May 2024 - Top 5 Funded Startups in MENAPT

10 June 2024•

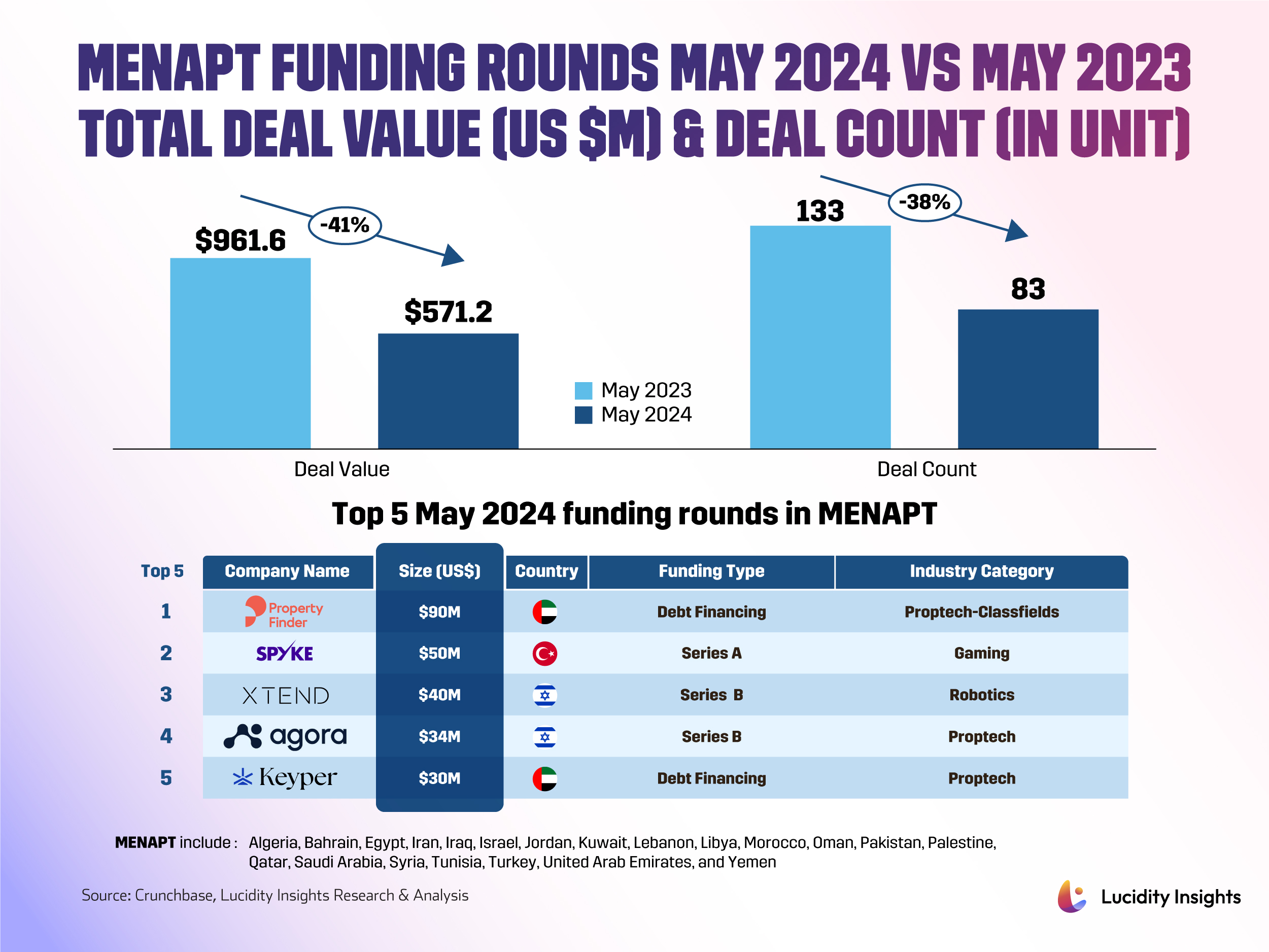

The VC scene in the MENAPT region has experienced some shifts in funding dynamics recently, particularly influenced by megarounds that propelled a significant year-over-year spike in deal value in April 2024. By contrast, May 2024 saw a notable YOY decline, with total deal value dropping by 41% from $961.6 million in May 2023 to $571.2 million in May 2024. This decline was paralleled by a 38% decrease in deal count, from 133 in May 2023 to 83 in May 2024, notably absent of any megarounds.

Despite this drop in total deal value as last month's figures were skewed by a significant outlier megaround, month-on-month comparison from April to May 2024 reveals an increase in the number of deals. Proptech has clearly taken the lead, securing three of the top five funding rounds this month. Following behind are gaming and e-commerce, which continue to attract substantial investments as the year unfolds.

Infobyte: MENAPT Funding Rounds: May 2024 vs May 2023

#1 - Property Finder | Proptech

Dubai, UAE | US $90 Million Debt Financing

Founded in 2007 by Michael Lahyani and Renan Bourdeau, the Property Finder Group is a leading tech company that aims to offer the best property experience in the MENAPT region. Property Finder provides a platform for property listings, real estate search, and property management, as their websites, apps, and tools help users find, buy, sell, or rent properties. Property Finder has expanded across the region, including Qatar, Bahrain, and Egypt, with a focus on Saudi Arabia and Turkey, competing with platforms like Dubizzle and Bayut.

