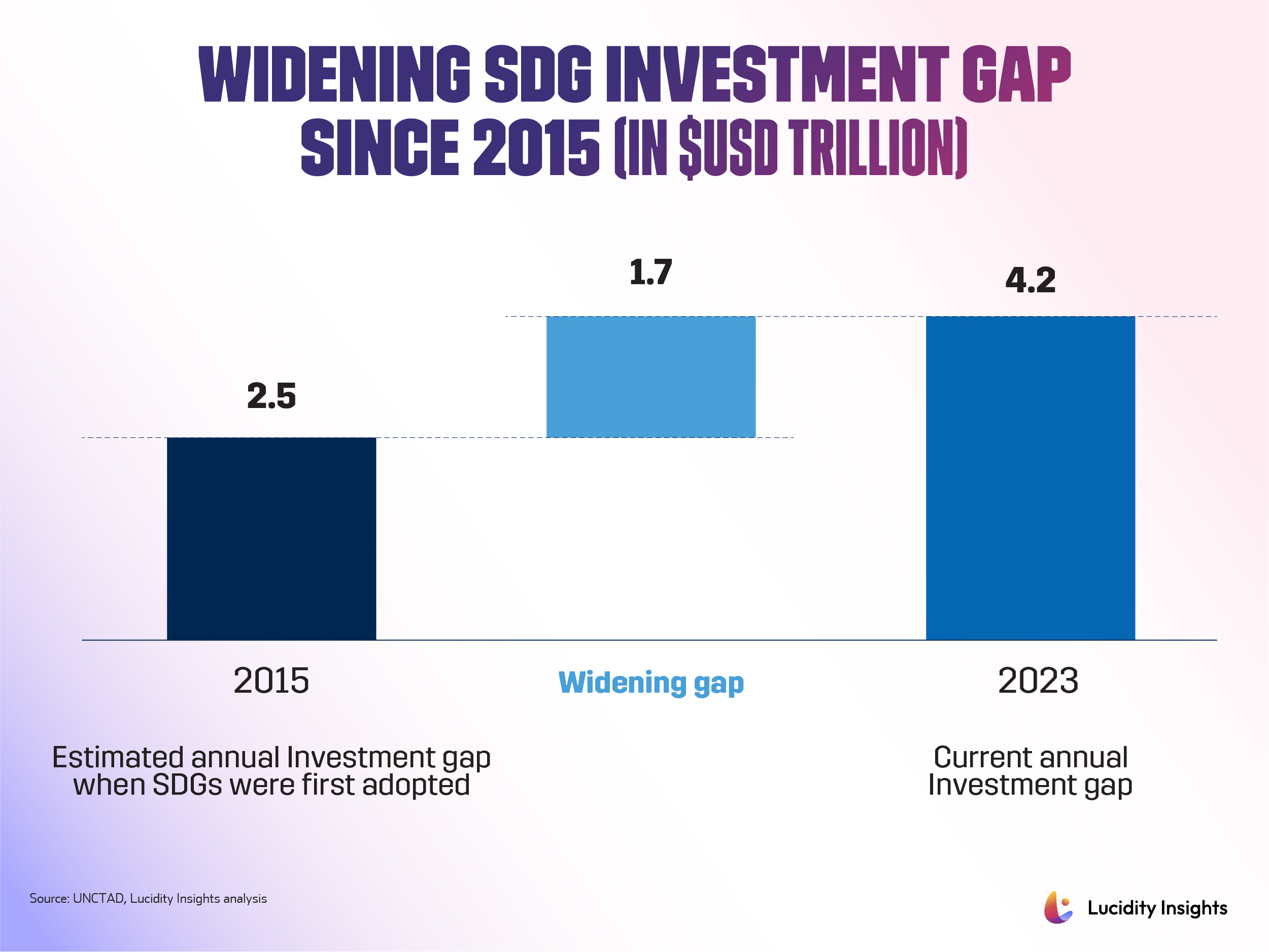

1. The widening SDG investment gap since 2015, in US $ trillion

According to the UNCTAD’s World Investment Report 2023, developing countries are facing a widening annual investment deficit to achieve the Sustainable Development Goals (SDGs) by 2030. The annual gap is now about US $4.2 trillion per year – up from US $2.5 trillion in 2015 when the SDGs were adopted, driven by weak growth in the early years and the sharp decline in investment during the COVID-19 pandemic.

According to the UNCTAD’s World Investment Report 2023, developing countries are facing a widening annual investment deficit to achieve the Sustainable Development Goals (SDGs) by 2030. The annual gap is now about US $4.2 trillion per year – up from US $2.5 trillion in 2015 when the SDGs were adopted, driven by weak growth in the early years and the sharp decline in investment during the COVID-19 pandemic.

