Compelling Data for Fintech in Saudi

04 June 2022•

Compelling macroeconomics, demographics, tech-adoption rates and user behaviors should get the conversation started, not just for regional but global fintech entrepreneurs and investors. What does the data say?

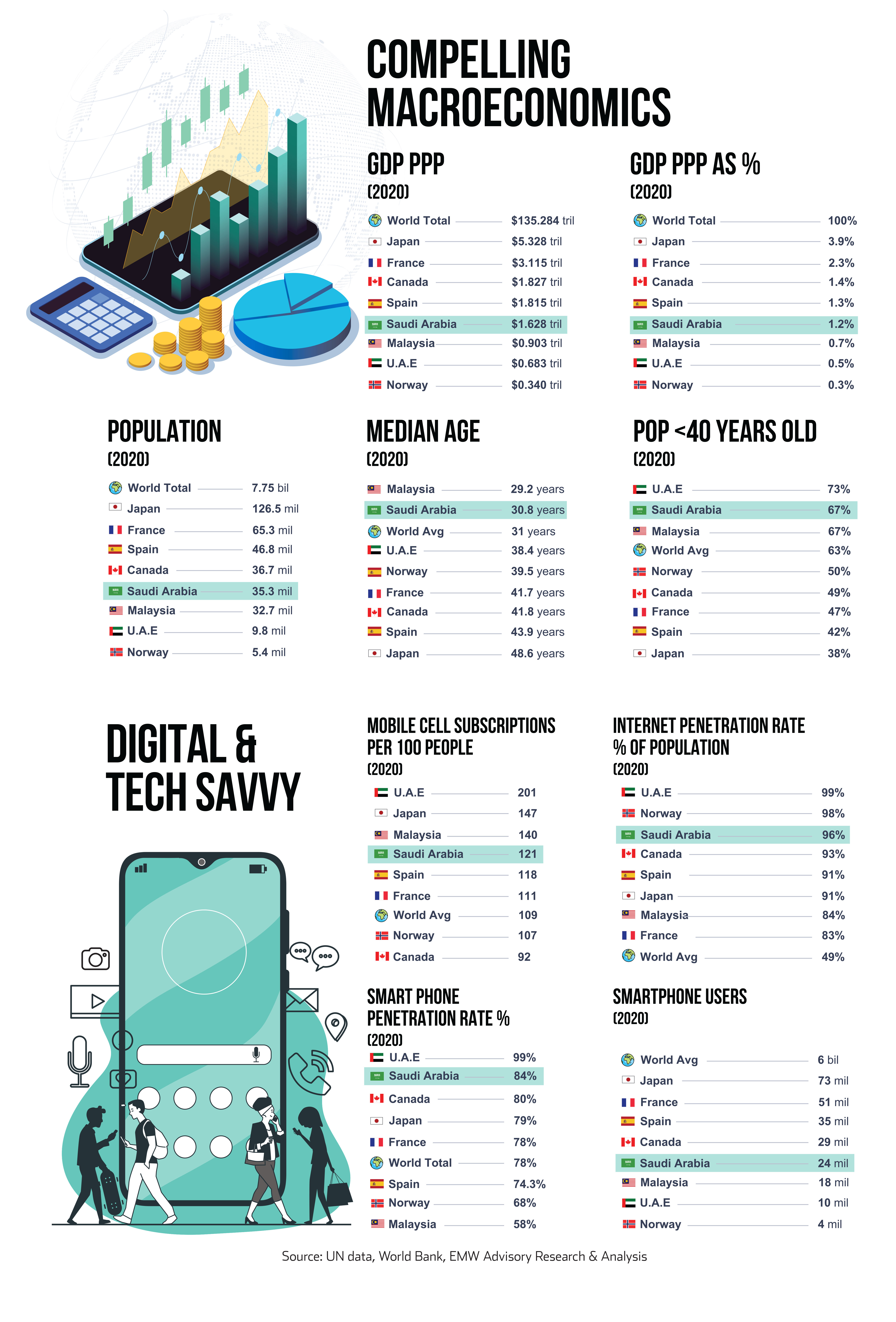

Saudi’s Compelling Macroeconomics.

