Expected Headwinds in Dubai’s Funding Landscape

23 June 2023•

Previously: Dubai's Global Attractiveness: Perspectives from Venture Capitalists

Challenges and Competition: Navigating the Path to Dubai's Digital Economy Capital Ambition

Investors expect to see the Dubai investor ecosystem mature in the coming months and years with a specific increase in growth-stage funds and sector-specific funds. However, as cautioned by Walid Hanna, Chairman and Co-CEO at Middle East Venture Partners, “We have witnessed a decrease in the valuation hype, the market has corrected, there might be a slight ‘funding winter’ as the ecosystem matures and becomes more competitive. To mitigate these risks, it will be important for the government to continue to support and invest in the startup ecosystem, and for the VC community to remain nimble and responsive to the needs of the market.”

Another challenge for Dubai in achieving its ambition of becoming the digital economy capital of the world will likely be competition from other cities and regions actively pursuing similar goals, not just within the region but outside as well. There are well-established technology hubs in Asia and Europe that offer better exit opportunities at present, in addition to the emerging hubs like Riyadh that are also attracting investment capital and talent in the region.

Another potential obstacle for Dubai could be the lack of experienced founders in the region, which was expressed by several investors. To overcome this, Walid Hanna suggested that “the city may need to continue to invest in training programs, mentorship opportunities, accelerators and other initiatives that help to develop the next generation of startup leaders.”

Improving Exit Opportunities: Enhancing Dubai's Startup Ecosystem for Sustainable Growth

Almost all the VCs we spoke to said one of their biggest concerns was exit options and how they could be improved for local startups. The main exit options exercised by Dubai-based startups to date have been through M&A. Saudi and Egypt-based startups have begun IPOs in secondary public markets, providing another viable exit opportunity.

