Turkey's Path to Unicorn-dom

19 February 2024•

In the competitive arena of venture capital and technological innovation, Turkey is stepping out of the shadows of its regional contemporaries.

*Edited on 11 March 2024.

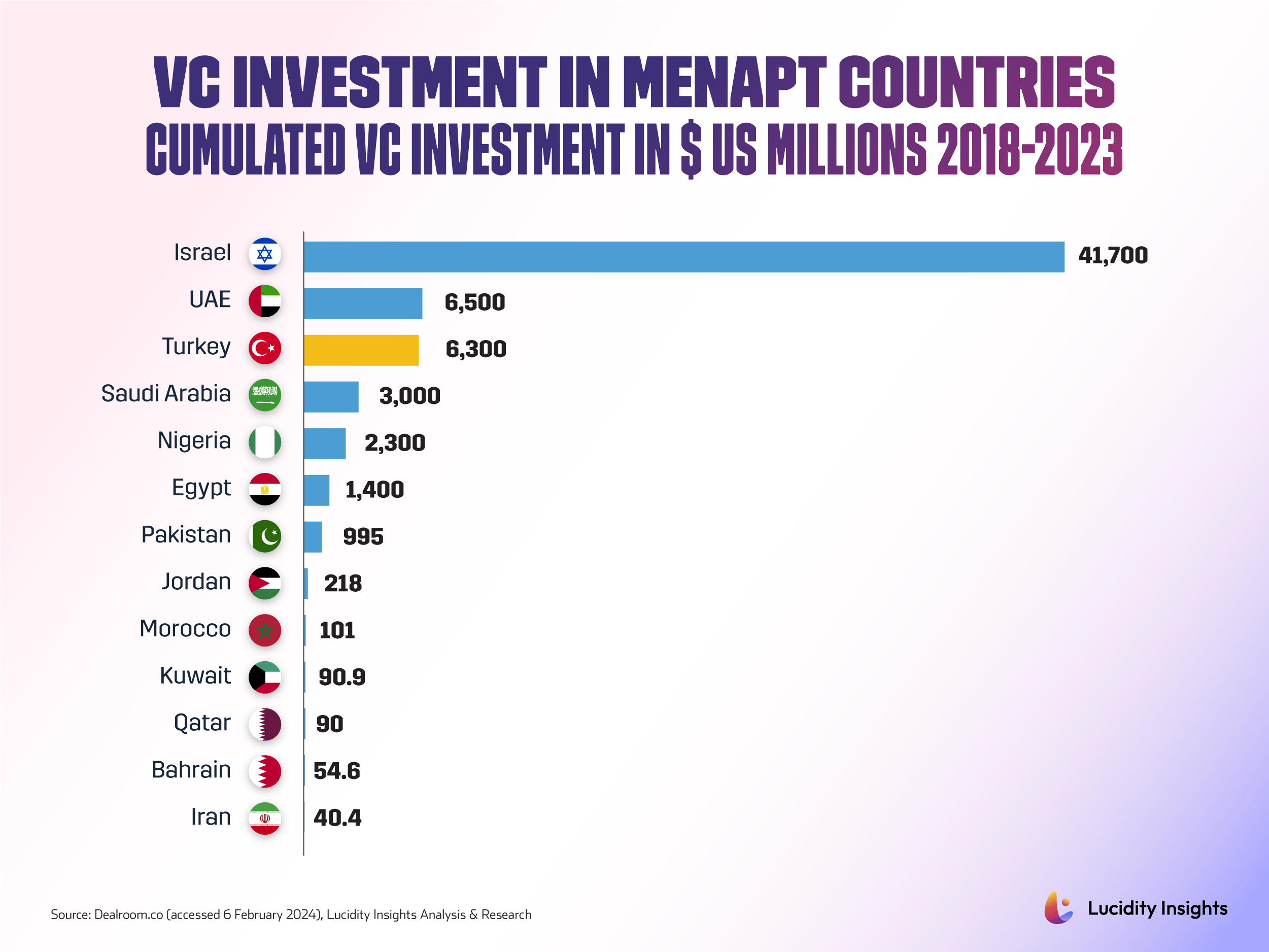

Turkey ranked 3rd in MENAPT for cumulative VC investments raised in the six years between 2018 and 2023, just behind Israel and UAE, ranking 1st and 2nd respectively.

