Why Governments Around the World are going Ga-Ga for CBDCs

25 July 2023•

Previously: Government Adoption of Blockchain and Web3

Growing Interest and Research in CBDC Projects Worldwide

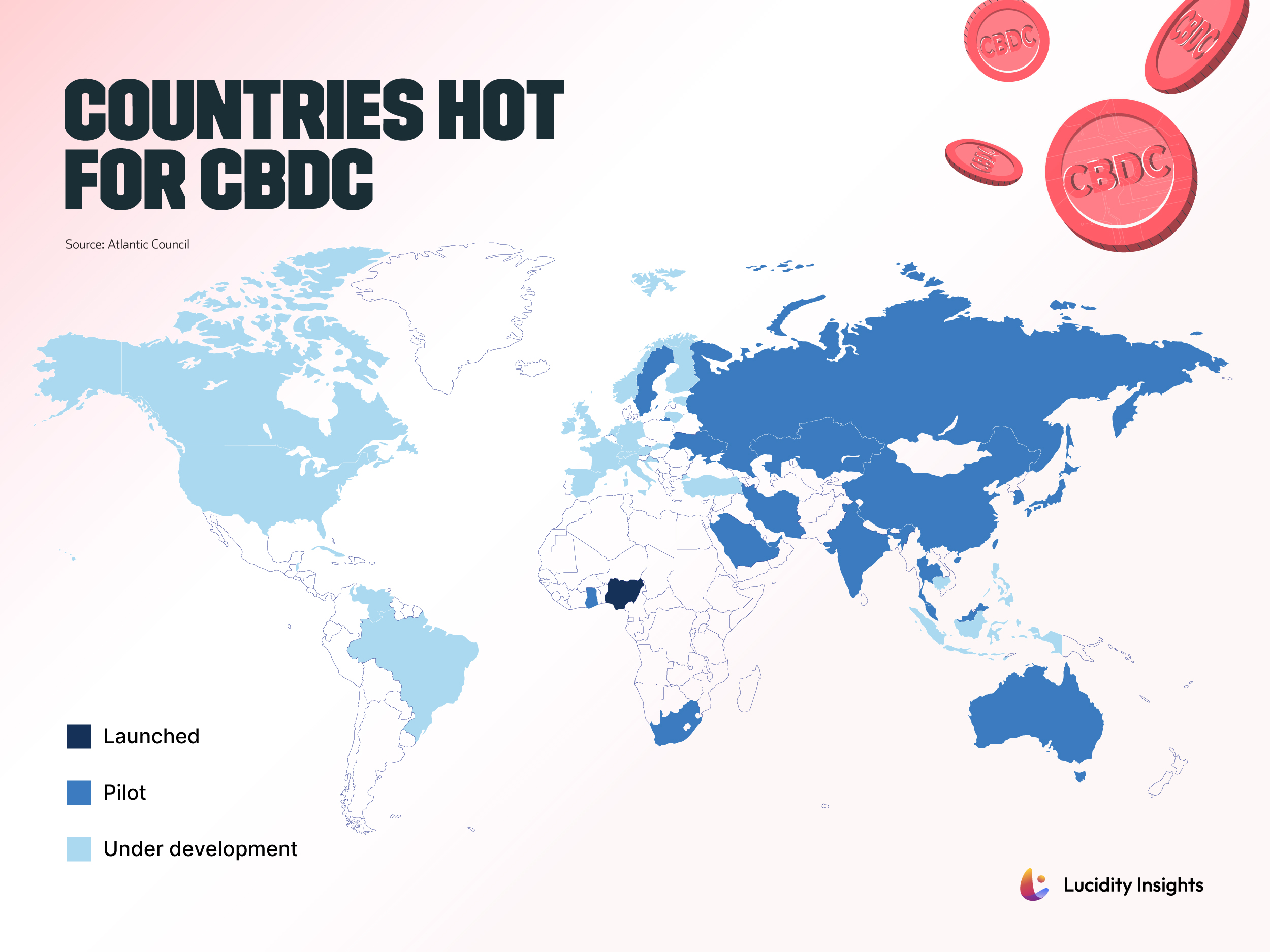

The emergence of CBDCs as a prominent use case of blockchain technology has garnered significant attention from governments worldwide. Many central banks are actively researching or piloting CBDC projects. CBDCs offer several potential benefits, such as facilitating faster and cheaper cross-border transactions, improving financial inclusion, and enabling more efficient monetary policy implementation. According to the Atlantic Council, there are 114 countries, representing over 95 percent of global GDP, that are exploring the implementation of CBDC today. This is in stark contrast to three years ago in May 2020, when only 35 countries were considering a CBDC”.

However, it is worth mentioning that not all CBDC projects are planning to use Distributed Ledger Technology (DLT) (i.e. blockchain technology). Out of the 114 countries looking into CBDCs, there are only 32 countries that are either in development, pilot or launched phase that are planning for using a blockchain.

Watch Video: These Countries are hot for CBDCs

Leading Examples of CBDC Adoption

|

Bahamas |

The Sand Dollar, the world's first Central Bank Digital Currency (CBDC) to go beyond the pilot stage, was officially launched in October 2020. With a 7.9% adoption rate, there are now 32,736 wallets in circulation, including 1,340 sovereign wallets. The Central Bank of the Bahamas aims to achieve full interoperability between wallet providers and integrate the digital currency with the commercial banking system. The motivations behind the project include enhancing financial inclusion, bolstering security against money laundering, and combating illicit economic activities. |

|

Eastern Caribbean Countries |

The Eastern Caribbean Central Bank (ECCB) launched its digital currency, DCash, in March 2021, making it the first currency union central bank to issue digital cash. As of June 2022, all Eastern Caribbean Currency Union member states have adopted DCash. The digital currency can be used through the DCash App or participating financial institutions. After facing technical issues in early 2022, the system resumed service in March with enhanced security. The ECCB aims to improve financial inclusion, strengthen anti-money laundering measures, combat terrorism financing, and expand banking services across challenging terrains. |

