Saudi Arabia's Fintech Revolution: Insights from the SAMA 2022 Annual Fintech Report

14 September 2023•

Saudi Arabia is in the midst of a fintech boom. That’s the message Ayman Al-Sayari, Governor of the Saudi Central Bank, also known as SAMA, is sending.

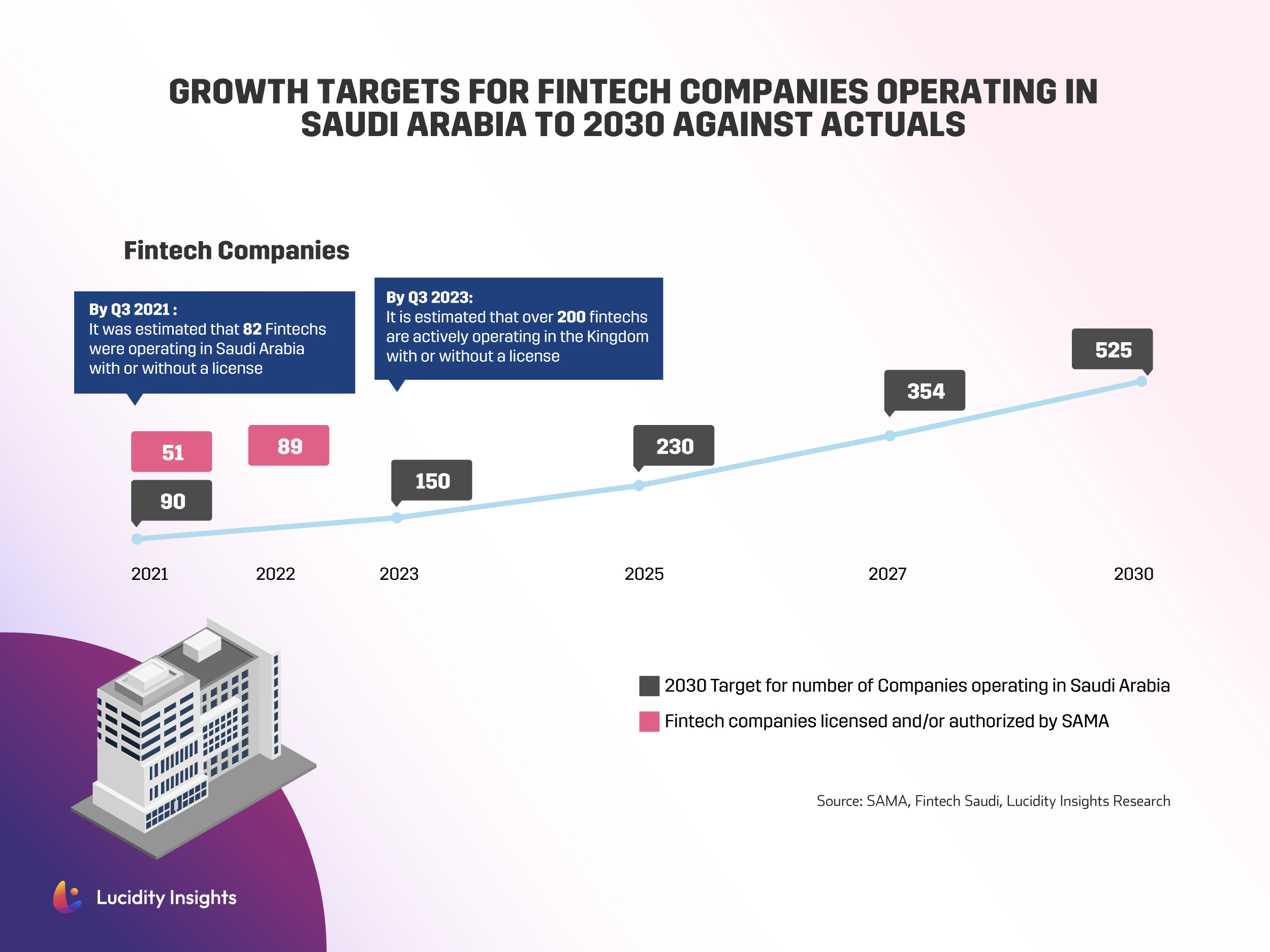

SAMA revealed that the number of fintech companies operating in the sector had more than doubled since the end of 2022; with over 200 fintechs operating in the Kingdom in Q3 2023, up from 89 in 2022 as revealed in SAMA's Annual Fintech Report. The country aims to be home to 525 fintechs by the end of 2030.

