4DX Ventures: Championing Pan-African Innovation

19 April 2024•

4DX Ventures is a Pan-Africa focused VC firm. The firm was founded in 2014, however was started officially in 2017. Focus on industries such as fintech, B2B e-commerce, healthcare and logistics.

- Year Established: 2017

- HQ: New York, US

- AUM: N/A

- # of Portfolio Companies: 43

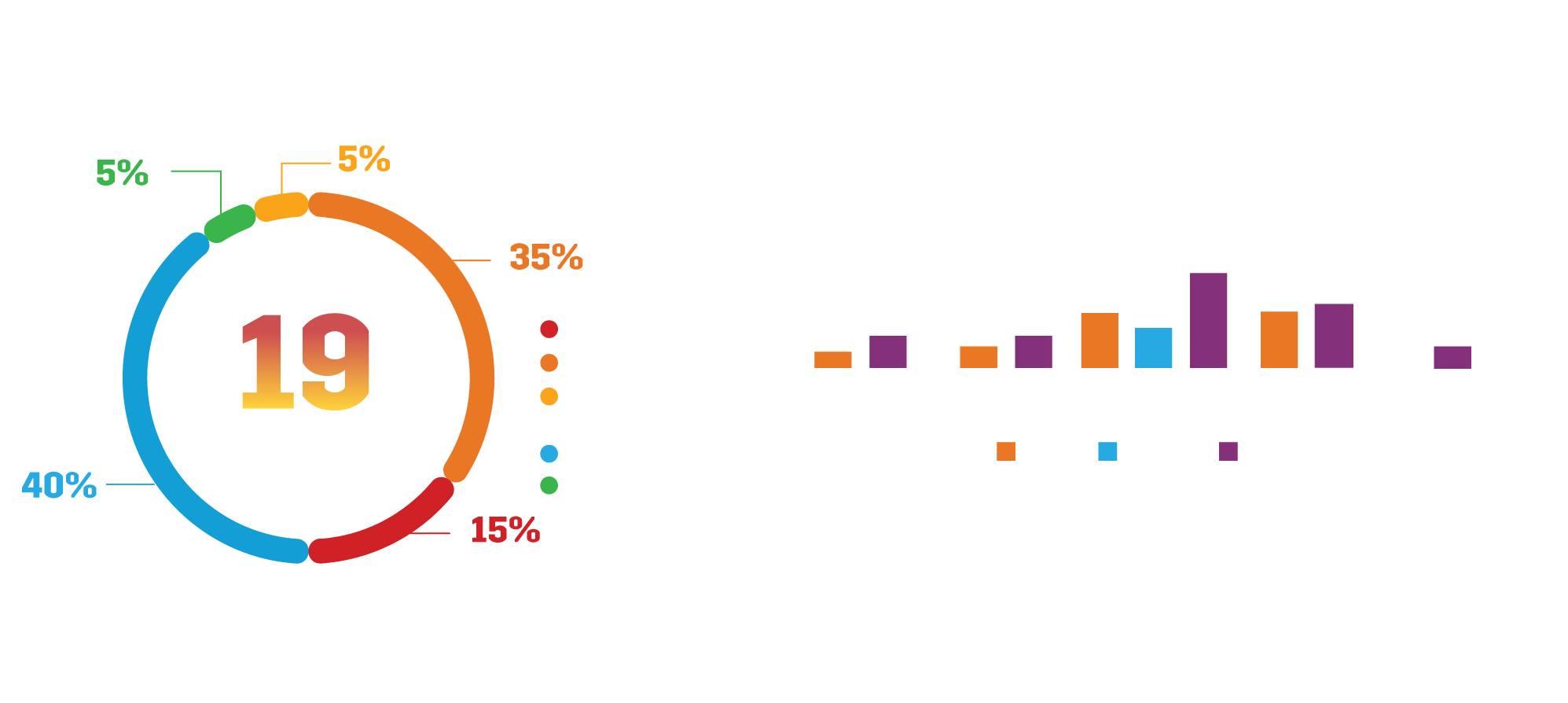

- % of companies in Egypt: 30%

- Total # of deals: 64 (* based on Crunchbase)

- Avg # of deals per year: 10-15

- Number of exits: 2

- Funding Stage: Seed, Series A

- Ticket Size: Upwards of US$ 100K

- Team Size: ~15-20

- Website: https://www.4dxventures.com/

4DX Ventures is a unique venture capital fund which has carved a niche as a Pan-African focused firm, deeply committed to connecting people, ideas, and capital to foster a thriving African continent and a dynamic global community. Its founders, Walter Baddoo and Peter Orth, bring a wealth of experience from their tenure at prominent institutions like Morgan Stanley, JP Morgan, and Bridgewater Associates. Their journey began with investing personal funds in African startups, including early successes like Andela and Flutterwave, which achieved unicorn status. In total, it has invested in over 40 companies, majority of which are based in the Middle East & Africa, and almost all have African founders.

In frame: 4DX Co-founders, Walter Baddoo and Peter Orth

4DX Ventures partners with extraordinarily bold and talented entrepreneurs at the forefront of Africa’s technology age. Its investment philosophy centers around early-stage funding, driven by comprehensive research, an extensive global network, and a rich local perspective, extending strategic, operational, and technical guidance to growing businesses. 4DX Ventures positions itself as a generalist, but most of its investments gravitate towards fintech, B2B e-commerce, healthcare, and logistics. The driving force behind their investment choices is the potential to solve foundational problems and tap into large markets, offering significant growth paths for the companies.

4DX Ventures’ investment strategy is intriguing. They typically invest from a few hundred thousand dollars to a few million, with a major focus on startups in Africa’s Big Four markets - Nigeria, South Africa, Egypt, and Kenya. This strategic focus is reflective of where most of the continent’s opportunities lie, however, the firm has also begun exploring investments in other countries, particularly in the Francophone region.

Since its inception, 4DX Ventures has been pivotal in backing some of Africa’s most iconic technology companies, although the fund is based outside of Africa. The firm ‘s first fund was just over US $20 million, and it completed the final close of its second fund at a staggering US $60 million in late 2021, surpassing its initial target due to overwhelming investor interest. 4DX Ventures has now kicked off the process to raise its third fund in less than two years after hitting the final close of its oversubscribed second vehicle. It is already in the process for raising US$ 100 million for its third fund, after the success of its first two funds.

With over 40 investments across Africa, the Middle East, and the US to date, and portfolio companies raising over $1.2 billion in follow-on funding, 4DX Ventures is a testament to the vibrancy and potential of the African tech ecosystem. It stands as a beacon of hope and opportunity, not just for startups but for the continent as a whole, driven by a team that believes in the transformative power of technology and entrepreneurship.

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)