|

Nigeria |

Nigeria launched Africa's first digital currency, the eNaira, in October 2021. The Central Bank of Nigeria adopted a phased approach to rollout, initially allowing only bank account holders access. As of October 2022, transactions valued at just under $18 million had taken place, with 919,000 customers onboarded and 700,000 transactions completed. The eNaira aims to increase financial inclusion from 64% to 95%, potentially adding $29 billion to Nigeria's GDP over the next decade. The development of eNaira entered its second phase in August 2022, targeting 8 million users. |

Future Prospects: Blockchain and Web3 in Government

Blockchain and Web3 hold the potential to revolutionize government operations and create more transparent, efficient, and secure systems. Governments worldwide are in various stages of blockchain technology and Web3 adoption. While some countries have already implemented successful pilot projects, others are in the research and development phase. It is crucial for governments to collaborate and learn from each other’s experiences to overcome the challenges associated with implementing these emerging technologies as they actively explore and implement these technologies in various sectors, such as land registry, digital identity, voting systems, supply chain management, and CBDCs.

While there are still challenges to be addressed, such as regulatory issues, security and privacy concerns, and integration with legacy systems, the potential benefits of these technologies are substantial. It is evident that governments around the world will continue to invest in research and development, and pilot projects to harness the power of blockchain and Web3. As more governments embrace these technologies, we can expect increased collaboration, knowledge sharing, and innovation in the public sector. Ultimately, the widespread adoption of blockchain and Web3 technologies could lead to a more transparent, accountable, and efficient government that better serves its citizens in the digital era.

To read more about the future of web3, the decentralized web – read the full report here.

Next Read: The Dawn of Web3: Joseph Lubin’s Visionary Journey

%2Fuploads%2Fopportunities-web3%2Fcover14.jpg&w=3840&q=75)