April 2024 - Top 5 Funded Startups in MENAPT

13 May 2024•

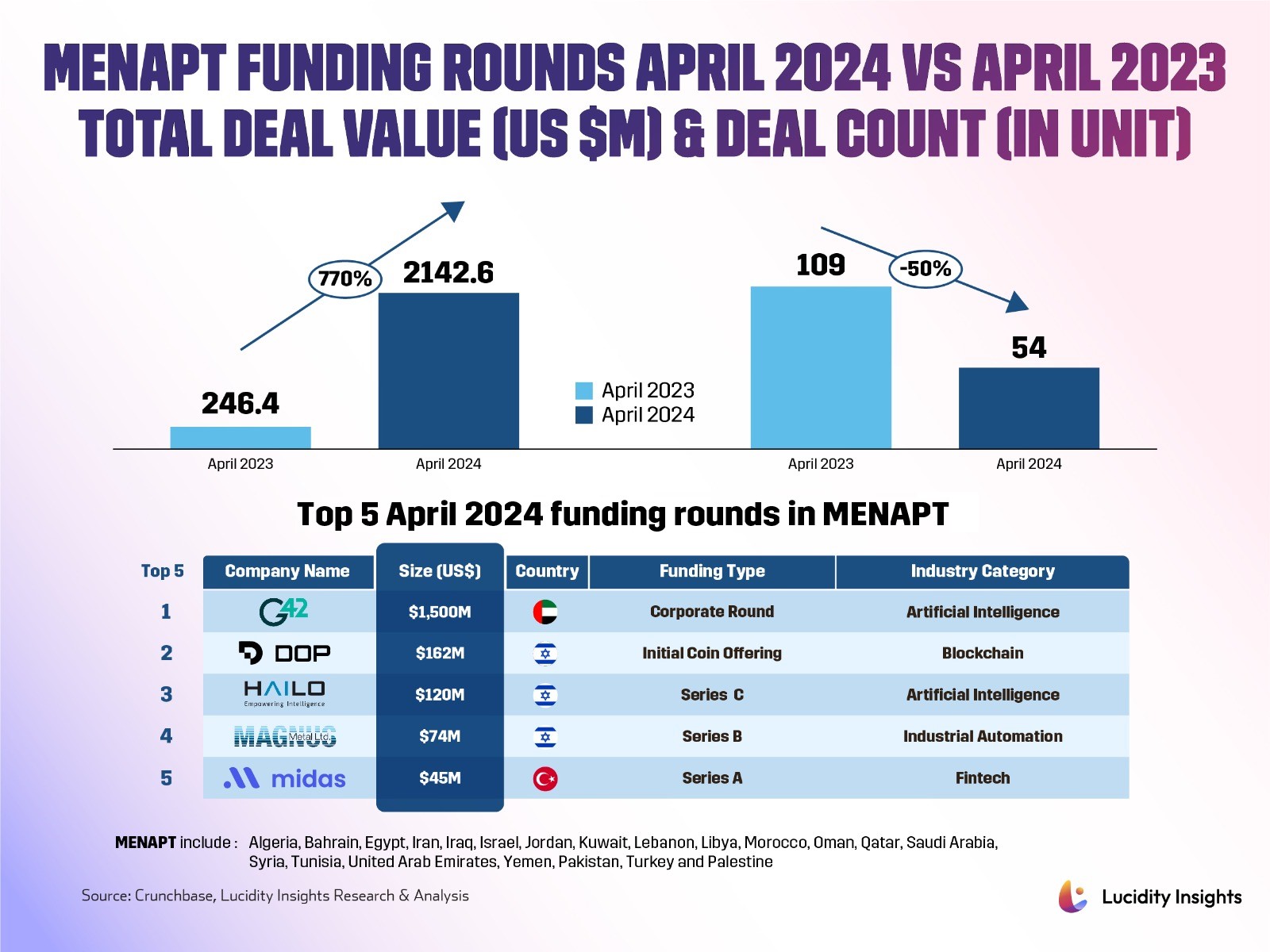

Unlike the constant declines seen in funding rounds of Q1 2024, April marks the first YOY increase in total deal value with a significant incline of 770% from $246.4 million in April 2023 to $2,142.6 million in April 2024. The sharp increase was driven by 3 megarounds including G42, an AI company raising US $$1.5 billion. Deal count decreased by 50% from 109 deals in April 2023 to 54 deals in April 2024.