A Wealthy Nation

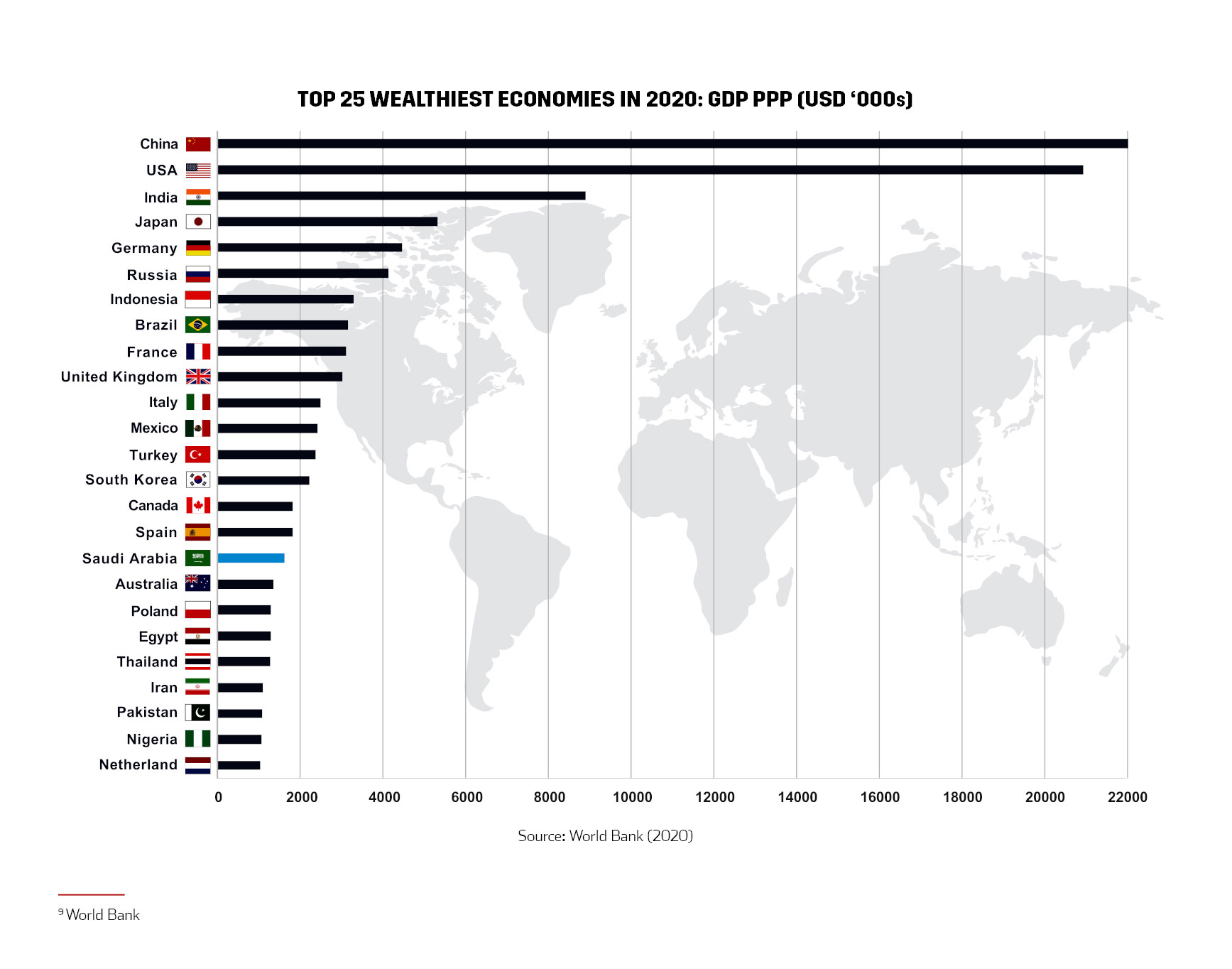

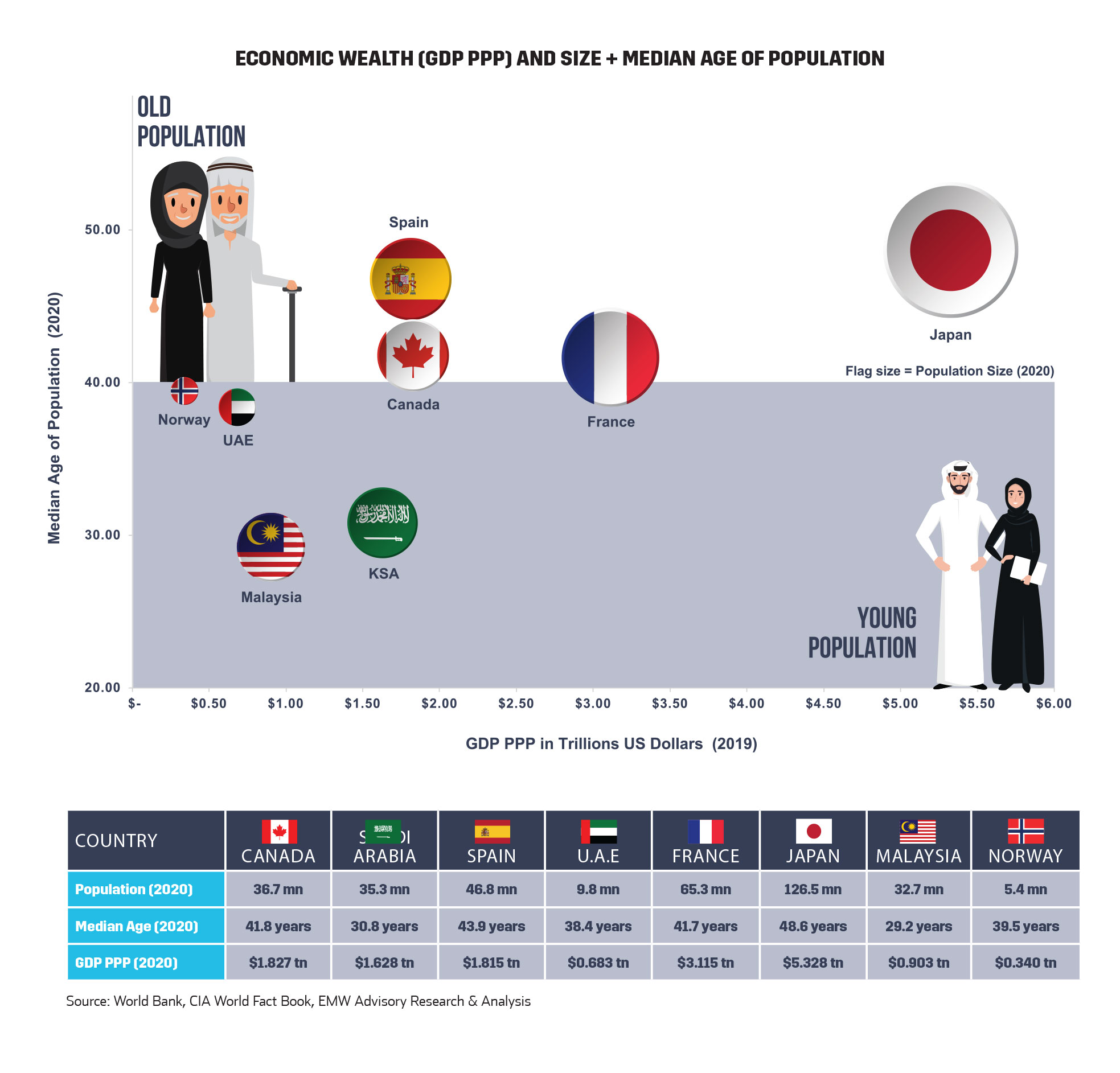

Saudi Arabia is a wealthy nation, considered by the World Bank as a “High-Income Economy” and is the only Arab country to be a part of the G-20 major economies. Saudi Arabia is the 17th wealthiest economy in the world with a GDP PPP of $1.63 trillion USD9 in 2020, largely due to having the world’s 2nd largest oil reserves and being the 2nd largest oil producer. This places the Kingdom of Saudi Arabia just behind Spain and Canada and ahead of Australia.

