Africa as the Next Major Frontier: The Drivers for Fintech in Africa

06 June 2023•

Africa is the next major frontier for the global economy and will see its population nearly double from 1.4 billion today to 2.5 billion by 2050.

The GSMA estimated that sub-Saharan Africa was home to nearly 550 million mobile money accounts in 2021, with over 160 million of these accounts being active on a regular basis. The World Bank credits mobile money and similar fintech solutions in helping to pull out millions of Africans out of poverty in the past decade. The opportunity is greater still. Like everywhere else on the planet, Covid19 has only accelerated this wave of digitization, and mobile payments across the continent are soaring.

Here are some of the unique drivers for fintech adoption in Africa:

1. High Mobile Phone Adoption & Penetration

Africa has one of the highest mobile phone penetration rates in the world, with over 80% of the population owning a mobile phone. This provides a strong foundation for the growth of fintech, particularly mobile-based financial services such as mobile money and mobile banking. In fact, Sub-Saharan Africa is the global leader in mobile money adoption, with over 400 million registered mobile money accounts.

2. The Financial Inclusion Opportunity

Despite significant progress in recent years, a large proportion of the African population remains unbanked and underserved by formal financial institutions. Fintech has the potential to bridge this gap, providing affordable and accessible financial services to previously excluded populations. The sheer size of the fintech opportunity in Africa is so large, that carving out a few percent through a fintech solution could mean big business.”