Infobyte: MENAPT Funding Rounds April 2024 vs April 2023

#1 - G42 | Artificial Intelligence

Abu Dhabi, UAE | US $1.5 Billion Corporate Round

Group 42 Holding Ltd (G42) is an AI development holding company established in Abu Dhabi in 2018 that specializes in AI solutions across the government, healthcare, finance, oil and gas, aviation, and hospitality industries. Chaired by National Security Advisor of the UAE, Sheikh Tahnoon bin Zayed Al Nahyan, G42 has become a leader in the UAE’s hub of innovation driving technological advancement and excellence. Tailored to meet the UAE’s unique needs, G42 Cloud Services provide scalable, secure, and efficient solutions for businesses and organizations in the region. With a team of 20,000 scientists and engineers, G42 has published 300+ research papers surrounding AI evolution and applications and advanced tech across industries over the last 3 years.

G42 reached unicorn status in 2022, and now the company has received a US $1.5 billion investment by Microsoft. As the largest private round to go to an AI startup this year, this round comes as another move in the tech titan’s AI takeover. This collaboration will bring the latest Microsoft AI technologies and skilling initiatives to the UAE, empowering organizations of all sizes in new markets to harness the benefits of AI and the cloud in line with world-class standards in safety and security.

G42 CEO, Peng Xiao, said: “This partnership significantly enhances our international market presence, combining G42's unique AI capabilities with Microsoft’s robust global infrastructure. Together, we are not only expanding our operational horizons but also setting new industry standards for innovation.”

Samer Abu-Ltaif, Microsoft Corporate Vice President and President for Central and Eastern Europe, Middle East and Africa region, added: “Our investment in G42 stands as a testament to the thriving and dynamic tech landscape in the UAE and the broader region. This strategic partnership is well-positioned to ignite opportunities for our customers and partners, accelerate innovation, and fuel economic growth.”

#2 - Data Ownership Protocol | Blockchain

Tel Aviv, Israel | US $162 Million Initial Coin Offering

Founded by Kohji Hirokado in 2023 and built on Ethereum, the Data Ownership Protocol (DOP) aims to enhance user control over personal data in the Web3 space by allowing selective transparency. DOP grants users the autonomy to decide what information they want to disclose or keep private on blockchain and decentralized platforms through selective disclosure of transactions, zero-knowledge cryptography, and dynamic context-based permissioning. DOP also supports an internal ecosystem for developers to create marketplaces and DeFi applications, fully compatible with major Ethereum wallets and services. By promoting customizable data control, DOP ensures that as blockchain technology evolves, user privacy and consent remain priorities, making selective transparency feasible.

DOP recently raised US $162 million through a pre-launch token sale of its $DOP token, marking it as the ninth-largest token sale in history and the first to surpass US $150 million since 2018. “It’s been a while since the crypto world has seen a token sale quite like this, and it underscores our innovative approach to data ownership. By leveraging blockchain technology, we aim to empower individuals with complete control over their data, ensuring privacy, security, and the opportunity to partake in the value it generates,” commented Hirokado.

This landmark sale reflects DOP's commitment to using blockchain technology to allow selective transparency, enabling users to decide how they encrypt and share their information, thereby maintaining a balance between privacy and transparency. The support from DOP’s large community of 2.7 million testnet users underscores the demand and necessity for user-controlled data in the Web3 ecosystem, and these funds are set to facilitate the expansion of DOP as it prepares for its mainnet launch scheduled for May 2024.

#3 - Hailo | Artificial Intelligence

Tel Aviv, Israel | US $120 Million Series C

Founded in 2017 by Orr Danon and Avi Baum, Hailo designs specialized chips optimized for AI operations on edge devices. These chips are known for their efficiency, using less memory and power than typical processors, making them ideal for use in compact, battery-operated, and offline environments like vehicles, smart cameras, and robotics. Today, Hailo serves over 300 customers across various sectors including automotive, security, retail, industrial automation, medical devices, and defense. The Hailo-8 AI Processor was named the 2021 Edge AI and Vision Product of the Year in its category, and more recently, the Hailo-15 AI Vision Processor won a Picks Award at CES 2024.

