Africa as the Next Major Frontier: Challenges & Barriers for Fintech in Africa

07 June 2023•

Africa is the next major frontier for the global economy and will see its population nearly double from 1.4 billion today to 2.5 billion by 2050.

The GSMA estimated that sub-Saharan Africa was home to nearly 550 million mobile money accounts in 2021, with over 160 million of these accounts being active on a regular basis. The World Bank credits mobile money and similar fintech solutions in helping to pull out millions of Africans out of poverty in the past decade. The opportunity is greater still. Like everywhere else on the planet, Covid19 has only accelerated this wave of digitization, and mobile payments across the continent are soaring.

Though there are many driving forces at work to propel the fintech ecosystem forward across the African continent, there still remains many barriers and systemic challenges to mass adoption of fintech and the successful achievement of financial inclusion.

Here are some of the challenges for fintech adoption in Africa:

1. Where’s the Infrastructure?

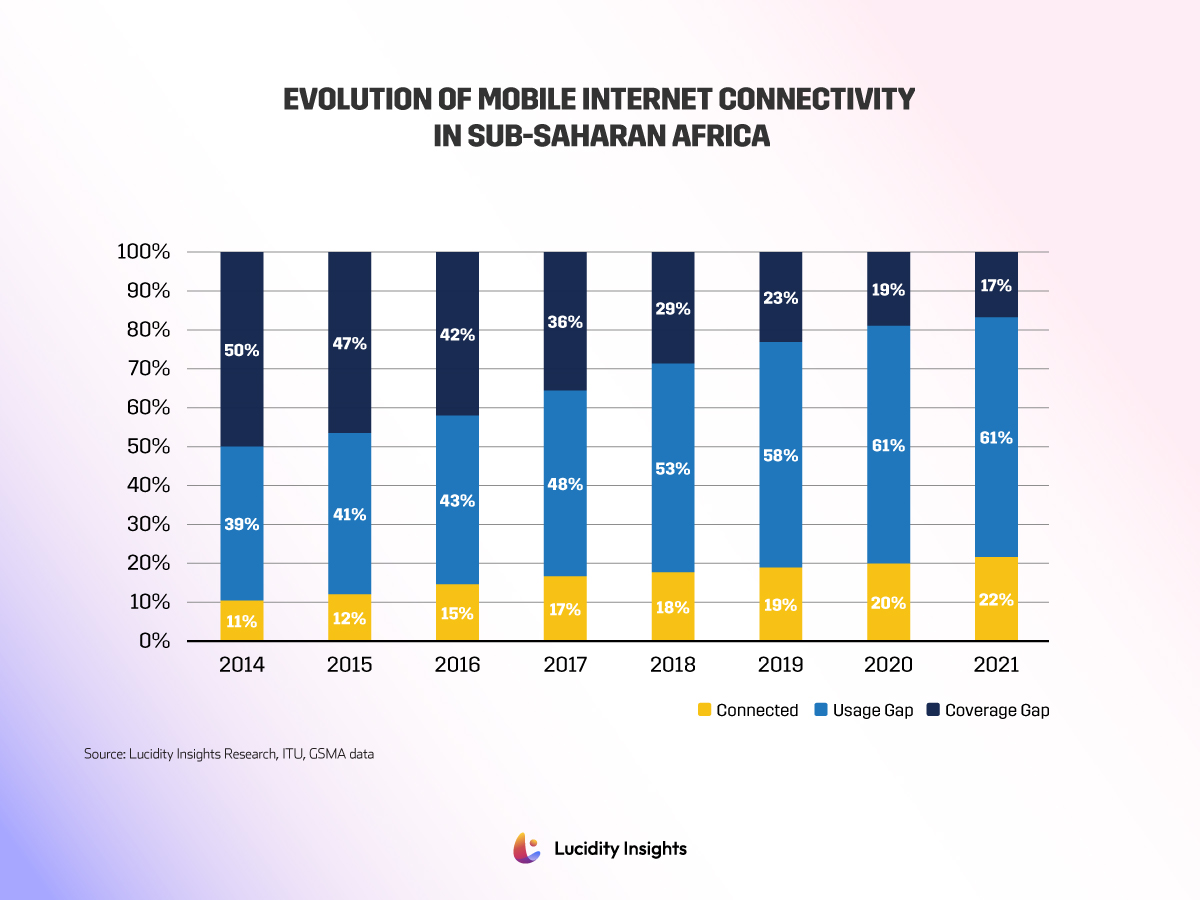

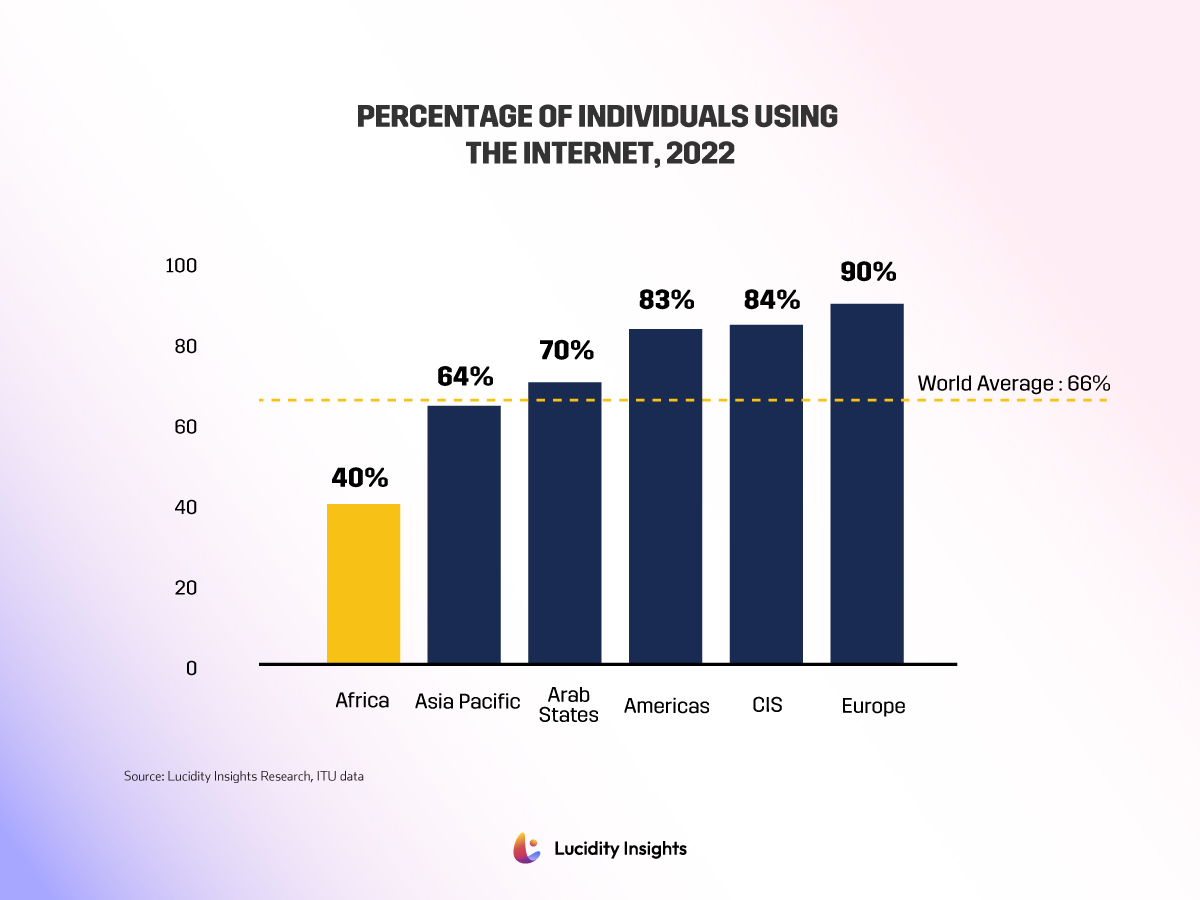

One of the main challenges is the lack of infrastructure and access to reliable internet connectivity in many parts of the continent. Despite strong mobile phone penetration, many of these mobile phone owners do not have steady enough incomes to afford data subscriptions. Thus, investments to expand mobile broadband connectivity across the continent has managed to cover 83% of the population, but only 40% of Africa’s population is actually subscribed to the internet. In fact, Sub-Saharan Africa is the only region in the world where mobile broadband coverage continues to outpace mobile usage; ; as a result, the usage gap has been widening over the years.