3. Growing Demand for Digital Payments

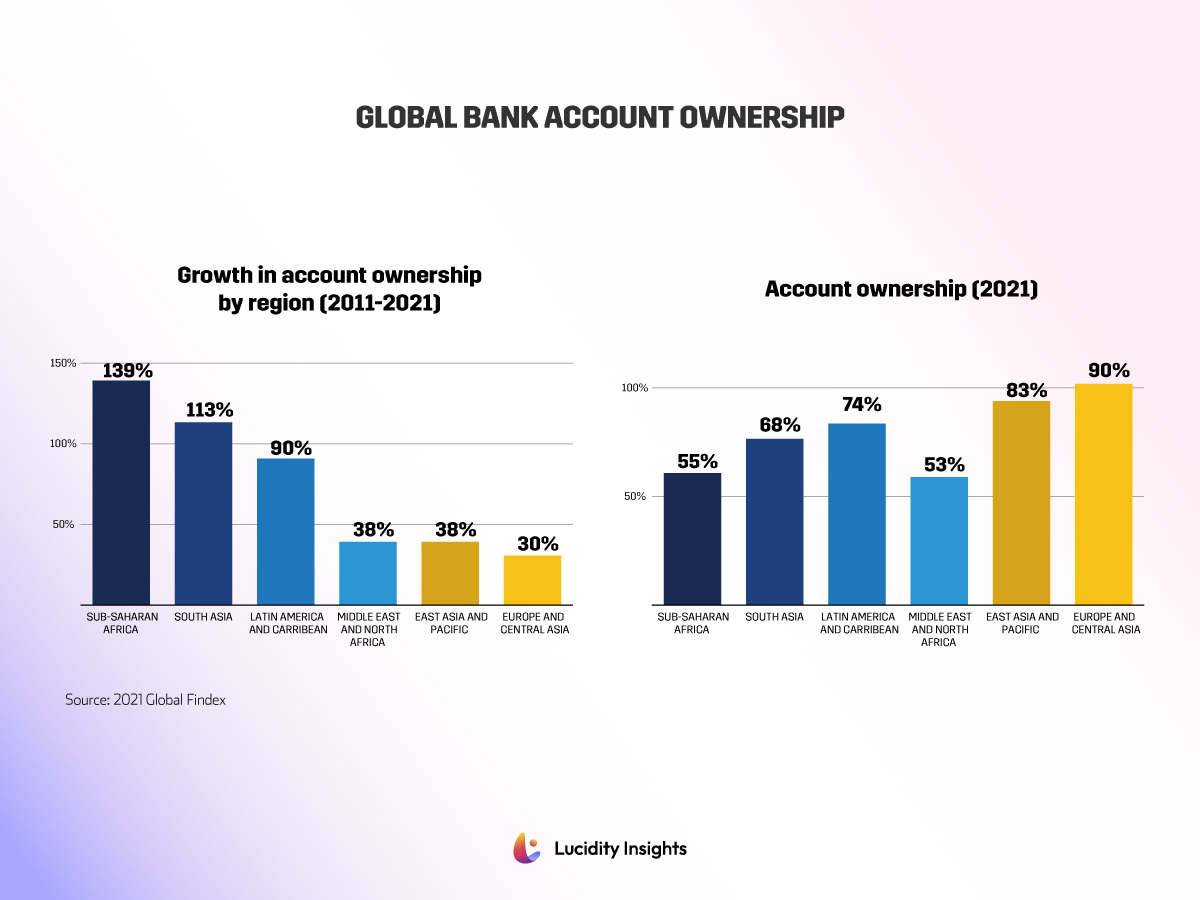

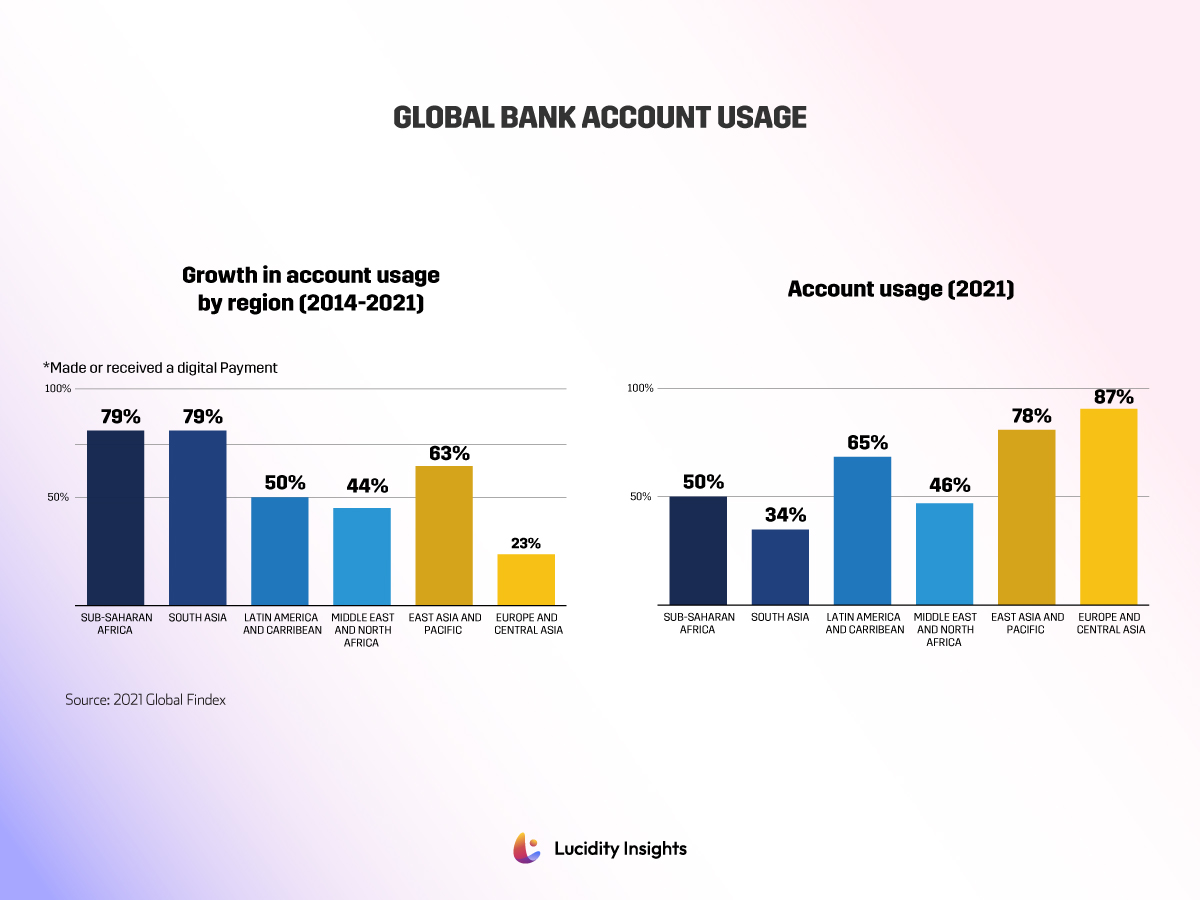

As Africa’s economies continue to develop, there is a growing demand for digital payment solutions that are convenient, secure and affordable. Fintech is well-positioned to meet this demand, offering a range of digital payment solutions that are tailored to the needs of African consumers and businesses. Over the past decade, sub-Saharan Africa showed the greatest growth in bank account ownership and usage, over any other region in the world. In 2021, it was found that 55% of Africans owned a bank account of some type, and 50% made or received a digital payment in the past year.