An Attractive Consumer Population

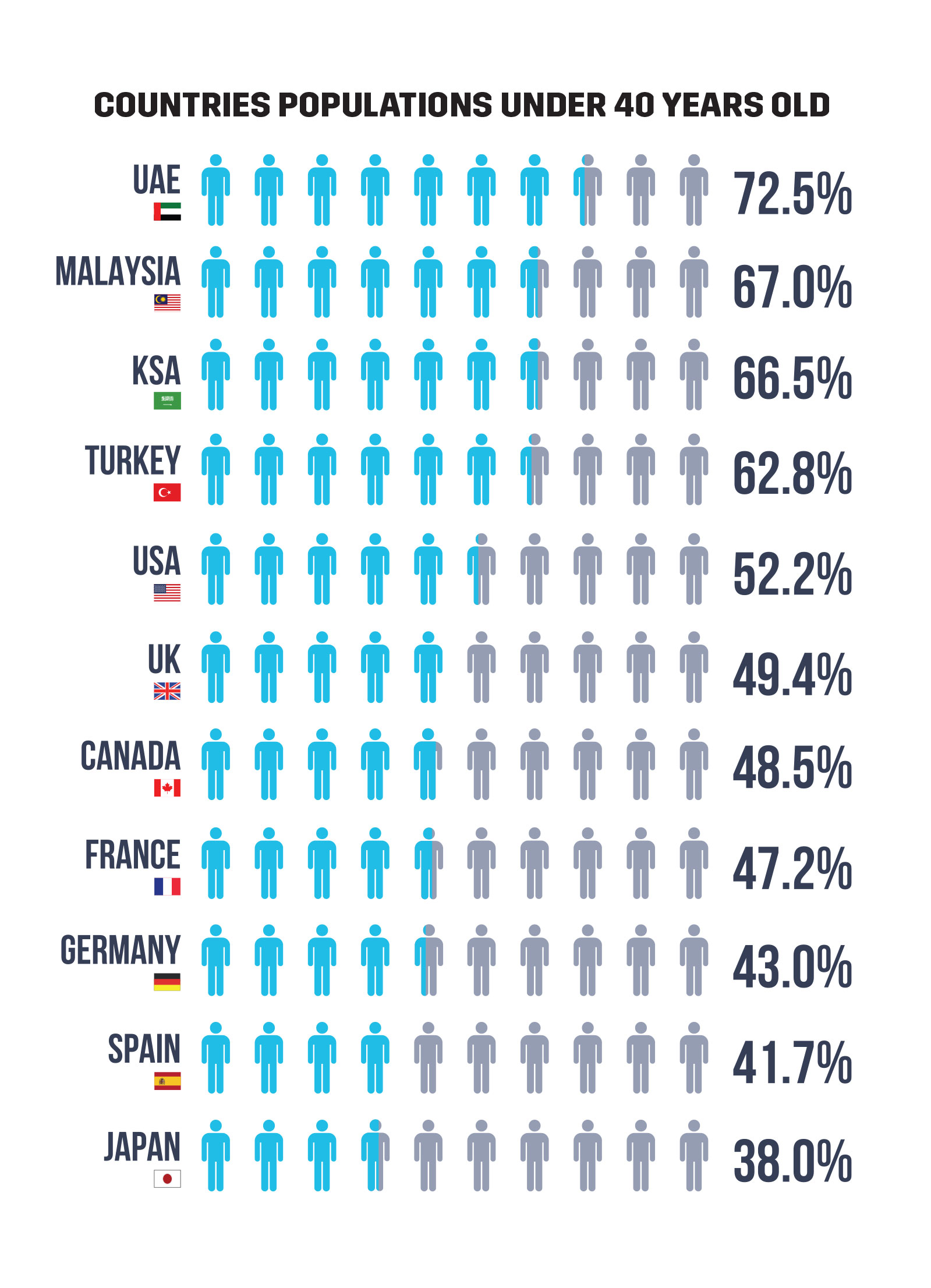

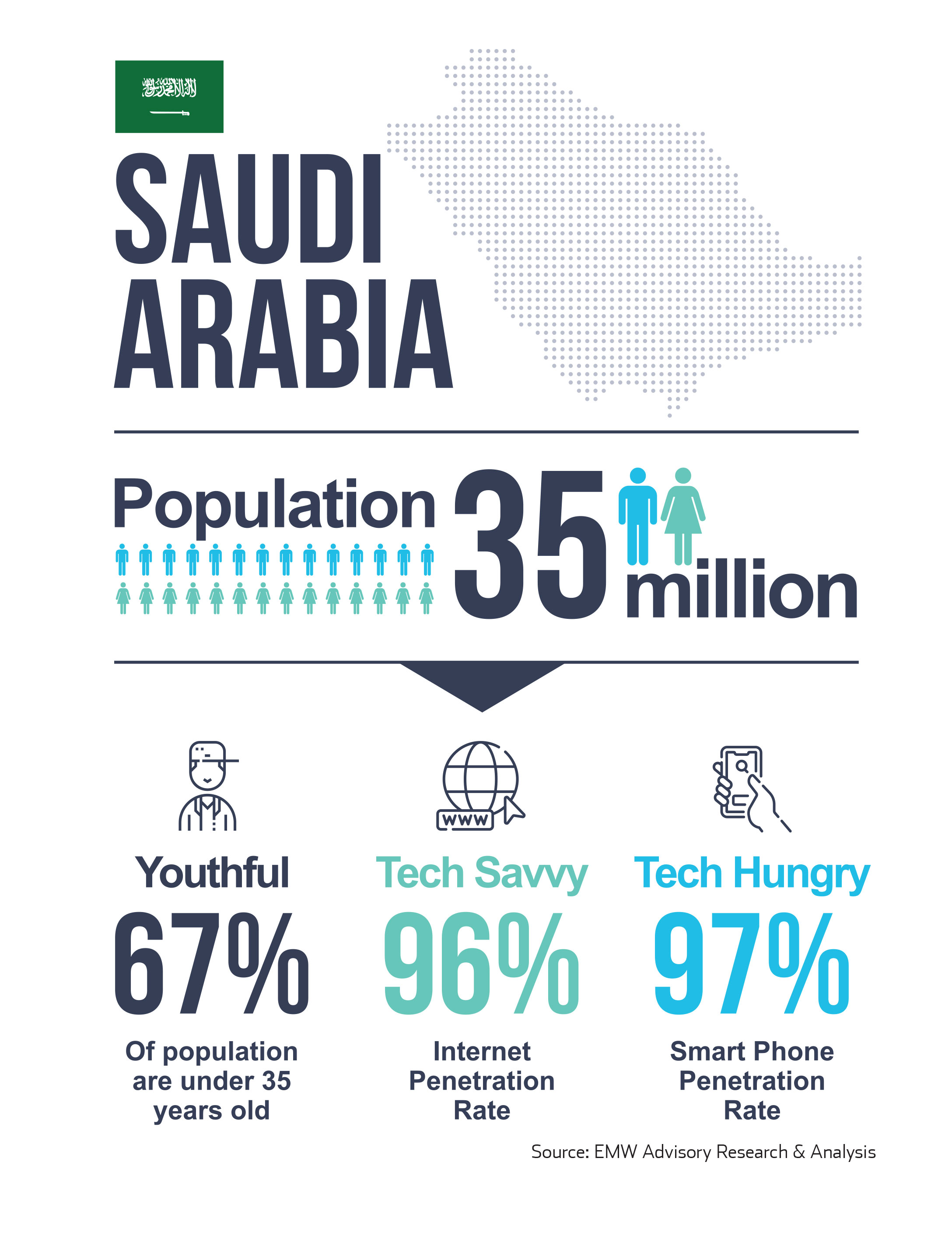

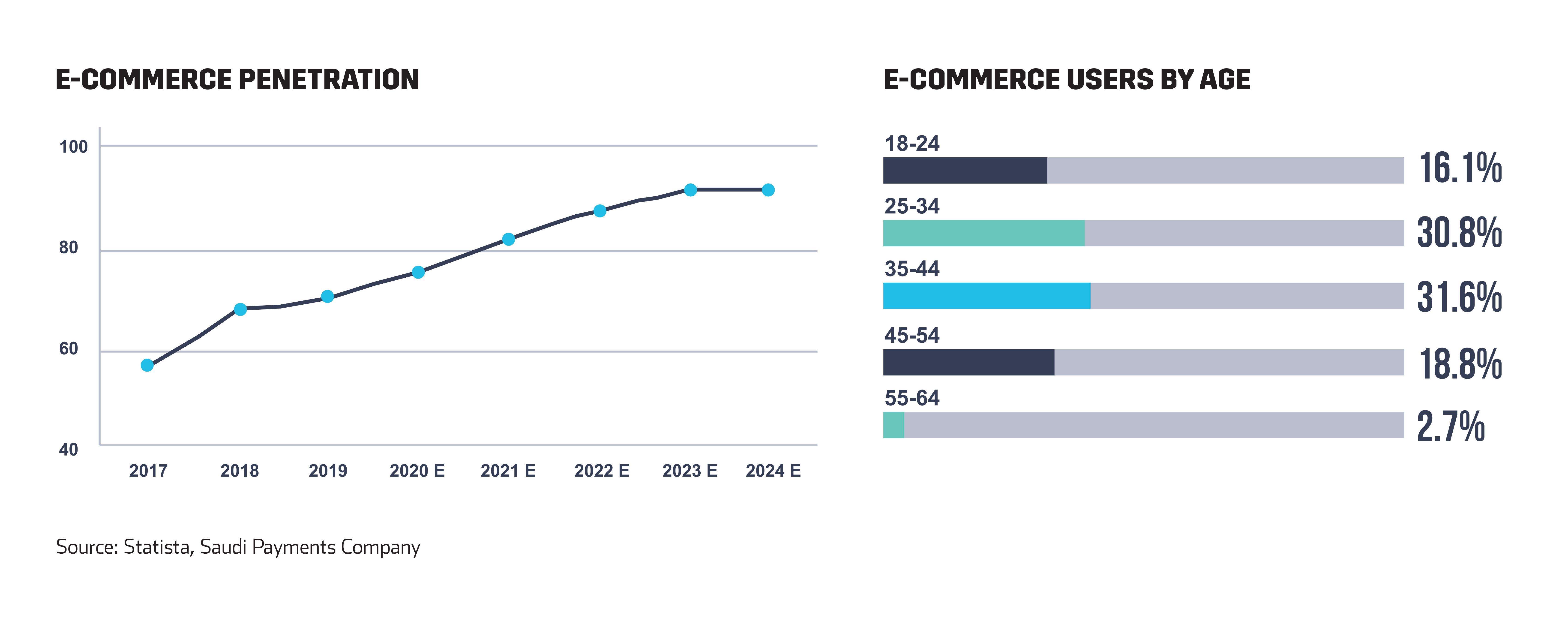

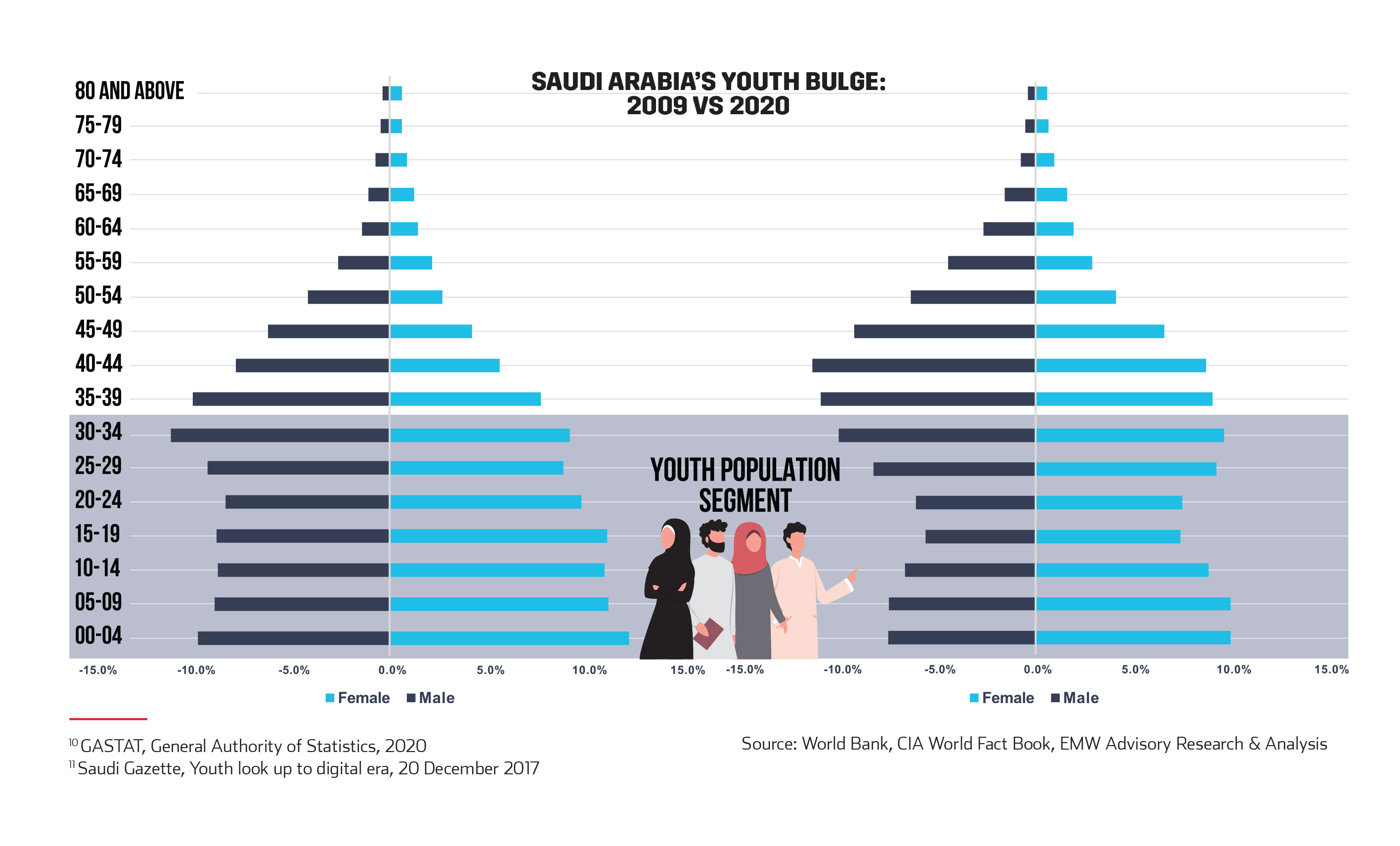

Not only is Saudi Arabia’s 35 million population wealthy, but it is also amongst the largest populations in the Middle East. Saudi’s population is also very young, with a median age of just under 31 years old, below the world average. 67% of the Saudi population is under 35 years of age10. His Royal Highness, the Crown Prince of Saudi Arabia, Mohammed bin Salman, has often remarked, “Our youth are our wealth. If they receive the proper guidance, they will create an excellent world on our earth.”11 This youthful population is what is the driving force behind Saudi Arabia’s ambitious “Vision 2030”, a comprehensive strategic review and redirection of Saudi Arabia’s social and economic priorities, launched in 2016.

Digitally Savvy & Tech Hungry.

