Is a Proptech Revolution on Its Way in the Middle East and Africa?

04 November 2024•

The property sector is pivotal to the economic landscape in the Middle East and Africa (MEA) region, accommodating a population of 1.7 billion homeowners and tenants as of 2024. The MEA region is poised to transform its property sector, driven by technological advancements in Proptech. Proptech, short for property technology, holds the potential to address the region's unique challenges—such as rapid urbanization, inefficient systems, and housing shortages—while capitalizing on emerging opportunities. This vast and virtually untapped market positions Proptech at the forefront of the region’s ongoing digitization and economic diversification efforts.

In a report published by Global Ventures in May 2024 titled: Proptech in the Middle East and Africa: Transforming the future of property in the world’s fastest-growing economies, the team explores the property market's importance in MEA, its pressing challenges, and how Proptech is well-positioned to overcome these hurdles. They examine what can be expected across the value chain over the next decade from design and build to commercialization and management.

Global Ventures’ Founder and Managing Partner, Noor Sweid believes “the MEA region has a unique advantage in developing, testing, and deploying property technologies largely driven by the size of the market, the depth of the opportunities, and the chance to leapfrog legacy infrastructure."

Each region within the MEA presents its own unique set of challenges and regulatory frameworks, making the area a hub for innovation. The Gulf Cooperation Council (GCC) countries have experienced consistent growth in the property sector over the past decade. As of 2024, the total value of planned or ongoing real estate projects in the Gulf stands at US $1.7 trillion. Real estate in these markets accounts for over 10% of the national GDP. However, the sector faces significant inefficiencies, largely due to the complexity of its value and supply chains, as well as longer-than-average licensing timelines.

In contrast, Sub-Saharan Africa is grappling with rapid urbanization, where cities are expanding much faster than the supporting infrastructure, including housing. The region’s population is currently growing three times faster than the global average, with half of the world’s population growth between 2022 and 2050 expected to occur in Sub-Saharan Africa. According to a report published by the African Development Bank, this has already resulted in a housing deficit estimated at around 51 million units. With 96% of Sub-Saharan Africa’s population living on just 6% of the land, Proptech offers a transformative opportunity to rethink how space is developed and utilized. Addressing this housing shortage could unlock significant economic benefits for the region. It is estimated that closing the housing gap in Sub-Saharan Africa could generate US $5 trillion in economic output and create 26 million jobs annually.

Across the MEA region, the property sector grapples with issues related to affordability, urban planning, and environmental impact. Sub-Saharan Africa’s housing crisis is compounded by inadequate infrastructure and planning, while the Gulf’s thriving real estate market struggles with inefficiencies from complex value chains. Additionally, the property sector’s significant contribution to global CO2 emissions and its reliance on outdated, manual processes highlight the urgent need for digital transformation. Rising interest rates and inflation further challenge the sector, emphasizing the critical role that tech-driven solutions must play in enhancing efficiency, affordability, and sustainability.

