The Mena Region's 5 Top Fintech Hot Spots

03 June 2022•

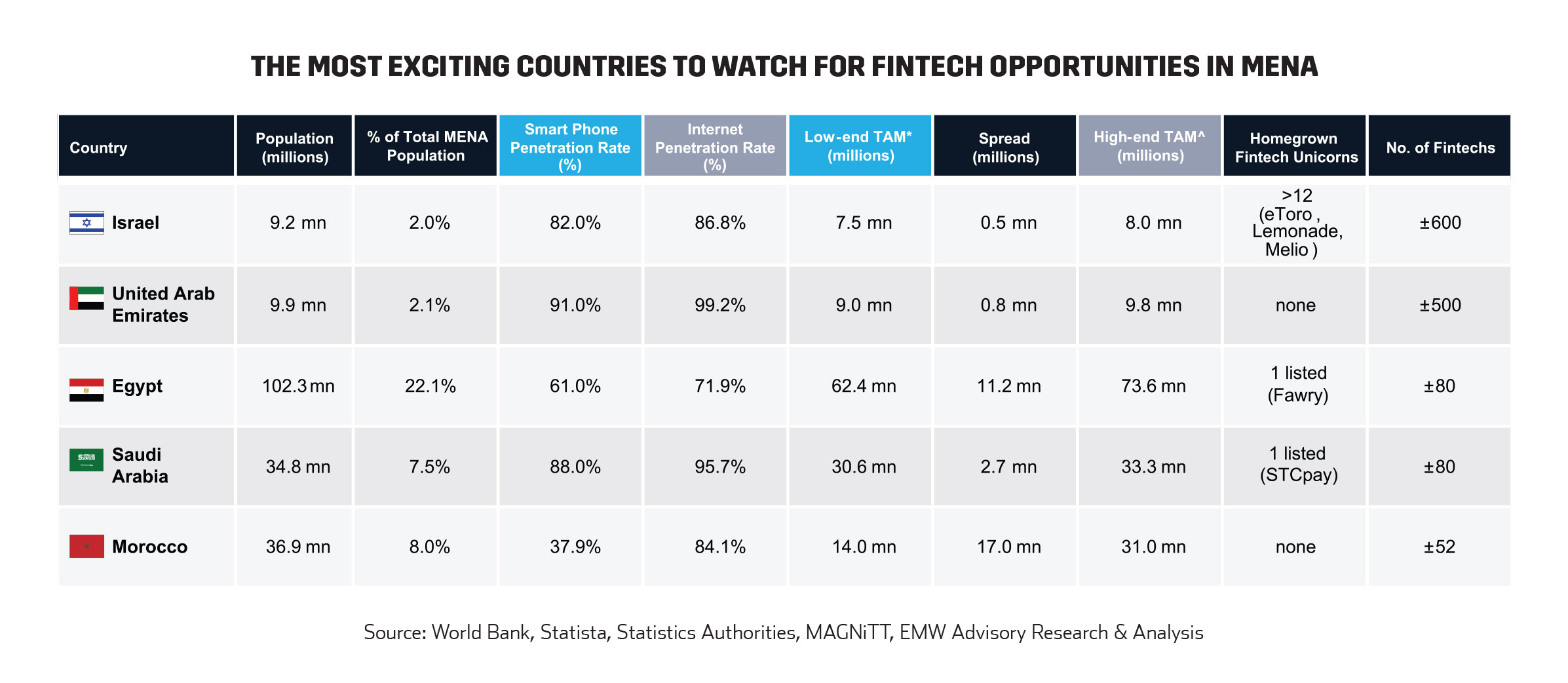

The most exciting Fintech Markets in the MENA Region are Israel and the United Arab Emirates in terms of maturity;

Israel is home to over 600 fintechs and is the only country in the entire region that is home to (privately-owned) fintech unicorns; all 3 of Israel’s current privately owned fintech unicorns have been recently minted between the last 18 months in 2020-2021. Israel has minted approximately a dozen fintech unicorns to date, many which have gone public in the United States. The United Arab Emirates is home to the largest cluster of fintechs in the Arab world, which tallies up to ±500 start-ups. The UAE is also the first destination in the region for prominent global fintechs to establish themselves, when looking to enter the region. A recent example is Stripe – the world’s largest privately owned fintech (valued at US$95 billion) – who opened its regional HQ in Dubai in Q1 2021.

The most exciting fintech markets in terms of Market Potential, are Egypt, Saudi Arabia, and Morocco; this is measured in terms of sheer volume, size and total addressable market. Think in terms of “total number of potential customers to acquire for my fintech product or service” and you can see why Egypt and Saudi Arabia’s large populations that have internet access and are smartphone users qualify. Egypt’s total potential fintech market is roughly double the size of Saudi Arabia. Morocco’s potential fintech TAM is roughly equal to that of Saudi Arabia’s, though fewer Moroccans are smartphone users.