Hailo became a unicorn when it raised $136 million in a Series C in October 2021, and now it has raised another megaround of US $120 million bringing the company valuation to US $1.2 billion. The team plans to use the new funds to accelerate their growth and execute faster on their roadmap, aiming to become a publicly traded company in the near future.

“The closing of our new funding round enables us to leverage all the exciting opportunities in our pipeline, while setting the stage for our long-term future growth. Together with the introduction of our Hailo-10 GenAI accelerator, it strategically positions us to bring classic and generative AI to edge devices in ways that will significantly expand the reach and impact of this remarkable new technology,” said Danon.

#4 - MagnusMetal | Industrial Formation

Tzora, Israel | US $74 Million Series B

Established in 2017, MagnusMetal is a pioneering technology in industrial, high volume digital casting for metal alloys. This company revolutionizes the traditional metal casting industry by introducing a fully automated manufacturing solution aligned with Industry 4.0 principles. Its technology not only speeds up the production process but also makes it safer and more environmentally friendly, enhances quality while cutting costs. Today, Magnus Metal is the first and only additive manufacturing technology that utilizes the customer’s existing metal raw materials, significantly boosting adoption rates. Products are customized and produced on a purpose-built, standalone platform that reduces the reliance on material, manpower, and time, streamlining the entire production lifecycle.

Magnus Metal recently secured $74 million in a Series B financing round, which was jointly led by Entrée Capital and Target Global. The company plans to use this new capital to advance its pioneering casting technologies and to expand its operations both domestically and internationally to better serve its Fortune 100 clients.

“This [round] is going to take us into industrialization this year and beta testing beginning of next year,” said CEO Boaz Vinogradov. “The goal is to use this funding to have an industrial machine that is quite robust that the customers finished testing.”

#5 - Midas | Fintech

Istanbul, Turkey | US $45 Million Series A

Launched in 2021 by Egem Eraslan, Midas is a fintech startup that provides over 2 million users in Turkey’s retail investment market a single platform for investing in both American stock exchanges and Türkiye's Borsa Istanbul with low commission rates. The company has made significant investments in market education by offering a variety of free, accessible financial content including real-time stock market updates, news, comprehensive company profiles, in-depth documentaries, a daily podcast, and a weekly newsletter—all designed to help investors better understand the markets.

Midas is now Türkiye’s most widely used stock market application with over 2.5 million users, and it just raised $45 million in a financing round spearheaded by Canada's Portage. Having just secured the biggest investment ever by a Turkish fintech, Nasdaq celebrated Midas with all of New York on a screen outside the Nasdaq Market Site in Times Square.

Midas intends to use the fresh capital to introduce three new offerings: cryptocurrency trading, mutual funds, and savings accounts, which aim to provide its users with effortless and free opportunities to invest in crypto assets and investment funds. Over the next two to five years, Midas also plans to broaden its reach beyond Turkey, targeting expansion into emerging markets across the MENA region.

“We have a long-term view for this company, and short-term market conditions have not hindered that. The raise comes as a significant vote of confidence in our mission to transform investing in the region,” says Eraslan.

Paul Desmarais III, Co-Founder of Portage and CEO and Chairman of Sagard, commented, “Midas is leading a wave of transformation within Turkey’s financial landscape. Globally, Portage invests in transformational financial technology and Midas is poised to lead that initiative in a region of early adopters. We are very pleased to participate in the development of Midas and to support this ambitious team in bringing financial inclusion and access to wealth-building tools to the Turkish people.”

April Takeaway

April 2024 has witnessed several record-breaking rounds, including the largest private round for an AI startup in the region this year, the ninth-largest token sale in history by DOP, and the largest investment ever by a Turkish fintech. These investments instill a confidence in MENAPT startups that reverberates globally to elevate the region's profile as a fertile ground for tech innovation and investment, and we're eager to see who will tap into the next big opportunity within the MENAPT startup landscape this year.

%2Fuploads%2Fdubai-digitized-economy-2%2Fcover.jpg&w=3840&q=75)