Asia Continues to Dominate World Trade

13 January 2023•

When Thomas Mann said, “Asia surrounds us, wherever one’s glance rests,” he didn’t just mean it figuratively. In their Special Report on international trade, Lucidity Insights in partnership with Entrepreneur Middle East and DP World explore the journey that trade has taken in recent years as countries around the world race for the top, highlighting how Asian regions are not slowing down in the slightest despite multiple challenges faced in that part of the world.

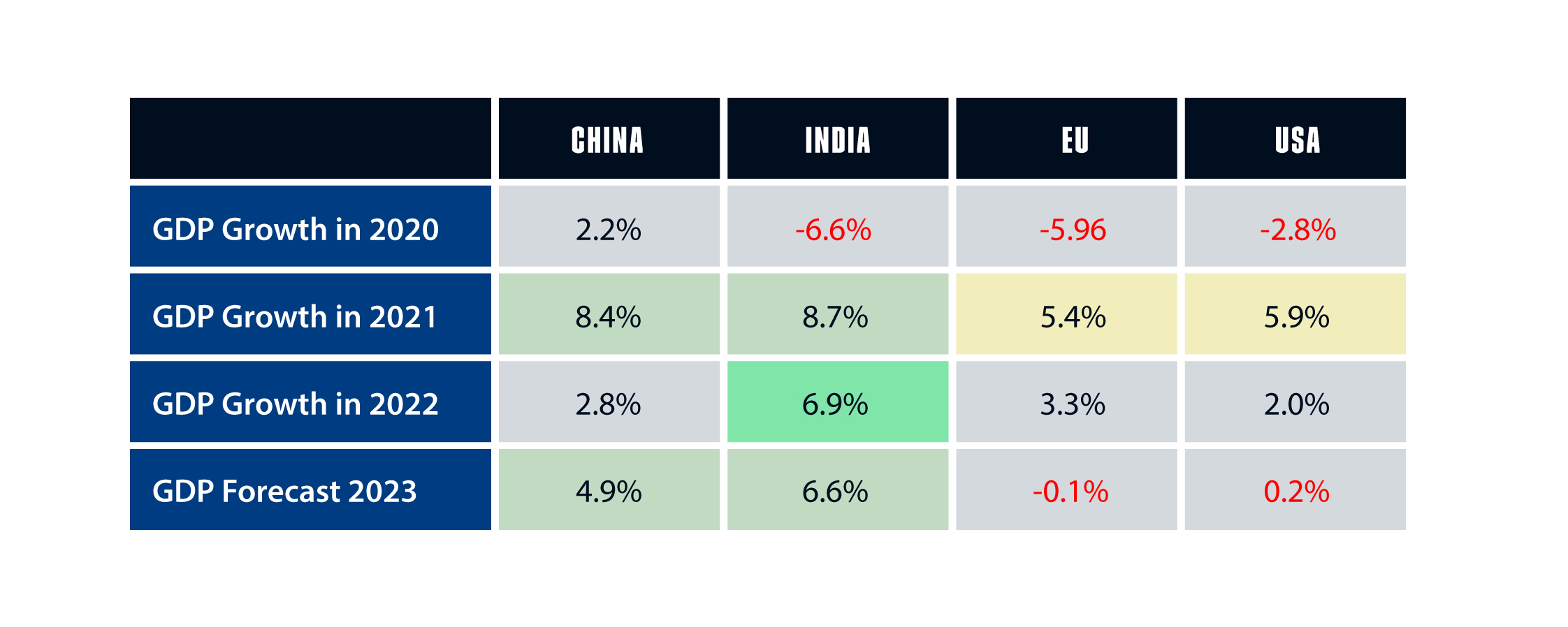

China and India are both powerful examples of economies that have both been hampered by the pandemic, but are still managing to perform considerable better than its North American and European peers. China is the only economy to survive the pandemic without a single year of economic contraction, and India posted the 2nd fastest growth rate of an economy in 2022, falling just behind Saudi Arabia. A major component of Asia’s economic strength might lie in its growing role in international trade. Many industries and manufacturers around the world rely heavily on Asia to either manufacture goods or import critical parts for products.