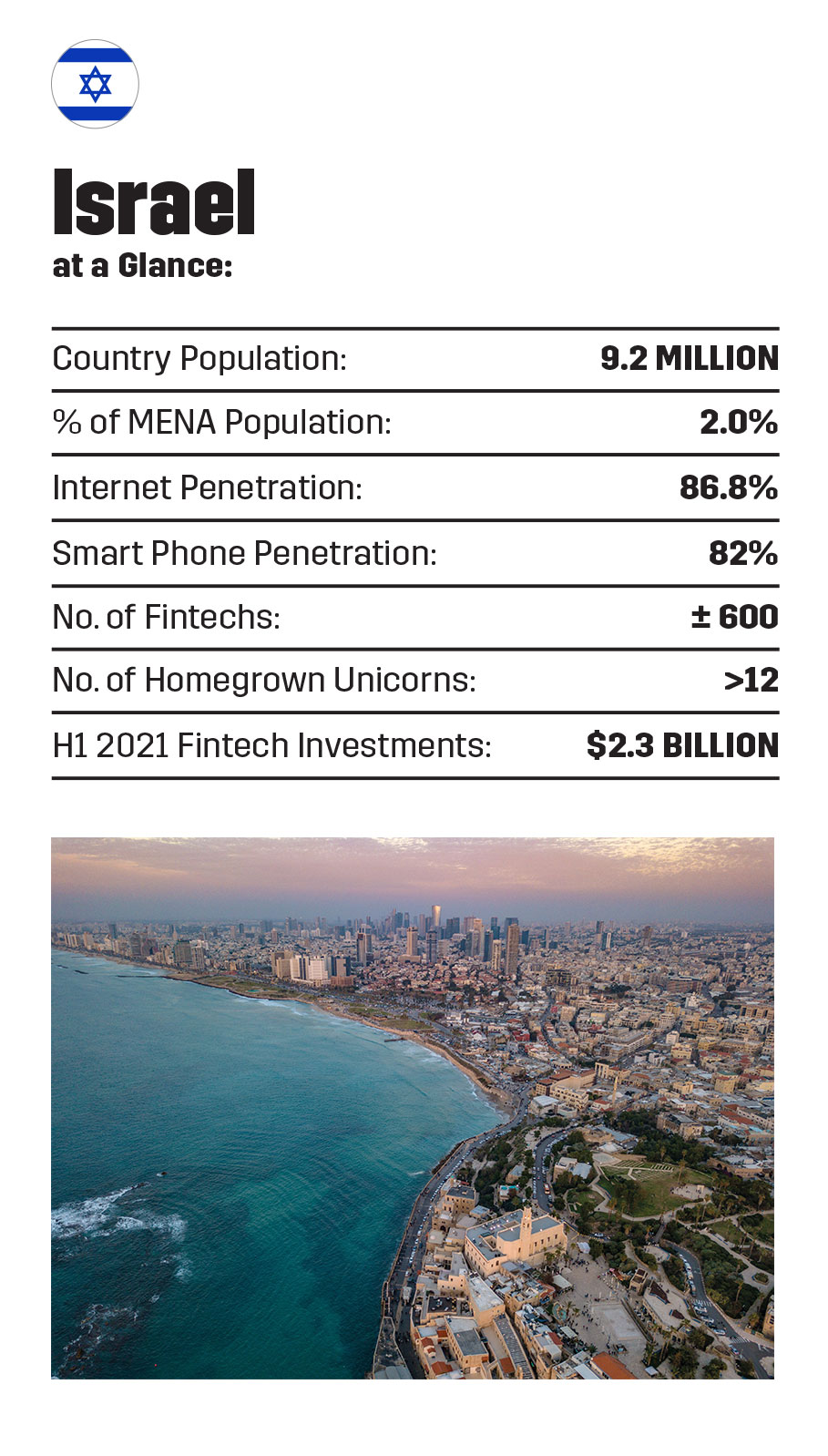

Israel

Israel is quite an interesting case in the MENA region. It is by far the strongest tech market in the region, and has one of the smaller populations with 9.2 million inhabitants. Its’ start-up scene is strong, but insular – which means it maximizes within its own borders and doesn’t venture outside of Israel too often; instead of growing to neighbouring countries in the MENA region, Israeli start-ups tend to export their tech solutions to the United States. This is unlike the rest of the Middle East, where Arab start-ups expand to neighbouring markets to find a larger user-base. The long geopolitical tension between Arab countries and Israel, makes it difficult for Israeli start-ups to become a regional player.

Despite that, Israel has become a hot-bed for fintech in recent years, freshly minting 3 unicorns in the past 18 months (Melio - $4bn, Pagaya - $2bn, and Earnix - $2bn). The country is no stranger to fintech unicorns either, being home to the likes of eToro, Lemonade and over a half dozen others. The country currently is home to over 600 fintechs, which make up roughly 10% of its’ start-up ecosystem. Large financial institutions such as Citi, Barclays and Santander have all built their fintech innovation labs in Tel Aviv, while RBS used an Israeli fintech to build the underlying technology for its spin-out, Esme. After cybersecurity, fintech seems to be the 2nd largest start-up sector in the Israeli start-up economy.

