Why use DePIN?: Centralized Infrastructure vs DePIN

19 July 2024•

DePIN has the potential to transform infrastructure development by being more efficient, resilient, and high-performing. This is critical for the DePIN sector’s success and sustainability.

Here are some strengths and advantages of DePIN compared with centralized infrastructure:

Centralized Infrastructure vs DePIN

|

Centralized Infrastructure |

DePIN |

|

Capital Expenditure (CapEx): Centralized systems require massive upfront investments, often running into billions of dollars, which create significant barriers to entry. For example, launching a new telecommunications network or building a utility plant demands extensive capital that can deter new entrants and stifle competition. |

Crowdsourced CapEx: DePIN allows users to contribute capital, assets, and labor towards shared objectives, significantly lowering barriers to entry. This crowdsourcing is incentivized through transparent and equitable token incentives, making it possible for more participants to join and contribute. |

|

Operational Expenditure (OpEx): Centralized infrastructures are often hampered by inefficient, bureaucratic processes that can depress operating margins. These processes, spanning from marketing to day-to-day operations, increase costs and complexity, reducing overall efficiency. |

Onchain settlement: DePIN uses blockchain technology to reduce administrative overhead. It serves as a single source of truth via shared ledgers across all participants, enhancing transparency and reducing discrepancies in at transactions. |

|

Security and single points of failure: Centralized systems, reliant on a small number of infrastructure providers, face significant security and operational risks. This centralization creates pronounced vulnerabilities, notably single points of failure, where an attack on a key server or system can jeopardize the entire network. Moreover, the opaque security practices common in these systems leave users with limited oversight and control over data protection, exacerbating trust issues. This centralization heightens the risk of breaches but also predisposes these systems to considerable downtime and service disruptions. |

Decentralized resiliency: DePIN inherently reduce the risks associated with single points of failure by distributing data and control across multiple nodes. This structure significantly hinders any single attack from disrupting the entire system, thereby enhancing overall system resilience. Blockchain technology provides transparent and auditable security protocols. Every transaction and data exchange within a DePIN network is verifiable by any participant, increasing transparency and trust among users. Furthermore, the decentralized nature of these networks oers superior resistance to DDoS attacks and ensures robust data integrity. Changes to data require network consensus, eectively preventing unauthorized modifications and bolstering security measures. |

|

Stagnant: There is often a limited innovation culture within large, centralized infrastructures, with new technologies taking decades to be rolled out and integrated. |

Innovation: DePIN thrives in an open, permissionless, and global ecosystem, which accelerates the pace of experimentation and innovation compared to most centralized companies. |