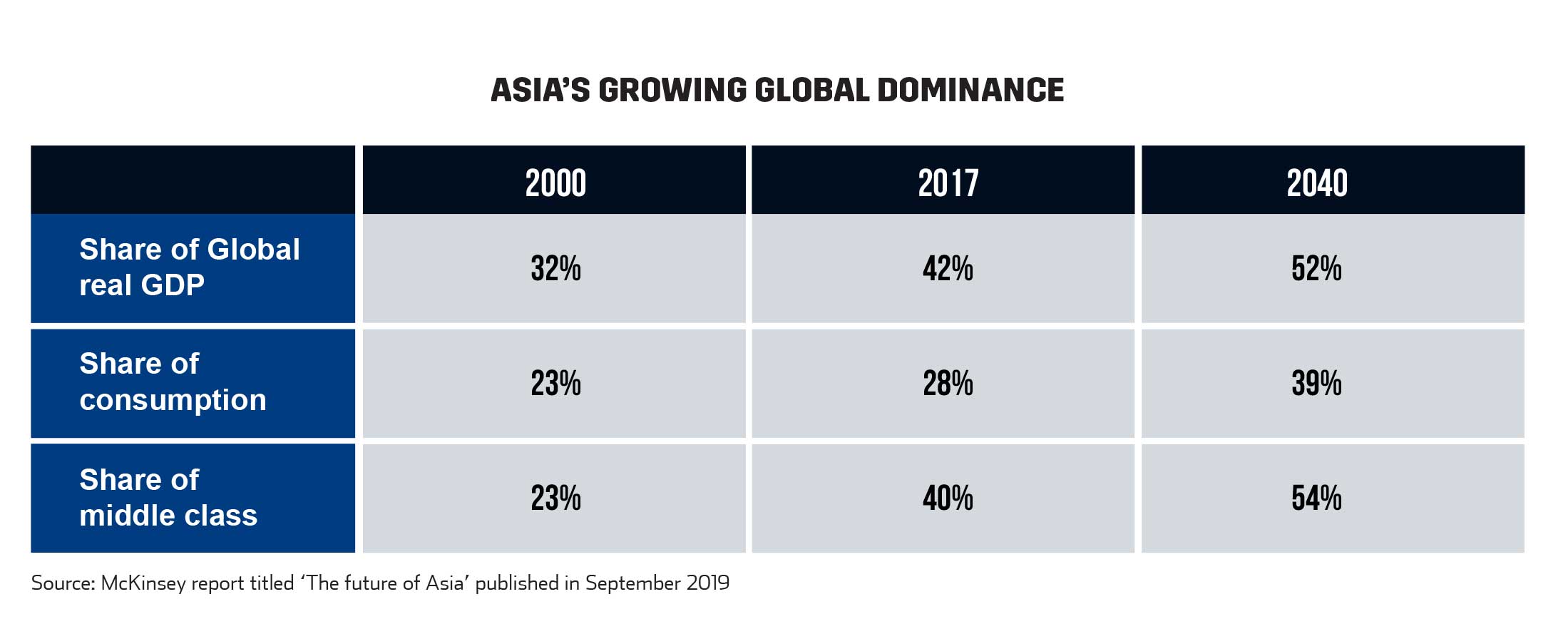

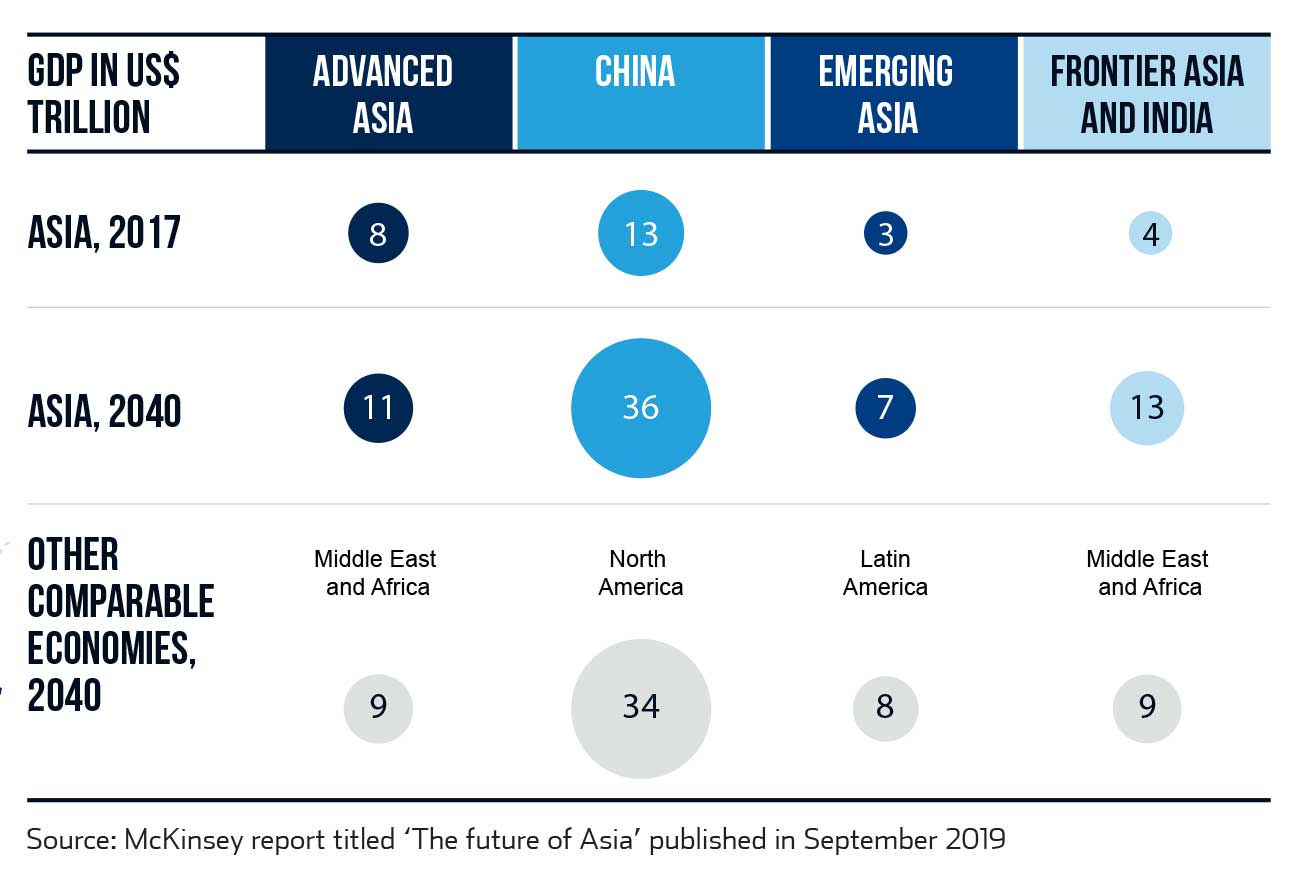

As per a recent McKinsey report on Asia’s growing dominance, Asia is quickly becoming the world’s center for both production as well as consumption. Trends in international trade will further lean in Asia’s favor as the region has forecasted a significant increase in consumption and may very well rank on top for both imports and exports in the near future. Even splitting up Asia into multiple categories, the singular GDP of China in 2040 would still be larger than that of Emerging Asia, Advanced Asia, and Frontier Asia and India combined.

Considering international trade stats, the majority of the trade is flowing to or from China, the USA, or the EU. China’s exports were US$ 3.4 trillion in 2021 (15.1% of global trade exports) followed by the USA that exported US$ 1.8 trillion worth of goods (7.9% of global trade exports). In the top 20, 7 European countries accounted for US$ 4.6 trillion worth of exports (20.6% of global exports), two of which are in the top five, including Germany and Netherlands. Rounding out the top five is Japan accounting for US$ 0.8 trillion (3.4%) of exports.

Even the ports handling the largest volumes have shifted globally, with the top 20 ports in the world now handling 45% of total global container port traffic, amounting to 379 million containers (TEUs or twenty-foot equivalent), while the top 50 ports handle approximately two- thirds of the global port traffic. While European and North American ports once dominated the list of the largest and most active ports in the world - today, Asian ports dominate the global port traffic as 14 of these top 20 busiest ports currently reside in Asia, 8 in China alone - a complete reversal from a few decades ago in 1973, when only 5 of the top 20 ports were present in Asia.

%2Fuploads%2Finnovations-international-trade%2Fcover8.jpg&w=3840&q=75)