2. The widening SDG investment gap in developing countries per sector, in US $ trillion

In 2022, international investment in critical SDG sectors such as infrastructure and energy showed growth in developing countries. Despite this growth, the gap has widened significantly driven by insufficient investment and escalating needs. More than half of the gap is made up by developing countries’ energy investment needs sitting at US $2.2 trillion per year. This underscores the urgency of mobilizing increased support and resources to bridge the SDG investment gap and accelerate progress toward a more sustainable and equitable future for all.

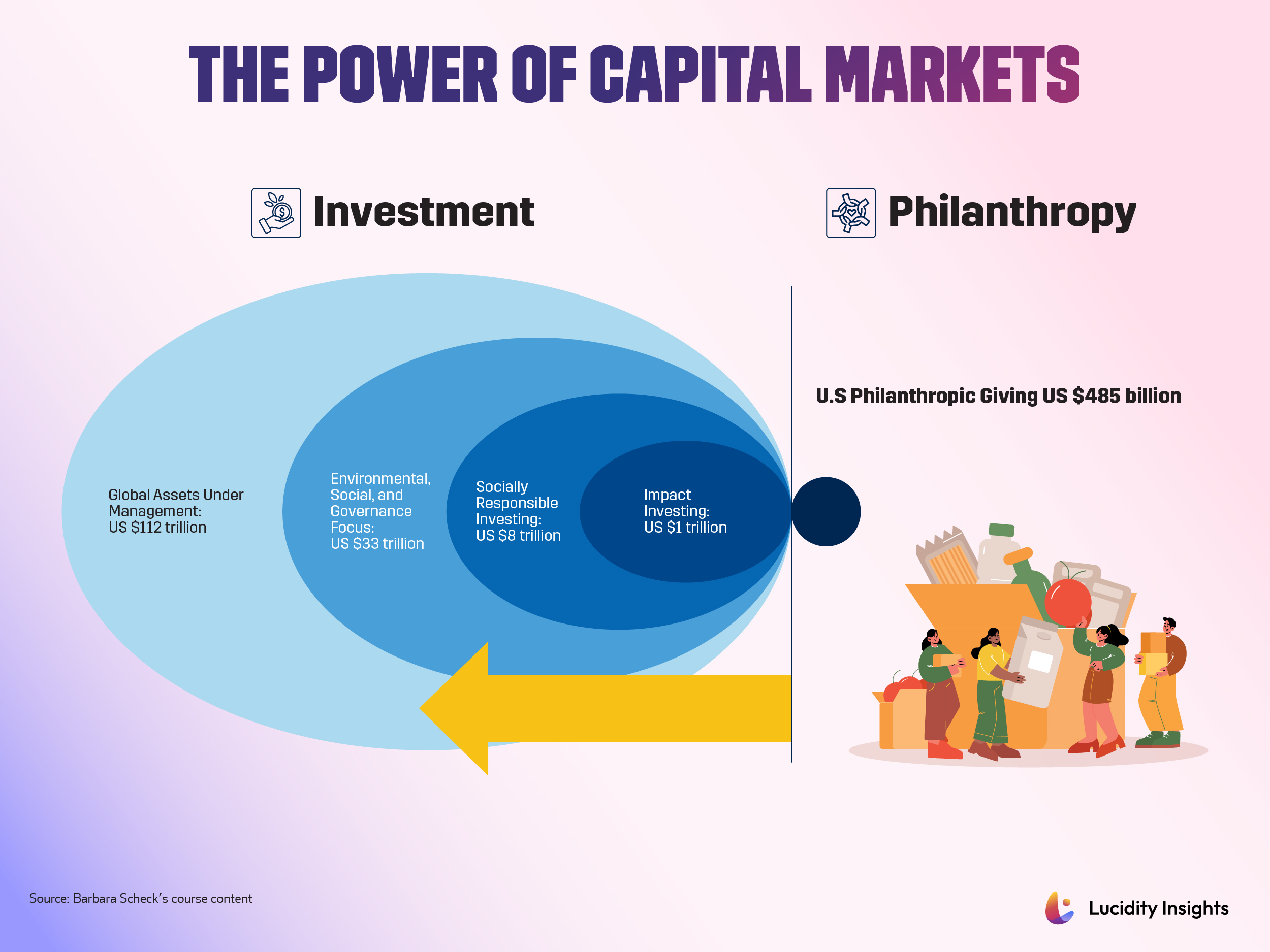

3. Unleashing the power of capital markets

The figures linked to the investment requirements for achieving the SDGs are staggering. However, they merely constitute a small portion of the enormous US $112 trillion in global assets under management. Clearly, the issue isn’t a lack of capital; rather, it’s the redirection of more of these funds toward the SDGs and ensuring that each dollar contributes significantly to the necessary positive transformations.