When it come to investment, Israel is a powerhouse. In H1 2021 alone, Israeli fintechs raised US$2.3 billion. In Q3 2021, Israel broke records when it raised

$1.5 billion in a single quarter across 25 fintech investing rounds. To put that in context, the entire MENA Region raised $1.2 billion in H1 across its entire start-up eco-system, not just fintech (though fintech was MENA’s 2nd largest investment segment). One of the drivers behind Israel’s fintech boom is the fintech sector’s ability to leverage the country’s expertise in fraud and data analytics. As a result, fintechs that have manoeuvred into areas like security and finance (ie. Data and fraud protection) have come out ahead. 70% of Israeli fintech funding went to Payments, Anti-Fraud, and Insurtech5

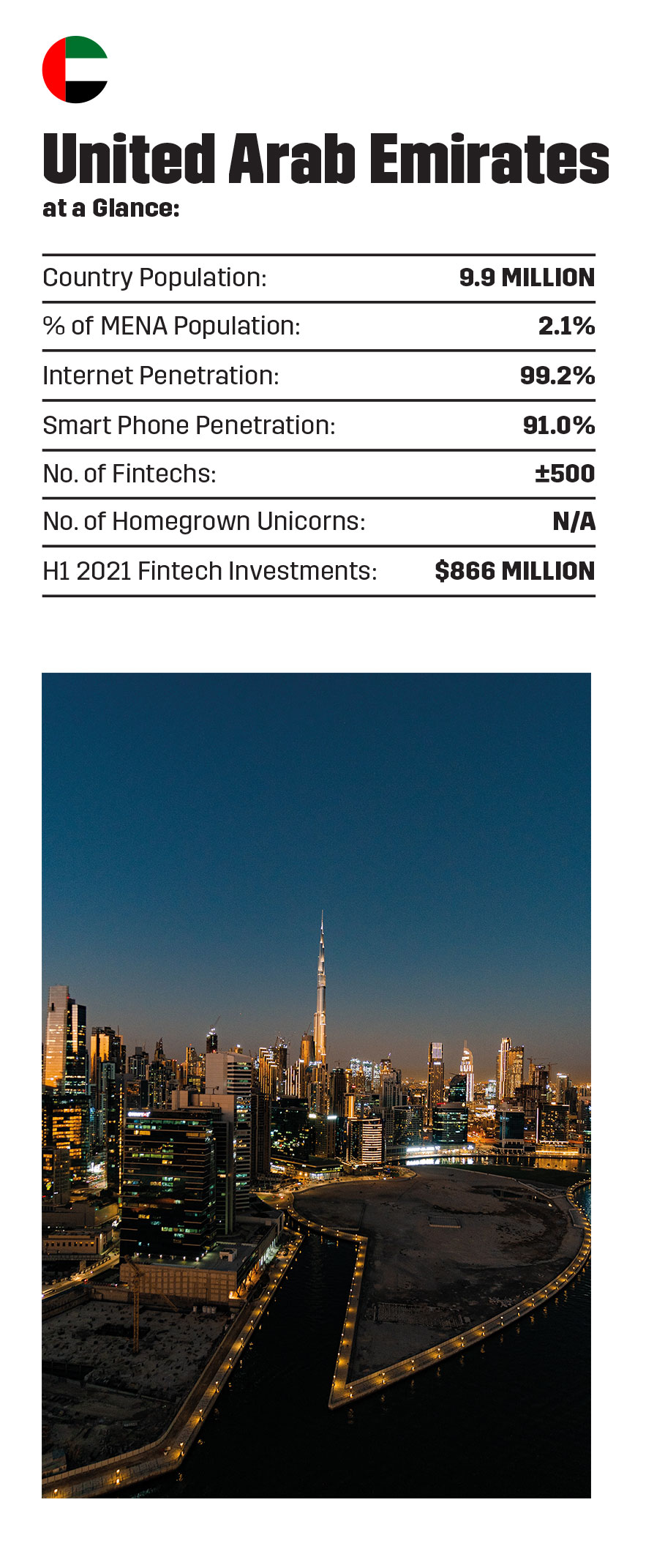

United Arab Emirates

When we think Fintech and the region, many think of the United Arab Emirates as an entrepreneurial ground zero, especially in the Arab world, from which a strong start-up can be built and then expanded across the region. As we look at the data, it is not difficult to see why. The UAE is the 16th easiest country to do business in in the world, according to the World Bank, and number 1 in the region by quite a long shot. The UAE also has some of the highest smartphone and internet penetration rates in the world, with 91% and 99.2% penetration respectively; this allows a country with a relatively small population of 10 million inhabitants, to still rank a relatively high 7th place overall in term of Total Addressable Market, as the UAE’s TAM is nearly its’ entire population.