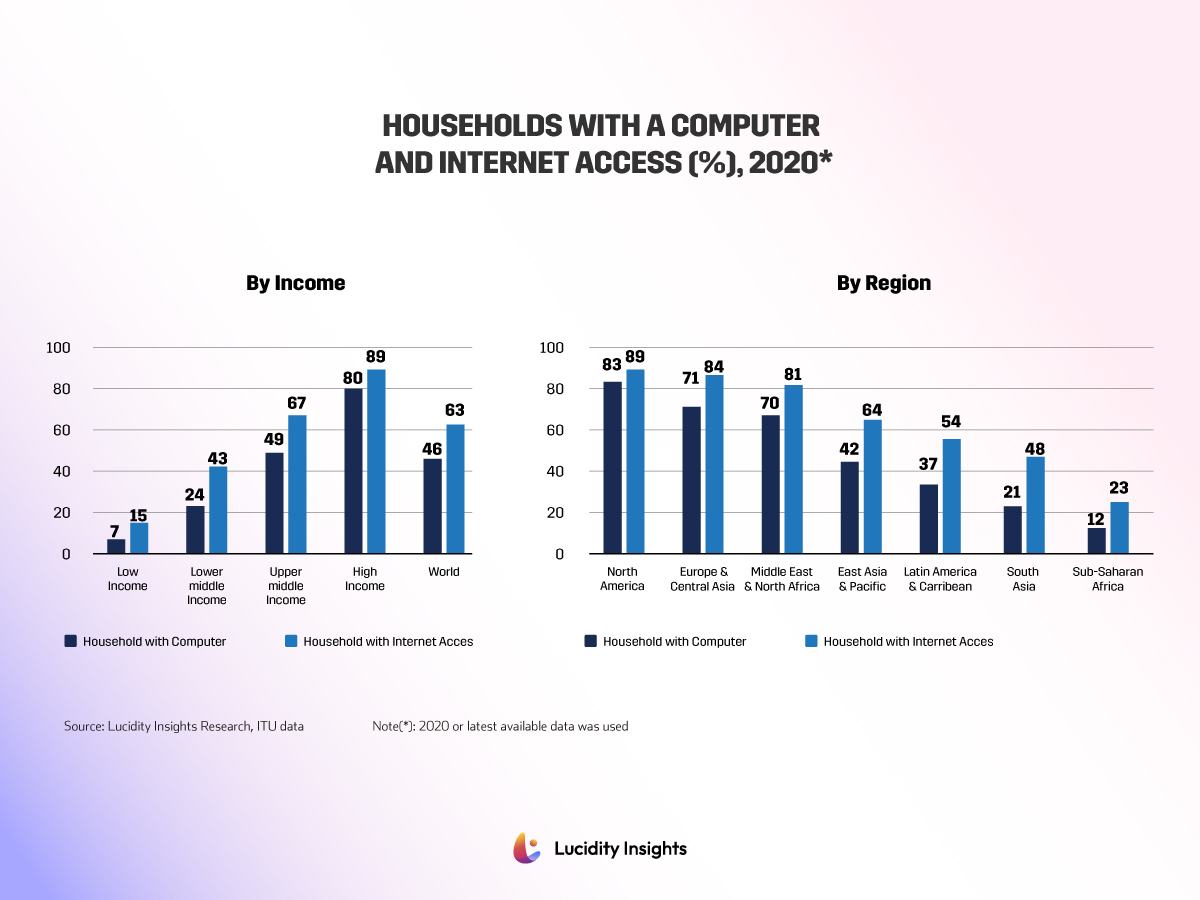

Furthermore, the International Telecommunications Union (ITU) conducted a study in 2020 to determine how many global households had access to the internet or to a household computer. 23% of Sub-Saharan African household respondents had access to internet, and only 12% had access to a computer at home. 13% of sub-Saharan Africans claimed to be using a computer on a regular basis, which states the importance of owning a computer at home.

