MENA’s Startup Comeback: The VC Winter Has Thawed—And a New Era Has Begun

20 November 2025•

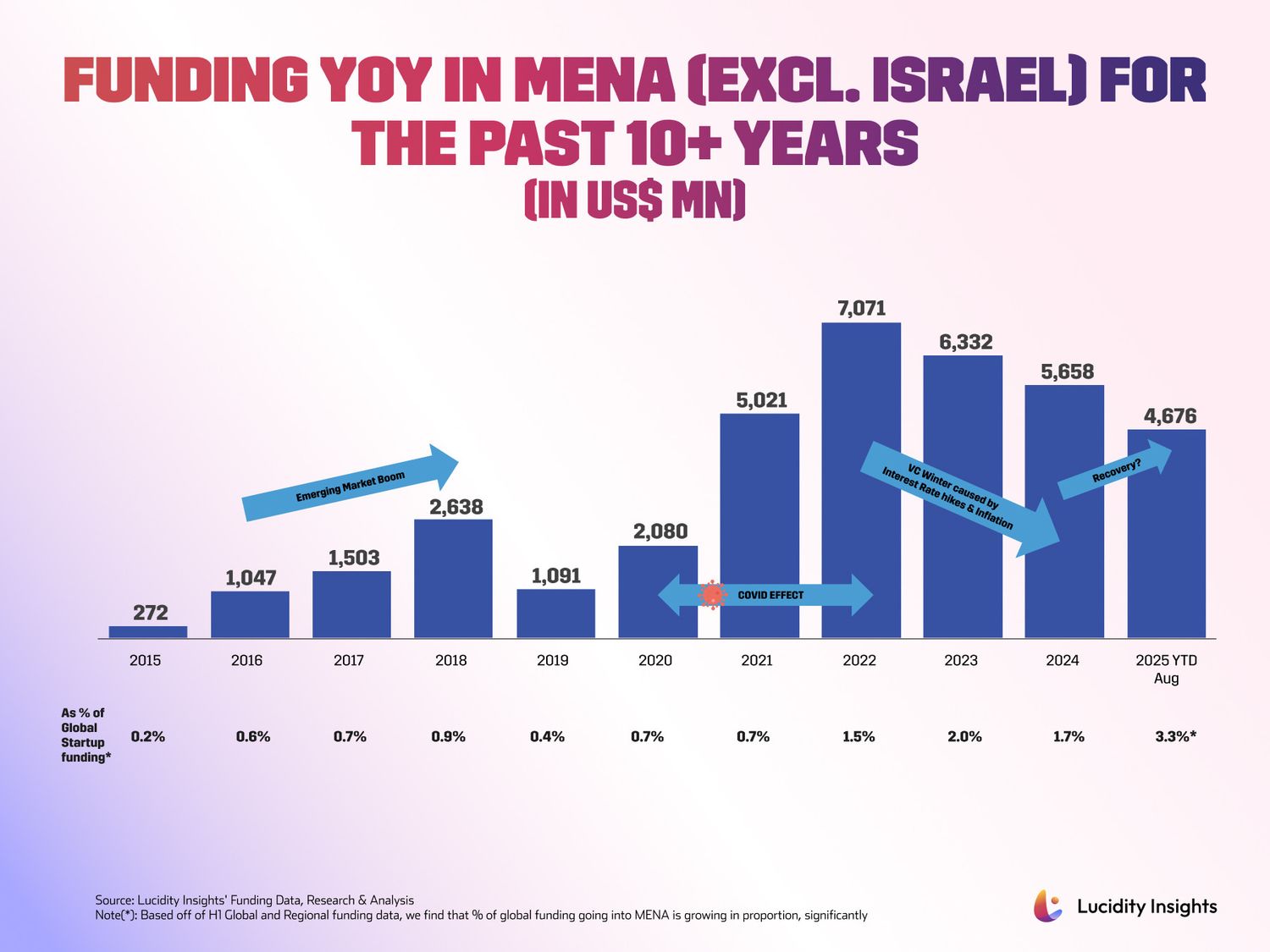

If you were anywhere near the venture ecosystem between 2022 and 2024, you lived through the chill. The global VC winter wasn’t subtle—it was a deep freeze. Rising interest rates, runaway inflation, and a sudden risk-off sentiment sent even the boldest investors burrowing underground. MENA, despite hitting its all-time funding peak in 2022, was not immune to the frost.