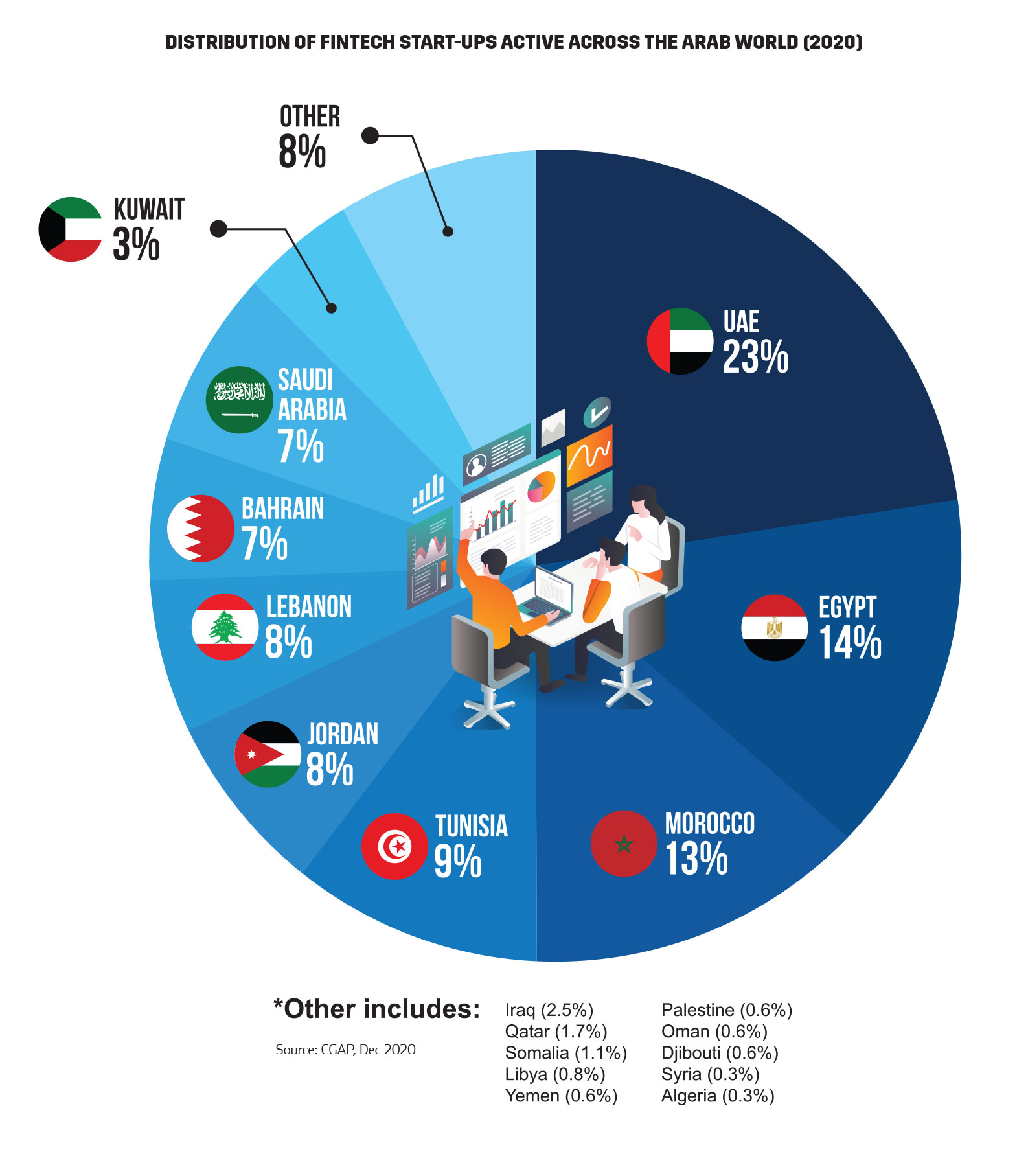

Currently, the UAE is home to approximately 200 fintech start-ups, which makes it the the 2nd largest cluster of Fintechs in the MENA region, behind Israel. If you follow the investment capital, the UAE is also always #1 in the Arab world. In H1 2021, the UAE inked 26% of all deals in the MENA (excluding Israel) region, of which fintech was #1 in terms of number of deals signed, and 2nd largest segment in terms of absolute value. Of the region’s Fintech deals, the UAE signed 23% of all deals, while Saudi nabbed 20%, and Egypt 12%. KPMG’s review of all fintech-related investment activity, including VC, PE & M&A deals found that the UAE led the Arab world with US $865.5 million in the first half of 2021.