Infobyte: Growth Targets for Fintech Companies Operating in Saudi Arabia to 2030 against actuals

Infobyte: Growth Targets for Fintech Companies Operating in Saudi Arabia to 2030 against actuals

Saudi Arabia was the fastest growing economy in the world in 2022, achieving an impressive 8.7 percent growth in GDP in 2022. One of the key drivers to boosting the Saudi economy is a decreasing reliance on the oil sector, and the development of the private sector – with a strong emphasis on entrepreneurship and the development of the Kingdom's startup ecosystem. One leading sub-sector of Saudi’s startup ecosystem, is fintech.

SAMA’s recently released 2022 Annual Fintech Report highlights key trends, developments, challenges, and opportunities in the fintech landscape of Saudi Arabia. The report showcases a sector that has been rapidly evolving since 2018, underscoring the sector’s recent growth which aligns with the Saudi Vision 2030 goals of creating a diversified and sustainable economy.

The most active areas of fintech in Saudi Arabia currently are payments, regtech, and insurtech, accounting for 50%, 30%, and 20% of all fintech activity, respectively. Payments is the most mature sector with both well-established and emerging players. Regtech, however, is a relatively nascent sub-sector, but is also the fastest-growing -- as financial institutions are increasingly adopting new technologies to comply with regulations. Insurtech, is considered the most innovative fintech sector at present, with numerous startups developing novel ways to provide insurance products and services to the market.