But here’s the headline: the thaw is here—and the landscape emerging from beneath the ice looks very different from the one we knew just a few years ago.

From Peak to Freeze to Rebirth

In 2022, MENA (excluding Israel) hit a record $7.1 billion in startup funding. Frothy? Yes. Unsustainable? Also yes. Those were the global easy-money days—0% interest rates, massive liquidity in the system, and a wave of FOMO that inflated valuations and deal volumes everywhere from Silicon Valley to Riyadh.

Then March 2022 happened. Central banks began hiking rates aggressively, culminating in the highest interest rate environment seen in decades by the end of 2023. The result: a global venture capital contraction, lower liquidity, fewer deals, and a recalibration of expectations.

But here’s the twist no one expected—MENA came out of the winter stronger than before. Funding levels in 2025 (as of August) reached $4.7 billion, setting the region firmly on track for a full-year comeback. Despite a decline in funding from 2022’s peak in the follow-on years, 2023 and 2024 still outperformed 2021 total VC funding in the region.

The Real Story: MENA’s Rise in Global VC Share

The more meaningful indicator isn’t the absolute amount of startup capital raised—it’s the region’s share of global startup funding. Back in 2022, even at a record high of $7.1B, the region only accounted for 1.5% of global VC financing.

Fast-forward to 2025: $4.7B raised between January to August represented 3.3% of global funding—an all-time record, and a powerful indicator of MENA’s rising strategic importance. Combine the rest of Africa and Israel’s funding, and the Middle East & Africa raises 6-7% of global VC capital; not an insignificant number.

The Middle East is no longer a peripheral player. It is becoming a global center of gravity for digital economy investment—led by the UAE’s D33 ambitions and Saudi Arabia’s Vision 2030 technology push. When global capital tightens, investors look for markets that are stable, liquid, and future-oriented. UAE and Saudi Arabia checked all three boxes.