Property Finder recently secured US $90 million debt financing from Francisco Partners to repurchase shares from its initial investor, BECO Capital, amidst ongoing domestic and international interest in the UAE's thriving real estate market. BECO Capital, which has previously invested in notable companies like Careem and Fetchr, has exited its investment in Property Finder with a significant return.

Michael Lahyani, CEO and founder of Property Finder, commented, ”The trust that the BECO Capital team and Dany Farha invested in us, since backing us 11 years ago, underscores the quality of our operations and the resulting outcomes. Our commitment to the real estate market stands firm, as we aim to continue to drive strong returns for our ecosystem. It is my hope that this event sets the precedent for other founders in the region to take their innovative companies to new heights, attracting global talent and, in turn, creating the returns that fuel the entrepreneurial ecosystem across MENA.”

#2 - Spyke Games | Gaming

Istanbul, Türkiye | US $50 Million Series A

Founded in 2020 by Fuat Coşkun, Mithat Madra, Remi Onur, and Rina Onur Sirinoglu, Spyke Games is a game development firm based in Istanbul focused on creating competitive mobile games that engage and thrill players through visual aesthetics, characters, storytelling, and data analytics. Their portfolio includes games such as Royal Riches, Blitz Busters, and Tile Busters. Tile Busters has generated over US $38.6 million in lifetime in-app purchase revenue, with October 2022 seeing a high of $5.2 million.

In 2022, Spyke Games secured US $55 million in Seed funding from Griffin Gaming Partners, one of the largest Seed funding rounds disclosed for any gaming company. They recently received a US $50 million investment from Moon Active, which now holds a 15.9% stake in the gaming company, placing Spyke Games' valuation at about $315 million.

The partnership with Moon Active offers significant support for Spyke Games, and investors' confidence in Spyke Games is thanks to its founding team of former C-level executives from Peak and Riot Games. They are known for their experience in leading large companies, scaling major projects, and securing significant funding, indicating Spyke Games' potential for future funding rounds and new game launches before considering any exit strategies.

#3 - XTEND | Robotics

Tel Aviv, Israel | US $40 Million Series B

Founded in 2018, XTEND is a technology company that develops solutions for interacting with drones and other unmanned machine technologies. Focused on both indoor and outdoor applications, they combine virtual reality, sensor fusion, and "mark and fly" capabilities to empower drone operators, improve tactical decision-making, and enhance overall situational awareness. Their wearable, lightweight controller based on natural hand gestures allows humans to virtually "sit inside" the drone during tactical missions, enhancing situational awareness and decision-making.

XTEND has now raised $40 million in a Series B funding round to further develop its AI-powered operating system, XOS. Led by Chartered Group, the funding saw substantial investments from both new and returning strategic investors, including Clal-Tech. This capital infusion will be used to enhance XTEND’s proprietary XOS operating system, which plays a crucial role in complex and risky enterprise and security applications worldwide. Additionally, XTEND aims to boost the global sales of its drones and robotics offerings.

#4 - Agora | Proptech

Tel Aviv, Israel | US $34 Million Series B

Agora was founded in 2019, Agora is a proptech/fintech SaaS platform that enables real estate firms to automate back-end processes and increase operational efficiency. Agora provides customizable and secure software for operational and financial service offerings such as payments, taxes, IRA investments, and liquidity solutions. They help real estate firms globally manage over 70,000 investors and $150B AUM across every single asset class, and have achieved threefold revenue growth year-over-year. Operating in North America, Europe, and Israel, with the U.S. being its prime target market, Agora plans to expand into Australia and Latin America as well.

The company recently closed a US $34 million Series B funding round led by growth fund Qumra Capital, along with Insight Partners and Aleph. "This funding will empower us to expand our company, allocate resources towards research and development, particularly in operational and financial services such as payments, tax, IRA investments, and liquidity solutions, and continue building the best real estate investment experience in the market," says Agora CEO, Bar Mor.

#5 - Keyper | Proptech

Dubai, UAE | US $30 Million Debt Financing

Founded in 2022 by Omar Abu Innab and Walid Shihabi, Keyper is a Rent Now Pay Later (RNPL) startup aimed to revolutionize real estate transactions and property management in the region, making them seamless and efficient. Keyper offers a property management platform that allows tenants to track expenses and pay rent online, while investors gain access to real estate portfolios and data-driven insights. In 2024, Keyper onboarded 3,000 residential units worth US $2 billion, processed over US $10 million in annual rent payments, and deployed over US $1 million in annual rent facilitation.

Keyper just raised $4 million in pre-series A funding and secured an additional $30 million through Shariah-compliant sukuk financing. The funding round was led by Dubai-based BECO Capital and Middle East Venture Partners, while the sukuk financing was arranged with Franklin Templeton Investments (ME) Ltd. The funds will be used to digitize the rental experience in the UAE and to scale Keyper’s (RNPL) solution, allowing landlords to receive their annual rents upfront while tenants will benefit from the flexibility of paying their rent in monthly installments using credit or debit cards and other digital payment methods.

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)