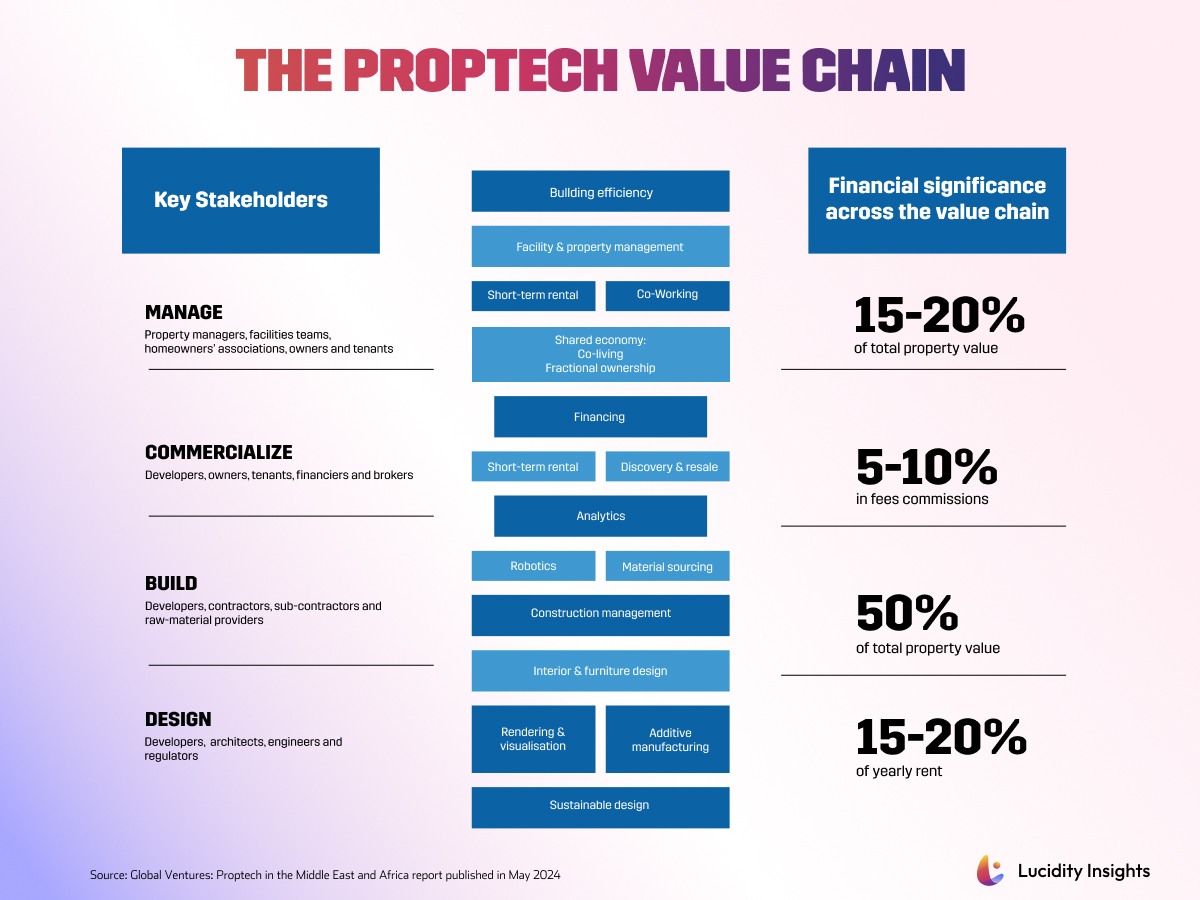

The Proptech value chain outlines key stakeholders and processes—ranging from property management to building efficiency—demonstrating how these elements contribute to the sector’s overall financial performance. Different processes and stakeholders are interconnected at various levels within the real estate ecosystem, highlighting the significant financial impact of activities such as efficient property management, innovative commercialization strategies, and thoughtful design.

Let’s explore some examples of solutions in Proptech across our 4 dimensions:

- Commercialize

Driven by digitization, evolving consumer expectations, and economic pressures, alternative financing models are transforming property commercialization. Between 2019 and 2023, global VC funding directed at startups developing commercialization solutions reached US $5.5 billion. As millennials and Gen Z become more prominent market participants, there is an increasing demand for flexible and innovative financing models. Younger buyers, accustomed to digital transactions, seek investment opportunities that align with their mobile, less capital-intensive lifestyles. Solutions like fractional ownership and property tokenization are reshaping the market by offering greater inclusivity, flexibility, and simplified transactions. -

Manage

Property management, which focuses on maintaining and optimizing real estate assets post-acquisition, often relies on outdated systems that fail to meet the evolving needs of consumers. As remote working becomes more common, there is a growing expectation for properties to support hybrid lifestyles, incorporating community-based living and co-working spaces. Consequently, property management strategies are shifting beyond mere space provision to enhance the overall user experience in an increasingly competitive market. Proptech solutions are filling the gaps left by legacy systems, improving areas such as energy management, security, and tenant experience, while offering more personalized and efficient property services. -

Design

Advancements in technology are reshaping how spaces are designed, influencing their functionality, sustainability, and integration with the environment. To address cost constraints, lengthy approval processes, and the need for sustainable design, the industry is adopting innovative solutions to enhance efficiency and open up new possibilities for spatial configuration.

Generative design, for example, uses AI to quickly produce multiple building design options based on specific constraints, optimizing both aesthetics and functionality. Additive manufacturing, utilizing materials such as self-healing concrete and climate-responsive glass, can reduce emissions and costs by up to 90%, while accelerating the production of prototypes and scale models. Furthermore, augmented and virtual reality technologies allow for the early detection of design and construction errors, while digital twins enable real-time monitoring and adjustments throughout the construction process. -

Build

The physical construction of real estate spans the entire lifecycle—from planning and procurement to the building process and post-construction management. In MEA, construction faces persistent challenges, including manual project planning, fragmented performance management, opaque supply chains, and skilled labor shortages. These issues often result in cost and schedule overruns, further complicated by the growing demand for environmentally sustainable construction practices. However, digital innovations are beginning to penetrate this traditionally low-tech sector, with construction-related Proptech in MEA experiencing a 125% year-on-year increase from 2022 to 2023 in VC funding.

Construction management platforms now offer automated scheduling, performance tracking, and real-time communication, while procurement platforms streamline and increase transparency in the supply chain, improving efficiency for large projects. Prefabrication, which involves manufacturing building components off-site, significantly reduces errors and speeds up construction, cutting costs by 20% and reducing build times by up to 50%. Robotics further enhances efficiency by automating repetitive tasks, contributing to faster and more precise construction processes.