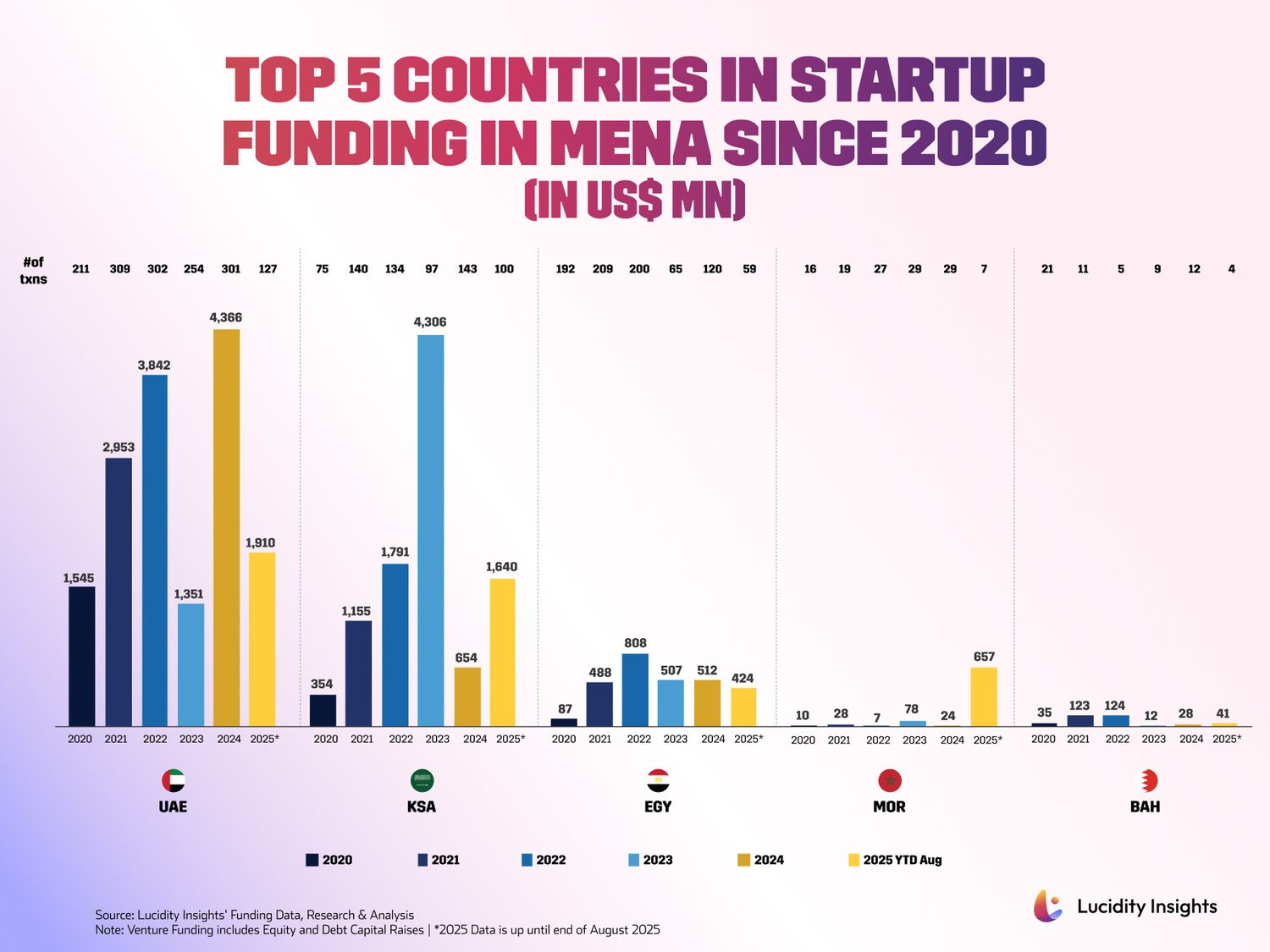

UAE vs Saudi Arabia: A Tale of Two Titans

The competitive energy between the UAE and KSA continues to shape the region’s investment landscape. Saudi shocked the region by out-funding the UAE in 2023; but the UAE reclaimed the crown in 2024 and is expected to hold it again in 2025.

Though some were sure “the tides had finally shifted” towards the Kingdom of Saudi Arabia becoming the future tech King, startup ecosystems are not built overnight. The reality is that Dubai remains the capital of scale-ups—home to 77% of all scale-ups in the region. Saudi’s tech ecosystem really started to birth in 2021, and had it’s big “coming out party” in 2023. Meanwhile, the UAE has a 15+ year history of building and its startup ecosystem, that really started to pick up steam in 2015. Because of this head start, UAE-based startups have also historically raised much larger rounds at every level from pre-seed, to Series B+. That said, tides are starting to change; Saudi’s massive public-sector stimulus is driving larger late-stage rounds—especially Series B+ deals where Saudi startups now raise roughly 2× what UAE startups do. As there is a clearer path to IPO exits for startups in Saudi Arabia, this might also explain a small but strong group of UAE-born Startups, relocating to Saudi Arabia in more mature stages of growth.

Translation: UAE dominates as the early-stage innovation engine. Saudi Arabia is making a name for itself as a scale-and-exit growth engine. Both ecosystems are now complementary poles of a unified regional market.