Infobyte: VC Investment in MENAPT Countries 2018-2023

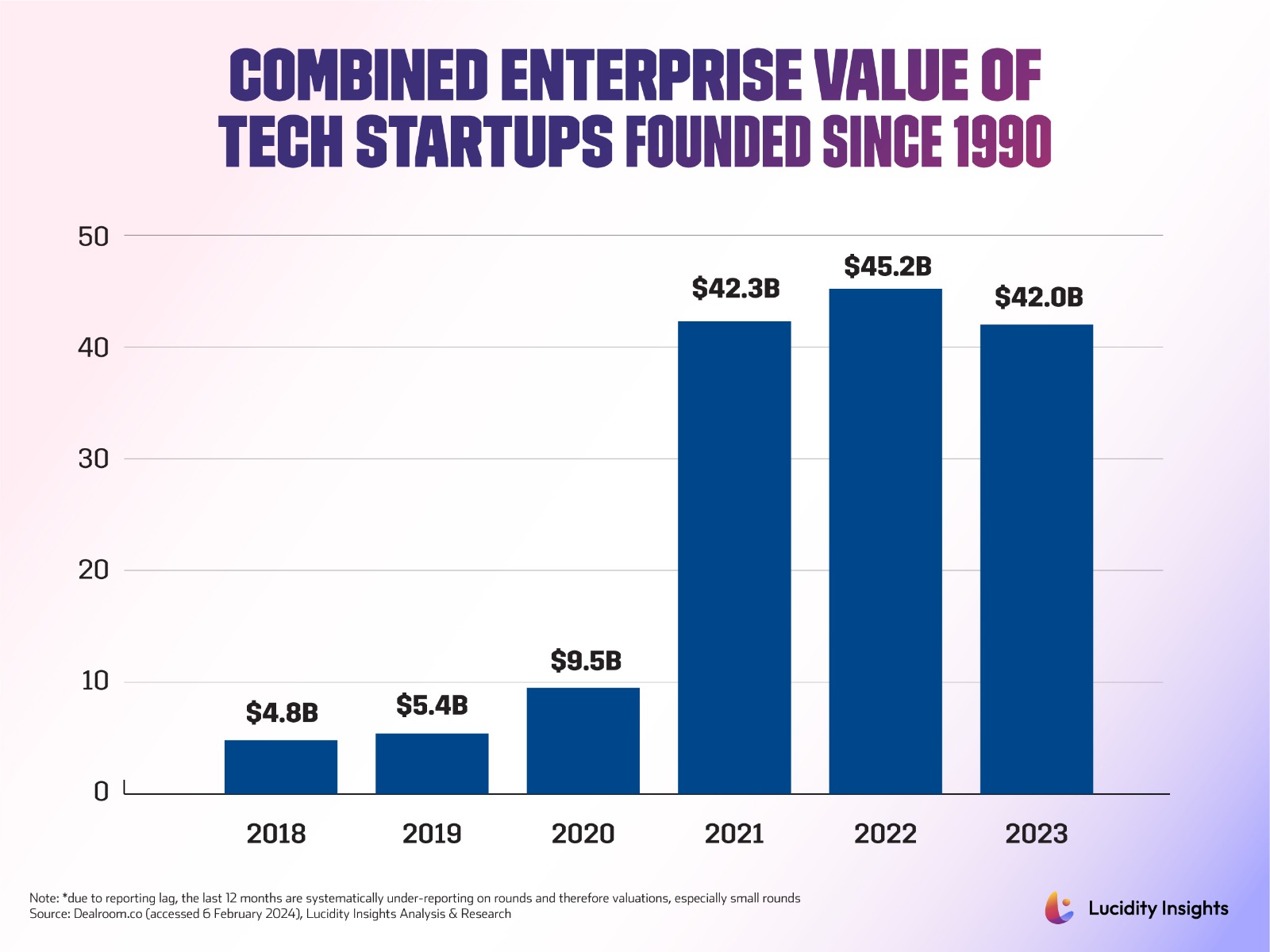

After a decade of cultivating talent, fostering innovation, and building investor confidence, the Turkish startup ecosystem achieved its highest enterprise value growing tenfold from US $4.8 billion in 2018 to a remarkable US $45.2 billion in 2022. Of course, just as seen everywhere else on the planet, there have been market valuation corrections in 2023, as the VC winter continues to set in – but what Turkey has been able to achieve in a remarkably short period of time, is head-turning.