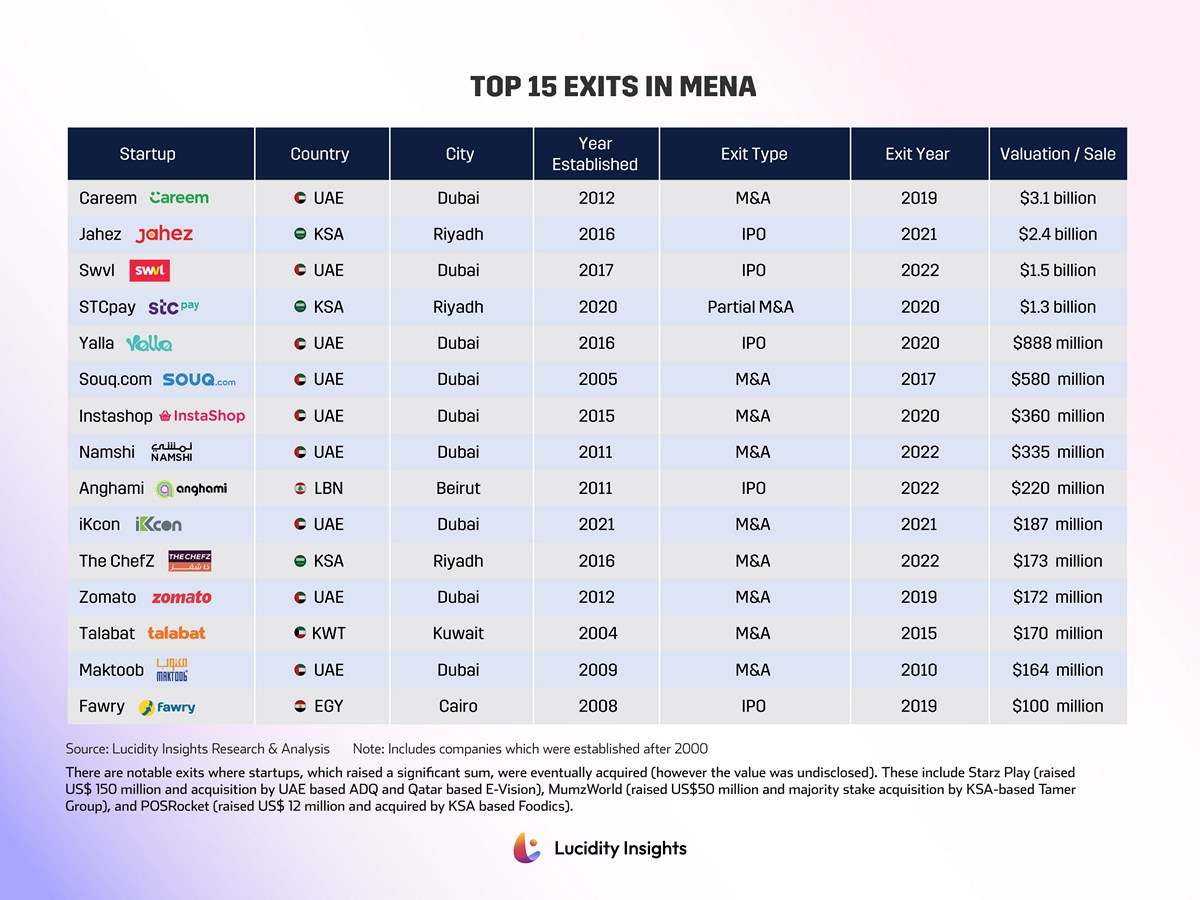

Ranking: Top 15 Exits in MENA (companies established after 2000)

The VC markets in MENA have historically been less liquid than the VC markets in the U.S. or Europe, though the region has begun to produce some major exits in recent years. There has been a clear increase in the number of exits in both numbers of transactions and valuation. In addition, public markets through IPOs and SPACs, special purpose acquisition companies, which were practically non-existent a few years ago, are starting to be a viable option for MENA-based companies, particularly Saudi Arabia’s Jahez, listing at US$2.4 billion valuation in January 2022 on Nomu, Saudi’s secondary exchange to Tadawul, and Anghami SPAC, which listed at nearly US$220 million on NASDAQ in February 2022.

This is a positive sign for the entrepreneurial ecosystem, and it is likely that this trend will reflect across the ecosystem in Dubai driven by the following:

1. For IPOs

a. Easing listing requirements on local markets.

b. Issuance of guidelines for dual-class shares, which allows founders to retain control of their companies even after going public.

2. For SPACs, which are formed to raise money through an IPO to buy another company, are becoming a realistic MENA exit option.

a. SPAC regulation was approved in Abu Dhabi in 2022, which is a first in MENA, with the first SPAC listed after raising nearly US$100 million

b. The 2021 launched Dhs 5 billion Abu Dhabi IPO Fund will be a key enabler, accelerating growth for enterprises by facilitating IPOs on the Abu Dhabi Securities Exchange

As stated by Noor Sweid, Managing Partner at Global Ventures, “When the prospects of returns expand through exits or mega-deals, foreign investors become more attentive to the market. So, to continue attracting international investors, it is important to invest in the factors that allow businesses to flourish and grow, including talent development, business friendly regulation, exit prospects and enabling infrastructure.”

Dany Farha, Managing Partner at BECO Capital, which is established since early days from 2012 and the largest VC firm in the Emirate, posits that “a viable path to IPO is an important attribute of a mature startup ecosystem for which attracting foreign investment is also imperative to bring true and deep liquidity into our stock exchanges.” He admits that “to make it a sustainable reality, we need to ensure that there is funding across the entire startup value chain. In particular, growth stage, pre-IPO, and post-IPO.”

To get the lay of the investor landscape across Dubai and MENA, and for insights provided by the investors backing the start-ups and scale-ups that are changing the face of entrepreneurship in the region, read the report by clicking here.

Related Articles:

- Driving Digital Economy: Dubai's Initiatives in Building a Resilient Tech Startup Landscape

- Dubai Chamber of Digital Economy: Why Dubai is a Great Global Launchpad for MENA Startups

- MENA's startup growth continues to be led by Dubai: over $11.7B lifetime raised across 306 scaleups

- Dubai Chamber of Digital Economy Publishes 2023 Venture Report; Dubai adds 64 more scale-ups in 2022

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)