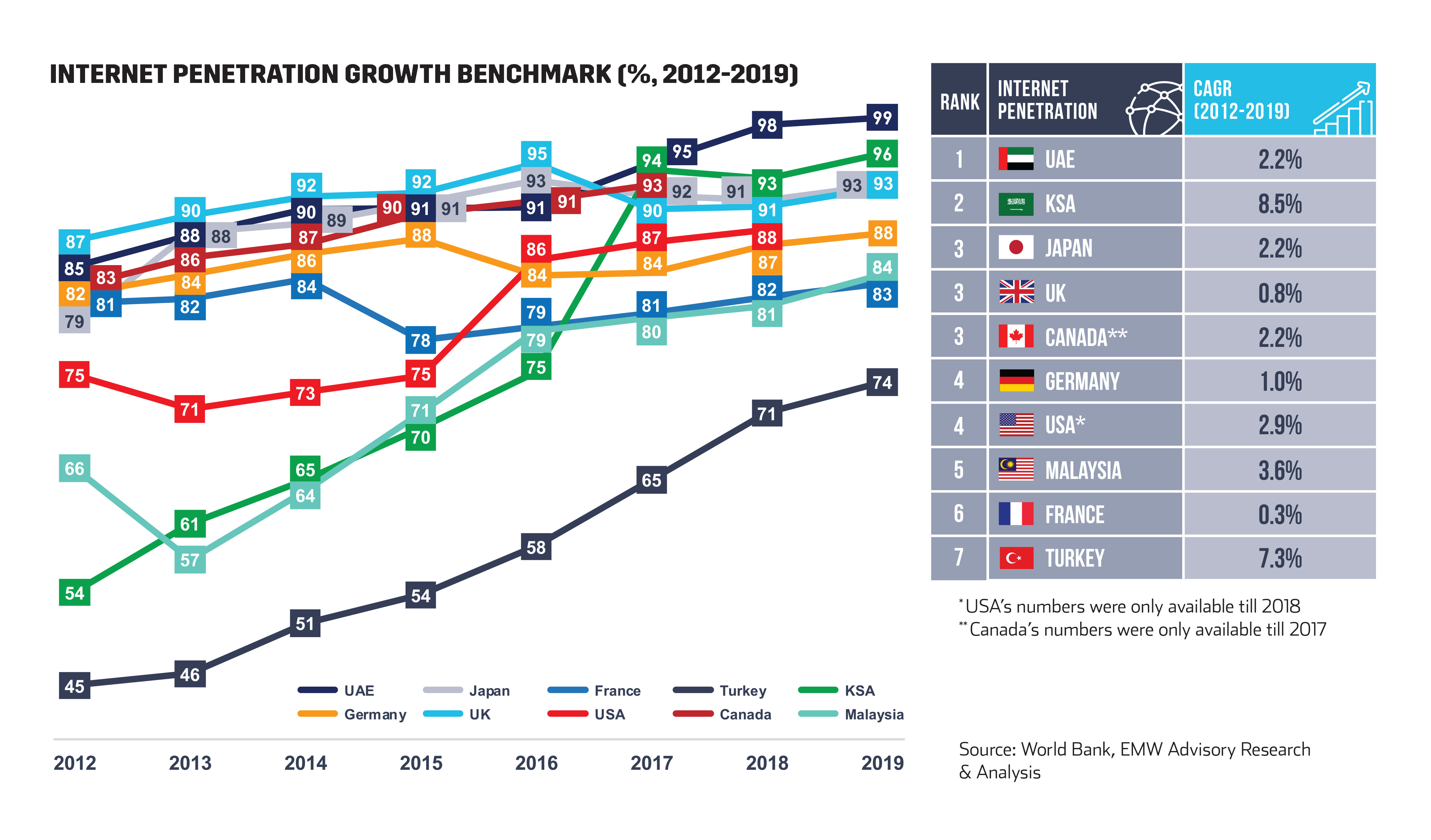

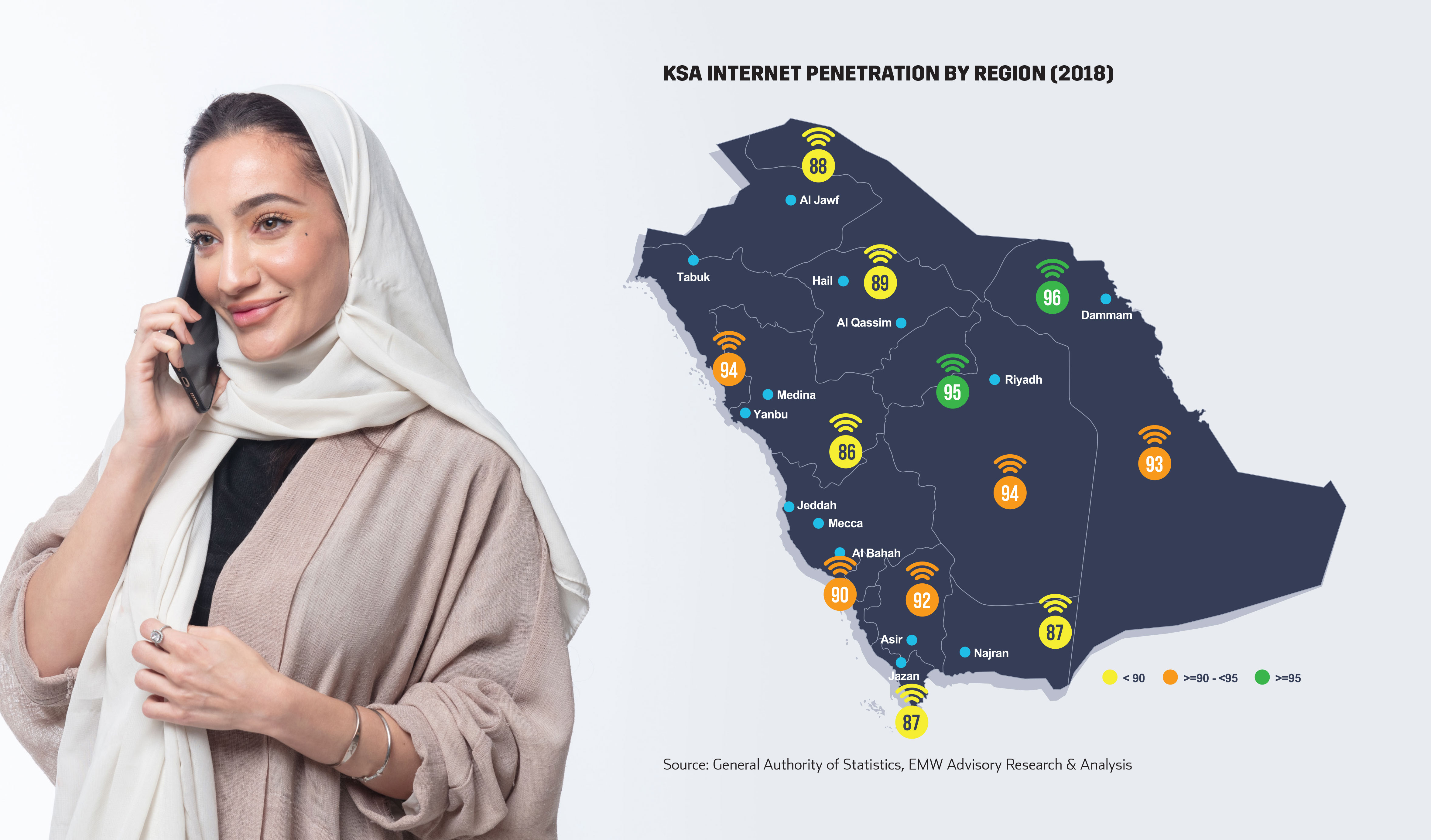

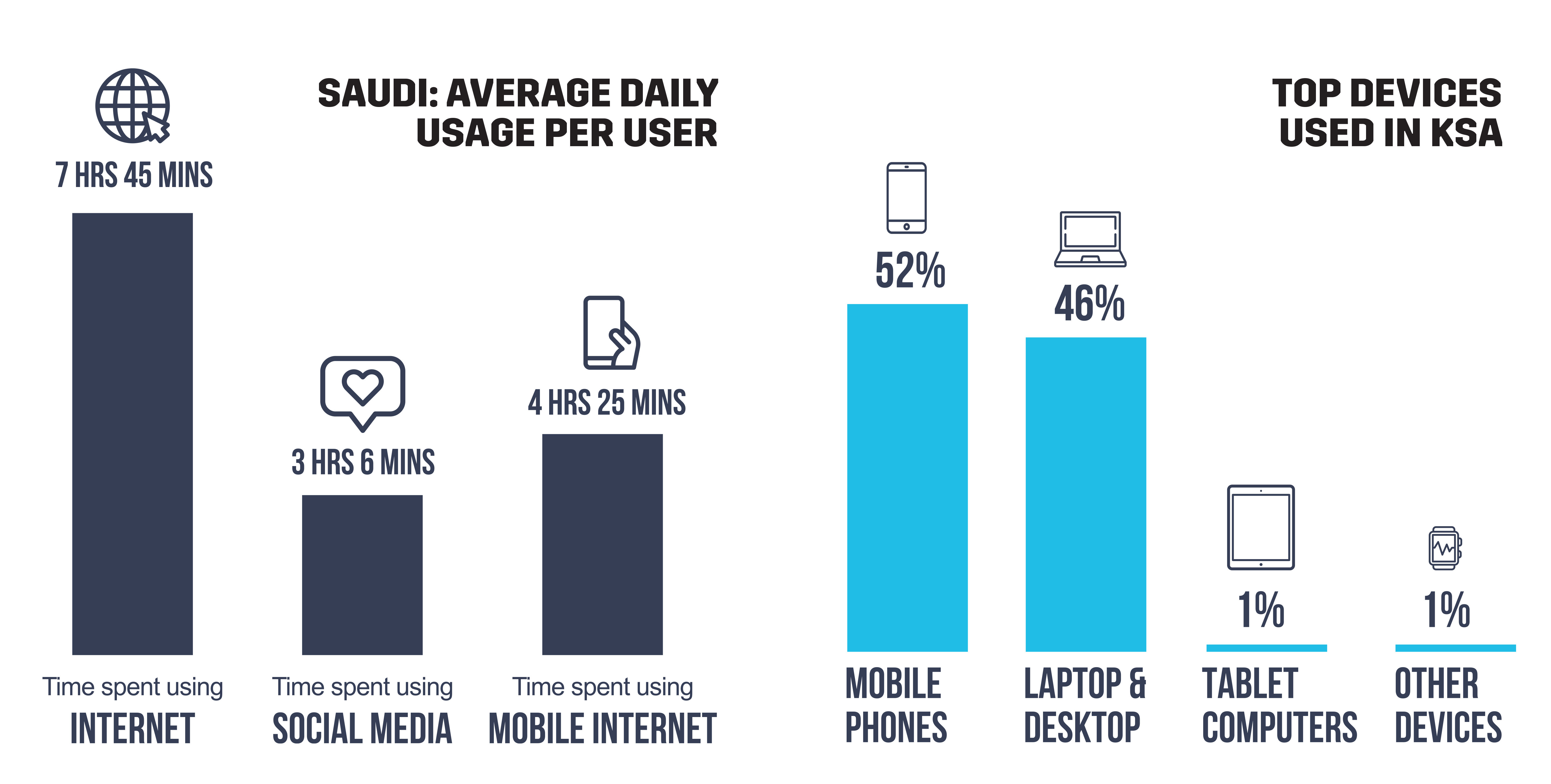

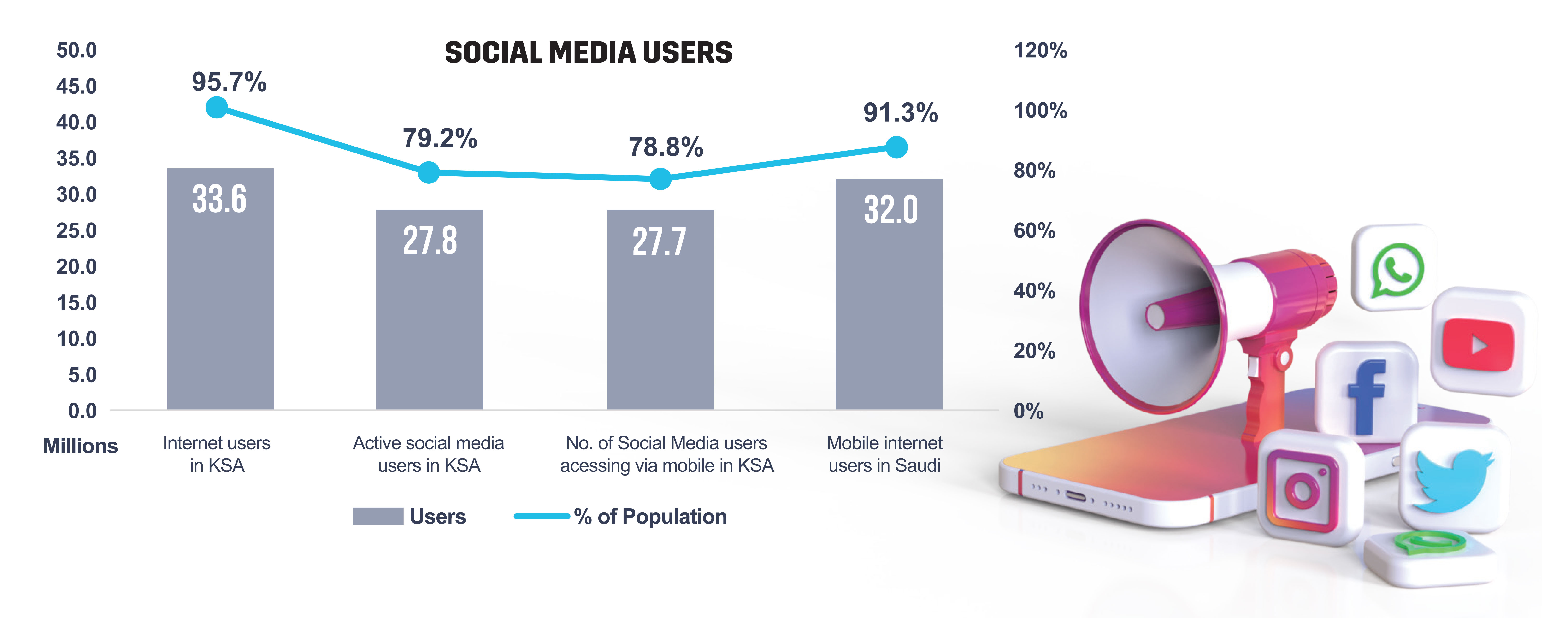

With such a young and wealthy population, it comes as no surprise that this is also a digitally savvy population. Saudi Arabia boasts 96% internet penetration and is among the first countries in the region to begin laying the foundations for 5G. Saudi has also experienced the highest cumulative annual growth rate in internet penetration, growing at a pace of 8.5% each year.

There are 121 mobile cellular subscriptions per 100 people in Saudi Arabia, meaning one in five Saudis has 2 cellphone subscriptions. This is stronger mobile phone penetration than Canada (92/100), France (111/100), and Norway (107/100), and more comparable but still higher penetration than in Spain (118/100).

The Kingdom has 84% smart phone penetration across the entire population12. When looking at smart phone penetration within the parameters of those aged 18 to 75 years old, penetration jumps to 97%13. This is much higher than Europe’s average, which stands at 91% smart phone penetration. Smart phone adoption is critical to drive mobile eCommerce and fintech consumerism.