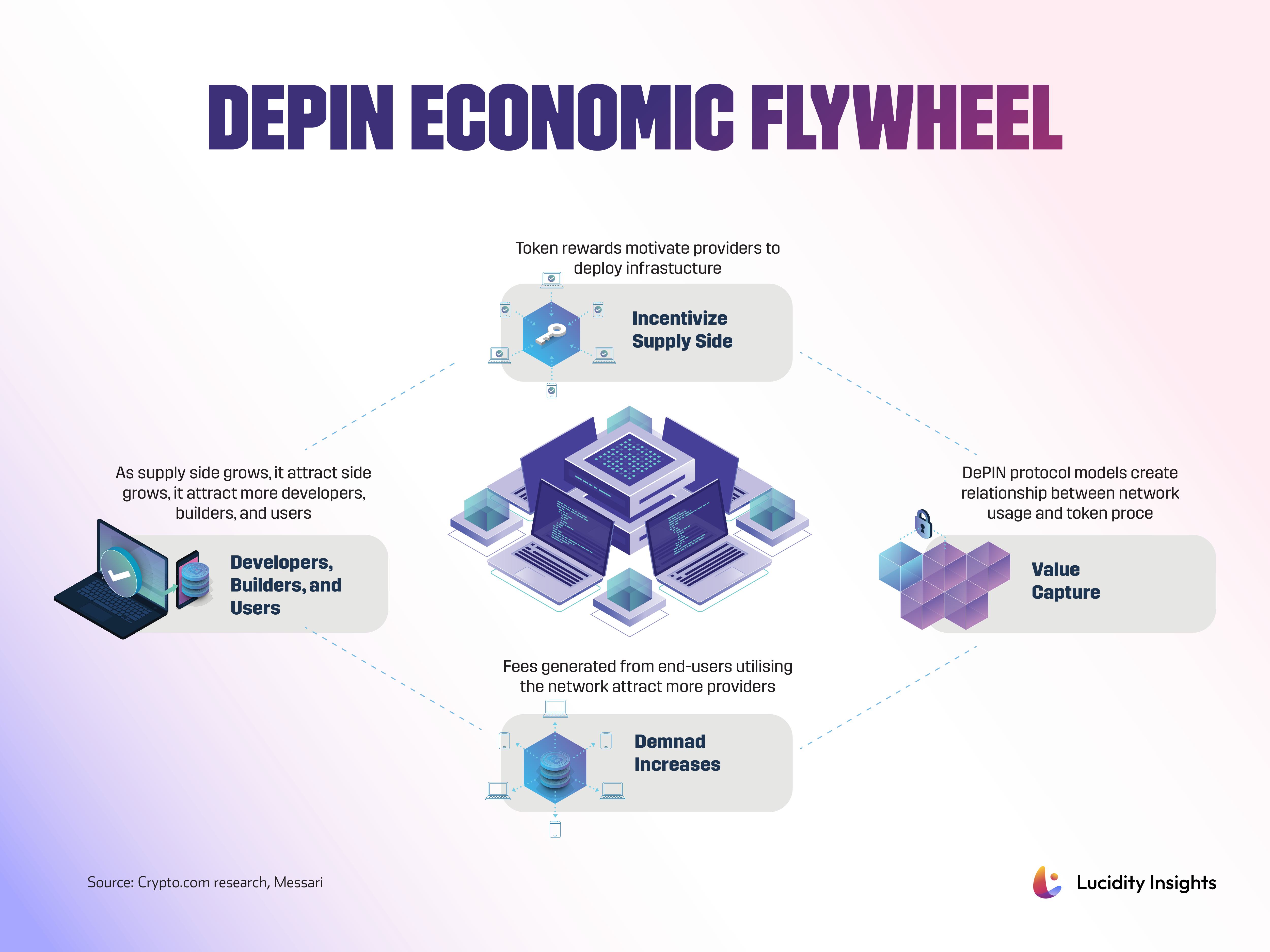

The beauty of DePIN also lies in its ability to create a self-reinforcing cycle of growth and improvement. As more people join and contribute their resources, the network becomes more robust and valuable to its users. This ‘flywheel effect’ not only makes the network more efficient and resilient but also democratizes access to essential services.

Previously: Why Decentralized Physical Infrastructure Networks (DePIN) Could Be the Next Big Thing in Infrastructure