Infobyte: Turkey’s Tech Startups: Road to Multi-Billion Combined Enterprise Value

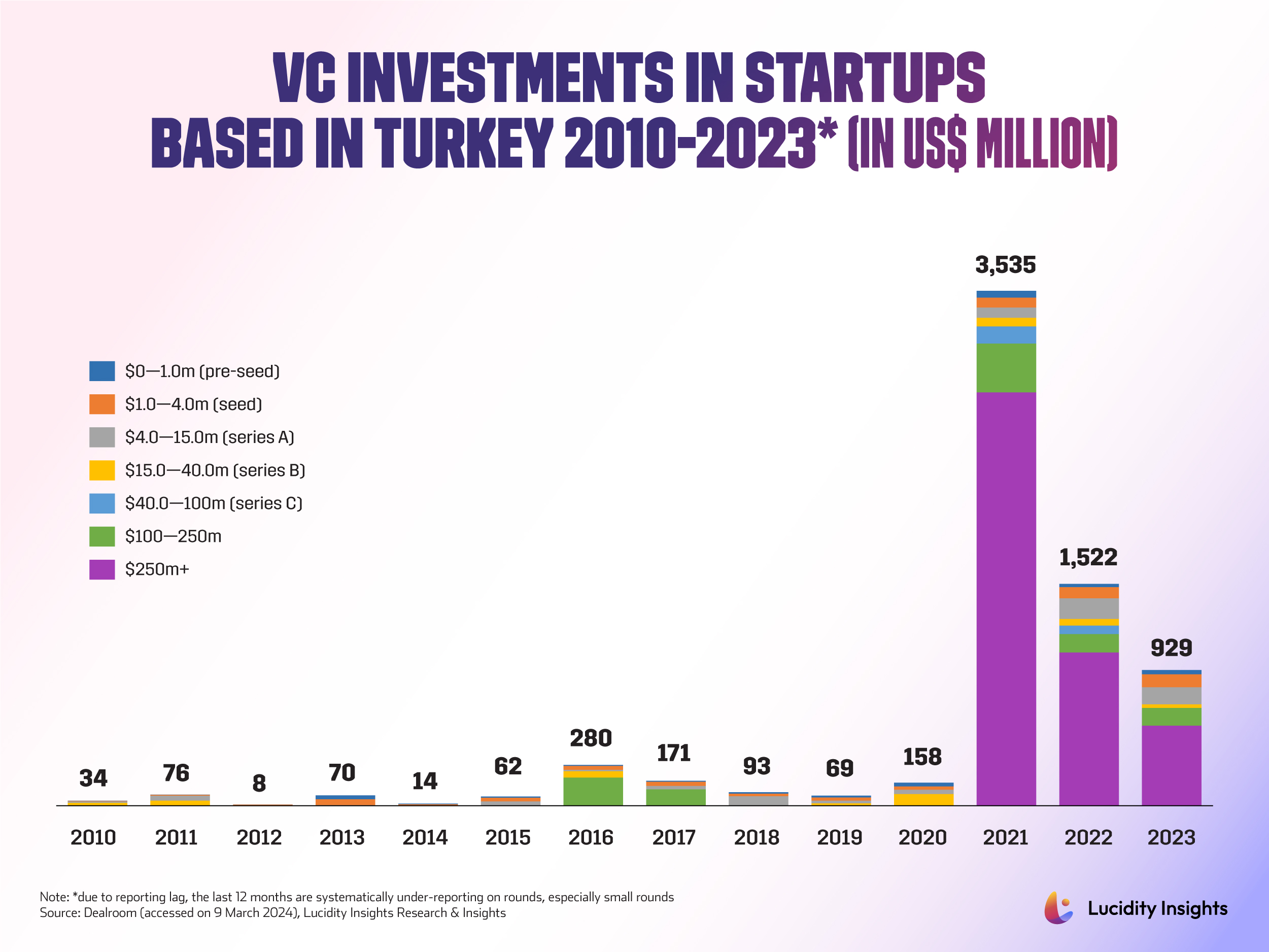

Investment in Turkish startups averaged US $100 million annually between 2010 and 2020 – a very modest figure in the global startup landscape; but 2021 marked a seismic shift, when over US $3.5 billion was invested in Turkish startups, surpassing the total investment of the previous ten years, combined (in a single year)!

Infobyte: VC Investments in Startups Based in Turkey 2010-2023

The recent surge in Turkey's startup ecosystem can be attributed to a potent combination of longstanding latent talent and a significant influx of new funding, both domestic and foreign, particularly from the US and Asia. This influx has catalyzed the emergence of 'renaissance entrepreneurs' — dynamic pioneers who are not only launching new ventures but are also reinvesting in the ecosystem as angel investors, mentors, or limited partners in venture capital funds. This development has fostered a self-sustaining ecosystem, increasingly drawing international attention and investment.