Graphs: Global Growth in Bank Account Ownership, 2011-2021 & Global Bank Account Ownership, 2021

Graphs: Global Growth in Bank Account Usage, 2014-2021 & Global Bank Account Usage, 2021

4. Fintechs, show me the money!

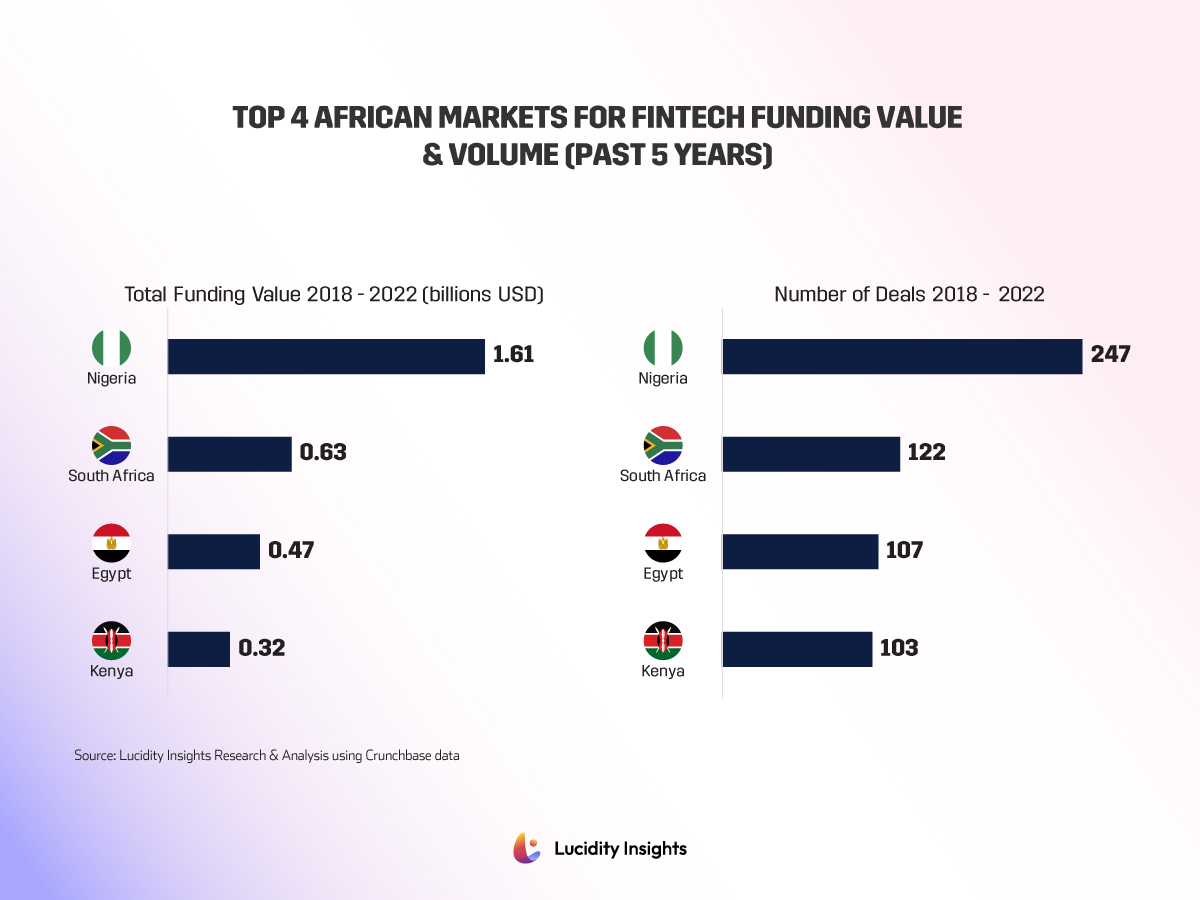

Fintech is attracting significant investments in Africa, with VC funding for African startups heating up. In 2019, fintech startups in Africa raised over US $1.35 billion. In 2022, the top 10 funded fintechs across the continent raised just under US $850 million between them; and Fintechs in Nigeria, Egypt and South Africa raised $761 million in total in 2022. Over the past 5 years, the top 4 fintech markets in Africa, namely Nigeria, South Africa, Egypt and Kenya raised over US $3.03 billion collectively.

Graphs: Top 4 African Markets for Fintech Funding Value & Volume (2018-2022)

5. Pockets of Supportive Regulatory Environments

While regulatory challenges remain a barrier to fintech growth in some African countries, many governments are taking steps to create a more supportive regulatory environment for fintech. For example, several countries have introduced sandboxes and other regulatory frameworks that provide a more flexible and collaborative approach to fintech regulation, while also ensuring consumer protection and financial stability.

Read Next: Challenges & Barriers for Fintech in Africa

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)