The Top 5 Funded Startups in MENAPT in June 2024

08 July 2024•

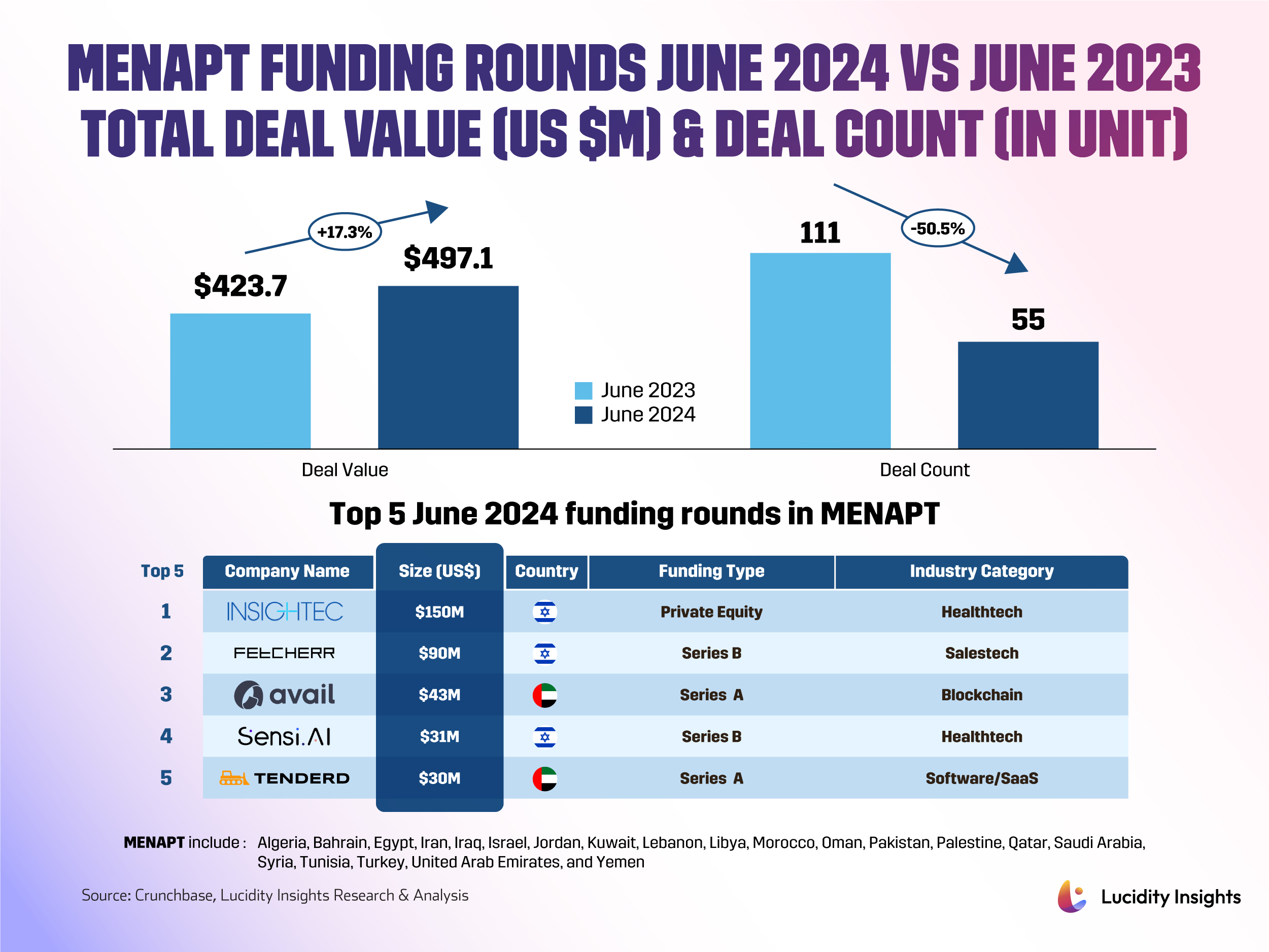

As H1 2024 came to an end, the MENAPT VC landscape saw a slight increase in total deal value from US $423.7 million in June 2023 to $497.1 million in June 2024, marking a 17.3% rise. Deal count plummeted, however, to half of last year’s number of signed deals in the month, from 111 in June 2023 to just 55 deals in June 2024 — marking a stark 50.5% decline.