While Turkey's market had the requisite talent for many years, it was the recent increase in funding, driven by both local and international success stories, that accelerated the rise of unicorns and positioned Turkey prominently on the global innovation map.

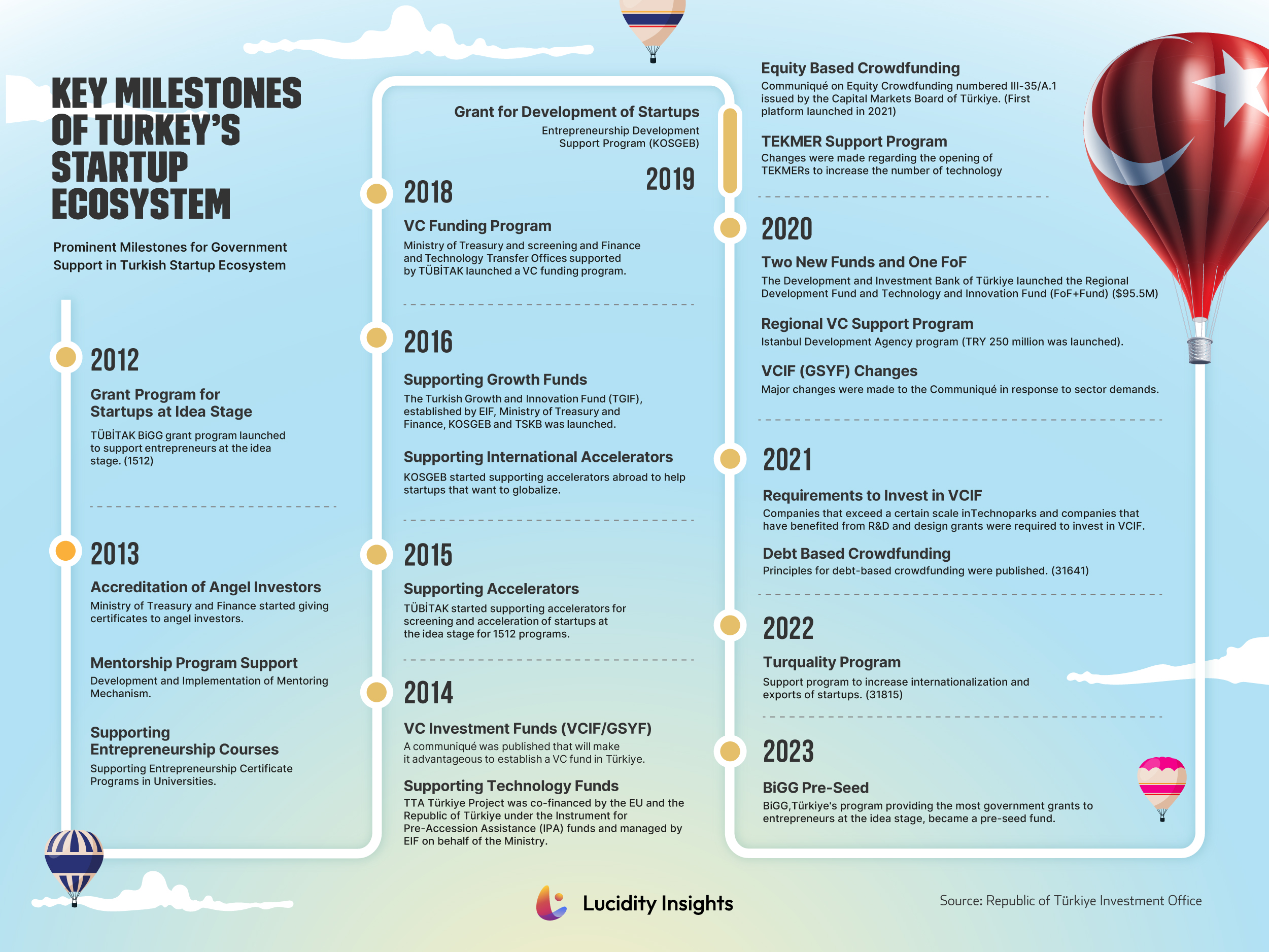

Infobyte: Key Milestones of Turkey’s Startup Ecosystem

Turkey's emergence as a notable player in the global startup scene is marked by the rise of unicorns across multiple sectors. The initial wave of unicorns comprised local powerhouses in consumer-focused areas like e-commerce, food delivery, and payments. This was followed by significant successes in the gaming sector, which has become a vibrant and influential part of the Turkish startup landscape. There have been optimistic predictions about Turkey's potential to produce new gaming unicorns annually, reflecting the sector's dynamic growth.