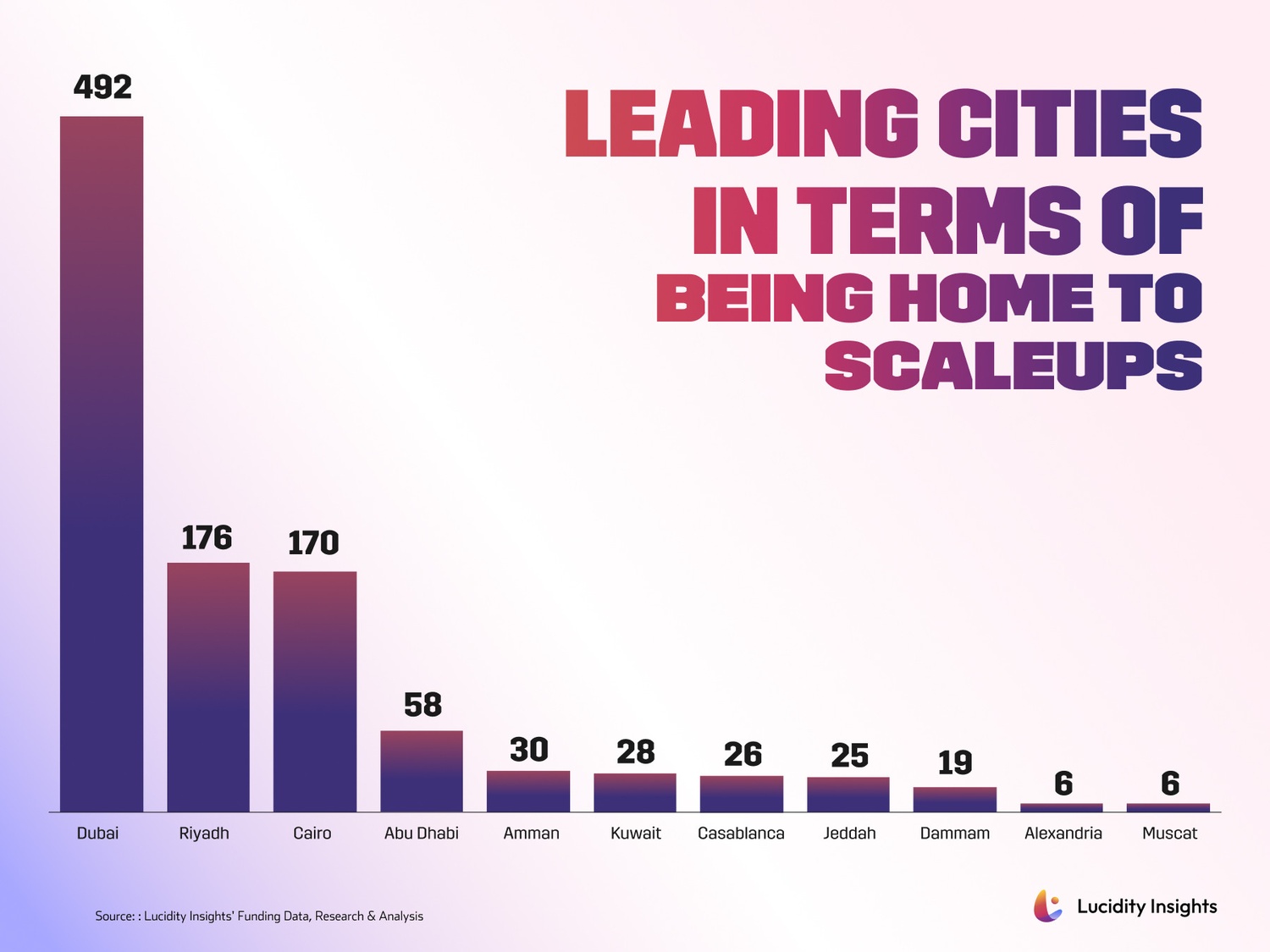

Dubai: The Undisputed Home of Scale-Ups

The numbers tell a story no one can debate:

- 492 scale-ups call Dubai home—almost 3x Riyadh.

