Post COP28: Zeroe Secures $2.2M to Catalyze Decarbonization

22 December 2023•

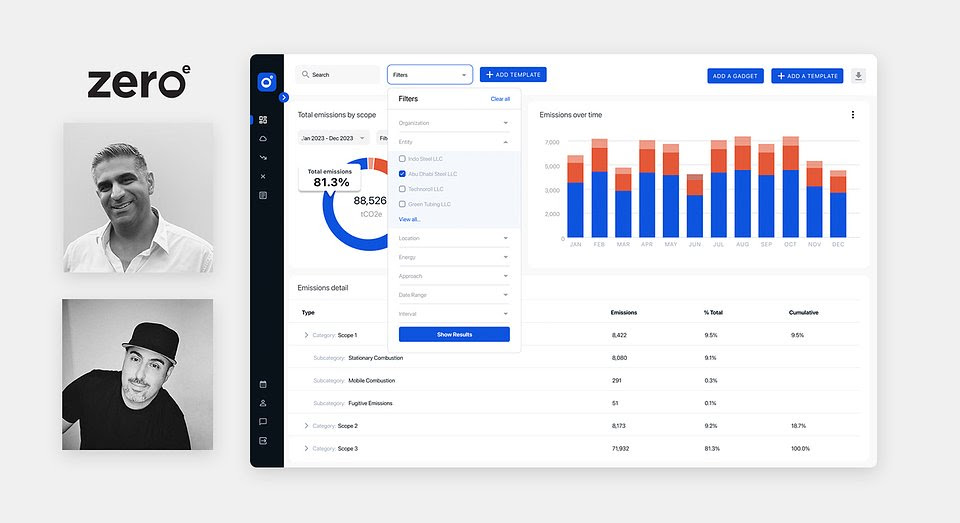

UAE-based Zeroe, an AI-enabled enterprise SaaS platform, announced the close of its series seed funding round.

The oversubscribed round raised $2.2 million in new capital to fuel the company’s next phase of growth.

The round was led by Indonesian investor Owen Rahadiyan, who provided access to key Southeast Asian growth markets.

This investment accelerates the company’s mission to facilitate decarbonization and the transition to net zero, building on the successful launch of its platform to enterprise customers in the UAE.

Unlocking Access and Deployment to Climate Finance

Zeroe’s SaaS platform allows companies to comprehensively measure emissions and report on decarbonization performance to a wide variety of stakeholders.

As regulators, customers, and capital all increase, so does the pressure organisations face to measure and reduce their emissions.

Zeroe provides enterprises with the tools and insights needed to not only understand and reduce their carbon footprint but also to align with sustainable finance frameworks, which are key to accessing the capital critical to this transition.

Zeroe's Vision for a Sustainable Future

Farouk Jivani - CEO, above, and Ali Najafian - CTO, bellow

Farouk Jivani, Founder and CEO of Zeroe, emphasises the importance of this funding in realising the company's vision: "The urgency to act on climate change has never been greater, and it will exponentially increase in the coming years. This investment is a testament to our commitment to driving tangible change. We're here to accelerate the enterprise decarbonization journey and unlock climate finance to fund the transition."

---

Send us your press releases to shareyournews@lucidityinsights.com