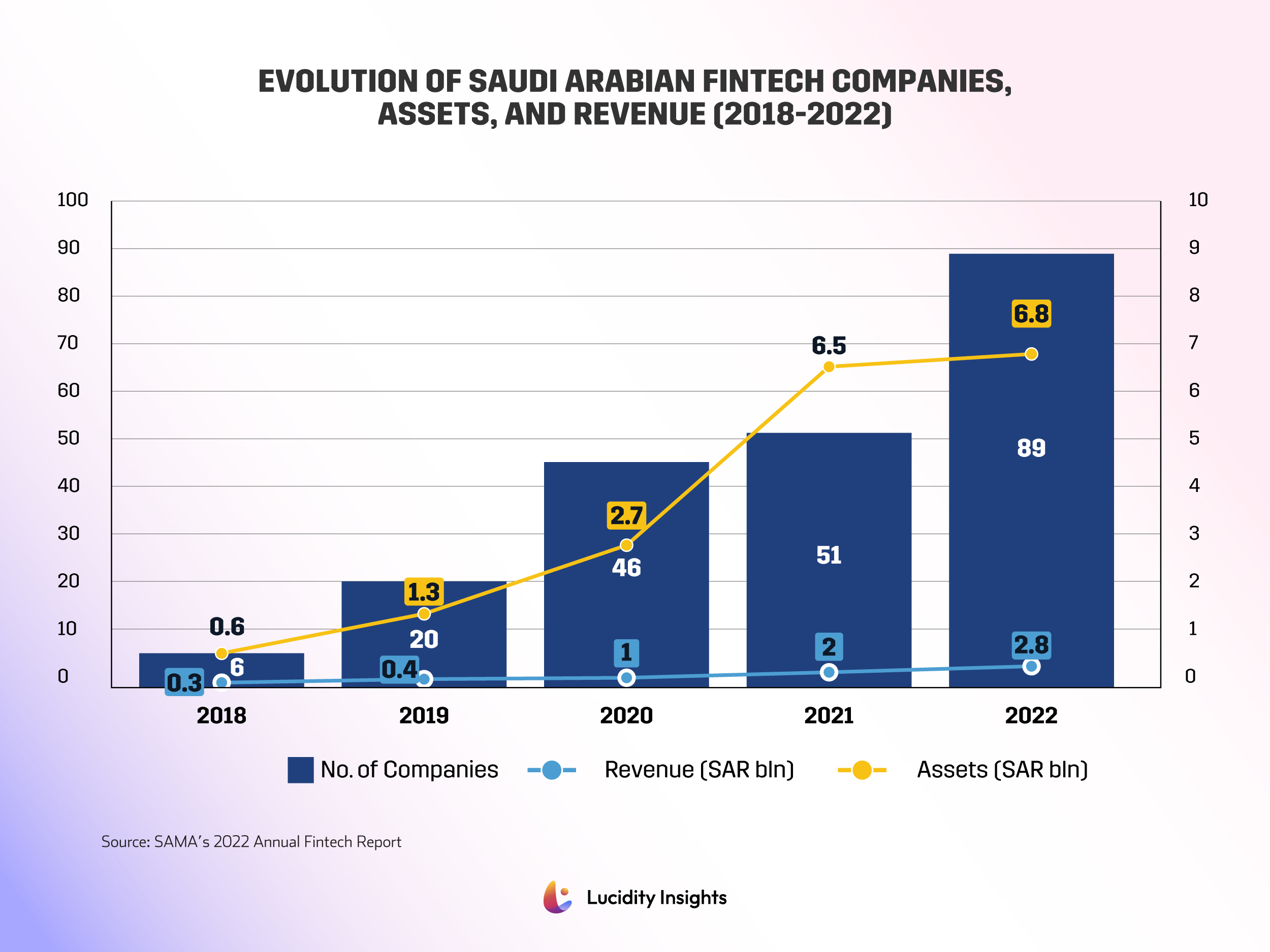

By the end of last year, SAMA’s Regulatory Sandbox had allowed 50 fintech companies to test new products and services in a controlled environment. By the end of 2022, there were 89 licensed fintech companies operating under SAMA's supervision. This includes 30 companies specializing in finance, insurance, and payments, 15 in the regulatory sandbox, and 44 authorized fintech companies in operation. The sector generated a total revenue of SAR 2.8 billion ($747 million USD) in 2022, up from SAR 2 billion ($533 million USD) in 2021, and held total assets of SAR 6.8 billion ($1.81 billion USD), a slight increase from SAR 6.5 billion ($1.73 million USD) the previous year. Furthermore, the fintech sector now employs 2,858 professionals. By 2030, the Kingdom has pledged to create 18,000 fintech jobs in the country.

Infobyte: Evolution of Saudi Arabian Fintech Companies, Assets, and Revenue (2018-2022)

Infobyte: Evolution of Saudi Arabian Fintech Companies, Assets, and Revenue (2018-2022)

The Kingdom has ambitious plans for the future, as outlined in its 2025 commitments. It aims to increase the share of non-cash (digital) transactions among individuals to 70% by 2025, reducing cash usage and raising the fintech sector's contribution to the nation’s GDP to SAR 4.5 billion ($1.2 billion USD), creating approximately 6,000 jobs by 2025. Furthermore, the Kingdom Vision 2030 targets 525 fintech companies, 18,000 job opportunities, SAR 13.3 billion ($3.55 billion USD) direct GDP contribution, 20% foreign direct investments (FDIs), and SAR 12.2 billion ($3.25 billion USD) cumulative venture capital (VC) investments by 2030.

Digital wallets, also known as e-wallets or mobile wallets, are a significant driver of this growth. These virtual wallets allow users to securely store and manage their digital assets, such as money, payment cards, loyalty cards, and other digital credentials, on electronic devices like smartphones, tablets, or computers.