Infobyte: DePIN Economic Flywheel

DePIN market size and funding

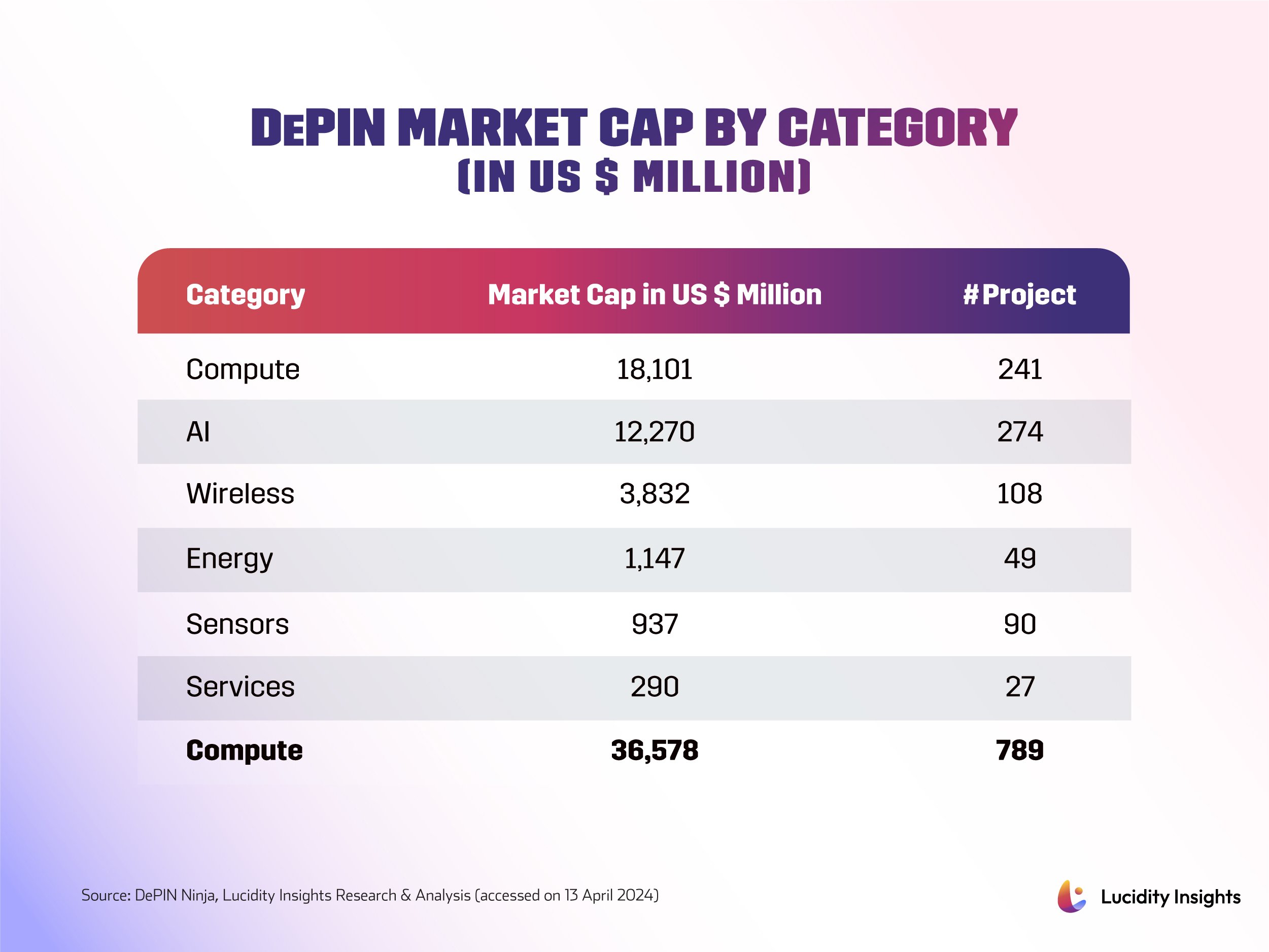

As of mid-April 2024, the market for DePIN has achieved a substantial market capitalization of US $36.58 billion, spread across 789 projects. The sectors of Compute and AI dominate, representing over 80% of the DePIN market. Moreover, the top 20 projects across all categories contribute 70% of the total market capitalization. Leading the charge are notable projects such as Bittensor and Fetch.ai in the AI category, and Filecoin and Render in Compute with a combined Market Cap of US $12.6 billion. These figures underscore the significant concentration of market value within a select few high-impact projects within the DePIN ecosystem.

Infobyte: DePIN Market Cap by Category (In US$ Million)

Top 20 Depin Project by Market Cap (In US$ Million)

|

Project Name |

Category |

Market Cap (In US$M) |

Chain |

Description |

|

Bittensor |

AI |

3,582 |

NATIVE |

Bittensor is a peer-to-peer machine intelligence network |

|

Filecoin |

COMPUTE |

3,577 |

FILECOIN |

Filecoin is the largest decentralized data storage market place, protocol, & cryptocurrency |

|

Render |

COMPUTE |

3,123 |

ETHEREUM |

Render is a decentralized rendering platform for next-gen media production |

|

Fetch.ai |

AI |

2,327 |

ETHEREUM |

Fetch.ai is a Blockhain-based AI and ML platform Connecting devices for market creation and data value addition |