Graph: Evolution of Mobile Internet Connectivity in Sub-Saharan Africa

Graph: Global Percentage of Individuals Using the Internet, 2022

Graph: Global Percentage of Households with Computer and Internet Access (2020)*, by Income and Region

2. Black Outs

Further complicating Africa’s attempt at reliable internet connectivity is electricity power outages and the lack of reliability of Africa’s electrical grid. According to the world bank, over 600 million people in Sub-Saharan Africa do not have access to reliable electricity; the EIA found in a 2019 study that 80% of those without access to electricity in Africa lived in rural areas.

For those that do have access to electricity, power outages can be common; some countries experience an average of 15 days of power outages per month! It is not uncommon for areas in even the more developed markets like South Africa and Ghana to experience power outages for several hours each day. In 2021, companies in sub-Saharan Africa averaged 8.8 power outages per month, according to the World Bank. South African companies averaged 7.7 power outages per month in 2020. Nigerian companies averaged a whopping 32.8 power outages in a month back in 2014.

3. Unaffordable Internet

Despite broadband coverage existing for many Africans, it is a challenge of affordability. The ITU posits that the average cost of mobile broadband in Africa is equivalent to 7.1% of the average monthly salary, which is significantly higher than the global 2.9%. The Alliance for Affordable Internet (A4AI) reports that in some African countries, the cost of 1GB of mobile data can be equivalent to more than 10% of the average monthly income, and the cost of fixed broadband in Sub-Saharan Africa was more than 50% of the average monthly income – making it an unaffordable luxury for many people.

4. To Trust or Not to Trust

Another challenge is the lack of trust and awareness of digital financial services among many Africans. In a 2019 survey conducted by Pew Research Centre, 70% of adults surveyed across 10 African countries said that they believed that mobile money and other digital financial services were not secure, and 78% of them said they were concerned with unauthorized access to their personal data. Another GeoPoll study in 2019 found that over half of all respondents in East Africa had experienced fraud or scams related to digital financial services.

Many fintech startups and financial institutions are attempting to develop solutions that can address these challenges, such as developing user-friendly interfaces, enhanced cybersecurity protocols, and providing financial education to underserved populations, but this comes at a high-cost, often with little to no financial returns – as many of these potential users in Africa lack the knowledge and skills to use digital financial services effectively. It is this exact same reason, many banks are closing brick-and-mortar branches in rural areas, stating costs are unjustified – but this leaves entire communities without access to formal banking services.

5. Paperwork Woes

Should Africans have access to the internet, be able to afford the internet, have reliable electricity and trust digital financial services enough to get an account, many Africans also lack the necessary documentation, such as a national ID card or proof of address to access formal financial services. Fintech startups are developing innovative solutions to address this challenge, such as using biometric data to verify the identities of potential customers. However, these solutions require significant investment in digital infrastructure and collaboration between public and private sector stakeholders.

6. What Regulations?

Another sore spot for fintechs in the African startup ecosystem is the opaqueness of the regulatory markets. Many countries lack clear and comprehensive regulatory frameworks for fintechs, which can cause unease amongst investors and hinder development of new fintech solutions. Central banks are generally slow to react, preferring to operate in a “business as usual” way, serving their handful of long-running institutional banking stakeholders instead of trying to determine how to serve fintechs as well.

Many of these institutional banks that the Central Bank governs are also not happy about fintechs coming to ‘eat their lunch’. Many incumbent banks perceive fintechs to be a disruptive force that should be heavily monitored and regulated by the Central Bank, if allowed to operate at all. Central Banks, on the other hand, largely don’t know where to begin in regulating fintechs. If any fintech regulations are released by Central Banks across Africa, much of it is vague and hard to enforce. With hundreds of fintechs popping up each year, Central Banks seem ill equipped to deal with the sheer scale of the regulatory challenge.

7. Interoperability

Last but not least, another challenge is the lack of interoperability between different digital financial service providers. For those that do use digital financial services, many Africans are forced to use multiple digital financial services that often operate in silos, making it difficult to transfer money or access credit across different platforms. Addressing this challenge will require the development of common standards and infrastructure for digital financial services, as well as collaboration between different service providers.