- More than 50% of all MENA funding in the last 5 years went to Dubai-founded startups.

- The city attracts founders from Egypt, Jordan, Pakistan, Turkey, Kenya, the UK, and increasingly, the U.S. and Europe.

Dubai has become the region’s default global launchpad. Infrastructure + talent + capital + regulatory stability + lifestyle = a gravity force no other MENA city currently matches. And the signal is clear: the world’s sharpest founders want to build from here.

The Era of Fewer Deals—but Bigger Bets

One of the most revealing trends is the decline in transaction volume despite stable or rising funding amounts. Investors across the region are backing fewer startups, writing larger cheques, and doubling down on proven incumbents.

This is classic post-correction behavior. When uncertainty rises, capital consolidates.

But there’s a consequence: for early-stage founders, the odds of landing institutional capital are now tougher than ever. Lucidity Insights research shows only 2% of startups that seek VC funding in the region actually receive it— that’s tougher than getting into Harvard (3.9%). That said, nearly half of all startups (45%) that manage to successfully fundraise at least one round, manage to fundraise at least US $1 million. And in today’s AI-powered market, all investors will tell you, a million dollars today goes a long way, perhaps equivalent to $5 million in 2020. (Check out Shorooq’s Omar Zabit talking about how AI has changed the game for Building Startups in this episode of The Perfect Pitch Podcast)

The message to founders is sobering but empowering: You must become fundraise-ready long before you meet an investor. The ecosystem no longer rewards “promise.” This isn’t Silicon Valley, where they’ll give you $2 million for an idea on paper. MENA VCs are more risk averse, and they reward traction, clarity, and execution.

