The World’s Largest Lithium Producer: Albemarle Corp Is Mining for the Future of Electric Mobility

03 October 2023•

From the bustling avenues of Charlotte, North Carolina, Albemarle Corporation stands tall as a beacon of industrial and chemical innovation, not just for America, but for the world.

With a staggering market value of $30 billion, the mining operator and specialty chemicals manufacturer is becoming a global giant, holding its crown as the world's largest miner of lithium carbonate and the world’s largest producer of lithium hydroxide. These chemicals and precious metals are specifically used for electric vehicle battery manufacturers and electronic goods manufacturers working hard towards electrification and green mobility.

Powering Electrification

Lithium is more than just an element on the periodic table; it's the lifeblood of not just the EV revolution but also ceramics, glass, lubricating greases, and more. As of 2020, ALB along with Sociedad Química y Minera, and FMC Corporation provided lithium products that account for just over half of the world's lithium and lithium storage products while China produced the other half. With its aim to triple its output by 2030, reaching an annual capacity of about 225,000 metric tons (mt), ALB sees a future where EVs are within everyone's reach.

Surging Demand for Lithium in Electric Vehicle Batteries

Demand for lithium is continuing to skyrocket, largely due to the high demand for electric vehicle batteries. A key component for EV batteries is lithium carbonate, which is expected to surge from 500,000 mt in 2021 to over 3-4 million mt by 2031. If ALB were to achieve 225,000 mt capacity by 2030, the company would only account for roughly 7% of the world’s EV battery-related lithium demand. To meet the world’s growing demand, ALB is planning to bring another domestic lithium mine online in North Carolina by 2027.

Expansion and Operations

Today, ALB has functioning mines in Australia, Chile, and the USA. The company is also building a US $1.3 billion processing facility in South Carolina, where it will process battery-grade lithium hydroxide; this translates to this plant supporting the manufacturing of 2.4 million electric vehicles each year, and will be able to process lithium from recycled batteries as well.

Albemarle’s Projections for Net Sales in 2023

Results for the second quarter of 2023 showed ALB financials skyrocketing by 60% with net sales reaching US $2.4 billion and net income reaching $650 million.

