MNT-Halan: From Ride-Hailing Roots to Becoming a Payments SuperApp Unicorn in 2023

11 April 2024•

MNT-Halan made headlines in February of last year, when it was crowned Africa’s first unicorn of 2023.

- Total Funding: US$ 692 million

- Year Established: 2017

- HQ: Cairo

- Sector: Fintech

- Employees: More than 30,000

- Website: www.mnt-halan.com

Today, MNT-Halan describes itself as Egypt’s largest non-bank lender to the unbanked; but it may surprise you to learn that it originally debuted as a ride-hailing platform called Halan Inc., established and based out of Zamalek, Giza – an affluent and diplomatic neighbourhood of Cairo.

Founded in 2017 by Mounir Nakhla and Ahmed Mohsen, MNT-Halan made its debut as a ride-hailing platform centered in Zamalek, Giza. The founders got their start to build the ride-hailing platform, following a US $2.5 million Seed round raised between November 2017 and March 2018. Subsequent rounds followed, starting with Halan’s Series A, which closed at $4.4 million at the back end of 2018. An additional $15 million Series B funding round was disclosed in 2020.

In frame: MNT-Halan founders, Mounir Nakhla and Ahmed Mohsen

In frame: MNT-Halan founders, Mounir Nakhla and Ahmed Mohsen

A merger came onto the table in the second half of 2021 after a share swap with Dutch lender MNT Investments BV, that seemed to come with a $120 million funding. Thus, Halan Inc. officially became MNT-Halan and its transition and evolution to become a digital payment and fintech player began with haste.

The company expanded rapidly, encompassing B2C and B2B on-demand logistics solutions in its first year after the merger, before venturing into food delivery and becoming a super app within two years. It expanded aggressively in part by borrowing and taking on $150 million in debt-financing in June 2022. By the end of the same year, the firm had processed transactions worth $1.8 billion with a monthly throughput that had soared over 20 times in the last five years, surpassing $100 million.

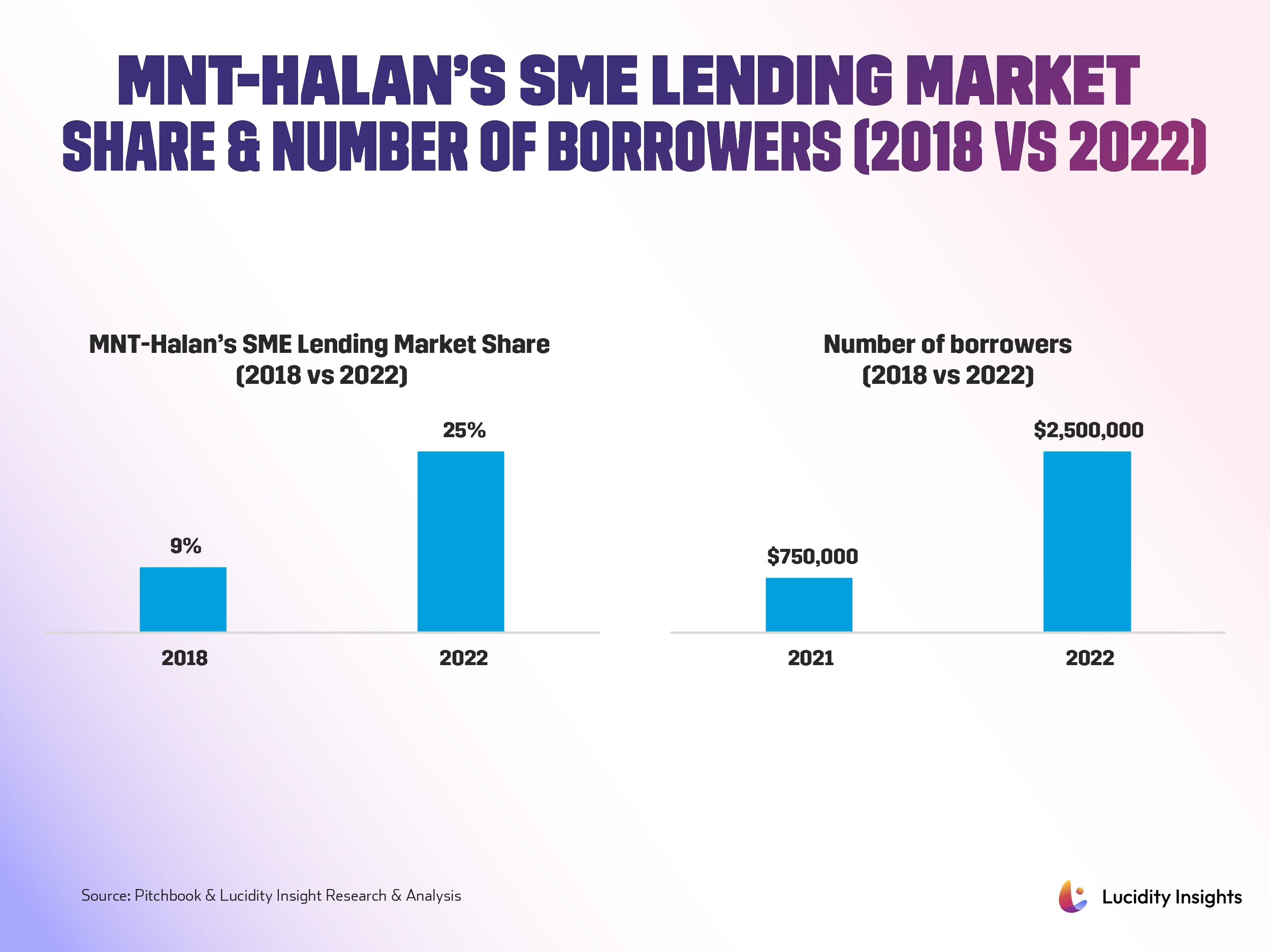

Today, MNT-Halan offers loans, BNPL options, e-commerce, and more through its payment-processing software Halan Neuron, as well as its digital cards and wallets. In fact, MNT-Halan’s market share in SME lending was 9% in 2018, which has risen to 25% in 2022. Number of borrowers grew more than 3x from 750,000 in 2021 to 2.5 million in 2022.

Infobyte: MNT-Halan's SME Lending Market Share & Number of Borrowers (2018 vs 2022)

Infobyte: MNT-Halan's SME Lending Market Share & Number of Borrowers (2018 vs 2022)

Fast-forward to February 2023 when MNT-Halan raised $260M in equity financing partly provided by Abu Dhabi–based Chimera Investments, and an additional $140M through two securitized bond issuances for a total of $400 million at a $1 billion valuation to reach the coveted Unicorn status. Today, MNT-Halan boasts 1.5 million monthly active users, six million customers, four million financial clients, and 2.5 million borrowers.

But as impressive as the company’s timeline has been, perhaps the most potent of narratives lie in a future where MNT-Halan’s technology transcends borders.

Founder and CEO, Mounir Nakhla, envisions a future where financial services are accessible to all; MNT-Halan values empowering underserved sectors, alleviating disparities, amplifying female economic participation, and supporting young people – which is a crucial aspect in a nation where 70% of the population is financially underserved.

Mounir first alluded to this direction of the company upon their rebranding in 2021, when he first said, “MNT-Halan will be the leading player digitizing the unbanked and bringing financial services to millions of underserved customers in the region.”

Next Read: Egyptian Unicorns & Success Stories

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)