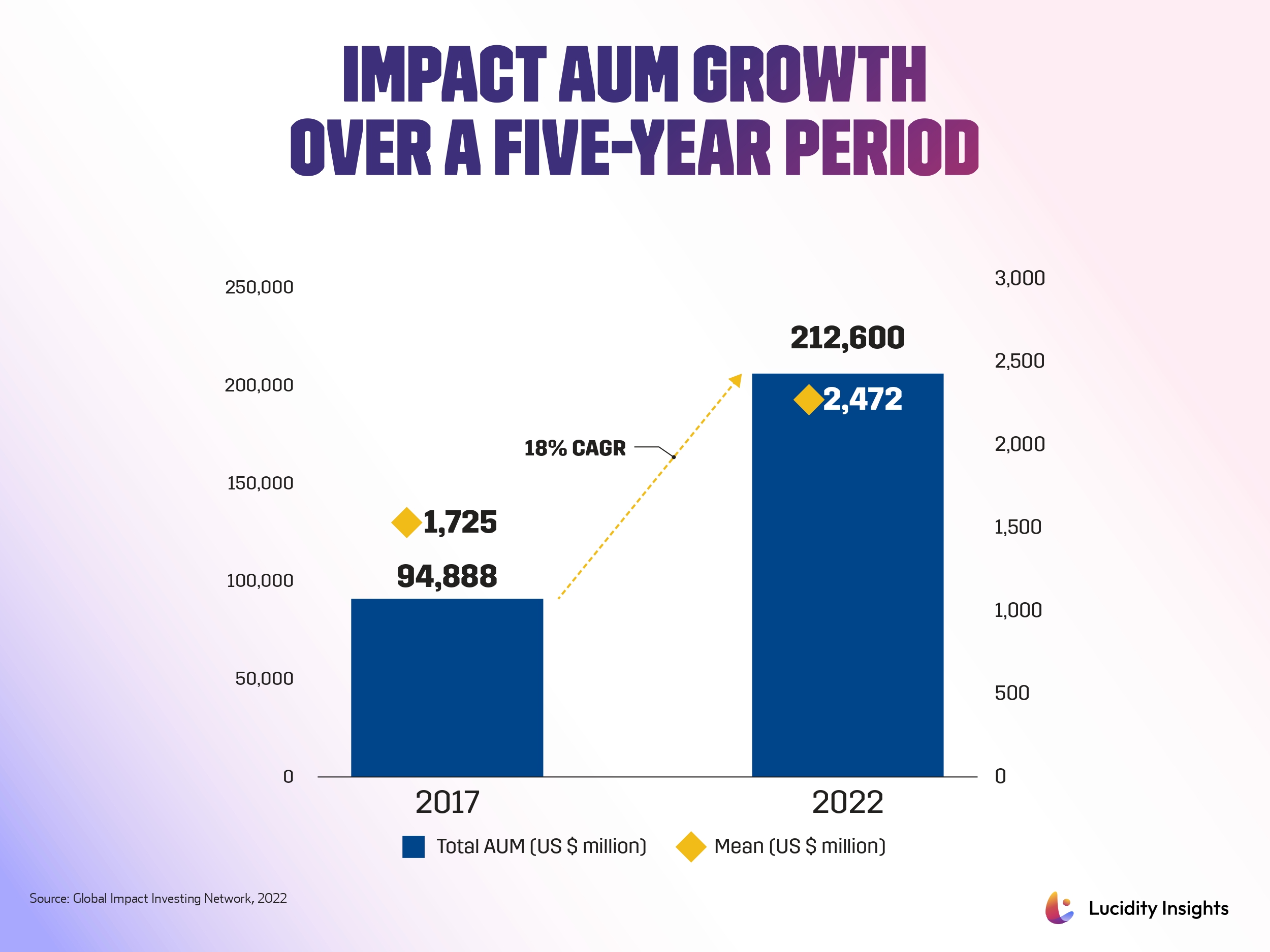

4. Impact AUM growth over a five-year period

According to research conducted by the Global Impact Investing Network, organizations have significantly increased their impact assets in the past five years. In total, impact assets under management (AUM) surged from US $95 billion in 2017 to US $213 billion by the close of 2022, representing a compound annual growth rate (CAGR) of 18%. At the median, organizations held US $98 million in impact AUM in 2017, which has surged to US $242 million in 2022, suggesting that organizations are increasing their impact assets. This data indicates a clear trend of organizations progressively expanding their commitment to impact-driven investments. While this is encouraging, this trend needs to strongly accelerate to be able to meet the UN SDGs.

