GCC Startups Raised $1.35B in March 2025, But Who Got Funded?

14 April 2025•

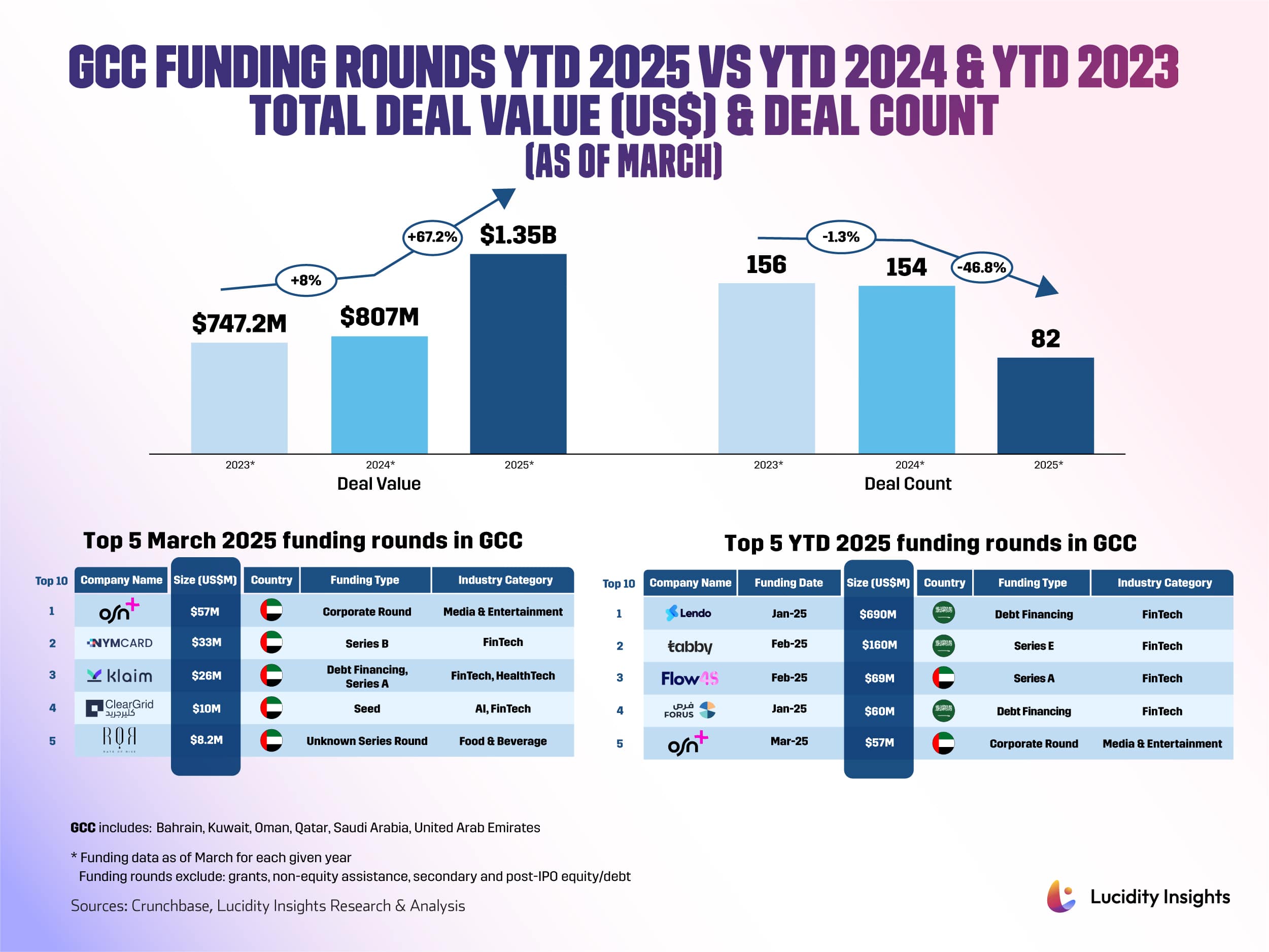

Over the past three years, Gulf startups have navigated booms and busts but Q1 2025’s surge is remarkable in scale yet narrow in scope. As of end of March 2025, cumulative YTD funding in the GCC reached US $1.35 billion, a 67.2% jump on US $807 million at the same point last year. Yet deal volume tells a counter‑narrative: only 82 rounds closed, down 46.8% from 154 in Q1 2024, underscoring a pivot toward fewer, capital‑intensive financings.

VC Funding Deals Dynamics

The gulf between funding value and deal count has never been starker. While ticket sizes swelled—lifting total capital to new highs—founders in the seed and early‑growth brackets face a pronounced capital drought. Average cheque size climbed from US $5.2 million in Q1 2024 to US $ 16.5 million in Q1 2025. The disappearance of “mega‑round” (>US $100 million) droughts from 2024 has been replaced by a scarcity of small and mid‑stage checks.

Geography & Sector Concentration

UAE dominated capital flows securing 100% of March’s top five rounds, leaving Saudi Arabia on the sidelines for marquee financings. The FinTech sector continues to be the GCC's powerhouse, accounting for four out of the top five largest YTD deals and three out of the top five deals in March 2025. This reinforcesthe region's strategic focus on diversifying away from traditional oil-based economies by modernizing financial services.