|

XNET |

WIRELESS |

1,878 |

POLYGON |

XNET is a Blockhain-powered mobile carrier building neutral-host telecommunication infrastructure |

|

Arweave |

COMPUTE |

1,818 |

NATIVE |

Arweave is permanet and decentralized web inside an open ledger |

|

SingularityNET |

AI |

1,124 |

ETHEREUM |

SingularityNET enable easy creation, sharing, and monetization of AI services through its global marketplace |

|

NetMind.AI |

COMPUTE |

970 |

ETHEREUM |

NetMind.AI enable deep learning model development for AI applications |

|

Helium |

WIRELESS |

876 |

SOLANA |

Helium is a decentralized network of networks with Mobile, loT, & Other subnetworks |

|

Akash |

COMPUTE |

841 |

COSMOS |

Akash is an Open-sources supercloud that enable secure and efficient buying and selling of computing resources |

|

AIOZ |

COMPUTE |

728 |

ETHEREUM |

AIOZ is a decentralized content delivery network |

|

CorgiAi |

AI |

699 |

- |

CorgiAi is a community-driven AI project centered around the creation of a tight-knit community with one objective in mind: to unleash the power of togetherness and build tools to enable the ultimate community |

|

LumiShare |

ENERGY |

686 |

BINANCE |

LumiShare, powered by $LUMI, is a financial blockchain ecosystem focused on tokenizing renewable energy assets through its NFT Marketplace |

|

Theta Fuel |

COMPUTE |

600 |

NATIVE |

Theta Fuel is a decentralized video delivery network |

|

UtilityNet |

COMPUTE |

550 |

BINANCE |

UtilityNet is a global Decentralized Digital Chip Network that provides chip resources for next-generation edge computing and AI infrastructure |

|

STEPN |

SENSORS |

474 |

ETHEREUM |

STEPN is a Web3 lifestyle app with inbuilt Game-Fi and Social -Fi elements. Players can make handsome tokens earnt through walking, jogging or running |

|

Sia |

COMPUTE |

467 |

NATIVE |

Sia is a decentralized cloud storage network combining Proof of Work with a contract-based storage model |

|

Holo |

COMPUTE |

457 |

ETHEREUM |

Holo is a P2P, Open-source framework for decentralized applications with focus on privacy and security |

|

Golem |

COMPUTE |

414 |

ETHEREUM |

Golem is a decentralized computing marketplace. it consist of a network of nodes that implement the Golem network Protocol |

|

OriginTrail |

AI |

401 |

POLKADOT |

OriginTrail is a decentralized knowledge graph enabling trustless knowledge sharing for everyone |