More recently, a third wave is emerging within the B2B SaaS space, targeting mid-range clients with services ranging from US $1,000 to US $10,000 monthly. This sector's expansion has been notable, contributing to the country's growing list of unicorns. Since 2020, Turkey has successfully introduced 7 unicorns to the world, a significant achievement considering none existed before this period. These developments not only highlight the diversification of Turkey's startup ecosystem but also its ability to adapt and excel in various technology domains.

Infobyte: List of Turkey’s Unicorns

The unicorn journey started with Peak Games, the gaming powerhouse that became Turkey's first unicorn valued at a staggering US $1.8 billion in 2020, following its acquisition by American social gaming giant, Zynga, in 2020 (now part of Take-Two Interactive Software since its acquisition for US $12.7 billion in 2022). Turkey being home to more than 30 gaming studios worth over US $100 million each, this milestone marked the beginning of a new era for Turkish gaming startups.

Hot on its heels was Getir, a dynamic player in the "quick" commerce or Q-commerce space; they quickly rose to prominence with its rapid grocery delivery model and achieved a valuation of US $11.8 billion in 2022; this cemented their position as a major force in the tech ecosystem when it became a decacorn by the end of the pandemic. In 2023, Getir saw its valuation slashed to US $2.5bn when it raised a down-round, a telling trend on how high-interest rates and the extended downturn in venture capital markets is shifting fundraising dynamics and forcing valuation corrections across the world.

Trendyol, leading the MENA region as the largest mobile commerce company, became Turkey's third unicorn and second decacorn, underscoring its substantial impact and success in the digital commerce landscape. Trendyol was last valued at around US $15bn.

Meanwhile, Dream Games, renowned for its creativity and engaging content, stands out as Turkey's fourth unicorn, and second unicorn in the video game development sector. A few days later, HepsiBurada, an e-commerce business, becomes the first Turkish firm to IPO on Nasdaq hitting a US $3.9 billion valuation becoming the 5th Turkish unicorn.

Software company, Insider, emerged as Turkey's sixth unicorn with investments from renowned funds such as Sequoia Capital and Riverwood Capital, valued at just over US $1.1bn. The latest addition to this illustrious group is Papara, an electronic payments firm that joined the Turkish unicorn club in July 2023. With over 18 million active users, Papara has become a symbol of Turkey's rapid adaptation to digital payment solutions and its growing fintech sector.

"The Turkish government has been increasingly proactive in nurturing the fintech sector, recognizing its potential to revolutionize financial services and contribute to economic growth," says Ahmed Faruk Karslı, Founder of Papara. "On the regulatory front, Türkiye has made significant improvements. Legal reforms have streamlined the once-complicated processes for businesses, allowing startups to concentrate more on innovation. Various investment channels are injecting much-needed capital into these ventures, with a keen eye on governance and regulatory compliance. This multi-faceted support validates the significance of fintech in Türkiye's economic landscape and signals a strong commitment to fostering a competitive and compliant sector that can stand up to global standards."