Macro Underpinnings

The shift reflects global headwinds. Emerging‑market outflows, driven by Fed tightening and a strong dollar, have curbed Limited Partners (LPs) commitments to regional VC funds. Coupled with oil‑price volatility and Red Sea shipping risks, investors are excising optionality—backing proven models over experimental bets.

Outlook

With fewer but heftier rounds on the table, the GCC ecosystem must ask: will fund managers recycle gains into nascent startups once liquidity normalizes, or will capital coalesce around a shrinking cohort of scale‑ups? Q2 2025’s pipeline announcements will offer the clearest signal.

Let’s take a look at the top 5 funding rounds of March 2025 in GCC.

#1 - OSN+ (UAE) | Media and Entertainment | US $57 Million Corporate Round

OSN+ is the subscription video-on-demand streaming service rebranded by Orbit Showtime Network in 2022 and led by Lebanese CEO Joe Kawkabani. Available across MENA, OSN+ saw a 40% year-on-year increase in engagement in 2022, merged with music provider Anghami in 2024, and is currently one of the top three paid streaming apps in Egypt, Saudi Arabia, and the UAE.

In March 2025, OSN+ secured US $57 million in a corporate round led by Warner Bros Discovery for a 30% stake. The deal comes as WBD has said it has a “clear path” to reach 150 million global subscribers by the end of 2026 and that it anticipates the streaming segment will deliver a profit of approximately US $1.3 billion in 2025.

#2 - NymCard (UAE) | FinTech | US $33 Million Series B

Founded in 2018 by Omar Onsi and Ayman Chalhoub, NymCard runs the only issuer processor in MENA that fully owns its processing and switching technology, rather than licensing from third parties. Its localized, full-stack infrastructure, nCore, gives clients a competitive edge, enabling them to design, launch, and scale payment programs with unmatched flexibility. Built on modular APIs, nCore allows businesses to seamlessly manage card issuance, transaction processing, lending infrastructure, and real-time payments—all within a fully integrated financial stack that ensures speed, control, and efficiency.

In March 2025, NymCard secured US $33 million in its latest Series B funding round led by QED Investors, bringing its total amount raised to US $69.1 million. This marks QED Investors’ most significant investment in the region and the first one in the Gulf, underscoring the growing global confidence in MENA’s expanding fintech ecosystem. With this investment, NymCard is deepening its presence across 10+ markets in MENA, strengthening its payment infrastructure solutions to better serve banks, enterprises, fintechs, telecom providers, and more across its three core verticals: Card Issuing Processing, Embedded Lending, and Money movement.

#3 - Klaim (UAE) | FinTech, HealthTech | US $26 Million Debt Financing, Series A

Founded in 2020 by Ghafoor Ahmad and Karim Dakki, Klaim revolutionizes the healthcare industry by providing healthcare providers with access to working capital through the purchase of their submitted claims, which allows providers to receive payments within 24 hours instead of waiting for the typical 60 to 90 days. In 2024, Klaim announced a strategic milestone in its expansion into Saudi Arabia through a collaboration with Tharawat Tuwaiq Financial Company, an asset manager and financial advisor licensed by the Saudi Capital Market Authority (CMA).

In March 2025, Klaim secured US $10 million in Series A equity funding led by CDG Invest and Mad'a Investment Company as well as an additional US $16 million financing fund led by Tharawat Holding, bringing its total funding to US $59.8 million. Klaim will use the funding to expand its footprint in the UAE, deploy capital in Saudi Arabia, Oman, and other regions, and continuously refine its technology to better serve healthcare providers.

#4 - ClearGrid (UAE) | AI, FinTech | US $10 Million Seed Round

ClearGrid was founded in 2023 by Khalid Bin Bader Al Saud, Mohammad Al Zaben, and Mohammed AlKhalili, ClearGrid offers an AI-powered collections platform that automates every step of the recovery process – from borrower engagement to negotiations – helping lenders scale while providing a better borrower experience. By combining AI, self-service tools, and omnichannel outreach, ClearGrid reduces resolution times and increases recovery rates. Having managed hundreds of millions in debt portfolios and secured partnerships with the largest fintech players in the Middle East and leading MENA banks, ClearGrid has signed over 10 major enterprise clients.

In March 2025, ClearGrid announced its launch from stealth with US $10 million in a pre-seed round co-led by Raed Ventures and Beco Capital as well as a seed round co-led by Nuwa Capital and Raed Ventures. The funding is dedicated to building the first modern debt collection infrastructure for the digital age in MENA as well as its robust pipeline for 2025, which includes expanding revenue in the UAE and entering the KSA market.

#5 - ROR Coffee Solutions (UAE) | Food and Beverage | US $8.2 Million Funding Round

Founded in 2017 by Aaron Marshall, ROR Coffee Solutions is a specialty coffee provider focused on sustainability and quality set to transform the coffee industry by investing in infrastructure, advanced roasting technology, and workforce development. The company aims to make premium specialty coffee more accessible to businesses and consumers, ensuring every cup meets the highest standards of craftsmanship and sustainability.

In March 2025, ROR Coffee Solutions secured a US $8.2 million investment to accelerate its expansion and innovation strategy over the next five years. This funding will enhance the company’s presence across the MENA region and Europe while reinforcing its commitment to sustainability, ethical sourcing, and cutting-edge technology in the specialty coffee industry.

%2Fuploads%2Fdubai-startup-guide-2024%2Fcover.jpg&w=3840&q=75)