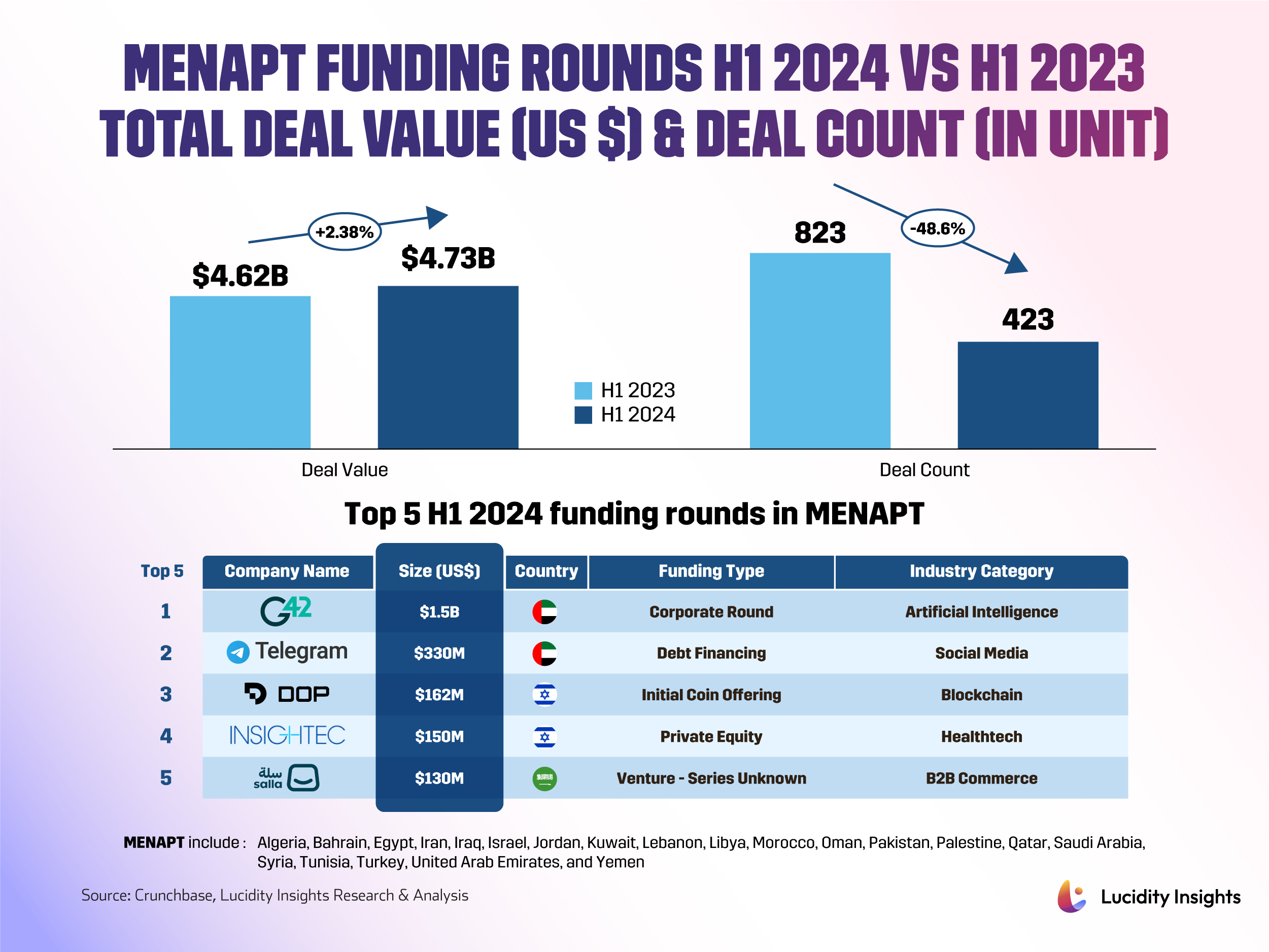

This suggests a continuation of a 2024 trend we are seeing across much of the region, where we are seeing less fundraising deals that are getting signed, but of the ones that are, they are larger and later stage investments. So far in 2024, startups in the MENAPT region have closed 423 deals, compared to 823 deals closed in 2023. Despite the lower number of deals signed in 2024 thus far, regional startups have managed to raise US $4,733.2 million, which is actually 2.38%% more than 2023’s figure of US $4,623 million, mainly due to the huge megadeals in April this year.

Infobyte: MENAPT Funding Rounds H1 2024 vs H1 2023

Nonetheless, this funding underscores a strengthening confidence among investors specifically in sectors poised at the cutting edge of technology and innovation. The sectors leading the charge in startups that secured the top five biggest funding rounds in June 2024 are healthtech, salestech, blockchain, and asset productivity improvement.

Infobyte: MENAPT Funding Rounds June 2024 vs June 2023

1. InSightec | Healthtech (Israel) | US $150 Million (Private Equity)

Founded in 1999 by Kobi Vortman, InSightec is a global healthcare company that pioneers focused ultrasound technology. With a mission to transform lives by delivering therapeutic acoustic energy, InSightec focuses on treating tremors associated with Essential Tremor and Parkinson’s Disease using non-invasive methods.

Founded in 1999 by Kobi Vortman, InSightec is a global healthcare company that pioneers focused ultrasound technology. With a mission to transform lives by delivering therapeutic acoustic energy, InSightec focuses on treating tremors associated with Essential Tremor and Parkinson’s Disease using non-invasive methods.