Dubai also acts as a regional hub for the GCC, for the Middle East, and sometimes for MENA as a whole; this means many of the traditional financial institutions’ have their regional headquarters here, including the likes of MasterCard and Visa, global and regional banks, and the like, overseeing their business activities for the entire Arab world (ie. Middle East excl. Israel). This seems to be the case for many regional entrepreneurial plays as well: where entrepreneurs will launch their Fintech Start-Up in Dubai and the United Arab Emirates first, establish its foothold, and then look to expand outwards across the GCC there afterwards. Examples of UAE-born Fintechs with footholds in other Middle Eastern markets include the likes of Network International Payments (POS and Payment Solutions), Beehive (P2P Lending), Telr (Digital Payments), Sarwa (Robo-Advisory), and Tabby (Buy-Now-Pay-Later). Global fintechs are also using Dubai as their headquarters for regional market entry. One prime example is Stripe (digital payments), which is the world’s second most valuable privately-owned start-up in the world, valued at $95 billion (second only to TikTok’s owner ByteDance. Stripe launched its first regional office in Dubai Media City in April 2021, and is looking to take a bite out of the UAE’s $18.5 billion USD digital transactions in 2020 at the height of the pandemic6.

There are multiple players supporting the development of fintech start-ups in the country, including Dubai’s Fintech Hive in the DIFC; Fintech Hive was the first Fintech-focused accelerator launched in the Arab world and was established in 2017. The Hive has also launched a $100 million USD Fintech Fund to help promising companies raise capital. Other players supporting fintech include Hub71 and Flat6Labs both in Abu Dhabi, Sheraa in Sharjah, and Intelaq and Dtec to name a few.