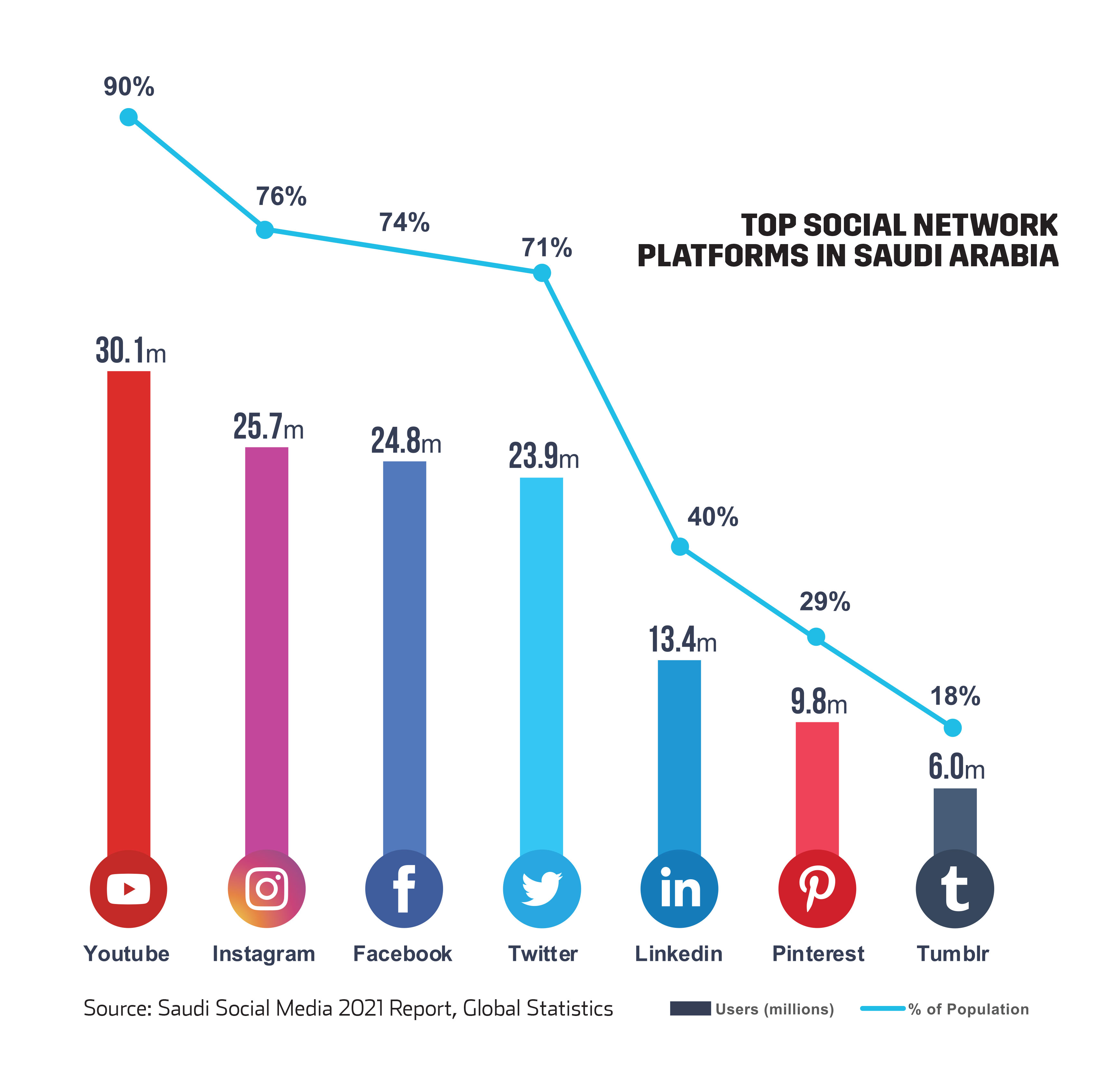

According to a BBC report, Saudi Arabia is the largest social media market in the Middle East. Notably, Saudi Arabia is the biggest user of Youtube.com, the video-sharing platform, per capita, in the world. There are user accounts in the country comprising 90% of the Saudi population. 56% of Saudi Consumers use Youtube on a daily basis. 90% of mothers in Saudi Arabia watch Youtube with their children on a daily basis. In 2014, over 90 million Youtube videos were being viewed daily. Youtube usage is followed by Instagram (76% of population), Facebook (74%) and Twitter (71%).

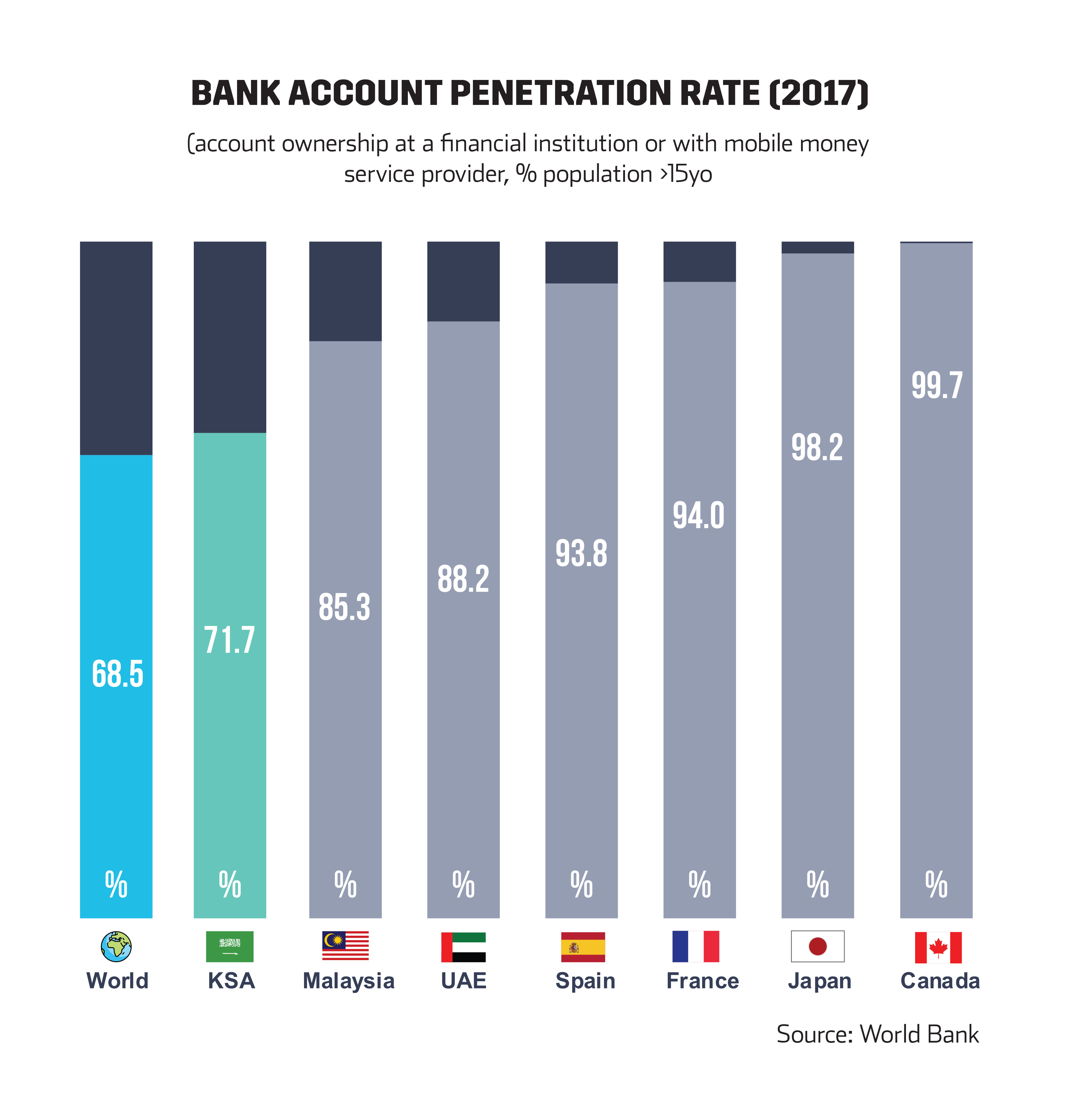

Moderately Well-Banked Population.