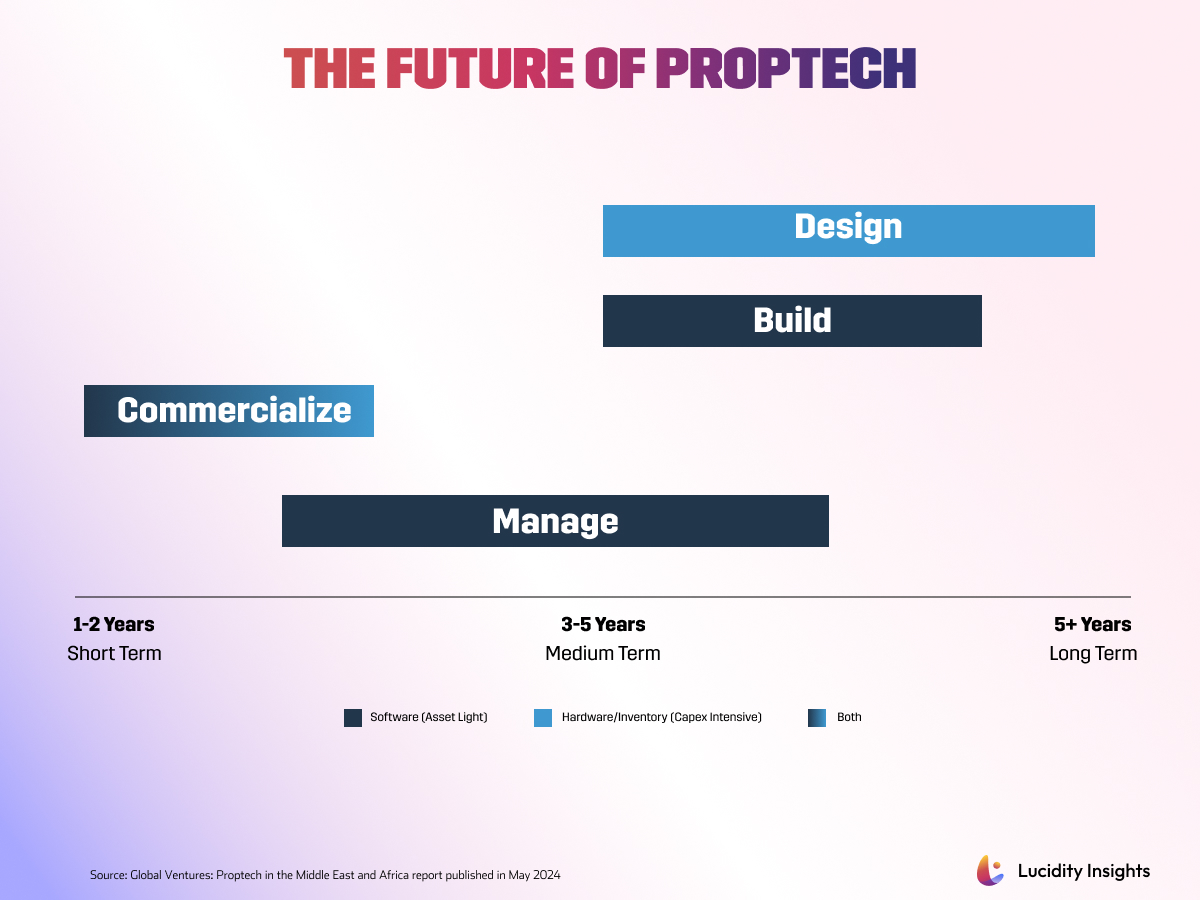

The Next 10 Years of Proptech in MEA

According to Global Ventures, the next decade will see a transformation across the Proptech value chain in MEA, presenting innovative solutions that streamline processes, boost sustainability, and improve affordability. The 4 key dimensions along the value chain will benefit:

- Design: Generative design, immersive experiences, additive manufacturing, 3D printing and material sciences

- Build: Construction management and procurement platforms, data-driven decision-making, modular construction, and robotics

- Commercialize: Marketplaces and fractional ownership

- Manage: Co-working spaces, building and tenancy management, IoTs and service bundling

According to Sacha Haider, partner at Global Ventures “Commercialization, which focuses on how people rent, own, and access the property market, has been the early mover in the proptech value chain. With incumbents like Property Finder leading the charge in regional marketplaces, innovative models such as fractional ownership platforms like Stake are gaining momentum, fueled by Gen Z and Millennials' distinct ambitions and economic realities around home ownership.”

Proptech is set to play a crucial role in shaping the future of the property market across MEA, addressing pressing challenges such as housing shortages, affordability, and environmental impact. By embracing the latest technologies, from generative AI in design to tokenization in commercialization, the region can leapfrog traditional practices and unlock new opportunities for growth. The journey has just begun, and with Proptech leading the way, the future of property in MEA looks promising, sustainable, and inclusive.

In our second article titled “Investors Show a Growing Appetite for Proptech in the Middle East and Africa”, based on Global Ventures' Proptech report, we explore the Venture Capital landscape in the MEA region and spotlight the top five most funded startups that are driving innovation in the Proptech space.

To dive deeper into these evolving trends, explore Global Ventures’ full report here.