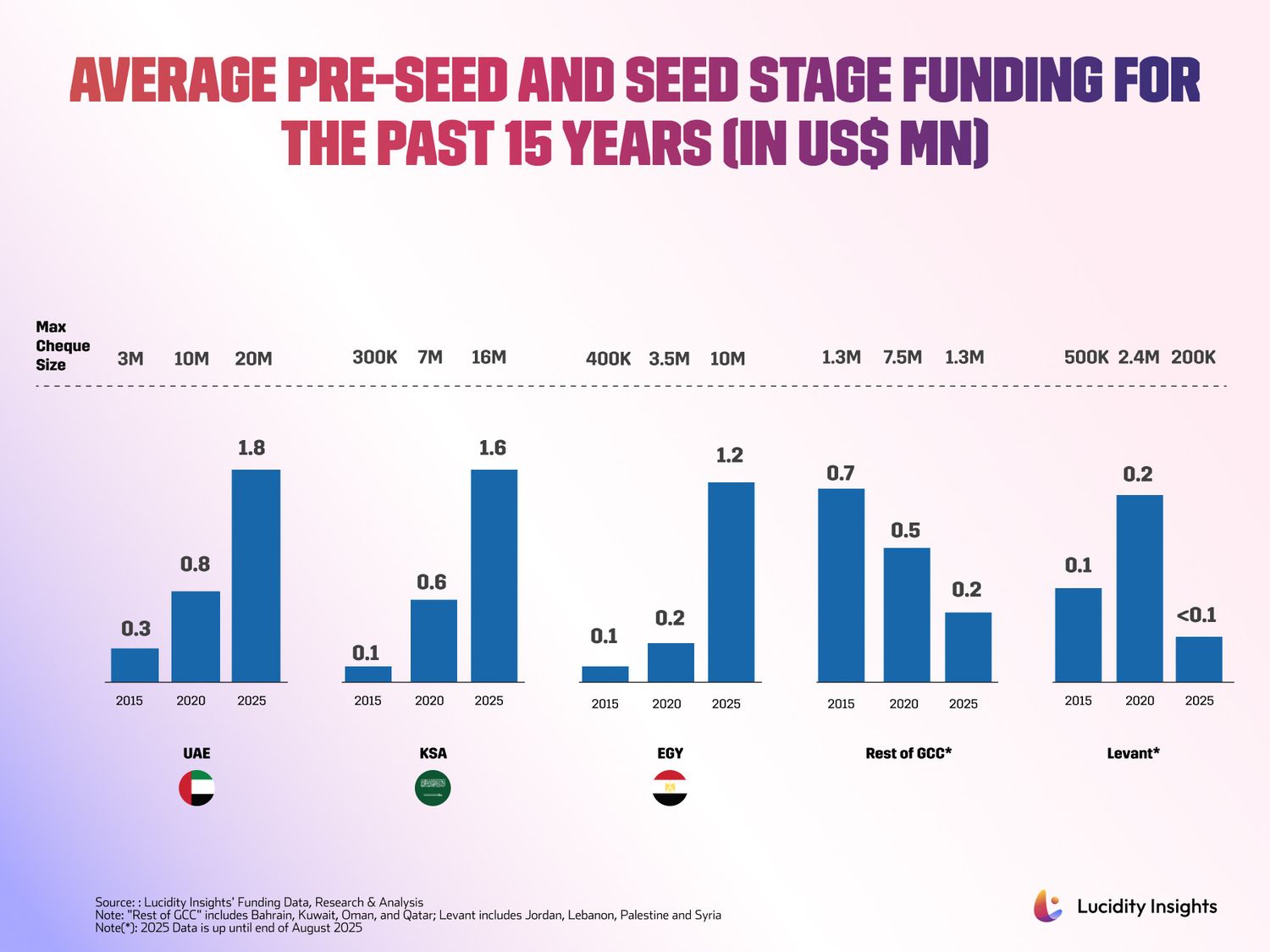

Cheque Sizes Are Rising Across the Region

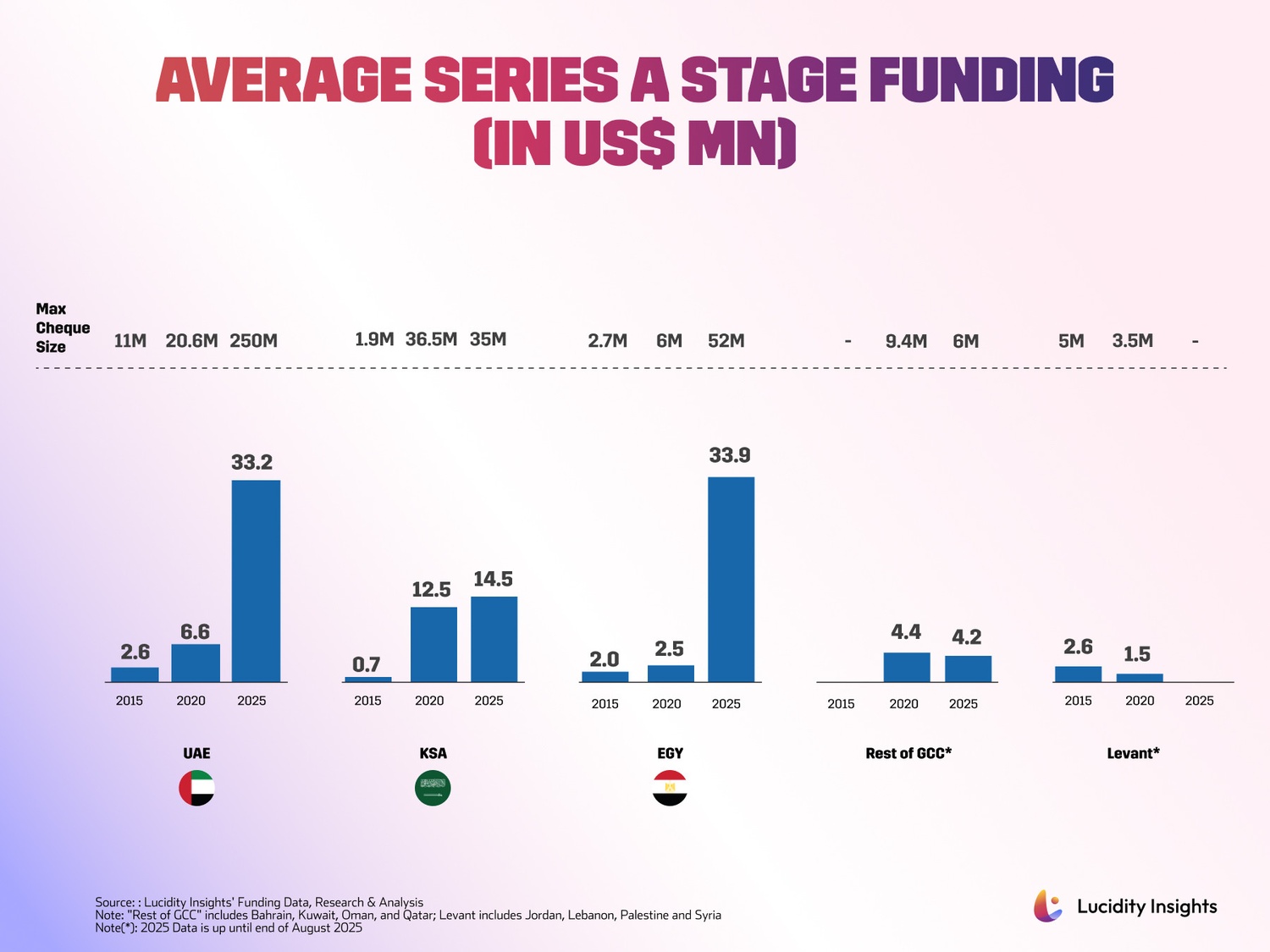

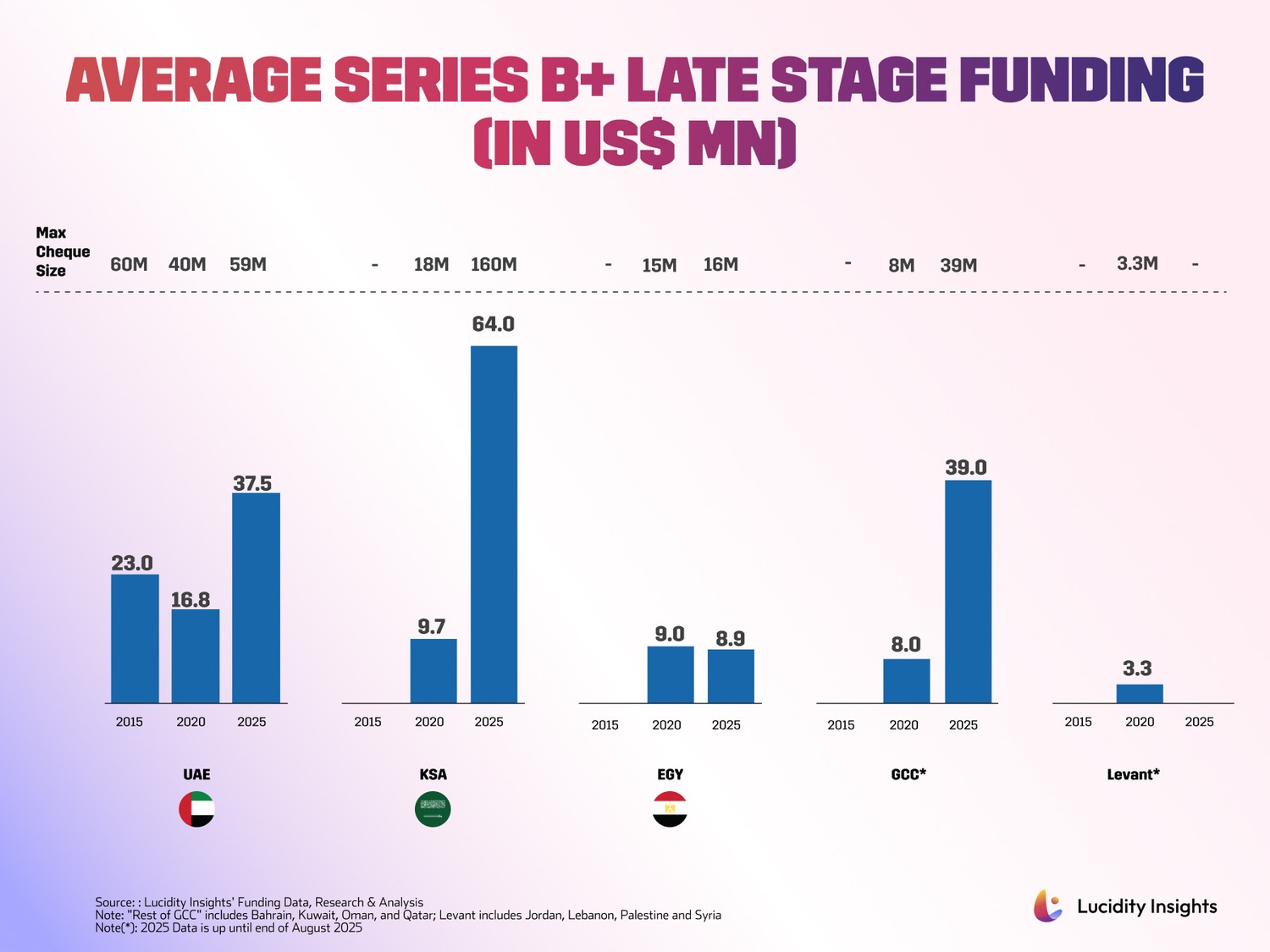

Despite the VC winter, average round sizes increased across UAE, KSA, and Egypt at nearly every stage over the past 5-10 years.

- Pre-Seed & Seed: UAE leads, followed by KSA and Egypt

- Series A: KSA has now caught up to UAE

- Series B+: Saudi startups are now out-raising UAE startups dramatically at growth stage

Unfortunately, the rest of the GCC and the Levant have fluctuated, or are in decline. These are places where ideas are incubated, and the strong entrepreneurs in these markets find accelerators, incubators or platforms to launch out of the UAE, KSA or Egypt.

The Unicorn Era: 30 and Counting