In June 2024, InSightec secured the only megadeal of the month at US $150 million in a Private Equity round led by Ally Bridge Group, Fidelity, and Nexus NeuroTech, bringing its total funding to US $882.9 million. InSightec has released that the new funds are dedicated to expanding its incisionless neurosurgery offerings while simultaneously pursuing strategic investments in new medical areas.

2. Fetcherr | Salestech (Israel) | US $90 Million (Series B)

Founded in 2019 by Uri Yerushalmi, Robby Nissan, Roy Cohen, and Shimi Avizmil, Fetcherr is an AI-powered price intelligence engine that has engineered a unique agnostic AI-driven market engine. Fetcherr’s software offers deep price neural network technology that collates and combines data from various industry verticals, including supply pricing and demand curves. Its Large Market Model (LMM) and cloud-based continuous pricing systems understand market dynamics and trends, enhancing performance and enabling real-time business decision-making.

In June 2024, Fetcherr raised US $90 million in Series B funding led by Battery Ventures, bringing its total raised to US $114.5 million. The new funds go towards developing an AI-powered “offer engine” to bundle and price multiple carrier services together and increased recruitment in 2024.

3. Avail | Blockchain (UAE) | US $43 Million (Series A)

Founded in 2022 by Anurag Arjun and Prabal Banerjee, Avail is a blockchain dedicated to transforming the blockchain world by helping other blockchains scale. Avail serves as a fundamental layer of modular blockchain infrastructure, solving blockchain fragmentation at scale, and enables users to execute bridgeless transactions while acting as a unification layer connecting various blockchains.

Founded in 2022 by Anurag Arjun and Prabal Banerjee, Avail is a blockchain dedicated to transforming the blockchain world by helping other blockchains scale. Avail serves as a fundamental layer of modular blockchain infrastructure, solving blockchain fragmentation at scale, and enables users to execute bridgeless transactions while acting as a unification layer connecting various blockchains.

In June 2024, Avail raised US $43 million in Series A funding led by cyber—Fund, Dragonfly, and Founders Fund, bringing its total raised to US $75 million. The new funding will be used to develop Avail's Unification Layer, a sophisticated technology stack designed to enhance the scalability and interoperability of modular blockchains through data availability, aggregation, and shared security, as well as its "Fusion Security" layer, which integrates cryptocurrencies to bolster the security of the Avail ecosystem, anticipated to launch in early 2025.

“With this new capital, we are poised to accelerate our development, expand our global presence, and continue to address the most critical challenges facing Web3 today,” adds founder Anurag Arjun.

4. Sensi.Ai | Healthtech (Israel) | US $31 Million Series B

Founded in 2019 by current CEO Romi Gubes, Nevo Elmalem, and Alon Brener and developed by Clanz Technologies, Sensi.Ai is an in-home virtual care agent for home health agencies and senior care providers. Established as the world’s first in-home AI-based virtual care agent, Sensi.AI offers a virtual care management platform that leverages audio analytics-based insights. It enables agencies to provide round-the-clock services, overcoming caregiver shortages and financial limitations for patients.

In June 2024, Sensi.Ai closed a US $31 million Series B funding round led by Insight Partners and Zeev Ventures, bringing its total funding to US $48.7 million. "This funding from renowned investors will help us continue to innovate our product and scale our go-to-market strategy, bringing our vision to life," said Gubes.

5. Tenderd | Asset Productivity Improvement (UAE) | US $30 Million Series A

Founded in 2018 by current CEO Arjun Mohan, Tenderd operates in the heavy industries, focusing on construction, energy, marine, and logistics. Tenderd operates a marketplace that allows companies to supply and rent construction machinery, while also providing customers with AI-generated insights to increase asset utilization and reduce emissions. Contractors can rent equipment such as asphalt paver machines or laser scanners from companies that have available, idle equipment.

In June 2024, Tenderd raised US $30 million in Series A funding led by A.P. Moller Holding, bringing its total funds to US $35.8 million. Leveraging sector-specific data, Tenderd is developing industry-focused AI models, distinguishing itself from generic models and leading transformative efforts within these industries with support from partners in logistics, ports, energy, construction, and technology. The new funds will accelerate technological advancements and facilitate Tenderd's expansion globally, particularly in integrating AI with operations across construction, mining, and industrial sectors.

“We are thankful for all the partners who believed in Tenderd’s vision and ability to shape global operations. Tenderd will continue to innovate and grow, impacting sectors that have remained unchanged for decades, but which form the pillars of society. Positioned at the intersection of the digital and physical worlds, our technology allows industries to access unparalleled levels of efficiency, safety, and sustainability,” commented CEO Mohan.

%2Fuploads%2Finnovations-blockchain%2Fcover22.jpg&w=3840&q=75)