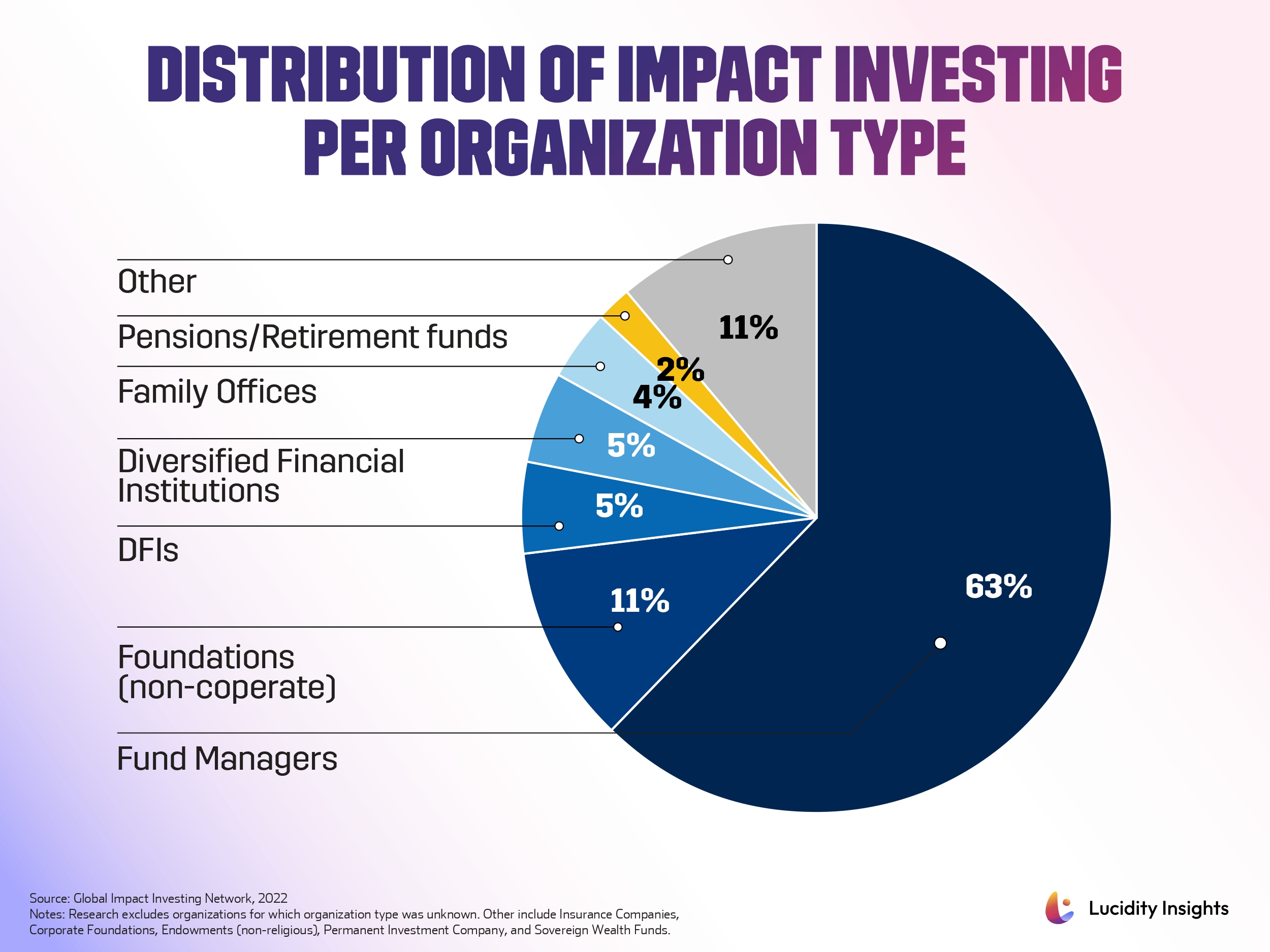

5. Distribution of impact investing per organization type

According to a GIIN’s report based on data insights from 308 impact investing organizations, the impact investing industry is diverse, spanning geographies, sectors and investor types. Most investors in the sample are investment managers (63%), with most investors are headquartered in developed markets (74%).

To read more about impact investing and the state of impact investing in the world today, download and read the Special Report here.

Next Read: Creating Impact: A comprehensive Special Report on The Business of Impact Investing

%2Fuploads%2Fimpact-investing%2Fcover19.jpg&w=3840&q=75)