MENA’s unicorn club has expanded rapidly:

- UAE: 16 unicorns

- KSA: 8 unicorns

- Egypt: 3 rising giants

- The broader region: 30 unicorns total

From Careem and Kitopi to Tamara, Tabby, XPANCEO, and Ninja—the region is producing billion-dollar companies across fintech, mobility, cloud, AI, marketplaces, and logistics.

This pace is not slowing down. Both Vision 2030 and Dubai’s D33 Agenda explicitly prioritize unicorn creation—meaning the environment is engineered to produce more.

Despite all this momentum, MENA still faces a critical challenge: not enough scale-stage capital. Many startups can raise pre-seed to Series A in the region. But Series B, C, and pre-IPO rounds are still highly concentrated—and often require international capital or sovereign backing. Debt financing is a new instrument that has only become available in recent years in this part of the world. This is the next frontier. And it will determine whether MENA builds not just unicorns, but perhaps one day, decacorns.

The Takeaway

The VC winter forced founders and investors to reset. It brought discipline. It brought a focus on fundamentals, and it ushered in a new era where MENA doesn’t just chase global benchmarks—it begins to play a role in shaping them. 2025 is more than a recovery year.

It’s the beginning of the region’s global ascent as a digital-first economic powerhouse.

The winter is over; and the ecosystem that has emerged is tougher, wiser, and more resilient than ever.

%2Fuploads%2Fdubai-startup-guide-2024%2Fcover.jpg&w=3840&q=75)