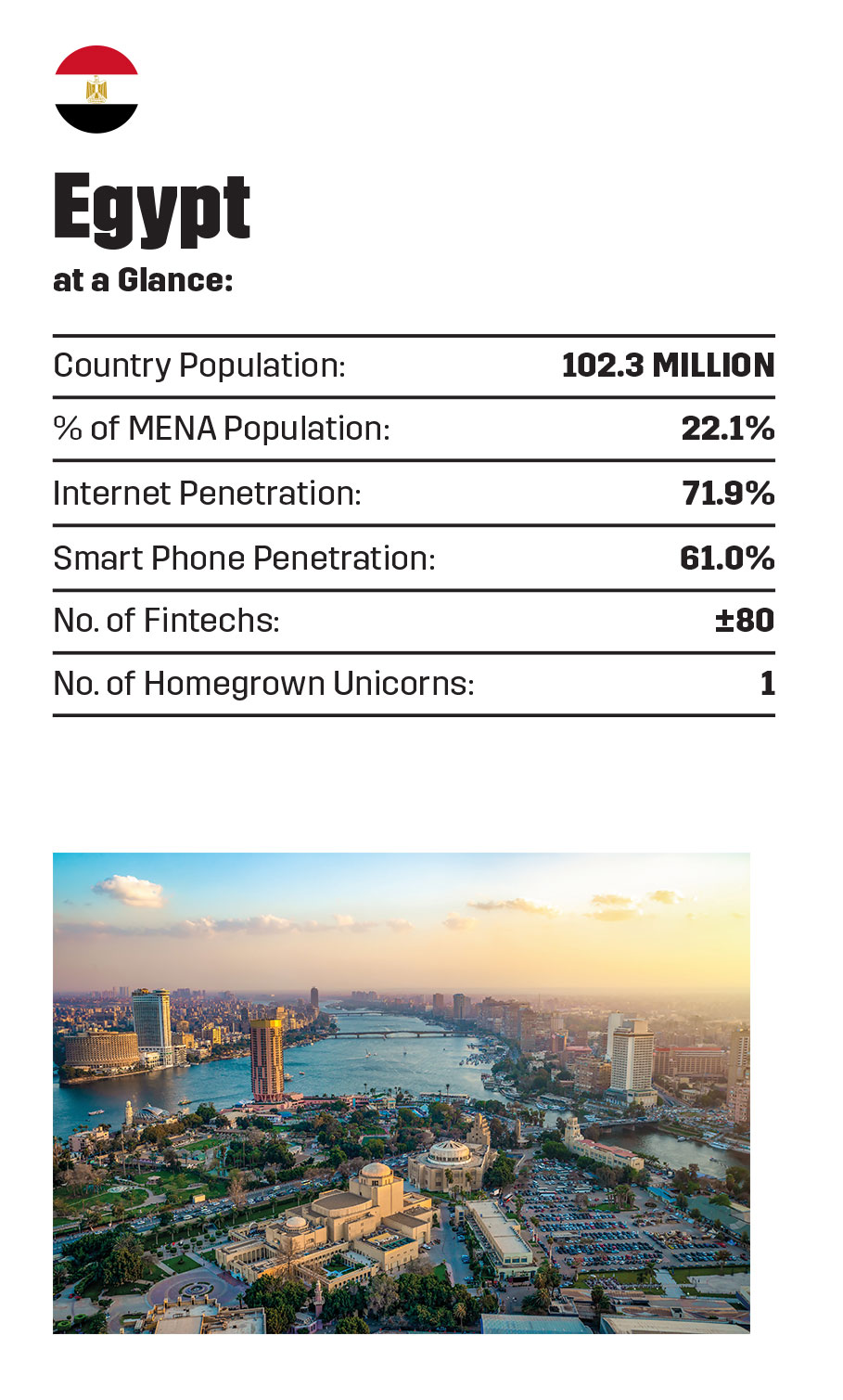

Egypt

Egypt is one of the most exciting markets in the region. With a large group of 102 million inhabitants, as smartphone and internet penetration rates increase, Egypt has a large and growing mass of potential Fintech consumers. Currently, Egypt’s total addressable fintech market is between 62 and 74 million users, 6 to 8 times the size of the UAE or Israel. Its’ internet penetration rate is 72% and smartphone penetration rate is 61%. To convolute matters, the Central Bank of Egypt estimates that up to 80% of its population is unbanked; thus, progress in fintech in Egypt is having a real impact on the ground amongst consumers who are often using financial products and services for the first time.

Egypt has the 3rd largest cluster of fintechs calling it home in the MENA region (tied with Saudi Arabia), with roughly 80 fintechs in its ecosystem, and growing rapidly with fintechs from neighboring Saudi Arabia and the United Arab Emirates entering the market and trying to get a part of the action. It is also home to the Arab world’s first homegrown fintech unicorn, Fawry – a B2B and B2C digital payments with over 20 million customers. In 2019, Fawry listed on the Egyptian Stock Exchange, and in 2020 it announced that it had a market capitalization over US$1 billion. When it listed, Fawry was oversubscribed by over 30.3 times. In terms of fintech investment, Paymob, an Egyptian digital payments player was able to raise $18.5mn in the first half of 2021.

Policy shifts and proactive action on the part of the Central Bank of Egypt have boosted fintech growth in the country. In 2020. The Central Bank and the Financial Regulatory Authority began addressing regulatory considerations for digital banks, digital wallets, cryptocurrencies, nano-finance, insurtech and the like. The old Central Bank building in Cairo has even been converted into a fintech hub. Institutional Investors like EFG-Hermes have partnered up with Egypt Ventures to launch EFG-EV, a fintech accelerator. Startup Bootcamp and Pride Capital’s Fintech Cairo are also helping funnel investments towards fintechs. The Central Bank of Egypt has its own fintech fund valued at 1 billion EGP (equivalent to roughly US$64 million).