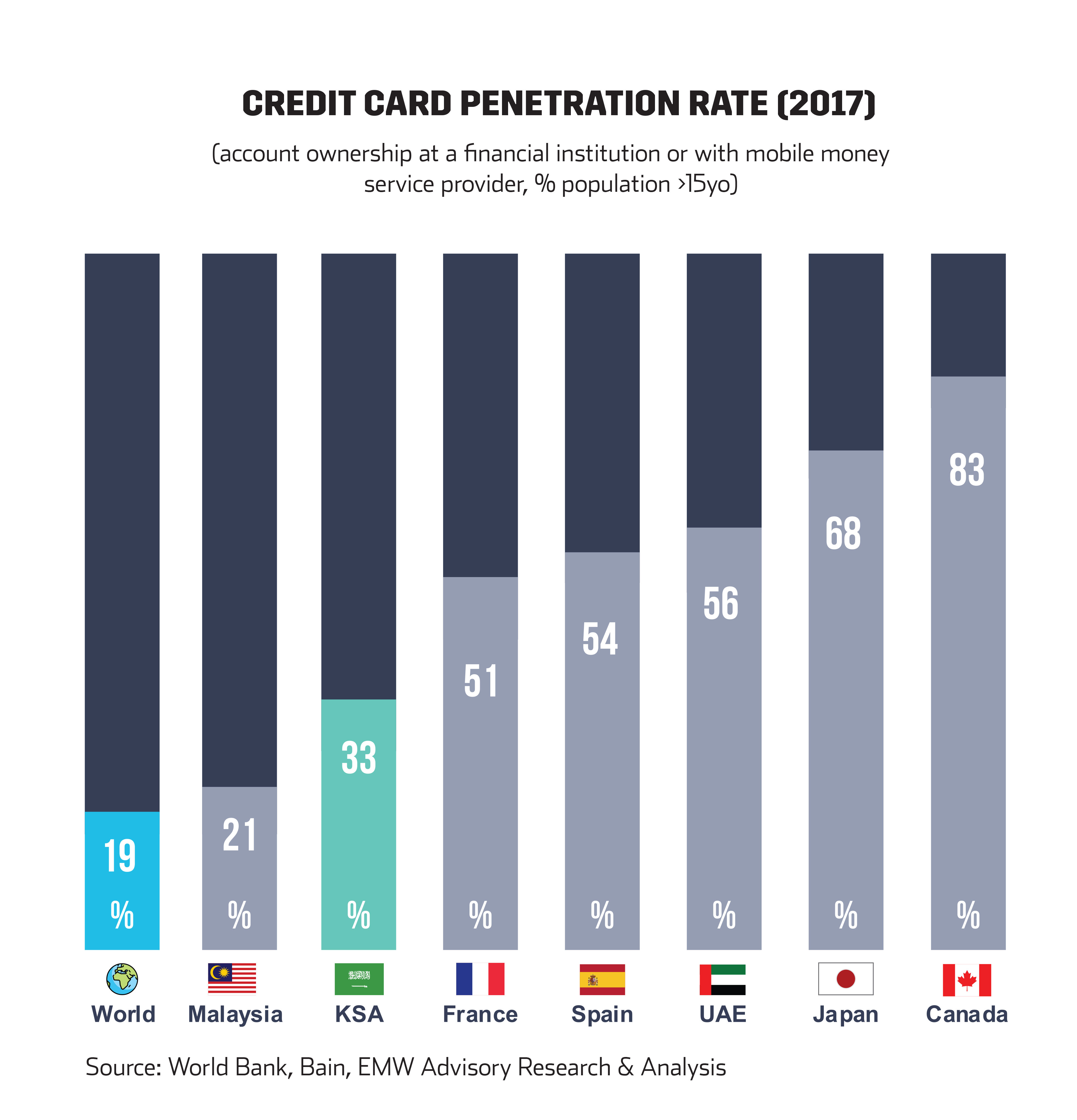

Saudi Arabia is ranked 60th in the world for bank account penetration rate (out of 195 Countries). The Kingdom ranks just above the world average in bank account penetration, with 72% of the population having access to banking and financial services (note: the survey was last conducted in 2017). In the Middle East region, Saudi Arabia ranks 7th, behind Iran (94%), Israel (93%), UAE (88%), Bahrain (83%), Kuwait (80%), and Oman (74%). Canada is among the 7 top countries in the world leading in bank account penetration, with a penetration rate above 99.5% (top countries include, Denmark, Finland, Norway, Sweden, Canada, Netherlands, and Australia).

Countries with higher GDPs tend to have larger rates of credit card adoption, but only 33% of Saudi Arabia’s population had an active Credit Card subscription in 2017. Some analysts state religious reasons as a potential barrier to credit card adoption due to the payment of interest being frowned upon in Islam. To counter this, local Saudi banks have been offering a wider range of Sharia-compliant credit cards in recent years.

e-Commerce Exploding.

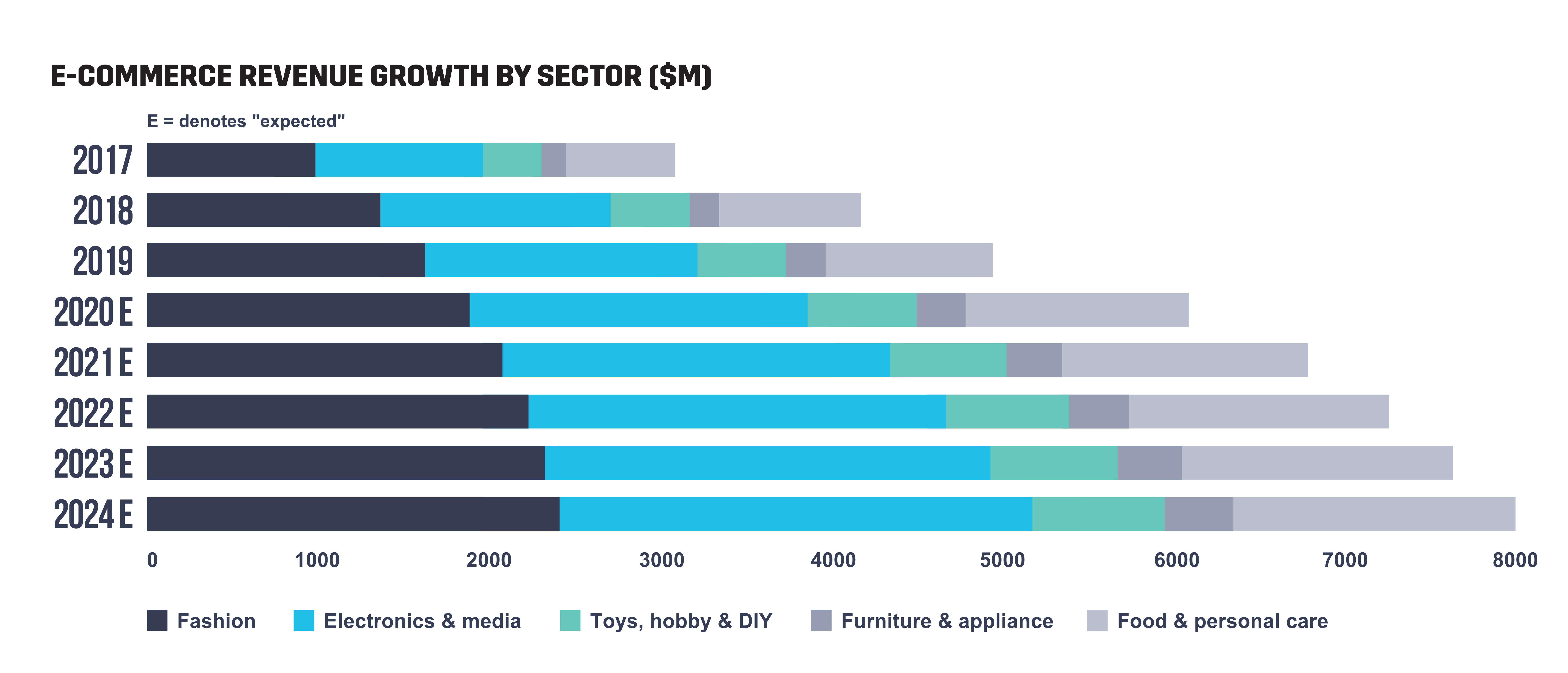

With a young, digitally savvy population, in a region known for its penchant for luxury shopping, Saudi Arabia has seen explosive growth in the eCommerce space. Currently the Saudi eCommerce market stands at $6.6 billion USD, and by the end of 2024, it is expected to reach $8 billion USD. This is foundational for the growth of fintechs in the region, especially as digital payments is the largest segment of fintech that is pushing the industry forward. Consumers are increasingly moving towards accepting digital or online payments, instead of cash-on-delivery (COD) which was very high at the onset of eCommerce adoption in Saudi Arabia. A joint survey run by Visa and mada in 2020 found that 77% of Saudi consumers increased the use of digital payments whether it was shopping in-store or online because of COVID19. The survey also found that 1 in 2 Saudi consumers found themselves shopping more online, with 62% of them using cards and digital wallets to pay instead of COD.

%2Fuploads%2Ffintech%2Fcover3.jpg&w=3840&q=75)