Egyptian Unicorns and Success Stories

10 April 2024•

In 2022, the top 10 startups from the Middle East garnered an astounding US $1.9 billion in funding, with the UAE dominating with nearly $1.5 billion and representing over 60% of the startups, followed by Saudi Arabia and Egypt, whose startups secured approximately $420 million and $62 million, respectively.

Egypt has always been a top 3 startup ecosystem in the MENA region, and until Saudi Arabia’s entrepreneurial rise – which was launched through the Kingdom’s Vision 2030 in 2016 but not visibly seen until 2018 or 2019 – Egypt was consistently the 2nd most active startup ecosystem behind the United Arab Emirates.

In 2023, the top places in the regional rankings had a shake up, as Saudi Arabia emerged as the market that attracted the most funding, knocking the UAE off its long-held pedestal. Saudi Arabia dominated with $4.3 billion raised, representing around 70% of the region’s total funding raised. The UAE and Egypt followed, who each raised $1.3 billion and $503 million respectively. The UAE and KSA has 5 startups and 4 startups respectively, in the 10 most funded startups, with mnt-Halan being the lone Egyptian startup to make it on the list in 2023.

Egypt’s entire ecosystem raised US$ 503 million in 2023, compared to US$ 810 million in 2022. Just a single company, mnt-Halan accounted for nearly 80% of total funding, which helped Egypt lead the helm of financial achievement even amongst the Big Four Tech Hubs in Africa.

February 2023 witnessed 44 startups raising over $675 million in funding, where Egypt secured a phenomenal $421 million predominantly spearheaded by MNT-Halan, carving out Egypt as a formidable player in the continent’s startup ecosystem Eight Egyptian fintech startups have made Forbes Middle East’s “Top 30 Fintech Companies” for 2023, overshadowing regional heavyweights like Saudi Arabia, which had six entries, as well as the UAE and Kuwait, both of which came in with five.

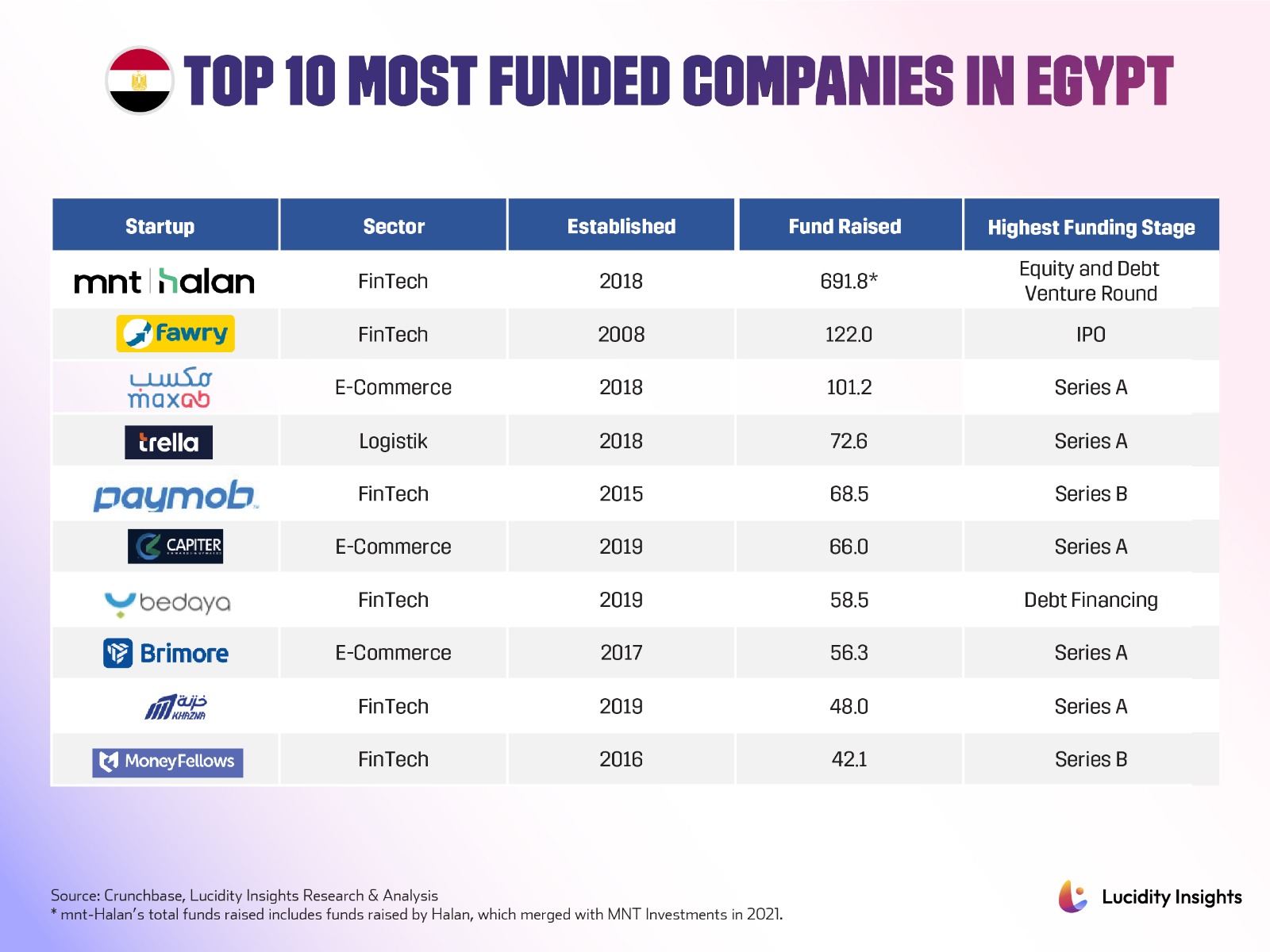

Among these are Egyptian unicorns, Fawry, who ranked first, and MNT-Halan, fourth, as well as several of the country’s most promising “soonicorns”. FinTech also dominates the overall Egyptian tech landscape as Fintech companies comprise half of the top ten most funded companies from Egypt. E-commerce companies take second spot with four companies and one logistics firm rounds out the top ten. All of Egypt’s startups that have achieved and maintained over $1 billion dollar valuations are fintechs.

We would be remiss to not mention Swvl, which has its roots in Egypt, though the tech startup eventually moved its headquarters to Dubai in 2019 in preparation for an IPO. Swvl was in essence an “Uber for buses”, focused on mass transit, allowing customers to book buses and vans for travel.

Swvl listed on the NASDAQ in March 2022, but quickly fell from grace. The company had lost 95% of its market value within 6 months of listing. Within 20 months of listing on the NASDAQ, Swvl lost 99% of its market capitalization with the company’s valuation plummeting down from a high of US$ 1.5 billion to a measly US$ 9 million.

Many factors were at play for Swvl’s eventual demise, including the implications of the pandemic on the transportation industry, the Russian invasion of Ukraine – which sent the price of fuel skyrocketing, negatively impacting Swvl’s operating costs.

Meanwhile, Swvl had been on an aggressive spending spree acquiring similar transportation and logistics companies around the world, leaving their coffers empty to fight the unforeseen battles that would arise. The NASDAQ index lost one-third of its value in 2022 alone, indicating that Swvl was not alone in suffering some devastating blows.

Next Read: Egypt’s Resilient Tech Ecosystem: 10 Graphs You need to see to understand Egypt’s Startup Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)