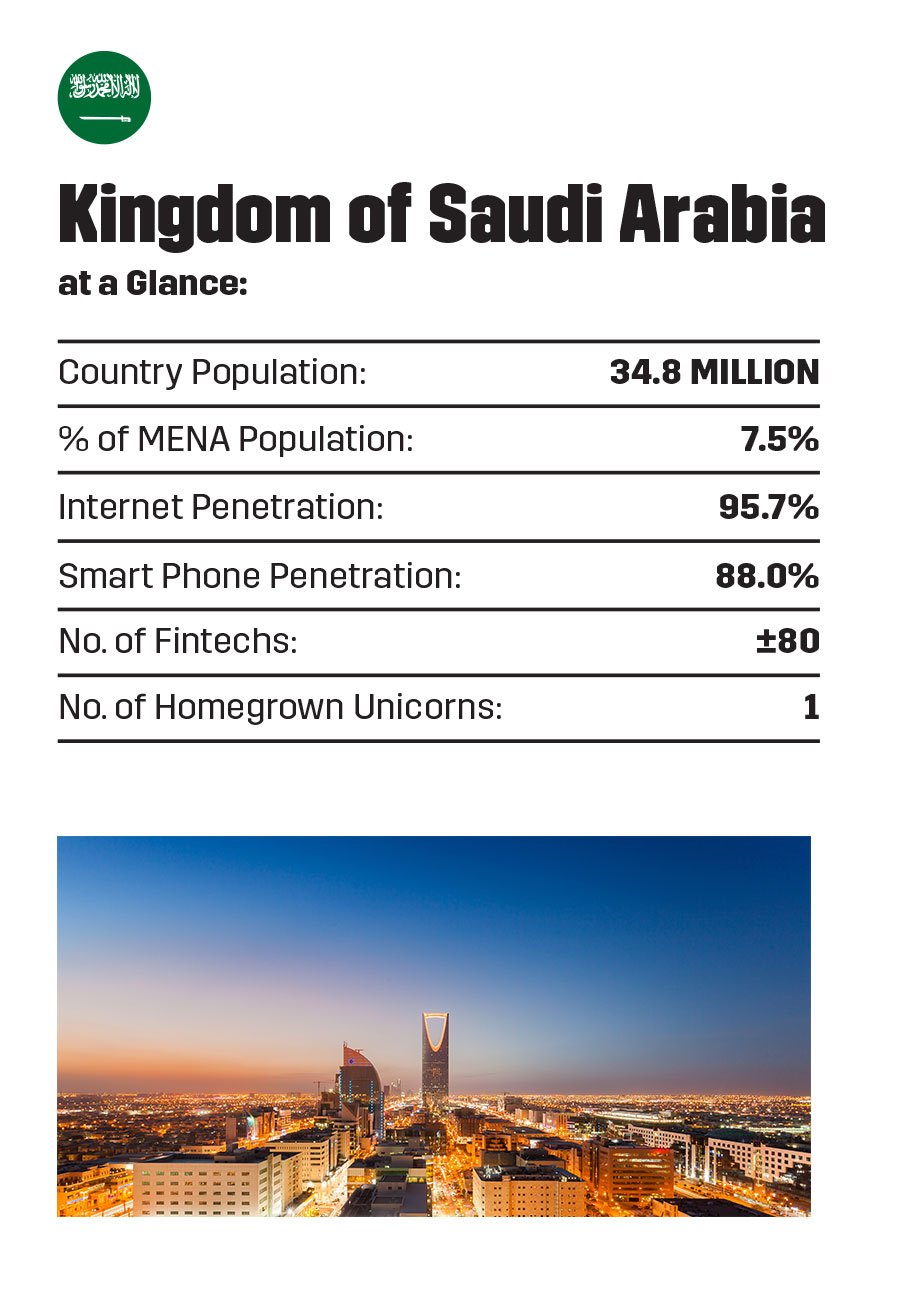

Kingdom of Saudi Arabia

The Kingdom of Saudi Arabia, the 3rd most populous country in the MENA region, is fast becoming a buzz with fintech activity. Since 2018, the Kingdom has grown from being home to just 10 fintech companies to now reaching 82 fintechs in its ecosystem in 2021. With strong internet and smartphone penetration rates, the Kingdom has a fintech user base somewhere between 30.6 million and 33.3 million potential fintech users. The Kingdom attracts 20% of the MENA region’s fintech investments (excluding Israel), having secured US$137 million in fintech funding in H1 2021. Fintech was the largest subsegment to get funding in the Kingdom in the first half of the year. To date, homegrown fintechs in Saudi Arabia have raised nearly US $800 million (based on fintechs that disclosed their fundraising data) according to Fintech Saudi, a government-led organization tasked with supporting the development of the fintech ecosystem in the Kingdom. The country launched its first two fintech regulatory sandboxes and fintech licensing protocols in 2018, and the Saudi Central Bank have since been on a regulatory rehaul – issuing policy and new regulatory guidelines for digital payments, digital banking, insurtech, roboadvising, microfinancing, debt crowdfunding, and the like. The Saudi Fintech’s market size was valued at US $19 billion in 2019, and is expected to reach US $33 billion by 202310.

There are several home-grown fintechs that have become regional heavy-weights. STCpay was Saudi Arabia’s first unicorn announced in 2020; STCpay is Saudi Telecom Company’s digital wallet corporate VC-backed start-up, which Western Union acquired a 15% stake in for a $200 million investment. Geidea is the dominant POS player in the market, having a >50% market share of POS systems in the Kingdom. Geidea has expanded into multiple regional markets including Egypt, and is competing head to head with the likes of PayTabs Egypt. PayTabs, also a Saudi-born digital payments player, is also a regional payments player having expanded into multiple MENA markets. Read more about these companies in the following spotlight case studies. For a deep dive into the Saudi Arabian fintech industry, read Entrepreneur Middle East’s special 2021 report, published in December 2021 titled, “The Ultimate Guide to Fintech in Saudi Arabia.”