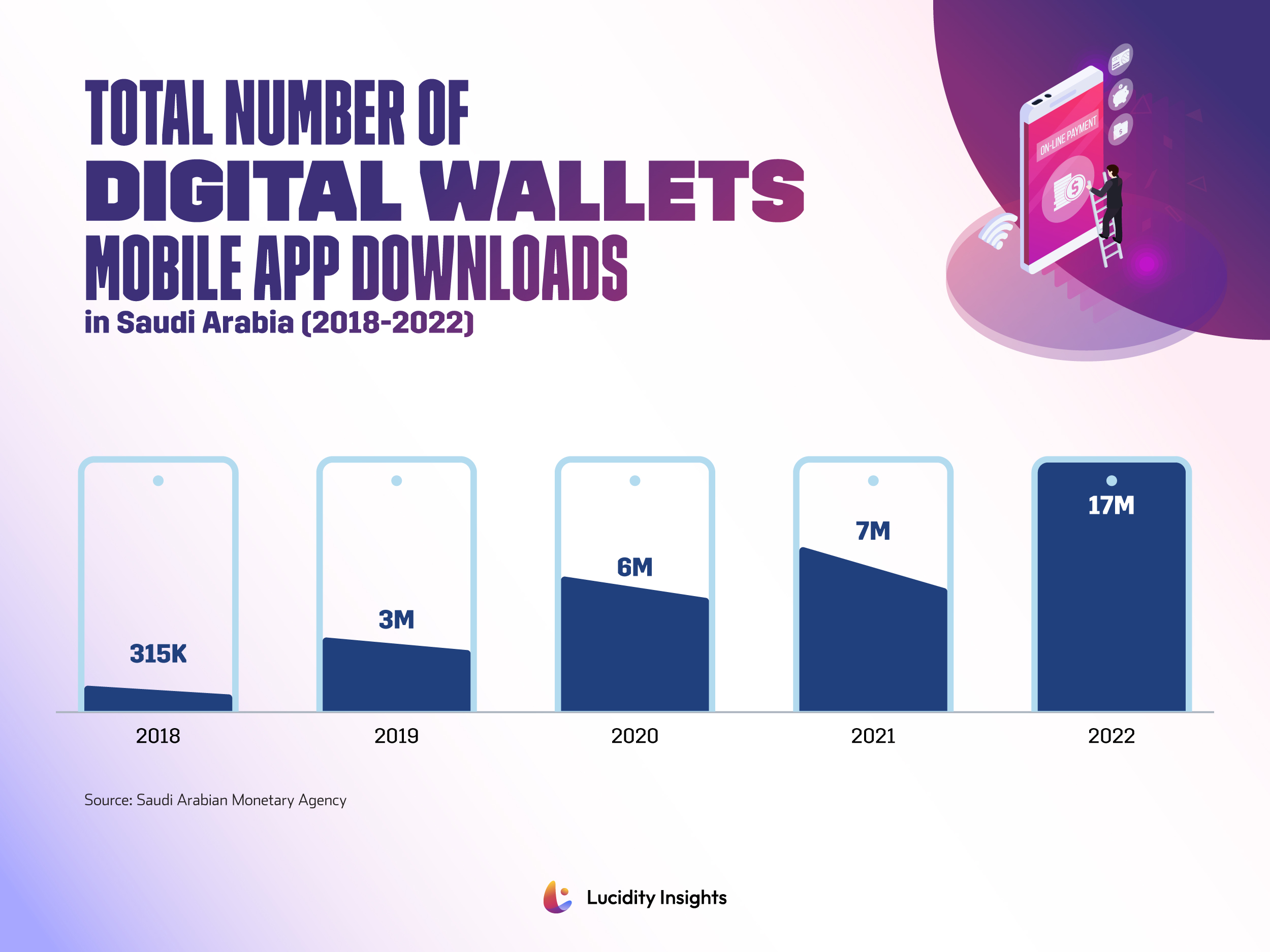

In 2018, 4.3 million Saudis adopted digital wallets, indicating a willingness to explore new payment methods. By the end of 2022, deposits in electronic money institutions (EMI) digital wallets reached nearly SAR 69.8 billion ($18.6 billion USD), with SAR 57.6 billion ($15.36 billion USD) deposited via credit/debit cards and SAR 12.2 billion ($3.25 billion USD) via bank transfers. Digital wallets facilitated 27 million international transfers worth SAR 43 billion ($11.5 billion USD), while POS systems gained traction, with 73,000 merchants processing transactions worth SAR 13 billion ($3.5 billion USD). The total value of local transfers with EMI digital wallets amounted to SAR 15 billion ($4 billion USD), and cash withdrawals from EMI digital wallets totaled SAR 8 billion ($2.13 billion USD). Additionally, 13.8 million retail customers, including 8.6 million active ones, registered with EMI digital wallets, and 176,000 merchants registered, resulting in 17 million digital wallet mobile app downloads.

Infobyte: Total Number of Digital Wallets Mobile App Downloads in Saudi Arabia (2018-2022)

Infobyte: Total Number of Digital Wallets Mobile App Downloads in Saudi Arabia (2018-2022)

The report also highlights the growing popularity of Buy Now, Pay Later (BNPL) services, with nearly 10 million customers, including 5.8 million active ones, registered by the end of 2022. The Kingdom’s efforts to promote digital banking underline its growing appeal as 27% of the population now uses one form of BNPL solution or another. This growth has also been accompanied by a decline in cash usage as cash accounted for only 26% of total transactions in 2022, down from 40% in 2021.

Infobyte: Total Number of Retail Customers Registered with BNPL in Saudi Arabia (2020-2022)

Infobyte: Total Number of Retail Customers Registered with BNPL in Saudi Arabia (2020-2022)

The report also provides key recommendations for the continued development of the fintech sector in Saudi Arabia. These include continued government support in terms of funding, regulatory support, and access to data; investment in fintech startups by the private sector; a focus on solving real problems for consumers and businesses by fintech companies; and collaboration among fintech companies to develop common standards and practices.

The Kingdom is committed to making Saudi Arabia a global hub for fintech innovation and is providing the necessary support to achieve this goal. The country's young and tech-savvy population is eager to adopt new financial technologies, and the growing economy and high level of disposable income create a large potential market for fintech products and services.

%2Fuploads%2Ffintech%2Fcover3.jpg&w=3840&q=75)