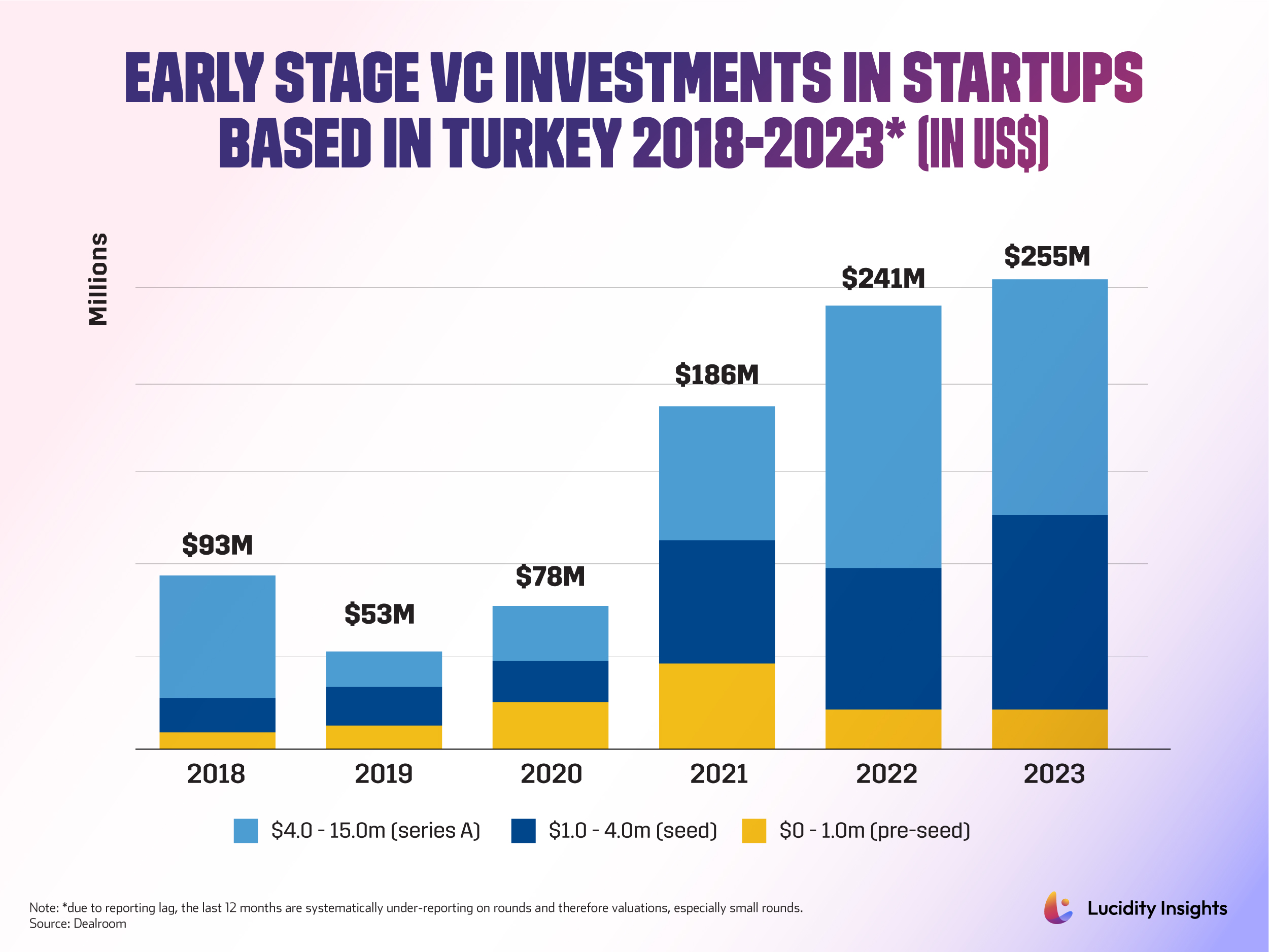

Infobyte: Early Stage VC Investments in Turkey's Startups (2018-2023)

Early-stage funding in Turkey reached an all-time-high in 2023 totaling US $255 million. This growth trajectory is further supported by significant infrastructural developments: as reported by the Republic of Türkiye Investment Office, there has been a nearly fivefold increase in accelerator programs, a sevenfold rise in incubation centers, and a thirteenfold expansion in co-working spaces from 2010 to 2017, illustrating a robust and rapidly maturing ecosystem conducive to startup innovation, entrepreneurship, and digital nomad lifestyles.

Turkey's startup ecosystem stands at a pivotal juncture, not just as a regional leader but as an emerging global hub of innovation and entrepreneurship, setting the stage for a future rich with potential and groundbreaking achievements.

Infobyte: The 12 Most Funded Startups in Turkey (Until January 2024)

When we look at the most funded startups in Turkey, we see a healthy diversity of startup sectors from gaming, q-commerce, e-commerce, advertising, and even some deep-tech and AI/ML players, and more. Funding raised for the top 12 most funded startups in Turkey (to date) range from US $58 million all the way to US $2.26 billion (Getir); and these dozen well-funded startups have fundraised a total of US $5.89 billion between themselves alone.

Interestingly, the two oldest startups on the most funded list were established in 2010, but nine out of twelve of these startups have been founded in 2015 and beyond. Only time will tell what the next generation of Turkish startups will bring.

%2Fuploads%2Ffoodtech-2%2Fcover15.jpg&w=3840&q=75)