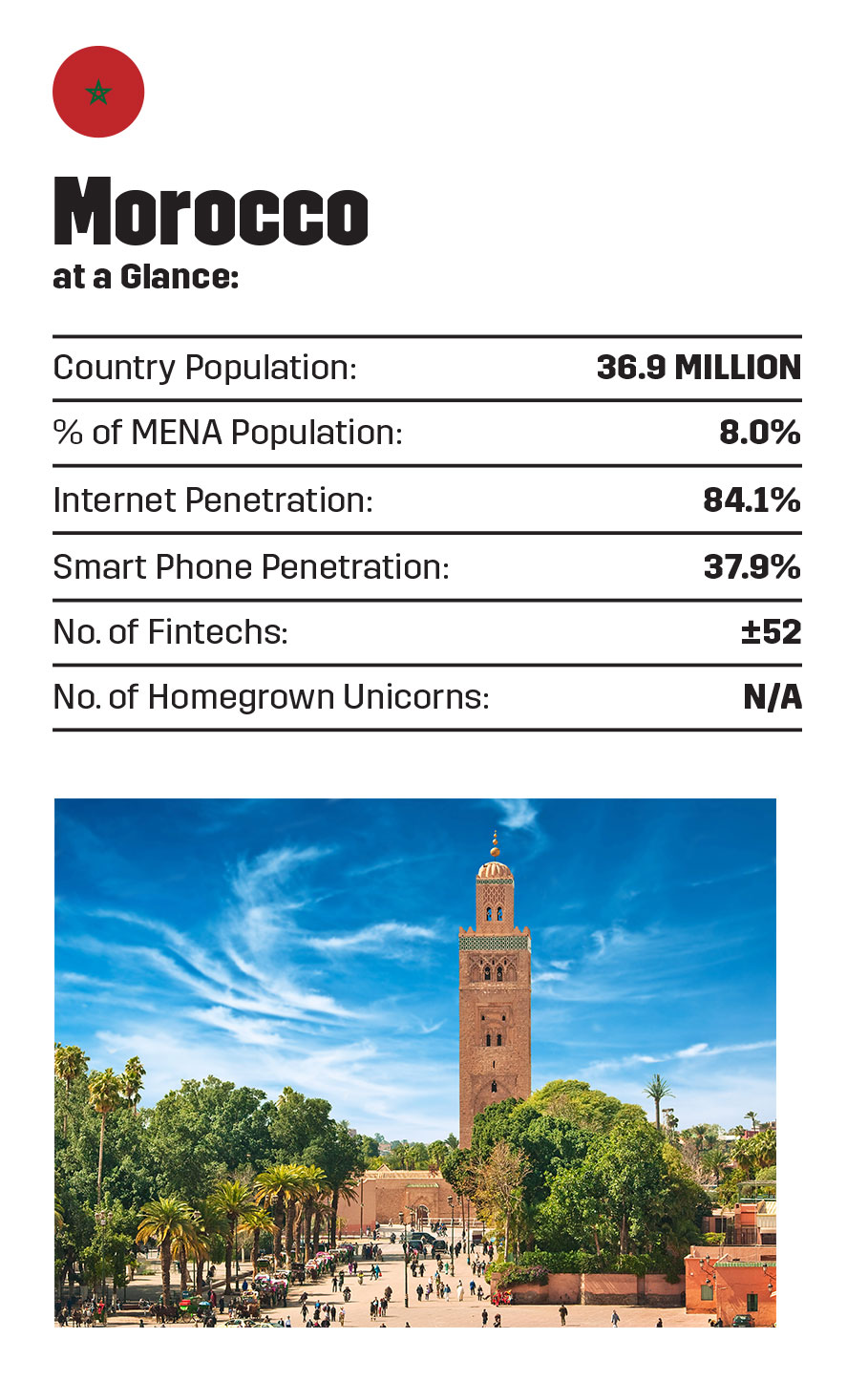

Morocco

Rounding out our top 5 markets to watch in MENA for Fintech, is Morocco. With a population of 36.9 million, it is the 4th most populous country in the region. Due to quite a significant difference between internet penetration rates and smartphone penetration rates, the total addressable fintech market in Morocco is somewhere between 14 million and 31 million users. There are over 50 active fintechs in Morocco, with the most active sub-segment being digital payments (which includes remittances and POS systems); the digital payments market is expected to exceed US$4.1 billion in 202111 and is expected to encompass 17.9 million users by 202511. The second largest, and fastest growing, sub-segment is neo banking (digital banking), which is expected to reach a market size of US $267 million in 202111.

Though approximately 80% of transactions in the country were settled in cash in 2017, digital transactions surged 43% in December 2020.

Morocco’s government is making fintech solutions part of its National Financial Inclusion Strategy, which aims to give all citizens and businesses fair access to formal financial products and services. Bank Al Maghrib (BAM) is the country’s central bank and the financial sector’s main regulator and policy-maker. A banking law was introduced in 2015 which made it possible to incorporate a new category of non-banking institutions, called payment institutions, to serve the market. And the first digital payments fintech was launched in 2017, with four new fintech operators gaining approval in 2018, and has seen rapid growth since. The government has ambitions to achieve Dh50 billion (US$5.3 billion equivalent) in mobile transactions by 2023. The major telecoms players, Inwi, Maroc Telecom and Orange Telecom, have all launched their own e-wallets in hopes to help achieve this target. As of November 2020, there were 1.5 million users with mobile wallets in Morocco, and this number is expected to grow exponentially over the course of the next few years.

In terms of financial support for Fintechs, in February 2020, the House of Representatives adopted a bill on collaborative financing, also known as crowdfunding, to help mobilize new sources of funding for micro, small and medium-sized enterprises and young entrepreneurs. The government also created One-Stop-Shop Fintech, a dedicated unit to support and guide fintechs entering the Moroccan market and help them navigate the regulatory environment.

%2Fuploads%2Fmena-fintech%2Fmena-fintech-cover.jpg&w=3840&q=75)