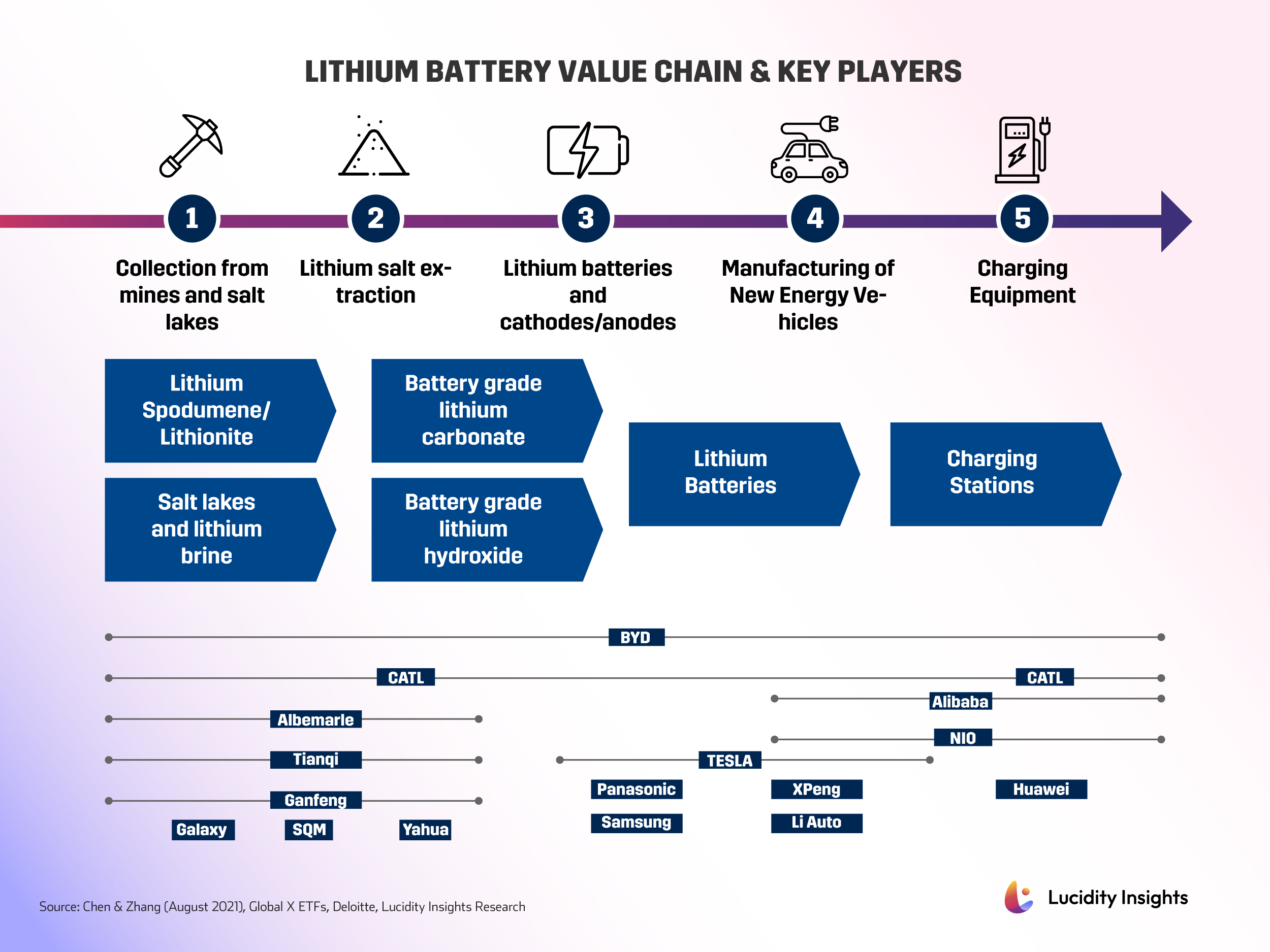

Infobyte: Lithium Battery Value Chain & Key Players

Infobyte: Lithium Battery Value Chain & Key Players

According to ALB CEO, Kent Masters, their recent success is “primarily driven by higher prices and volumes in our Energy Storage business." He expressed unwavering confidence in ALB's trajectory, emphasizing the positive outlook based on the escalating demand for lithium as their lithium business revenue alone this year touched $1.76 billion (a 120% increase YOY).

Strengthening Albemarle's Position: Investment and Ownership

With global recognitions like their inclusion in the Fortune 500 and TIME100 lists, ALB projects a 40% to 55% increase in net sales for the full year 2023. The company's proactive approach to sustainability is also evident in its achievement of the IRMA 50 performance rating and its ambitious goal to reduce sulfur oxide emissions by 90% come 2027.

Infobyte: Albemarle Corporation Market Summary

Infobyte: Albemarle Corporation Market Summary

Signaling a vote of confidence in his company, Masters recently made a personal investment of 5,470 shares, bumping his total ownership to 51,466 shares. Not to be left out, Executive Vice President and General Counsel, Kristin Coleman, also added 1,373 shares to her portfolio on that very same day. Seems like ALB's top brass are all in!

Forging Key Alliances

Albemarle's Investment in Patriot Battery Metals

In a move to consolidate their stronghold in the lithium market earlier this month, ALB invested around $124 million in Patriot Battery Metals, a hard-rock lithium exploration company, securing 4.9%-6.4% of Patriot’s issued shares. “I believe both Patriot and ALB can be a big part of building out the required front-end to the lithium chemicals supply chain in North America and Europe over the coming years. The additional funding will allow us to more aggressively advance the Corvette property through drilling, permitting, study work and more,” said Patriot president and CEO, Blair Way.

Innovations in Direct Lithium Extraction (DLE) Technology

ALB has also unveiled plans to establish a testing facility in Arkansas for its innovative direct lithium extraction (DLE) technology. DLE technologies aim to substantially elevate lithium extraction rates from brine deposits, doubling the efficiency of conventional evaporation ponds. While numerous players are racing to commercialize DLE without reliance on these ponds, none have yet achieved this breakthrough. For decades, ALB has extracted bromine, crucial for producing flame retardants, from the Smackover geological formation in Arkansas. Their ambition now is to eventually harness this technology to derive lithium from the company's established bromine operations, signaling a significant shift in its strategic vision.

"This is a new technology and we're going to make sure that we do it right; we have access to the brine and access to the infrastructure, so we’re well positioned to take advantage of that," says Masters.

Investment in the St. James Lithium Camp

ALB also made a $109 million investment in the St. James Lithium Camp, highlighting its potential to become a principal lithium source among the burgeoning lithium demand for EV battery production.

Arbor Metals Corp., an active player in the region, has expressed its enthusiasm regarding this development. CEO Mark Ferguson stated, "We are encouraged by ALB's substantial investment in the St. James Lithium Camp, as the St. James region is swiftly gaining recognition as a prominent lithium district." He went on to highlight Arbor's own stake in the region with their Jarnet Lithium project and added, "We share ALB's conviction in the substantial opportunity that this region presents – this recent investment only bolsters our determination to unlock the full potential of the project."

Albemarle’s Collaboration with Ford Motor Company

ALB also entered into a definitive agreement with Ford Motor Company in May this year, aiming to supply Ford with battery-grade lithium hydroxide, crucial for scaling its EV production. Under the terms, ALB commits to delivering over 100,000 metric tons of lithium hydroxide for about 3 million upcoming Ford EV batteries. This five-year pact will be in effect from 2026 to 2030.

Eric Norris, President of ALB Energy Storage, has hailed Ford as a legendary figure in automotive history, emphasizing the importance of such industry collaborations. "With the growing demand for EVs in the United States, our customers are seeking to regionalize their supply chain for greater security, sustainability, and lower costs."

Toward a Sustainable Future

Beyond this supply, both companies are venturing into research on lithium-ion battery recycling. Echoing the shared commitment to sustainability, Lisa Drake, Ford's Vice President of EV Industrialization, commented, "we are at a significant moment in Ford's next industrial revolution for the EV age." Drake's statement highlights the mutual goal of ensuring a more sustainable and traceable supply chain for the rapidly growing EV market.

Related: Arowana is betting big on renewable energy powered cryptocurrency mining

Albemarle's Ongoing Impact on the EV Industry

From its modest beginnings in 1994 to its undeniable presence today, ALB Corporation is a shining example of American entrepreneurial spirit. As they continue their mission of providing high-quality lithium to power the world's electric vehicles, they aren't just ensuring a profitable future for themselves, but a sustainable one for all of us. ALB literally mines products that power a greener future for us all. Stay tuned as they redefine the global lithium supply chain, propelling the EV industry to unprecedented heights.

Related: TEMBO: Electrifying Utility Vehicles One Commercial Fleet at a Time

%2Fuploads%2Fev-2023%2Fcover16.jpg&w=3840&q=75)