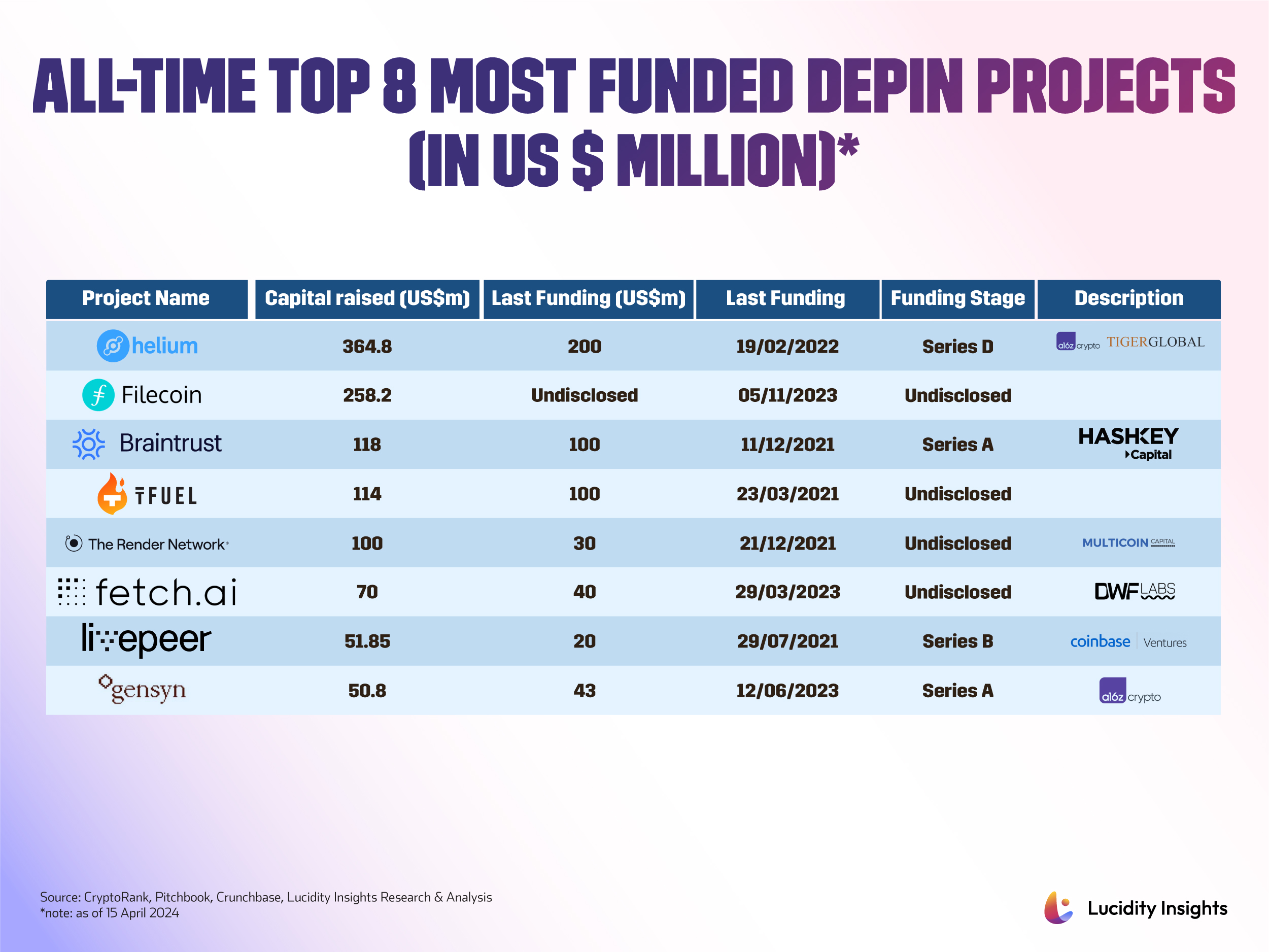

On the funding front, DePIN projects have collectively raised over US $1 billion, with prominent players like Helium and Filecoin accounting for nearly half of this total, having been operational for the past decade. Additionally, over the past 12 months, the sector has secured an additional US $139 million in funding, as reported by CryptoRank under the DePIN category.

Infobyte: All-Time Top 8 Most Funded DePIN Projects (in US $ Million)

Infobyte: All-Time Top 8 Most Funded DePIN Projects (in US $ Million)

The Future of DePINs

DePINs hold the potential to radically transform traditional industries by decentralizing infrastructures. They promise to democratize access to critical data and processes, reduce costs, enhance efficiency, and drive expansion. Moreover, DePINs aim to improve the resilience of existing systems against technical issues like outages and cyber-attacks.

Like many emerging trends within the crypto space, it’s expected that only a few projects will become major players. Those most likely to succeed are those with the demonstrated capability to replace traditional Web2 infrastructure, such as AWS data centers. Nevertheless, it’s important to acknowledge that DePINs are still in their infancy, and there are numerous challenges to address, including scalability, interoperability, security, and usability, before they can achieve mainstream adoption. Given the fast-evolving nature of blockchain technology, it’s only a matter of time before DePINs develop solutions to these issues. The future will reveal whether the DePIN sector can maintain momentum for exponential growth or fall short of expectations.

To learn more about the innovations driving blockchain forward – read the full report here.

Next Read: Opinions by Joseph Lubin: Blockchain Innovations and the Future of Decentralization

%2Fuploads%2Finnovations-blockchain%2Fcover22.jpg&w=3840&q=75)