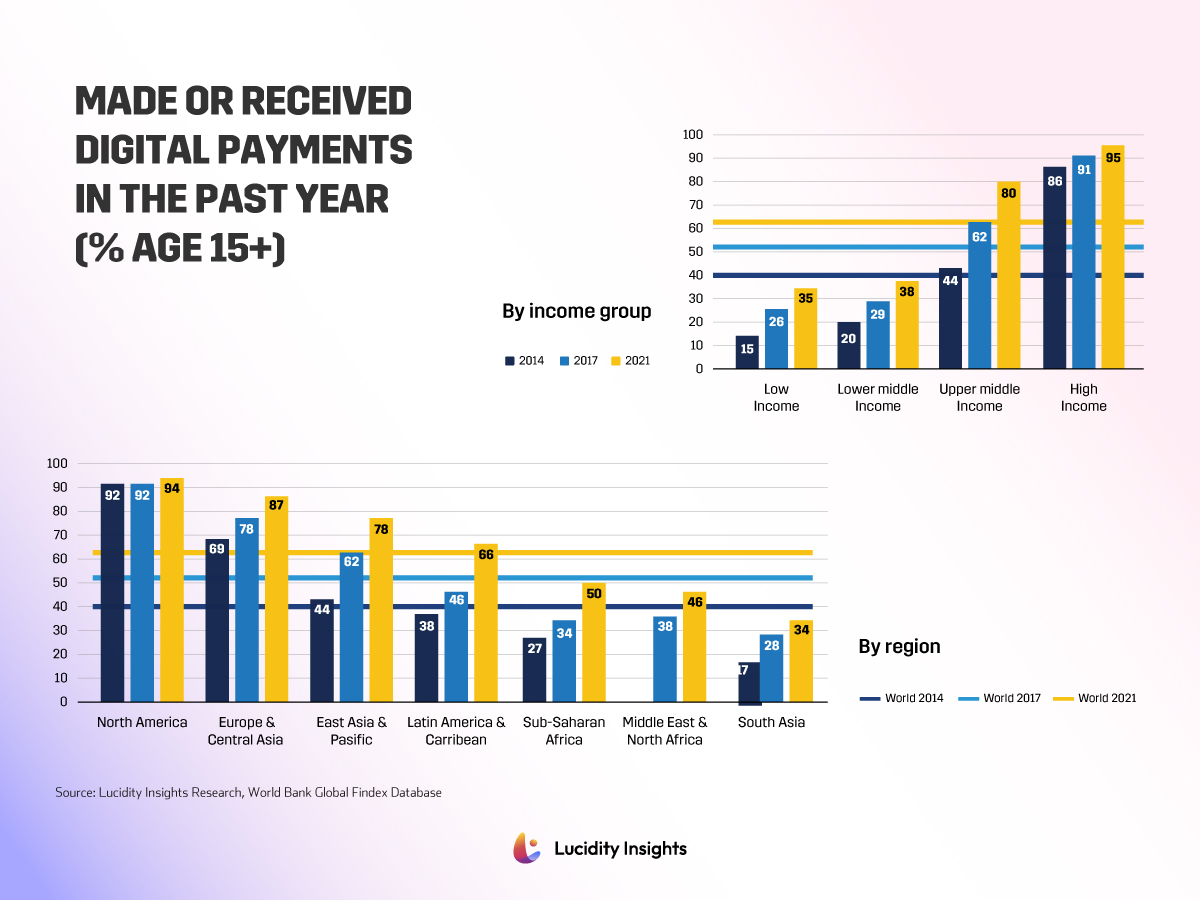

Despite all these challenges facing fintechs and fintech adoption in Africa, more and more Africans are getting online and making digital payments. In 2014, only 27% of sub-Saharan Africans made a digital payment in the previous year. By 2021, that rate had doubled to 50%, outpacing both the MENA region and South Asia’s digital payments adoption rates.

Graph: Global Percentage of Individuals (Aged 15+) Who Made or Received Digital Payments: 2014, 2017, and 2021 Comparison by Income Group and Region

Read Previous Article: The Drivers for Fintech in Africa

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)